[ad_1]

At the moment’s article is all about kicking issues up a notch with superior choice methods.

We’re going past the fundamentals to point out you some savvy strategies that the professionals use.

Prepared for a enjoyable experience within the choices buying and selling world?

Let’s get began!

Contents

Most choices merchants run via a typical evolution as they develop their information and accounts.

This seems to be just like the next: First, merchants who see outsized beneficial properties are drawn to both 0DTE or weeklies to chase some insane returns.

As this begins to show tougher than it’s value for a lot of, they evolve into buying and selling monthlies and longer-term choices and begin utilizing them for directional buying and selling.

Many choices merchants cease right here as they discover a system that works for them.

Some choices merchants proceed shorting choices and utilizing spreads to make all the things extra secure and predictable.

That is the place we are going to dive into at this time.

Unfold trades run the gambit from very simple to extremely complicated, however all will be extremely helpful.

Whereas some fundamental methods like verticals work tremendous, some extra superior methods may also help stage up your buying and selling.

These are 5 nice superior methods to look into if you’re on the lookout for some further methods to commerce the markets.

It is a nice technique that may be extremely helpful for smaller accounts.

The Poor Man Coated Name includes shopping for a longer-dated Within the Cash or On the Cash Name choice after which promoting shorter-dated calls in opposition to it.

This creates the same threat profile to an everyday lined name however usually requires considerably much less capital.

This technique will be categorized as superior for a number of causes.

The primary is that it’s potential to lose all the quantity put into the place.

The lengthy choice, although it’s In or On the Cash, nonetheless has the potential to run out nugatory if the inventory value declines considerably and stays there.

Moreover, the brief leg of the commerce must be far sufficient away in order that the dealer can profit from the theta decay with out having to fret concerning the lengthy positions whereas on the similar time being shut sufficient to supply sufficient premium to make the commerce value it.

It’s a balancing act between Strikes and Dates, however that is the tradeoff to having a considerably smaller capital requirement.

The married put technique is just like having an insurance coverage coverage on your inventory.

It includes buying a inventory and shopping for a put choice for an equal variety of shares concurrently.

Whereas this technique reduces the web revenue from a place, the safety is effectively value it if you’re in any respect fearful a few market drop.

If the inventory continues to climb, the put will expire nugatory, which is the best-case state of affairs. If the inventory value falls, you have got two important choices.

You’ll be able to preserve the inventory and promote the put choice for any revenue you might have realized. This feature will assist offset any loss unrealized on the shares.

You’ll be able to preserve the put and let the inventory get exercised away.

The figuring out issue for which path you must take is the magnitude of the drop. If it’s a information break and you are feeling the inventory will bounce again and/otherwise you wish to preserve it at your value foundation, then select the primary one.

If the worth has plummeted beneath the put strike, you possibly can all the time let the shares get exercised away and purchase again in at a lower cost.

What complicates this a bit of is the theta decay and strike choice on the put.

You don’t wish to go too low on strike; in any other case, you’ll notice a bigger loss, however for those who keep too near the present value, you can lose out on a doubtlessly worthwhile place.

The brief straddle is a web credit score choices technique that’s finest carried out when a dealer believes that the worth of a inventory will stay stagnant till the choices expire.

The commerce is about up by promoting a name and a placed on a inventory.

This offers this technique a threat profile that appears like an “A,” with the highest half being the place you revenue.

This could be a nice technique for short-term trades to capitalize on the theta decay of each the brief name and brief put.

The draw back is that it places you at limitless threat if the inventory strikes violently in both route.

