[ad_1]

Artem_Egorov

Funding Thesis

This is the punchline: indie Semiconductor, Inc. (NASDAQ:INDI) is a inventory that, I imagine, is pretty valued.

The outlook is anticipated to enhance within the again half of 2024. That is the bull case. But when the inventory is already pricing in that potential, it must ship in opposition to this expectation merely for the inventory to not dump.

Because it stands proper now, we’ve got a enterprise with a steady steadiness sheet, that is burning via some money move. However I imagine that paying round 4x this 12 months’s gross sales already costs in a substantial quantity of hope.

Subsequently, I proceed to be impartial on this title.

Fast Recap

Final October, I mentioned,

I find myself impartial on INDI inventory, as I wrestle to get behind this firm’s imaginative and prescient. It isn’t that I doubt its narrative. As an alternative, I’ve sure reservations about its fundamentals.

That paragraph succinctly surmises my place. And this forces my subsequent query.

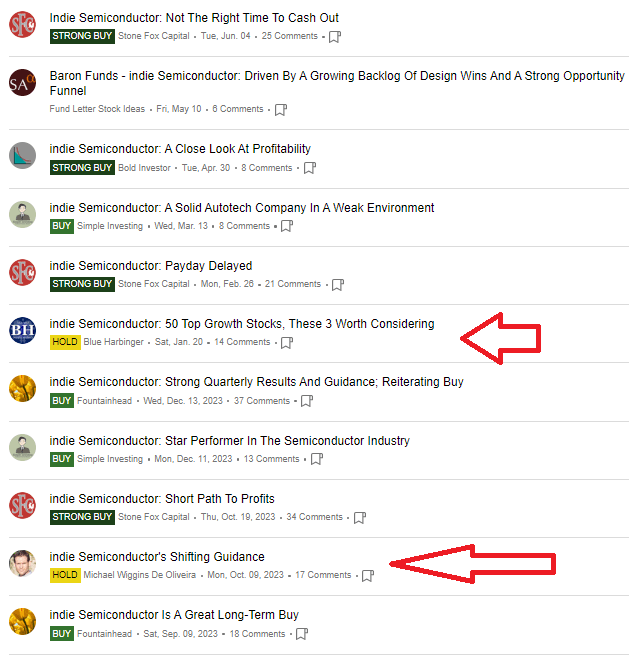

SA

Why, once I look via SA, solely I, and one other analyst, have a maintain on this inventory (crimson arrows above)? What’s everybody so bullish about?

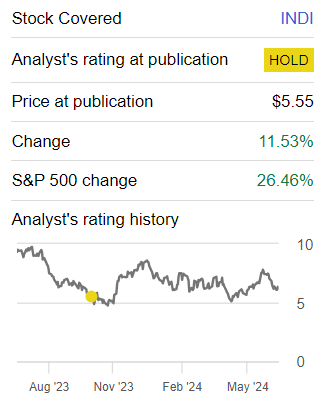

Writer’s work on INDI

As you may see above, since my earlier evaluation, this inventory has considerably underperformed the S&P 500 (SP500). And now, as I look forward, I nonetheless wrestle to see its enchantment. This is why.

indie Semiconductor’s Close to-Time period Prospects

indie Semiconductor makes a speciality of automotive semiconductors for Superior Driver Help Methods. It seeks to outpace its trade friends by leveraging superior know-how within the auto tech market.

indie’s product portfolio, which incorporates improvements in ADAS and electrification purposes, positions them for continued progress as new applications are anticipated to ramp up within the latter half of the 12 months.

indie makes the case that they’re set to profit from ongoing tendencies in automotive security and automation, best-in-class consumer experiences, and drivetrain electrification.

Regardless of market headwinds, indie expects to develop by round 20% y/y in 2024, pushed by the ramp-up of latest product introductions and huge program wins.

Nevertheless, indie faces headwinds, together with a contracting car market influenced by a shift in the direction of extra economical automotive fashions with decrease semiconductor content material.

The EV market can be experiencing a decline resulting from greater prices, decreased subsidies, and slower infrastructure rollout.

This has led to a deal with extra reasonably priced inner combustion engines and hybrid fashions, which comprise legacy silicon. Moreover, the general automotive semiconductor market progress is anticipated to decelerate considerably in 2024.

Given this balanced background, let’s now focus on its potential progress charges for 2024.

Income Progress Charges Absolutely Fizzle Out, Will It Decide Again Up?

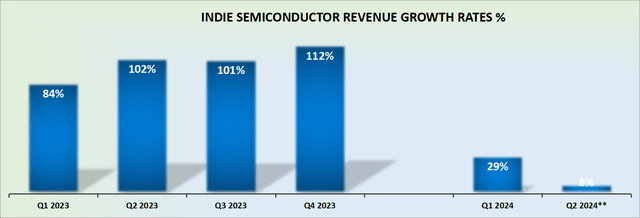

INDI income progress charges

indie’s Semiconductor’s steerage for Q2 2024 factors to excessive single-digit progress charges. This suggests a big drop from its income progress charges of final 12 months.

Given the backdrop that we have mentioned above, I wonder if there is a potential for indie’s income progress charges to reaccelerate in 2024, or whether or not that is extra probably than not a 2025 story?

What’s extra, as you may see above, the comparables for the rest of 2024 do not ease up. The truth is, This autumn 2024 is more likely to see indie’s income progress charges flip adverse.

Which means that it is potential that the worst of its outlook hasn’t but arrived. Therefore, with this line of reasoning in mind, let’s now flip as to if this inventory is undervalued?

INDI Inventory Valuation — 4x Gross sales

indie’s steadiness sheet is in a steady place. Sure, it holds a internet debt place of $30 million, however given it carries almost $140 million of money, this is not instantly restrictive. Nevertheless, indie’s internet debt place in the end will get in the best way of its potential to return capital to shareholders any time quickly.

Furthermore, we’ve got to remember that indie is on a path towards burning via roughly $30 million of free money move over the following twelve months.

So, we’ve got a enterprise that is free money move adverse, along with somewhat unexciting progress charges. What kind of a number of are traders keen to pay for this form of enterprise? Very roughly 4x ahead gross sales.

Evidently, this valuation is not exuberant. In spite of everything, after years of its share value going nowhere, the inventory is now extra probably than not pretty valued.

However on the similar time, I query the enchantment of backing indie Semiconductors? Regardless that I undoubtedly acknowledge that one ought to be bullish on semiconductors when their outlook is the worst, I stay unclear whether or not traders are actually pricing in such a poor consequence? Or maybe there’s additionally hope that the again half of 2024 might, in actual fact, speed up?

In sum, I do not imagine this title has a gorgeous risk-reward.

The Backside Line

Given the present market circumstances and particular challenges indie faces, such because the shift in the direction of decrease semiconductor content material autos and the deceleration in automotive semiconductor market progress, it seems that the corporate’s near-term progress prospects are tempered by important headwinds.

Regardless of indie Semiconductor, Inc.’s robust design win momentum and strategic positioning for long-term tendencies, paying 4x this 12 months’s gross sales for a cash-burning enterprise with unsure outlooks is not thrilling sufficient for me.

The steadiness between its progressive potential and the prevailing market pressures means that the inventory is already pretty valued, with restricted speedy upside.

[ad_2]

Source link