[ad_1]

stockcam

Introduction & Funding Thesis

Reddit (NYSE:RDDT) is a community of communities the place individuals dive into their pursuits, hobbies, and passions. The corporate went public in March and, since then, has outperformed the indices. It reported its Q1 FY24 earnings in Might, the place income grew 48% whereas Adjusted EBITDA turned optimistic to $10M, exceeding expectations. The energy in income was led by robust development in Day by day Energetic Uniques (“DAUq”) as the corporate drove sturdy product innovation to reinforce on-platform search, break language obstacles, and enhance content material moderation, leading to promoting income rising 39% YoY to $222.7M.

Since then, the corporate has introduced its partnership with OpenAI, the place Reddit will probably be constructing on Open AI’s platform of AI fashions to enhance consumer expertise and drive innovation. Whereas the inventory jumped because the announcement, I imagine that the partnership will assist Reddit speed up its knowledge licensing income stream, whereas additionally laying the inspiration to drive increased advert spend from higher consumer concentrating on. Whereas there are dangers of consumer attrition within the course of, coupled with a aggressive panorama the place firms like Google (NASDAQ:GOOG), Meta (NASDAQ:META) and Amazon (NASDAQ:AMZN) are spending closely on capex to construct proprietary LLM capabilities. I like that Reddit is selecting to stay mild on the capex aspect, given it has slender revenue margins in the intervening time. Assessing each the “good” and the “dangerous”, I imagine that the inventory presents a beautiful entry level at its present ranges, making it a “purchase”.

The great: Income development accelerated as consumer engagement deepens from sturdy product innovation and advert income grows, OpenAI partnership will probably be a win-win

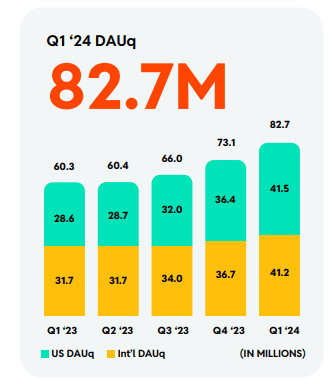

Reddit reported its Q1 FY24 earnings, the place income grew 48% YoY to $243M, whereas Adjusted EBITDA turned optimistic to $10M with a margin of 4%. Throughout the quarter, DAUq’s rose 37% YoY as the corporate targeted its efforts on making the platform higher with investments in ML and AI to enhance relevance, engagement, and moderation, enabling customers to seek out communities that align with their pursuits in addition to lowering the time required for communities to implement their very own guidelines.

Q1 FY24 Shareholder Letter: Rising Day by day Energetic Uniques throughout geographies

Out of the $243M in income, commercial income contributed 91.6% to Complete Income rising 39% YoY, whereas the remaining 8.4% of income was pushed primarily by knowledge licensing agreements that grew 450% YoY. I imagine the energy in Reddit’s promoting income will be attributed to the corporate’s success in attracting new customers and deepening engagement on the platform by sturdy product improvements that embody the rollout of their new internet platform, Shreddit, that may enhance on-platform search options, coupled with launching early use circumstances of machine studying to interrupt the language barrier by translating extremely visited posts into French, with extra languages on the roadmap, together with utilizing AI to help moderately and scale back frequency with contributing on the platform and permit moderators to concentrate on main and rising their communities.

Throughout the quarter, the corporate grew its Common Income Per Person (“ARPU”) by 8% YoY to $2.94 because it continued to construct its full funnel options to drive superior advertiser outcomes. Notably with Free-form Advertisements, advertisers can create long-form multimedia content material throughout media codecs with the aim of contributing their voice and experience to related communities, outperforming different advert sorts in click-through charges by 28%. Plus, the corporate additionally launched Reddit Professional, which is a free suite of social listening and engagement instruments for companies to grasp how their model is mentioned on Reddit, leading to over 1000 companies onboarding the device as of the primary quarter. As the corporate sees success in advertiser development throughout channels, verticals, and geographies, I believe Reddit can carve out a distinct segment within the promoting trade the place it faces competitors from Large Tech firms reminiscent of Google, Meta, and Amazon because it continues to advance its full-funnel commercial expertise and rising world attain to concentrate on consumer-centric and privacy-conscious promoting options, particularly with the worldwide advert market anticipated to develop 5.3% YoY, coupled with tailwinds from the election cycle within the US and different cyclical occasions just like the Olympics.

