[ad_1]

Printed on August sixteenth, 2024 by Bob Ciura

Completely different traders could have completely different interpretations of the time period “blue chip,” however usually, it refers to firms which might be thought of the leaders of their respective industries.

For us, a inventory earns the title of “blue chip” when it options not less than a decade of constant dividend progress. It’s not a small accomplishment, because it demonstrates that the corporate’s enterprise mannequin is more likely to stand up to powerful financial occasions whereas persevering with to ship regular progress.

Consequently, we really feel that blue chip shares are among the many most secure dividend shares traders should buy.

With all this in thoughts, we created a listing of 400+ blue-chip shares, which you’ll obtain by clicking beneath:

The tech sector isn’t sometimes identified for dividend progress shares, however these firms have demonstrated a dedication to rising shareholder money returns.

To spotlight these trade leaders, we’ve compiled a listing of the highest 10 tech sector blue chip shares. Every of those tech shares have raised their dividends for not less than 10 consecutive years.

As well as, the ten tech shares beneath have Dividend Threat scores of ‘C’ or higher, indicating that their payouts are safe.

The shares are ranked so as of five-year anticipated annual returns, from lowest to highest.

Desk of Contents

Blue Chip Tech Inventory #10: Skyworks Options (SWKS)

Years of Dividend Progress: 11

5-12 months Anticipated Annual Returns: 2.0%

Skyworks Options is a semiconductor firm that designs, develops, and markets proprietary semiconductor merchandise worldwide. Its merchandise embody antenna tuners, amplifiers, converters, modulators, receivers, and switches.

Skyworks’ merchandise are utilized in various industries, together with automotive, related house, industrial, medical, smartphones, and protection.

On July thirtieth, 2024, Skyworks reported third-quarter outcomes for Fiscal 12 months (FY)2024. The corporate posted income of $906 million. The corporate achieved a GAAP diluted earnings per share (EPS) of $0.75 and a non-GAAP diluted EPS of $1.21.

The year-to-date working money movement stands at $1.35 billion, with a free money movement of $1.27 billion, reflecting robust money movement margins of 43% and 40%, respectively. These outcomes underscore Skyworks’ profitability and constant efficiency consistent with its steering.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWKS (preview of web page 1 of three proven beneath):

Blue Chip Tech Inventory #9: HP Inc. (HPQ)

Years of Dividend Progress: 13

5-12 months Anticipated Annual Returns: 3.7%

HP Inc. has centered its enterprise actions round two fundamental segments: its product portfolio of printers, and its vary of private techniques, which incorporates computer systems and cell units. HP reported its second quarter (fiscal 2024) outcomes on Might 30.

The corporate reported income of $12.8 billion for the quarter, which beat the analyst consensus estimate, and which was down 1% from the earlier 12 months’s quarter. This was barely higher than the income decline that HP skilled throughout the earlier quarter, when revenues had been down by 5% on a year-over-year foundation.

Non-GAAP earnings-per-share totaled $0.82 throughout the second quarter, which was forward of the analyst consensus estimate. HP Inc. noticed its working margin enhance over the past 12 months.

The corporate at the moment forecasts earnings-per-share in a variety of $0.78 to $0.92 for the third quarter, which might imply a greater outcome versus the newest quarter on the midpoint of the steering vary. For the present 12 months, HP forecasts earnings-per-share of round $3.45.

Click on right here to obtain our most up-to-date Positive Evaluation report on HPQ (preview of web page 1 of three proven beneath):

