[ad_1]

On occasion, firms could repurchase shares of their very own inventory. Two main synthetic intelligence (AI) gamers presently shopping for again inventory are Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA). Whereas buyback applications are sometimes considered positively by buyers, I see the respective choices from Apple and Nvidia fairly in another way.

Under, I’ve damaged down why it is necessary for buyers to concentrate to share repurchases, and clarify which AI buyback inventory I see because the extra compelling alternative proper now.

Why do firms repurchase inventory?

There are a number of causes firms could select to repurchase inventory. One cause for doing so could possibly be that administration believes the present share worth is under its intrinsic worth. Moreover, buyback applications generally is a higher method to create shareholder worth over paying a dividend. Why is that? Properly, share repurchase applications have some nuances which might be price noting.

Specifically, even when the board of administrators authorizes a buyback, the corporate is not required to do it. Which means if an organization does not find yourself shopping for again shares in any respect, or solely completes a portion of its approved program, buyers are more likely to be much less dissatisfied in comparison with a state of affairs wherein administration decides to chop its dividend unexpectedly.

One final necessary element to notice is that buybacks cut back the excellent share depend for an organization. This can provide the phantasm that earnings per share (EPS) is rising at a quicker price than it truly is. This monetary engineering mechanism might be notably helpful for companies which might be witnessing decelerating gross sales or revenue progress. Actually, that is the case with Apple.

The inventory buyback inventory to purchase: Apple

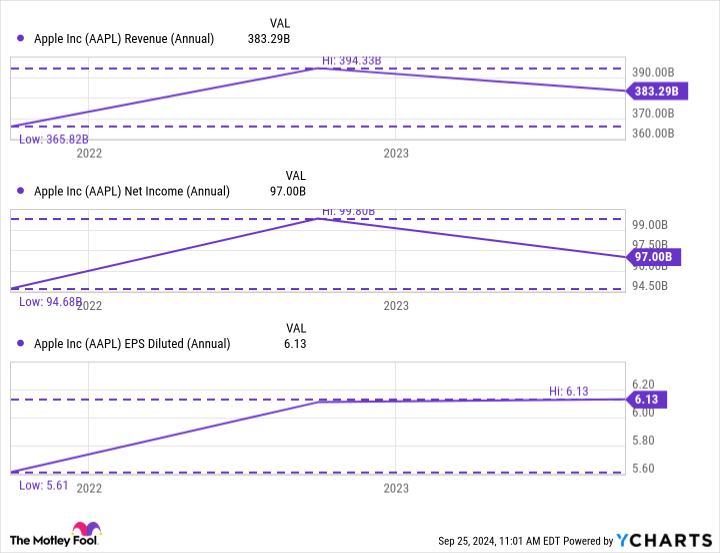

Let’s get one factor established proper up entrance: Apple’s income and revenue progress have been uninspiring for a number of years now. The chart under illustrates the shortage of progress between the corporate’s income and internet revenue during the last three fiscal years. Regardless of the inconsistencies, Apple’s EPS has continued to pattern upward over the identical time interval. This EPS progress is essentially attributable to constant buybacks.

You are in all probability questioning why I like Apple — an organization that is not actually rising — over Nvidia, the de issue poster baby of the AI revolution.

For starters, Apple’s enterprise has been hit onerous by macroeconomic forces similar to excessive inflation and rising rates of interest during the last couple of years. It is affordable that the typical client hasn’t been in a rush to improve their costly iPhone.

Story continues

Nonetheless, I feel client spending will begin to speed up provided that inflation is exhibiting constant indicators of slowing and the Federal Reserve lastly began tapering charges.

These macro elements have come at an attention-grabbing time for Apple, as the corporate simply launched its new iPhone 16. Furthermore, as the corporate begins rolling out extra {hardware} built-in with AI-powered companies that includes OpenAI, I am optimistic that Apple’s subsequent progress narrative has arrived.