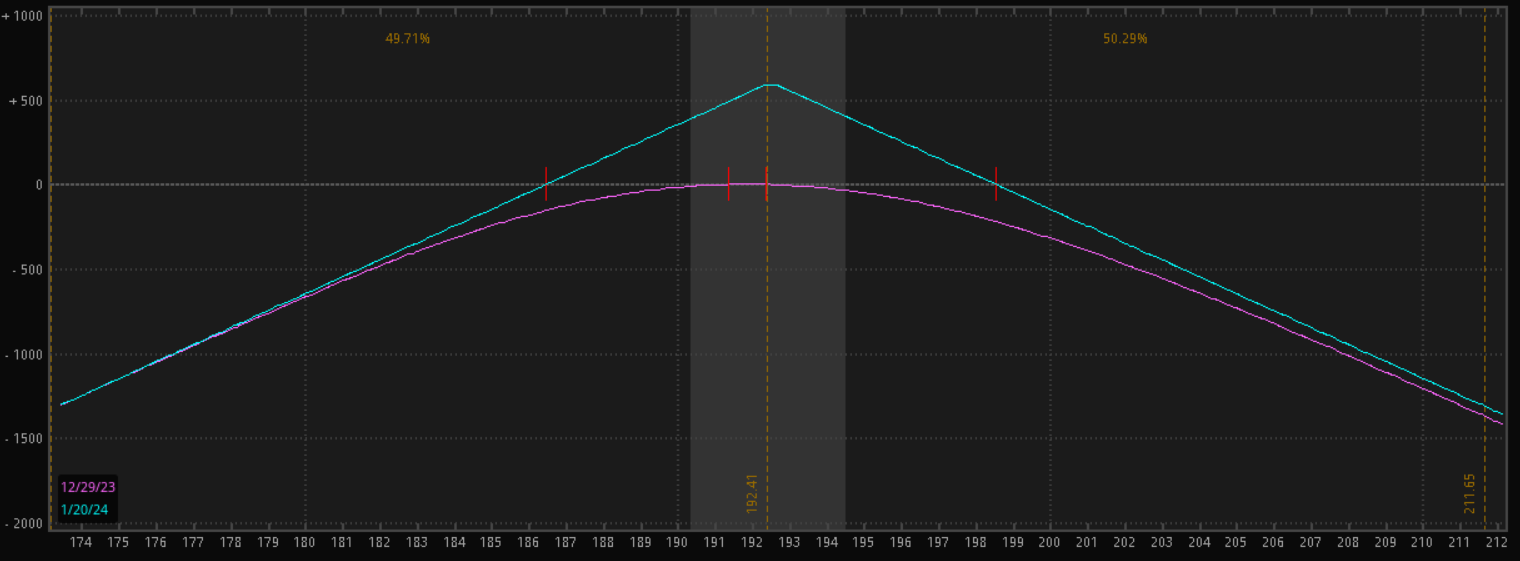

Beneath is a threat profile for a Brief Straddle on AAPL for the January 2024 expiry.

Your max revenue will probably be roughly $500 if the inventory value doesn’t transfer over the following month.

Suppose the inventory strikes up or down by various {dollars}, although you’ll begin to notice a loss on the commerce.

The brief calendar unfold is a superb technique for a set reward commerce that captures potential volatility in a reputation.

This commerce is about up by buying a shorter-dated name after which promoting a longer-dated name on the similar strike value.

The brief calendar unfold is a type of credit score unfold, which implies your most revenue is what you might be paid for the commerce.

This happens as the worth strikes farther away from the strike value you offered the unfold at, so you might be solely hoping for the underlying inventory to be as risky as potential.

Since you might be brief the longer-dated all choice, your threat for this specific commerce is technically limitless.

If the short-dated name expires and also you keep open within the longer-dated choice, you at the moment are bare shorting a name; this may be a particularly harmful commerce for those who aren’t cautious, so for those who plan on buying and selling a brief calendar unfold, it’s finest to maintain an in depth eye on the place and attempt to shut out each legs concurrently so you might be by no means in an uncovered place.

Entry 9 Free Choice Books

The protecting collar technique is just like the married put we mentioned above.

It exists to assist present some safety to an underlying inventory place.

The setup for this commerce is fairly easy: first, you should personal a minimum of 100 shares of the underlying inventory.

Subsequent, you buy an out-of-the-money put choice on the inventory; this protects your draw back publicity.

Lastly, you promote an out-of-the-money name choice on the inventory to assist offset the acquisition put’s value. One other method to consider this commerce is that you’ve a lined name with some draw back safety.

It’s known as a collar as a result of the lengthy put and brief name cap the inventory’s motion in each instructions, thereby “collaring” the place to the strikes purchased and offered.