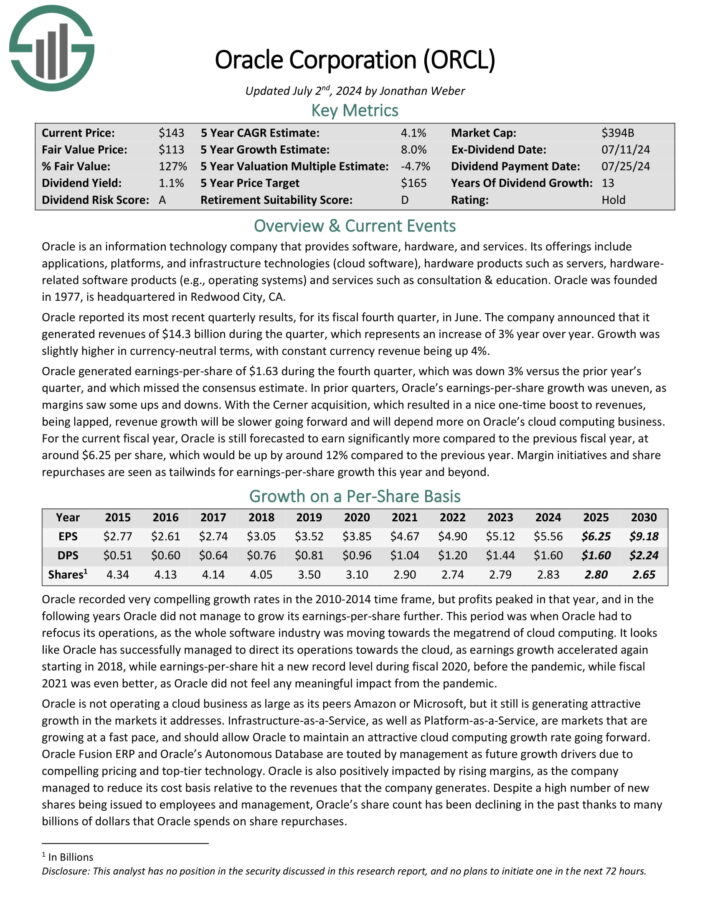

Blue Chip Tech Inventory #8: Oracle Company (ORCL)

Years of Dividend Progress: 13

5-12 months Anticipated Annual Returns: 5.1%

Oracle is an info expertise firm that gives software program, {hardware}, and companies. Its choices embody purposes, platforms, and infrastructure applied sciences (cloud software program), {hardware} merchandise similar to servers, hardware-related software program merchandise (e.g., working techniques), and companies similar to session & schooling.

Oracle reported its most up-to-date quarterly outcomes, for its fiscal fourth quarter, in June. The corporate introduced that it generated revenues of $14.3 billion throughout the quarter, which represents a rise of three% 12 months over 12 months. Progress was barely increased in currency-neutral phrases, with fixed foreign money income being up 4%.

Oracle generated earnings-per-share of $1.63 throughout the fourth quarter, which was down 3% versus the prior 12 months’s quarter, and which missed the consensus estimate. In prior quarters, Oracle’s earnings-per-share progress was uneven as margins noticed some ups and downs.

Click on right here to obtain our most up-to-date Positive Evaluation report on ORCL (preview of web page 1 of three proven beneath):

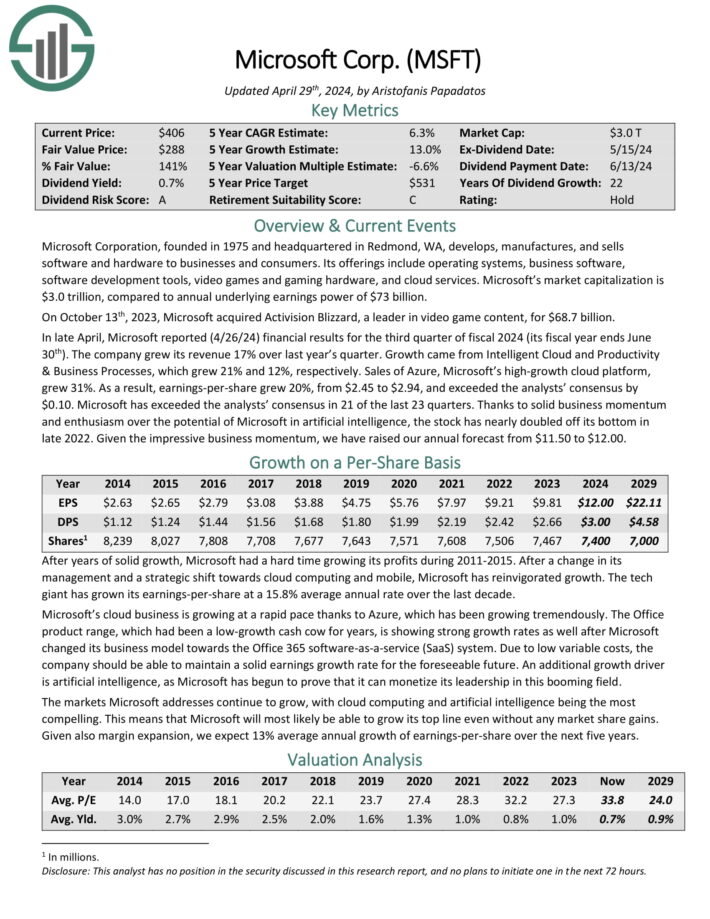

Blue Chip Tech Inventory #7: Microsoft Company (MSFT)

Years of Dividend Progress: 22

5-12 months Anticipated Annual Returns: 5.5%

Microsoft Company, based in 1975 and headquartered in Redmond, WA, develops, manufactures, and sells software program and {hardware} to companies and shoppers.