Final quarter Apple repurchased $26 billion of inventory, bringing its trailing-nine-month whole to a whopping $70 billion. Furthermore, again in Might Apple’s board approved an extra $110 billion buyback program.

Whenever you account for these buybacks overlapping with Apple’s long-anticipated dive into the AI panorama, I am bullish that even higher days are forward for shareholders. For these causes, I feel Apple inventory is a superb purchase proper now.

The inventory buyback inventory to keep away from proper now: Nvidia

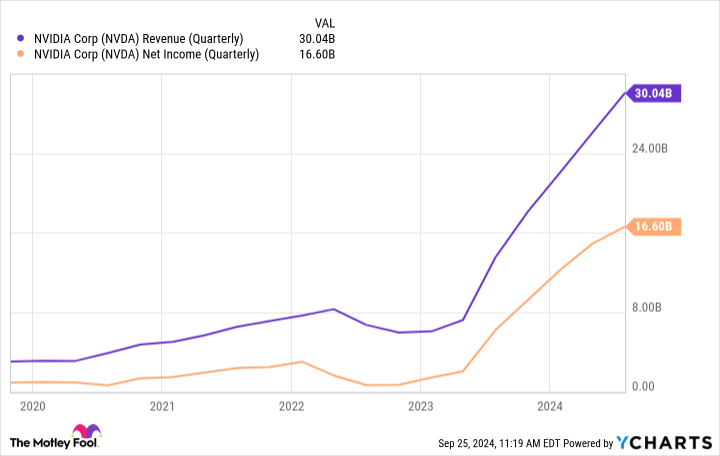

Simply take a look at the slope of the income and internet revenue strains for Nvidia. It is mainly the other of Apple. Nvidia has been a serious beneficiary of the AI motion, largely because of gross sales of its chipsets referred to as graphics processing items (GPU), that are used for quite a lot of generative AI functions.

What is admittedly distinctive about Nvidia is that its earnings are literally rising quicker than income. Which means the inventory is definitely cheaper on a price-to-earnings (P/E) foundation as we speak than it was a yr in the past.

Given its valuation in comparison with historic ranges, Nvidia’s administration may see the inventory as undervalued. This could possibly be one thing that influenced its latest $50 billion buyback program. One actually necessary element to spotlight is that the brand new repurchase program doesn’t have an expiration date.

To me, the most important disadvantage of investing in Nvidia inventory proper now stems from competitors. A lot of Nvidia’s personal clients are beginning to develop their very own GPUs in an effort to compete extra straight with the chipmaker and transfer away from an overreliance on the corporate’s {hardware}.

Though it can take a while, I feel Nvidia’s pricing energy will weaken as extra GPUs come to market. In flip, Nvidia’s income will decelerate — a dynamic that may probably take a cloth toll on revenue margins.

On high of this, Nvidia presently boasts about $35 billion of money and equivalents on its stability sheet — lower than the approved $50 billion buyback. Contemplating there’s a good likelihood that the corporate’s profitability begins decelerating, I see Nvidia’s buyback as a poor capital allocation technique in the long term.

In a approach, I hope Nvidia doesn’t full this buyback in its entirety (if in any respect), as I see this resolution as unwise.

The place to take a position $1,000 proper now

When our analyst crew has a inventory tip, it might probably pay to hear. In any case, Inventory Advisor’s whole common return is 773% — a market-crushing outperformance in comparison with 168% for the S&P 500.*

They simply revealed what they consider are the ten finest shares for buyers to purchase proper now… and Apple made the record — however there are 9 different shares it’s possible you’ll be overlooking.

See the ten shares »

*Inventory Advisor returns as of September 23, 2024

Adam Spatacco has positions in Apple and Nvidia. The Motley Idiot has positions in and recommends Apple and Nvidia. The Motley Idiot has a disclosure coverage.

1 Synthetic Intelligence (AI) Inventory-Buyback Inventory to Purchase Hand Over Fist, and 1 to Keep away from (for Now) was initially printed by The Motley Idiot

[ad_2]

Source link