The good thing about this technique is that it removes quite a lot of potential volatility out of your place and does so for a really restricted value when in comparison with a married put.

The tradeoff is that your potential revenue is capped as effectively.

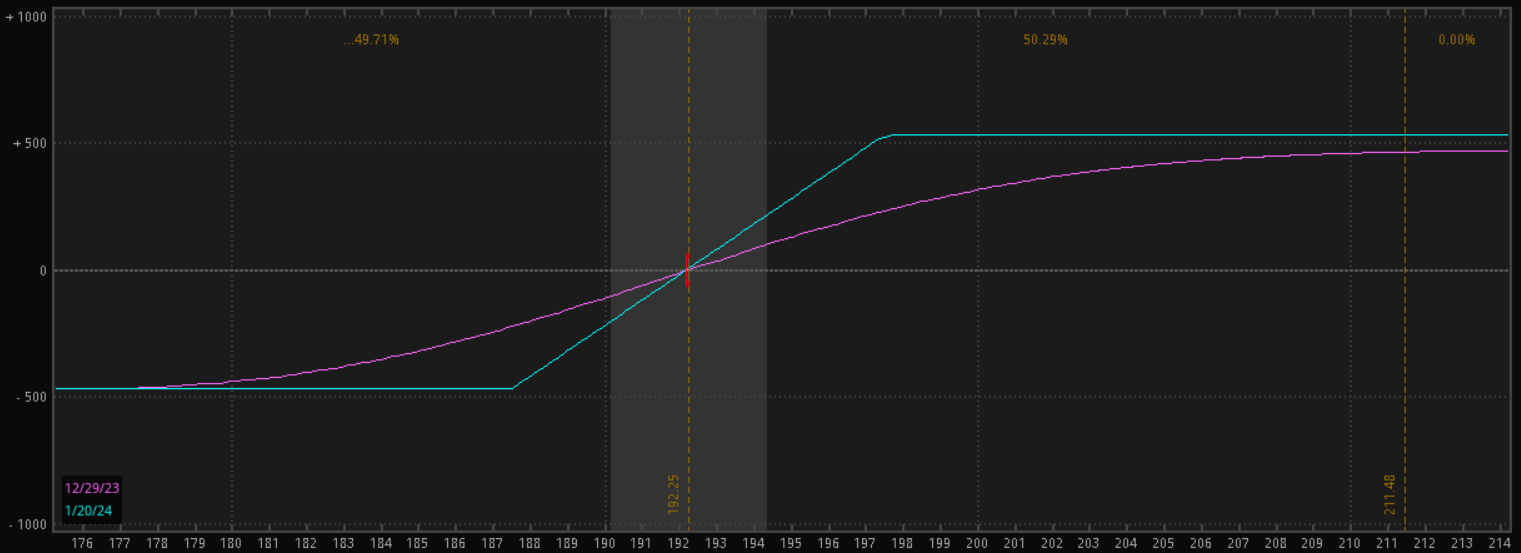

Beneath is a pattern collar threat profile; it seems to be similar to a bull unfold, with the one distinction being you personal the inventory within the center.

Methods just like the Poor Man’s Coated Name, Married Places, Brief Straddle, Brief Calendar Unfold, and Protecting Collar supply extra superior strategies to navigate market dangers and capitalize on market alternatives.

Every of those comes with its distinctive tradeoffs however will be an effective way to enhance portfolio profitability when extra typical methods aren’t working for you.

Embracing these superior methods requires extra than simply fundamental information.

Merchants should proactively handle these methods, particularly these just like the Brief Straddle and Brief Calendar Unfold, which carry the danger of limitless losses.

By integrating these complicated methods into their portfolio, merchants can obtain a extra refined management over threat, paving the best way for doubtlessly higher returns.

Nonetheless, like all buying and selling endeavors, balancing the potential advantages in opposition to the inherent dangers and prices is essential, adapting every technique to suit particular person buying and selling types and market cycles.

We hope you loved this text on superior choice methods.

When you have any questions, please ship an e mail or depart a remark beneath.

Commerce protected!

Disclaimer: The knowledge above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for buyers who usually are not aware of change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link