[ad_1]

This program is designed to supply monetary help and facilitate homeownership for important staff in Florida. It goals to make home-buying extra inexpensive, serving as a gesture of appreciation from the state to those important neighborhood members.

What’s the Florida Hometown Heroes Refinance Program?

The Florida Hometown Heroes Refinance Program is particularly designed as the only, quickest, and handiest method to refinance a mortgage obtained via the Florida Hometown Heroes program.

This program streamlines the refinancing course of for many who initially secured their residence mortgage beneath the Hometown Heroes initiative, which helps important staff in Florida.

Its main goal is to offer an expedited and user-friendly refinancing pathway for eligible individuals, making certain they will benefit from improved monetary phrases as their wants and market circumstances change.

This would possibly embody securing decrease rates of interest, adjusting mortgage phrases, or accessing residence fairness for different monetary functions.

Advantages of the Hometown Heroes Refinance Program

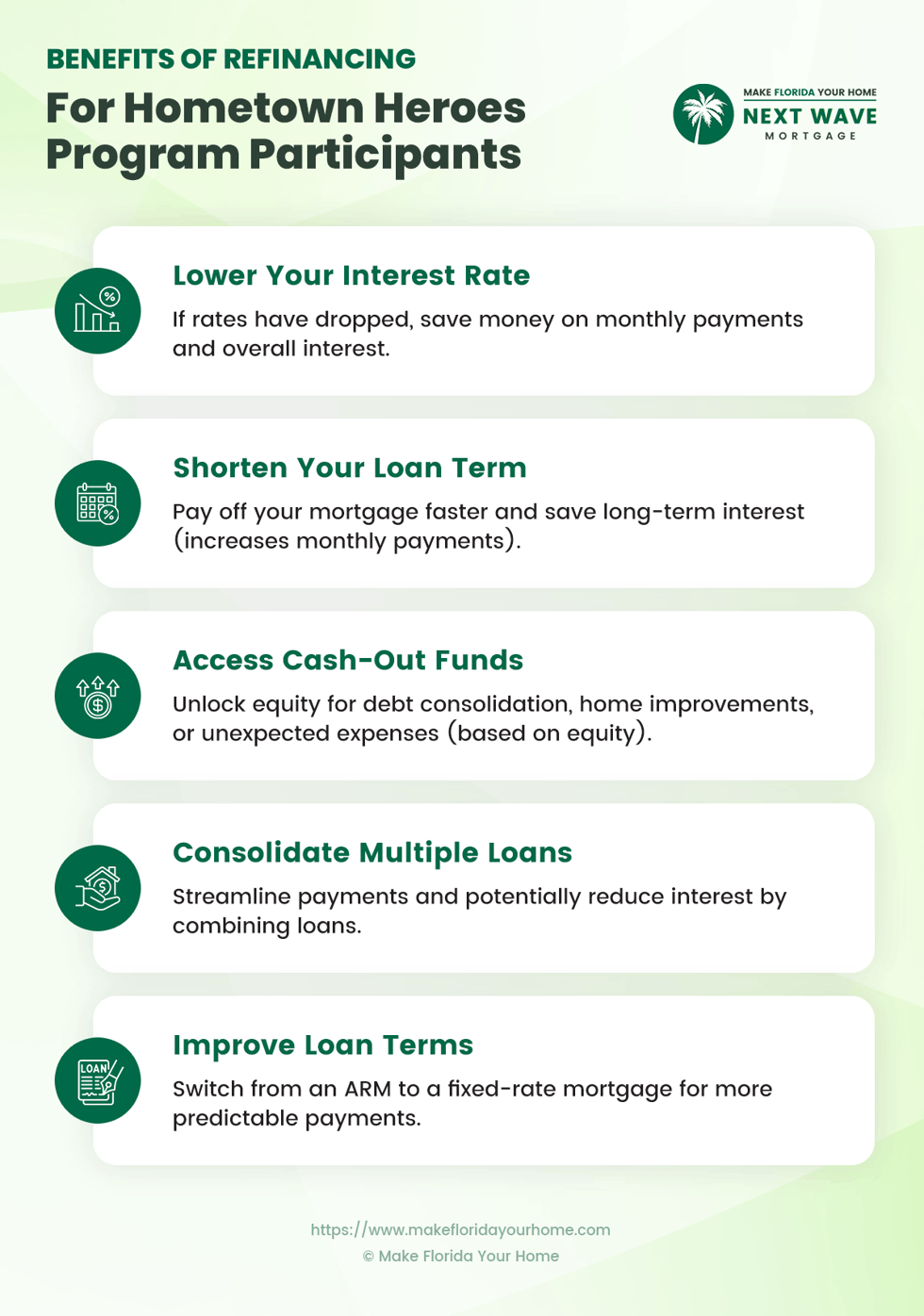

The Hometown Heroes Refinance Program provides a number of advantages, significantly for these whose monetary conditions have modified since acquiring their authentic Hero Mortgage. One of many key benefits of refinancing is the potential to decrease your rate of interest.

If market charges have fallen because you first secured your mortgage, refinancing may result in substantial financial savings in month-to-month funds and whole curiosity paid over the mortgage’s length.

One other profit is the flexibility to shorten the mortgage time period. Whereas this will likely enhance your month-to-month funds, it lets you repay your mortgage faster and save on long-term curiosity, which will be financially advantageous in the long term.

For householders who’ve constructed up fairness of their property, this system additionally provides a cash-out refinance possibility. This may be significantly helpful for consolidating debt, funding residence enhancements, or managing sudden bills, offering a flexible monetary device primarily based on your house’s worth.

