[ad_1]

A Few Ideas on Pragmatic Asset Allocation

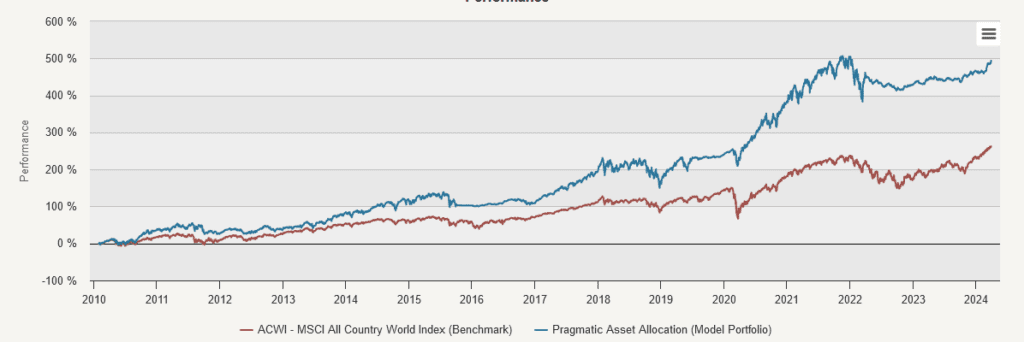

One of many important the explanation why the Pragmatic Asset Allocation Mannequin was designed is to provide buyers a tax-efficient chance to spend money on a world fairness portfolio with a decrease threat than the passive purchase&maintain method. Subsequently, the PAA mannequin is just not the “absolute return” mannequin however reasonably the tactical mannequin that prefers to spend money on the fairness threat premium and transfer to the hedging portfolio (gold, treasuries, or money), just for quick durations and solely when it’s completely essential. We use worth development+momentum indicators and yield curve inversion as indicators for such conditions when (based mostly on the previous knowledge) there’s a greater likelihood of recessions and fairness bear markets.

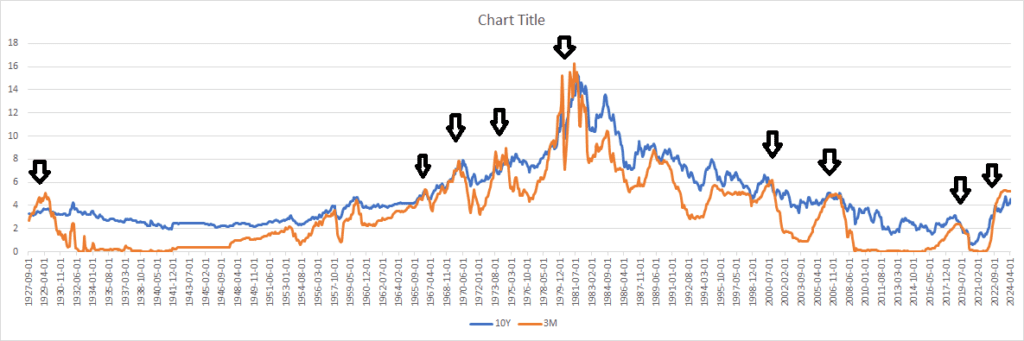

The yield curve inversion sign has an necessary place in the entire mannequin and final such sign for avoiding equities occured on the finish of the 2022 and when the 3-month yields jumped considerably over the 10-year yield. Such conditions usually are not unusual and occurred numerous the time during the last 100 years.

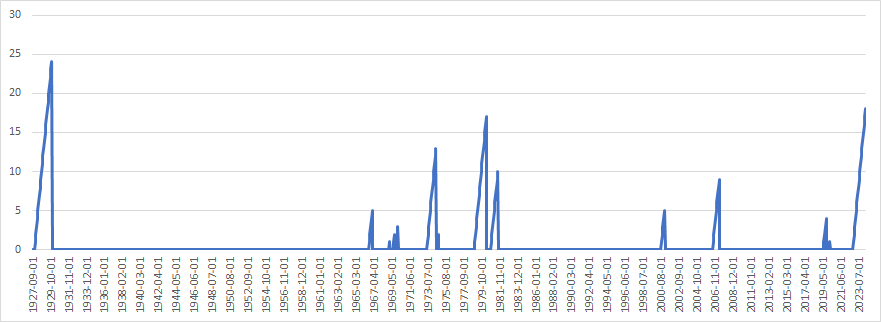

What’s uncommon within the present state of affairs is the size of the time that the YC is inverted (19 months in the mean time), which makes it the 2nd longest YC inversion within the final 100 years (the longer was solely the inversion within the Nineteen Twenties).

