[ad_1]

shih-wei

After a protracted 10-month search course of, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) lastly introduced Anat Ashkenazi, former Govt Vice President and Chief Monetary Officer at Eli Lilly (LLY), as the corporate’s new CFO.

I’ve fairly a protracted wishlist for the new CFO, who, in my opinion, has a transparent path to generate significant worth for Alphabet’s shareholders.

Introduction & Revisiting The Google Funding Thesis

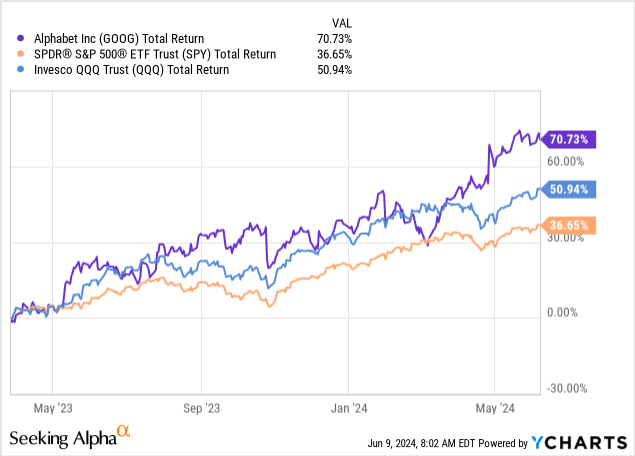

I have been overlaying Alphabet on Searching for Alpha since March of 2023, sustaining a bullish ranking all through the interval. To date, we had been right:

The funding thesis right here was, and stays, fairly easy. Alphabet has a number of extraordinary property beneath its umbrella, together with YouTube, Android, Search, Google Cloud, and the remainder of the Google suite. These are all companies which have extraordinarily broad moats, profit from one another, and have very engaging margins, in addition to an abundance of development alternatives.

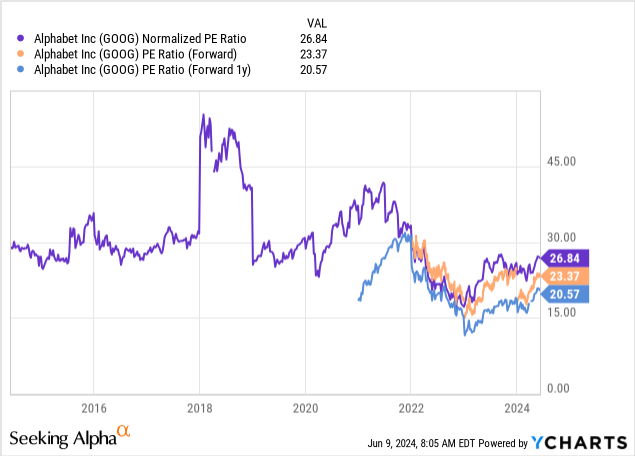

And the cherry on prime, Alphabet, who owns all these companies, was, and nonetheless is, comparatively undervalued, in comparison with its historic ranges and its friends.

That stated, we will not ignore the explanations for the market putting the next threat, and due to this fact a decrease a number of on Google’s father or mother for the previous a number of years.

Three Causes The Market Was (And Nonetheless Is) Rightfully Discounting Alphabet

Although I had a Purchase ranking on Alphabet and in addition held shares, I had many adverse issues to say concerning the firm’s complacency, capital allocation, and lack of transparency.

Aspect notice, maybe that is the perfect testomony to Google’s energy, as even massive critics discovered the corporate to be a lovely funding, on account of a uncommon mixture of high quality and valuation.

Beginning with complacency. 2023 was the yr of effectivity for a lot of corporations, together with Meta (META), whose CEO, Mark Zuckerberg, was the one who coined the time period. After the massive selloff in 2022, corporations, primarily within the tech panorama, understood that buyers had been anticipating them to chop pointless prices aggressively, and lots of of them delivered. Nevertheless, throughout a time when Google’s rivals had been aggressively shedding staff, Google was much less aggressive and far more complacent, which resulted in a slower restoration of margins.

Second, capital allocation. Persevering with from the complacency level, Alphabet was additionally sluggish to chop non-core actions and continued to speculate closely in some Different Bets tasks. As well as, the corporate continued to sit down on an enormous ~$100 billion pile of money, with no aggressive sufficient buybacks and no dividend announcement, even when the inventory was plummeting.