This brings me to the corporate’s announcement of its partnership with OpenAI on Might sixteenth, the place Reddit will leverage OpenAI’s expertise to construct AI instruments and options to deepen its consumer engagement and advert load, whereas OpenAI’s ChatGPT will combine Reddit’s content material in a “real-time, structured” method. This can permit Reddit to advance its income from its knowledge licensing enterprise, given its benefit of distinctive conversations within the dimension of 1B posts and 16B feedback, which is a gold mine for OpenAI, whose fashions be taught from textual content and pictures to generate new and comparable content material. One of many issues that I want to level out is that not like Meta and Google, that are closely spending in AI capex to construct and prepare their proprietary LLM fashions, Reddit is protecting it capex mild the place it may well get entry to the AI expertise capabilities just by licensing its knowledge as a substitute of spending assets to construct in-house fashions, which permits it to monetize its twenty years value of content material right into a income stream whereas concurrently accelerating its advert income development from higher matching consumer intent with related and personalised adverts.

The dangerous: Person attrition stays a risk amid the OpenAI partnership, Aggressive panorama could end in margin pressures

Whereas the partnership with OpenAI opens up a brand new income stream for Reddit, there’s a threat of consumer attrition on the platform. Earlier final month, Reddit printed a Public Content material coverage stating the next:

“Sadly, we see increasingly industrial entities utilizing unauthorized entry or misusing licensed entry to gather public knowledge in bulk, together with Reddit public content material. Worse, these entities understand they haven’t any limitation on their utilization of that knowledge, they usually achieve this with no regard for consumer rights or privateness, ignoring cheap authorized, security, and consumer elimination requests. Whereas we’ll proceed our efforts to dam recognized dangerous actors, we have to do extra to limit entry to Reddit public content material at scale to trusted actors who’ve agreed to abide by our insurance policies. However we additionally have to proceed to make sure that customers, mods, researchers, and different good-faith, non-commercial actors have entry. Anybody accessing Reddit content material should abide by our insurance policies, and we’re selective about who we work with and belief with large-scale entry to Reddit content material.”

There is no such thing as a doubt that Reddit has been vocal about its pursuits in pursuing knowledge licensing to speed up enterprise development; nonetheless, it concurrently dangers consumer protests and attrition from its platform, prefer it has seen earlier than round using user-generated content material to gasoline AI fashions with out customers getting compensated and a few customers rejecting the concept their social media posts ought to be used for AI coaching functions.

Concurrently, it additionally faces competitors from massive gamers within the advert panorama that embody Meta and Google, which management over 60% of the US digital advert market. Whereas Reddit is positioning itself as a distinct segment, it additionally must proceed to spend on its R&D to drive consumer engagement and advertiser spend development on the platform. Given its already slender profitability margins in the intervening time, it dangers turning right into a loss ought to it expertise a decrease than anticipated ROI on its R&D spend.

Tying it collectively: Reddit is a “purchase”

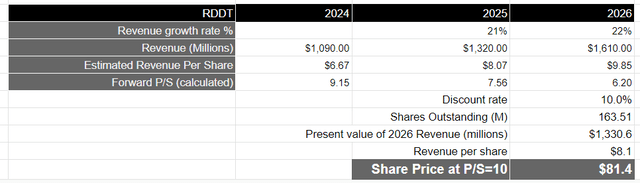

Wanting ahead, I’ll take the consensus expectation for income development over the subsequent 3 years till FY26, the place income will develop within the low twenties area to $1.6B throughout this time period. I imagine this ought to be achievable as Reddit continues to see development in its promoting and data-licensing enterprise, with enhanced AI capabilities from its OpenAI partnership deepening consumer engagement and driving higher concentrating on, thus leading to increased advert spend.

For the reason that firm hasn’t supplied a long-term working mannequin, it will be tough to evaluate how the corporate will enhance its profitability panorama throughout this time period. Because of this, I’ll base my valuation of Reddit on income development projections over the subsequent 3 years. Due to this fact, assuming that it generates $1.6B in income, that might translate to a gift worth of $1.3B when discounted at 10%. Taking the S&P 500 as a proxy, the place its firms develop their revenues at a median charge of 4.8% with a price-to-sales ratio of two.19, that might imply that Reddit ought to be buying and selling at roughly 4.5 occasions the a number of given the expansion charge of its income throughout this time period. This can translate to a P/S ratio of 10, or a worth goal of $81, which represents an upside of 33.4%.

Creator’s Valuation Mannequin

Though there may very well be short-term volatility, particularly as revenue margins stay low, I imagine that Reddit will drive substantial long-term upside in traders’ portfolios. As per analysis from GlobalData, genAI as an trade is predicted to develop at a compounded annual development charge of 79% to succeed in $33B by 2027. I imagine that by forming its partnership with OpenAI, Reddit has an early-mover benefit because it takes benefit of enhanced AI capabilities to unlock consumer insights to drive development for its promoting companies whereas monetizing from its knowledge on the similar time. Due to this fact, given the present risk-reward, I imagine that the inventory is a “purchase” over a 3-year funding horizon.

Conclusion

I imagine that the partnership with OpenAI is not going to solely permit it to develop its knowledge licensing income stream but in addition spearhead development in its promoting income, because it focuses on driving sturdy product innovation to deepen consumer engagement and expertise on the platform, making it a “purchase”.

[ad_2]

Source link