Its choices embody working techniques, enterprise software program, software program improvement instruments, video video games and gaming {hardware}, and cloud companies. Microsoft’s market capitalization is ~$3.0 trillion, in comparison with annual underlying earnings energy of $73 billion.

In late April, Microsoft reported (4/26/24) monetary outcomes for the third quarter of fiscal 2024 (its fiscal 12 months ends June thirtieth). The corporate grew its income 17% over final 12 months’s quarter.

Progress got here from Clever Cloud and Productiveness & Enterprise Processes, which grew 21% and 12%, respectively.

Microsoft’s cloud enterprise is rising at a speedy tempo due to Azure. The Workplace product vary, which had been a low-growth money cow for years, is exhibiting robust progress charges as effectively after Microsoft modified its enterprise mannequin in direction of the Workplace 365 software-as-a-service (SaaS) system.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSFT (preview of web page 1 of three proven beneath):

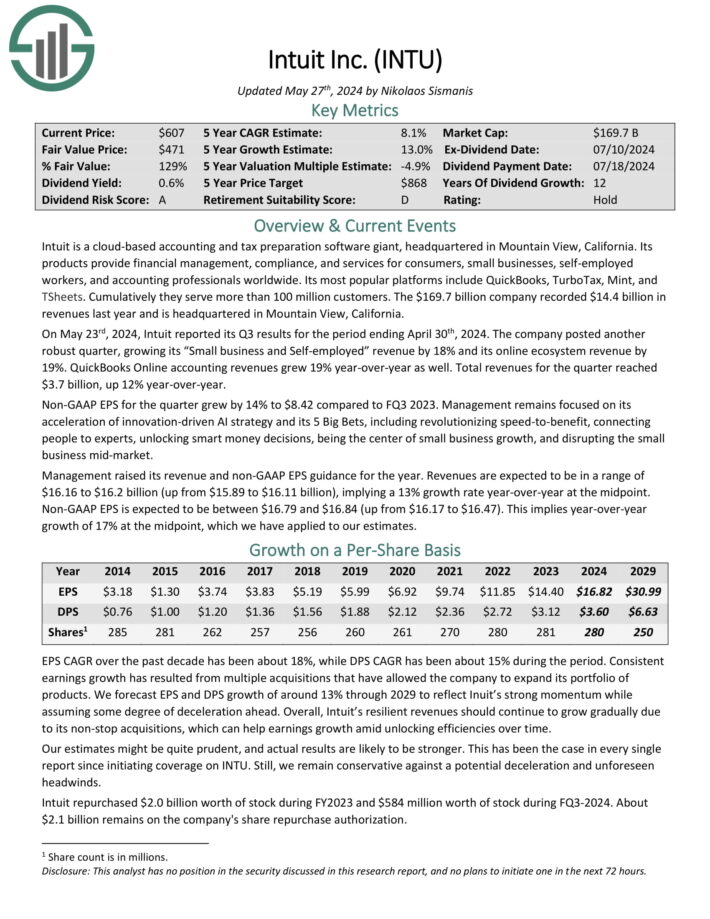

Blue Chip Tech Inventory #6: Intuit Inc. (INTU)

Years of Dividend Progress: 12

5-12 months Anticipated Annual Returns: 6.5%

Intuit is a cloud-based accounting and tax preparation software program large. Its merchandise present monetary administration, compliance, and companies for shoppers, small companies, self-employed employees, and accounting professionals worldwide.

Its hottest platforms embody QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve greater than 100 million clients.

On Might twenty third, 2024, Intuit reported its Q3 outcomes for the interval ending April thirtieth, 2024. The corporate posted one other sturdy quarter, rising its “Small enterprise and Self-employed” income by 18% and its on-line ecosystem income by 19%.

