[ad_1]

JHVEPhoto

After I put a Purchase ranking on Eli Lilly (NYSE:LLY) 1 / 4 in the past, I didn’t imagine that it was an funding for the short-term, however that it had potential from the long term perspective. Because it occurs, it turned out to be one for short-term good points too, with an over 17% enhance in value since I wrote. The inventory is now up by 56% year-to-date [YTD], far outstripping the simply 7% rise within the S&P 500 Well being Care Index on this time.

Value Chart (Supply: In search of Alpha)

On the face of it, that is thoughts boggling, contemplating its market valuations. The inventory’s ahead non-GAAP price-to-earnings (P/E) ratio is at an enormous 65.8x in comparison with its five-year common [5y avg] of 37.6x. Equally, the ahead GAAP P/E is at 67.8x in comparison with the 5y avg of 40.2x. However a better have a look at the inventory reveals that there are a number of causes for Eli Lilly’s continued attractiveness. Listed below are 5 of them:

#1. Exceptionally profitable remedies

A number of days in the past, the corporate launched an open letter on issues about using its diabetes and weight administration remedies. These issues vary from their beauty use to the sale of pretend variations of Mounjaro and Zepbound, which goal the situations. Unlucky because the causes for concern are, they underline the excessive diploma of recognition of those remedies and extra usually, the demand for weight administration options.

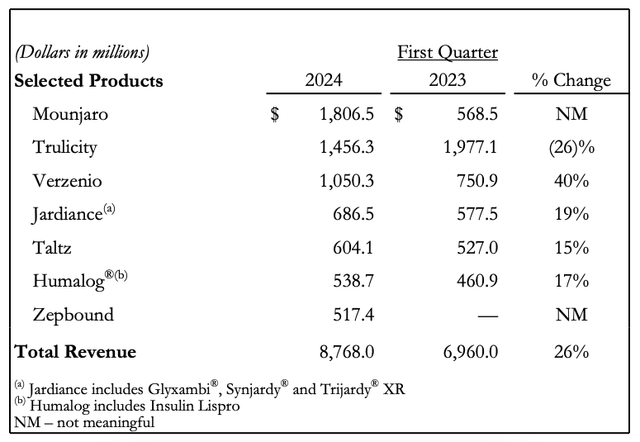

This demand can also be mirrored within the firm’s personal revenues from the section. Within the first quarter of this yr (Q1 2024), its single largest remedy, Mounjaro confirmed over 3x enhance year-on-year (YoY) (see desk beneath). Zepbound, which was launched solely in December final yr had already confirmed actually early indications of being a blockbuster for Eli Lilly in This fall 2023 itself. That grew to become extra seen in its first full quarter of being out there, Q1 2024, with a 6% contribution to complete income already.

Supply: Eli Lilly

#2. Strong Q1 2024 earnings

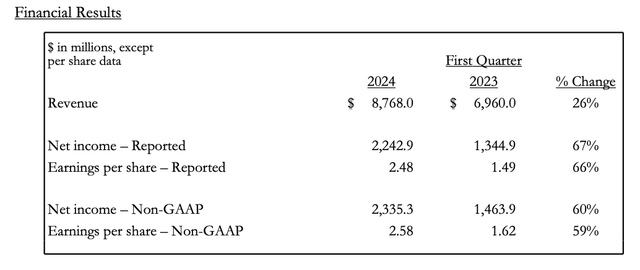

This, in fact, displays within the total earnings for Eli Lilly in Q1 2024, with total income development of 26%. There’s a base impact at play right here, although, as gross sales had contracted by ~11% in Q1 2023. This could in any other case point out that the corporate’s gross sales development might soften within the upcoming quarters, however as the following level notes, the steerage improve signifies that may not occur both.

Web earnings development was additionally robust at 67% on a reported foundation and 60% on a non-GAAP foundation. Actually, not like the income figures which got here in barely beneath analysts’ expectations, the earnings per share [EPS] stunned on the upside by ~4%. That is the second consecutive quarter of an upside shock for the EPS.