Lastly, the corporate suffered from an absence of transparency, as its former CFO, Ruth Poran, was reluctant to supply any quantifiable steerage concerning the firm’s future, each on the bills and the income entrance.

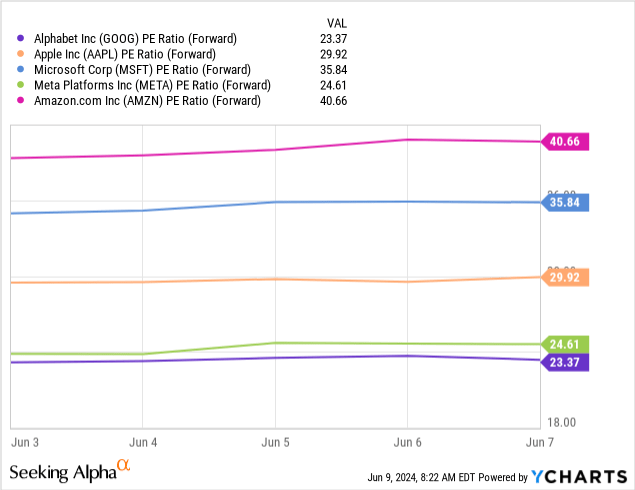

Whereas Alphabet did enhance upon the features we mentioned above, together with its largest buyback announcement ever, significantly better execution, improved margins, and the initiation of a dividend, we will nonetheless see the corporate is getting the bottom a number of in massive tech, although it is anticipated to develop sooner than a number of the names right here.

There are different causes that justify this low cost, together with the next threat of disruption to the core enterprise from AI, and being third within the cloud behind Microsoft (MSFT) and Amazon (AMZN).

Each of the above will stay a drag on valuation for fairly a while, however I nonetheless imagine there’s room for a number of growth if the brand new CFO adjustments a number of the earlier methods of doing issues.

Expectations From Alphabet’s New CFO

Former Govt Vice President and Chief Monetary Officer at Eli Lilly, Anat Ashkenazi, will begin her function on July thirty first, 2024. She’s been at Eli Lilly for 23 years and had a number of financial-related roles within the pharmaceutical empire.

Though she has no main expertise in tech, I imagine that the brand new CFO generally is a significant driver of shareholder returns within the close to time period.

Offering Readability & Steerage

Alphabet didn’t present tangible steerage for so long as I can bear in mind. For a corporation with such an expansive portfolio of companies, it is extraordinarily laborious for buyers to gauge the quantity of investments and bills Alphabet may have in a given yr. This leads analysts to closely depend on extrapolation and historic numbers to foretell subsequent yr’s numbers.

Other than much less dependable predictions, this creates a foul incentive for the administration workforce. As an illustration, Meta gives an annual expense information. If revenues come higher than anticipated, buyers will nonetheless count on bills to come back round that preliminary information, which suggests Meta’s administration is pressured into staying inside its vary.

For Alphabet, if revenues are higher than anticipated, administration may be prepared to spend extra, so long as margins stay cheap.

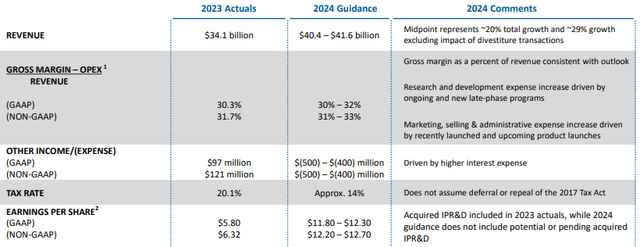

That is how typical steerage seemed like, for Eli Lilly, beneath Anat’s management:

Eli Lilly This fall’23 Presentation

The corporate additionally revealed complete quarterly displays and supplied in depth explanations about every of the P&L gadgets.

Usually talking, within the prescribed drugs sector, that is the customary manner of doing issues, and I would not count on something that comes near this stage of transparency.

That stated, I imagine that even an annual expense goal might contribute to a couple factors of a number of growth, and that’s one thing I count on the brand new CFO to push for.