QuickBooks On-line accounting revenues grew 19% year-over-year as effectively. Complete revenues for the quarter reached $3.7 billion, up 12% year-over-year. Non-GAAP EPS for the quarter grew by 14% to $8.42 in comparison with FQ3 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on INTU (preview of web page 1 of three proven beneath):

Blue Chip Tech Inventory #5: Analog Gadgets, Inc. (ADI)

Years of Dividend Progress: 20

5-12 months Anticipated Annual Returns: 6.7%

Analog Gadgets makes built-in circuits which might be bought to OEMs (unique tools producers) to be included into tools and techniques for communications, pc, instrumentation, industrial, navy/aerospace, and shopper electronics purposes.

The corporate is altering to fulfill the wants of latest markets with its $10 billion funding in Analysis and Growth over the previous 10 years, and their earlier acquisitions of firms like Maxim Built-in, Linear Know-how, and Hittite.

On February twentieth, 2024, Analog Gadgets introduced a 7% dividend improve to $0.92 per share quarterly.

On Might twenty second, 2024, Analog Gadgets reported second quarter 2024 outcomes for the interval ending Might 4th, 2024. For the quarter, the corporate reported income of $2.16 billion, down 34% in comparison with the prior 12 months’s quarter, which beat analysts’ estimates by $50 million. The corporate noticed adjusted earnings-per-share of $1.40, which additionally beat analysts’ estimates by 13 cents however represented a 51% decline in EPS in comparison with the year-ago quarter.

Through the quarter, Analog Gadgets repurchased $222 million of its shares, and paid $456 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADI (preview of web page 1 of three proven beneath):

Blue Chip Tech Inventory #4: QUALCOMM Integrated (QCOM)

Years of Dividend Progress: 22

5-12 months Anticipated Annual Returns: 7.3%

Qualcomm has advanced into a number one developer and distributor of built-in circuits for each voice and information transmissions. Due to its intensive patent portfolio, Qualcomm receives royalties from units working on cutting-edge 5G networks.

On April twelfth, 2024, Qualcomm elevated its quarterly dividend 6.3% to $0.85, marking the corporate’s twenty second consecutive 12 months of dividend progress.

On July thirty first, 2024, Qualcomm reported for the third quarter of fiscal 12 months 2024 for the interval ending June twenty third, 2024. For the quarter, income grew 11.3% to $9.39 billion, which was $170 million above estimates. Adjusted earnings-per-share of $2.33 in contrast favorably to $1.87 within the earlier 12 months and was $0.07 higher than anticipated.

For the quarter, revenues for Qualcomm CDMA Applied sciences, or QCT, improved 12% to $8.07 billion. Handset gross sales elevated 12% to $5.9 billion whereas automotive gross sales surged 87% to $811 million.

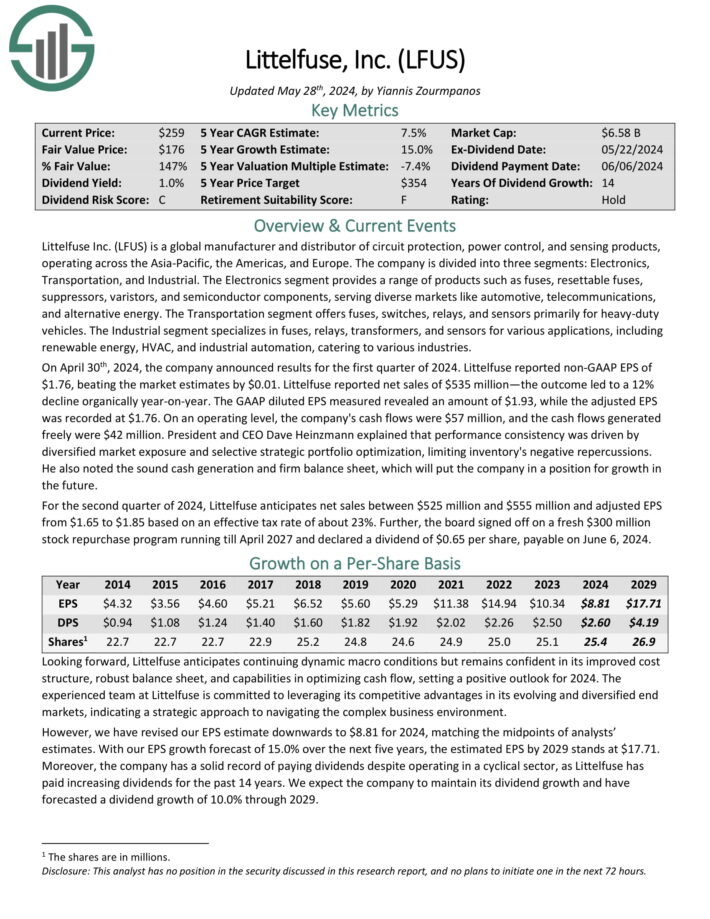

Littelfuse Inc. is a worldwide producer and distributor of circuit safety, energy management, and sensing merchandise, working throughout the Asia-Pacific, the Americas, and Europe.