Supply: Eli Lilly

#3. Upgraded steerage

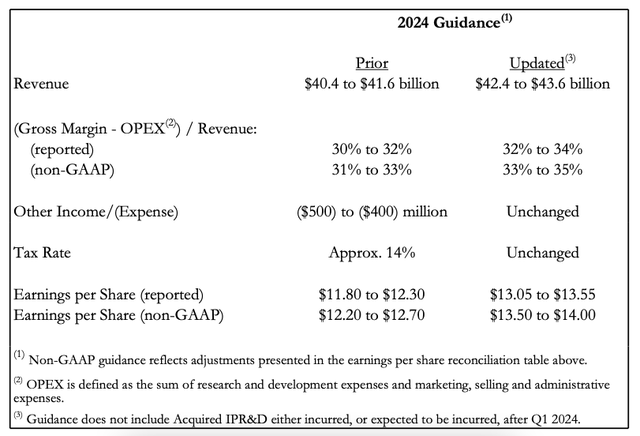

Significantly with Mounjaro and Zepbound’s robust efficiency together with “higher visibility into the corporate’s manufacturing enlargement for the rest of the yr” as Eli Lilly places it, it has upgraded its full yr steerage as nicely.

On the midpoint of the steerage vary, it now sees revenues to rise by 26% this yr (see desk beneath), the identical as that in Q1 2024. This follows an already robust 20% development in 2023, and the expectation for as a lot enlargement as per the preliminary steerage as nicely.

The earnings per share [EPS] steerage has additionally been upgraded. Each GAAP and non-GAAP figures at the moment are anticipated to develop by 10.4% on the midpoints of the steerage ranges. The corporate already anticipated a doubling in EPS this yr YoY as per the preliminary steerage, it now sees a 129% enhance in GAAP EPS and a 117% rise in non-GAAP EPS.

Supply: Eli Lilly

#4. Tirzepatide’s increasing utilization

Within the current months, the corporate has additionally discovered promising enlargement within the utilization of tirzepatide, which is branded beneath each Mounjaro and Zepbound. For one, it has proven encouraging ends in treating obstructive sleep apnea. The corporate factors to the truth that 80 million individuals undergo from the illness within the US alone, which suggests the potential enlargement of its remedies’ utilization.

It has additionally proven promising ends in treating metabolic dysfunction-associated steatohepatitis [MASH], a form of fatty liver situation, which is the primary cause for liver transplants within the US. Whereas it stays to be seen whether or not or not the utilization of its key remedies will likely be used to deal with the situations within the close to future, these developments do exhibit the potential for even larger development forward for them.

#5. Rising dividends

The corporate’s dividends are notable too. For 2024, Eli Lilly has elevated them by 15%, consistent with the 5y compounded annual development price [CAGR]. This reality can get blurred by the in any other case underwhelming ahead dividend yield at simply 0.6%. However that is solely as a result of the share value has on such a steep uphill climb, with nothing lower than a 717% enhance prior to now 5 years. As I identified the final time as nicely, the higher solution to take into account the corporate’s dividends is thru the yield on value, which isn’t dangerous at 4.4% during the last 5 years.

What subsequent?

Based mostly solely on its market multiples, I’d nonetheless say that it could possibly’t be assumed there gained’t be a pullback within the short-term. But when the expertise of the previous quarter is something to go by, it won’t occur both. Particularly not when there’s such robust momentum behind the inventory.

In any case, there’s nonetheless a really robust case to purchase Eli Lilly for the medium-to-long-term even from a elementary perspective. The corporate’s numbers are sturdy and the improve in steerage for this yr is notable too. That it’s partly based mostly on wholesome development in remedies like Mounjaro and Zepbound, whose utilization would possibly simply be expanded to deal with situations like sleep apnea and MASH, in addition to diabetes and weight problems is especially encouraging.

Lastly, the corporate’s dividend development stays robust, even because the dividend yield is low, as a result of the worth continues to rise quick. I’m sustaining a Purchase on Eli Lilly.

[ad_2]

Source link