Extra Granularity, Particularly In Different Bets

Alphabet lately modified its phase reporting, reworking its ‘Google Different’ line merchandise to ‘Google Subscriptions, Platforms, and Gadgets’. That, together with Alphabet’s Different Bets, leaves quite a lot of room for extra granularity about every of the corporate’s companies inside these divisions.

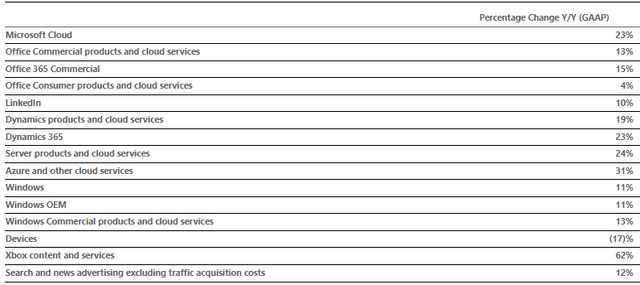

As an illustration, we don’t know how a lot cash Google generates from {hardware}, what is the measurement of YouTube’s subscription enterprise, and the listing goes on. This is how one other very well-known firm and a Google competitor on many fronts, gives element on every of its services and products:

Microsoft Q3’24 Earnings Launch

There’s the outdated saying ‘What you do not know cannot kill you’, however I feel that in investing, uncertainty is sort of at all times dangerous. I am not saying they’ve to interrupt out every little thing, however even some element on every of the enterprise strains on incomes calls might be useful.

Aggressively Capitalizing In Durations Of Power, Making ready For Durations Of Weak point

That is the realm the place I am most excited. One functionality that pharma corporations should possess is the flexibility to aggressively capitalize on profitable merchandise (i.e. Ozempic and Mounjaro). One other essential functionality is making ready for patent cliffs.

Alphabet’s portfolio consists of a number of jewels which are the overwhelming leaders of their verticals. A kind of jewels is in fact search.

In my opinion, there are quite a lot of similarities between what Alphabet is presently experiencing with a few of its core merchandise and the looming potential disruption from AI.

Though I discover it not possible that Google will lose vital market share on account of AI, and net-net I count on AI to be constructive for the corporate, primarily on account of its Google Cloud, I feel the brand new CFO ought to be capable of assist discover the correct steadiness between milking the earlier enterprise mannequin and making ready for the brand new period.

Valuation

Based mostly on present consensus estimates, Alphabet is buying and selling at a 23.4x a number of over 2024 earnings, and a 20.6x a number of over 2025.

We have already seen Alphabet handily beat Q1 estimates, and but present consensus nonetheless appears fairly low, because it displays worse seasonality, and a margin decline from Q1, each of which I can not discover good causes for.

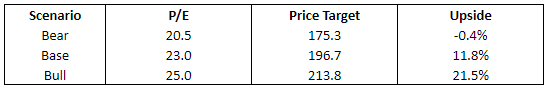

Even when we take present consensus estimates as they’re, I imagine the bottom case state of affairs can be a 23.0x a number of on 2025 earnings by the top of 2024, reflecting practically 12% upside. A bear case a number of can be 20.5x, and a bull case state of affairs is 25x.

Created and calculated by the creator utilizing information from Searching for Alpha; Based mostly on Alphabet’s share worth as of 06/09/2024.

If the brand new CFO delivers on the three key areas I listed above, I see no cause why Alphabet cannot expertise a big a number of growth.

Mixed with the very fact I count on the corporate to handily beat estimates, I imagine that the most certainly consequence can be that we find yourself someplace between the bottom and bull situations.

That leads me to a blended worth goal of $200 a share.

Conclusion

After the 2022 selloff, Alphabet shares recovered. Initially, the primary driver for the restoration was valuation. Then, it was the inevitable enchancment of the corporate’s legacy companies.

From March 2024 as much as right this moment, I imagine Alphabet’s management deserves a lot of the credit score, because the market clearly acknowledged Alphabet’s administration modified its tone and began executing at an industry-leading stage on many fronts.

Nonetheless, there’s extra to be desired, and I imagine that the brand new CFO has the chance to drive significant enhancements within the very close to time period.

The mixture of Alphabet’s big development alternatives and its comparatively low valuation makes it essential place in my opinion. Due to this fact, I reiterate a Purchase ranking.

[ad_2]

Source link