The corporate is split into three segments: Electronics, Transportation, and Industrial. The Electronics phase supplies a variety of merchandise similar to fuses, resettable fuses, suppressors, varistors, and semiconductor elements, serving various markets like automotive, telecommunications, and various power.

The Transportation phase provides fuses, switches, relays, and sensors primarily for heavy-duty automobiles. The Industrial phase makes a speciality of fuses, relays, transformers, and sensors for varied purposes, together with renewable power, HVAC, and industrial automation, catering to varied industries.

On April thirtieth, 2024, the corporate introduced outcomes for the primary quarter of 2024. Littelfuse reported non-GAAP EPS of $1.76, beating the market estimates by $0.01. Littelfuse reported internet gross sales of $535 million—a 12% decline organically year-on-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on LFUS (preview of web page 1 of three proven beneath):

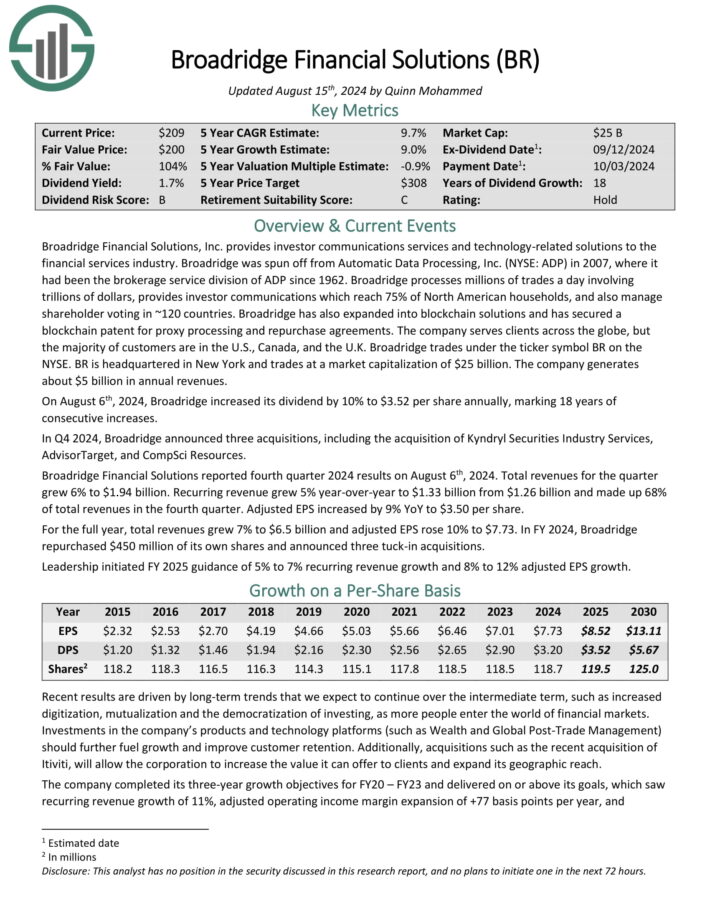

Blue Chip Tech Inventory #2: Broadridge Monetary Options, Inc. (BR)

Years of Dividend Progress: 18

5-12 months Anticipated Annual Returns: 9.6%

Broadridge Monetary Options, Inc. supplies investor communications companies and technology-related options to the monetary companies trade. Broadridge was spun off from Computerized Knowledge Processing in 2007, the place it had been the brokerage service division of ADP since 1962.

Broadridge Monetary Options reported fourth quarter 2024 outcomes on August sixth, 2024. Complete revenues for the quarter grew 6% to $1.94 billion. Recurring income grew 5% year-over-year to $1.33 billion from $1.26 billion and made up 68% of complete revenues within the fourth quarter. Adjusted EPS elevated by 9% YoY to $3.50 per share.