Moreover, refinancing can enhance different mortgage phrases. For instance, you would possibly change from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

This variation can provide extra predictability and stability in your month-to-month funds, making monetary planning simpler and extra dependable.

Eligibility Standards for Candidates

To make sure the Florida Hometown Heroes Refinance Program is accessible to these it goals to help, there are outlined eligibility standards. As of 2024, this system now caters to all full-time Florida staff.

Candidates should meet sure monetary thresholds and residential necessities, making certain that those that contribute each day to the well-being of Florida’s communities are those who profit:

Occupation: Candidates must be employed full-time (35+ hours per week) by a Florida-based employer.

Army Standing: Energetic-duty army personnel, veterans, and members of the Nationwide Guard are eligible for this system.

Homeownership: This system is open to first-time homebuyers and in sure instances, repeat consumers.

Residency Requirement: Candidates have to be Florida residents and plan to occupy the bought property as their main residence.

Earnings Limits: The family revenue of candidates should not exceed 150% of the median revenue for his or her county. This threshold varies primarily based on the county.

Credit score Rating: A minimal credit score rating of 640 is required to qualify for this system.

Debt-to-income Ratio: Candidates ought to have a debt-to-income ratio that doesn’t exceed this system’s most restrict, sometimes 50%.

Mortgage Kind Eligibility: This system is appropriate with a number of first mortgages, together with FHA, VA, USDA, Fannie Mae, and Freddie Mac loans.

Understanding the Refinancing Course of

Refinancing your house mortgage via the Florida Hometown Heroes Program is a streamlined course of consisting of a number of key levels to facilitate a easy expertise for individuals.

The journey begins with contacting a taking part mortgage officer related to this system. These professionals present detailed insights into the refinancing course of and consider whether or not it is useful for you, contemplating your present mortgage and monetary standing.

The subsequent step includes an eligibility evaluation. Right here, you may affirm that you just meet this system’s crucial standards, together with your occupation, revenue ranges, and residency. The mortgage officer will help you on this course of.

Following this, you may want to assemble important paperwork reminiscent of proof of revenue, employment verification, present mortgage statements, latest financial institution statements, and your credit score report. These paperwork must be present and precisely replicate your monetary scenario.

As soon as you’ve got compiled all the mandatory documentation, your mortgage officer will information you thru finishing and submitting the refinancing utility. This utility is a complete overview of your monetary standing and the small print of your present mortgage.

The mortgage processing stage follows the submission of your utility. Throughout this part, the mortgage officer and processing group completely evaluation your utility. They might attain out for extra data or clarifications.

Upon approval of your utility, you may obtain a closing disclosure that outlines the phrases of your new mortgage. It is essential to evaluation these phrases rigorously.

Following your settlement to those phrases, a time limit is about. The closing course of includes signing the brand new mortgage paperwork and formally finishing the refinancing course of.

After closing, the ultimate stage is post-closing, the place you begin making funds in accordance with the phrases of your newly refinanced mortgage.

FAQs About Florida’s Hometown Heroes Program

This part goals to reply the most typical questions on Florida’s Hometown Heroes Program, providing clear and concise data for potential candidates and people fascinated about understanding extra about this system.

Who’s Eligible for the Hometown Heroes Program?

Eligibility for this system embody full-time employment by a Florida-based employer. Residency in Florida and an intent to make use of the bought residence as a main residence are required.

First-time homebuyers, some repeat consumers, healthcare staff, academics, legislation enforcement officers, firefighters, active-duty army, veterans, Nationwide Guard members and army personnel are additionally eligible.

What are the Monetary Necessities for the Program?

Candidates will need to have a family revenue beneath 150% of their county’s median revenue. A minimal credit score rating of 640 and a debt-to-income ratio not exceeding this system’s most (normally 50%) are additionally required.

Can the Program Be Used for Refinancing?

Sure, this system provides refinancing choices for these with a Hero Mortgage. Refinancing may also help decrease rates of interest, shorten mortgage phrases, entry fairness for cash-out, or enhance total mortgage phrases.

What Varieties of Loans are Accessible?

This system is appropriate with varied mortgage sorts, together with FHA, VA, USDA, Fannie Mae, and Freddie Mac first mortgages.

How Does the Software Course of Work?

The appliance course of includes contacting a taking part mortgage officer, verifying eligibility, gathering crucial paperwork, submitting an utility, and going via mortgage processing, appraisal, underwriting, and shutting.

What Are the Advantages of the Hometown Heroes Program?

Advantages embody diminished rates of interest, favorable mortgage phrases, sustainable homeownership alternatives, monetary aid, and enhanced stability and safety for important staff in Florida.

Is There Help Accessible for the Software Course of?

Sure, taking part Florida Housing mortgage officers at MakeFloridaYourHome can be found to help candidates all through the method, from preliminary inquiry to last approval. They information eligibility, documentation, and some other questions associated to this system.

Conclusion

In conclusion, the Florida Hometown Heroes Program stands as a big initiative, acknowledging and supporting the important roles performed by important staff in our communities.

Via this program, Florida provides a token of gratitude and gives tangible help in making homeownership extra inexpensive and sustainable for these devoted people.

The Florida Hometown Heroes Refinance Program, a key element of this initiative, is tailor-made to be essentially the most easy, fast, and efficient manner for individuals to refinance their present Hero Loans.

This refinancing possibility ensures that important staff can adapt their mortgage phrases to go well with altering monetary circumstances via reducing rates of interest, shortening mortgage phrases, accessing fairness, or bettering total mortgage circumstances.

[ad_2]

Source link