For the complete 12 months, complete revenues grew 7% to $6.5 billion and adjusted EPS rose 10% to $7.73. In FY 2024, Broadridge repurchased $450 million of its personal shares and introduced three tuck-in acquisitions.

Click on right here to obtain our most up-to-date Positive Evaluation report on Broadridge (preview of web page 1 of three proven beneath):

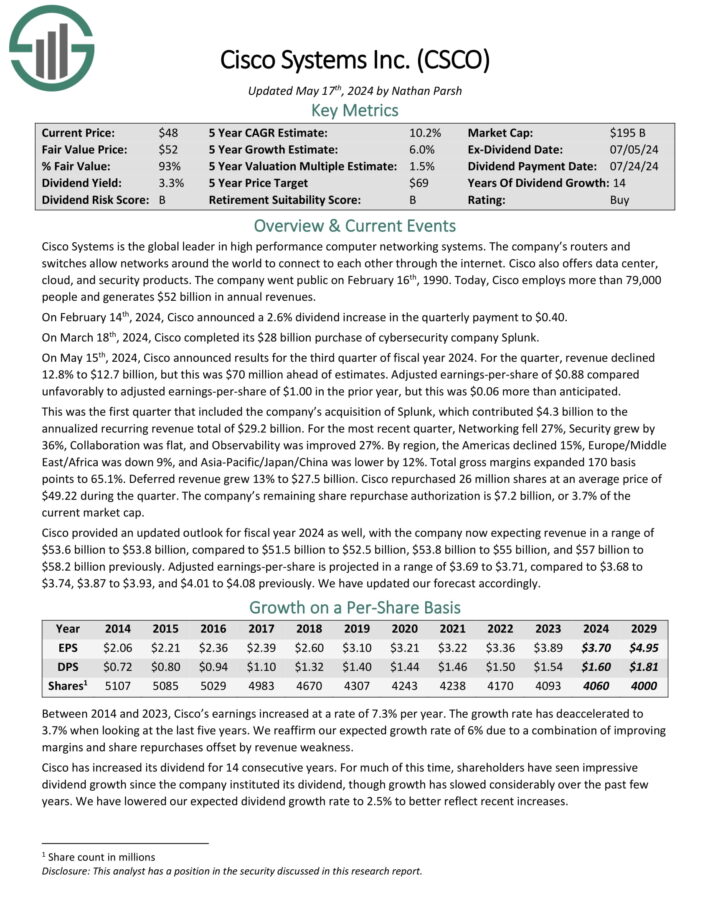

Blue Chip Tech Inventory #1: Cisco Programs, Inc. (CSCO)

Years of Dividend Progress: 14

5-12 months Anticipated Annual Returns: 10.0%

Cisco Programs is the worldwide chief in excessive efficiency pc networking techniques. The corporate’s routers and switches enable networks around the globe to attach to one another by way of the web. Cisco additionally provides information middle, cloud, and safety merchandise.

Cisco employs greater than 79,000 individuals and generates $52 billion in annual revenues. On February 14th, 2024, Cisco introduced a 2.6% dividend improve within the quarterly cost to $0.40.

On March 18th, 2024, Cisco accomplished its $28 billion buy of cybersecurity firm Splunk. On Might fifteenth, 2024, Cisco introduced outcomes for the third quarter of fiscal 12 months 2024.

For the quarter, income declined 12.8% to $12.7 billion, however this was $70 million forward of estimates. Adjusted earnings-per-share of $0.88 in contrast unfavorably to adjusted earnings-per-share of $1.00 within the prior 12 months, however this was $0.06 greater than anticipated.

This was the primary quarter that included the corporate’s acquisition of Splunk, which contributed $4.3 billion to the annualized recurring income complete of $29.2 billion. For the newest quarter, Networking fell 27%, Safety grew by 36%, Collaboration was flat, and Observability was improved 27%.

Click on right here to obtain our most up-to-date Positive Evaluation report on CSCO (preview of web page 1 of three proven beneath):

Remaining Ideas

General, traders can discover many funding alternatives amongst blue chip shares, as these firms are likely to function a protracted historical past of monetary stability and a powerful market place.

The tech sector has not traditionally been identified for dividends, however this has modified up to now a number of years. Many giant, established tech shares now pay dividends to shareholders.

If you’re enthusiastic about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources shall be helpful:

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link