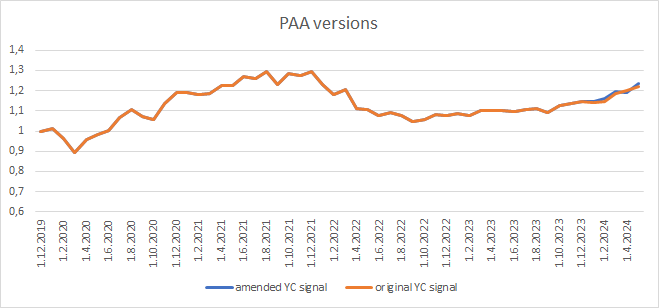

Within the present state of affairs, the FED is just not very inclined to decrease the short-term charges, and evidently the YC will keep inverted for a considerably longer interval. This 12 months, we’ll break the report from the Nineteen Twenties within the size of the YC inversion. As we talked about earlier than, the PAA mannequin’s intention is to carry primarily the fairness portfolio; nevertheless, within the present state of affairs, the portfolio consists of gold (37.5%) and money. The long-term efficiency of the mannequin is just not impacted considerably by omitting the equities within the final 1.5 years, because the chart reveals (comparability of the efficiency of the PAA mannequin and ACWI benchmark).

Nonetheless, there nonetheless could be buyers, that may really feel uncomfortably by not holding equities for an extended time frame as a result of YC inversion when worth/momentum indicators already turned optimistic. We acquired request to discover YC sign modification for this example. So, what’s the answer?

We are able to amend the YC sign in a means, that if the yield curve inverts, then we’ll swap present tranche from dangerous property to the hedging portfolio (or money), however the YC sign swap is legitimate just for 12 months. So after the 12 months, if the YC sign nonetheless indicators the recession however MA sign is optimistic, then we don’t take YC sign into the consideration.

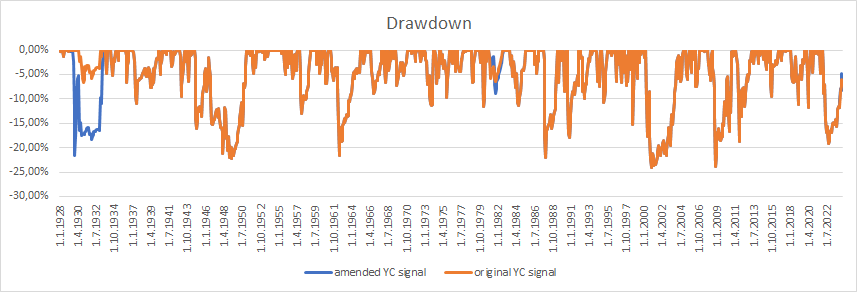

What’s the results of such an modification? The long-term outcomes present no massive distinction. The efficiency of the unique mannequin (with none modifications to the YC sign) is 10.73%, volatility 11.48%, and max drawdown -23.98%, which supplies a Sharpe ratio of 0.93 and Sortino 0.45. A technique with an amended YC sign has a efficiency of 10.62%, volatility of 11.68%, and max drawdown -of 23.98%, which supplies a Sharpe ratio of 0.91 and a Sortino ratio of 0.44. As we will see, the outcomes are negligible. The principle distinction occurred within the Nineteen Twenties when the mannequin with an amended YC sign purchased shares too quickly in 1929 and skilled some drawdown at the moment. However, PAA, which makes use of the unique YC sign, didn’t have this drawdown in 1929.

And what about present instances? What’s the distinction between each variations? The unique PAA is invested primarily in money (62.5%) and gold (37.5%). The PAA, with an amended YC sign, began to spend money on equities on the finish of January 2024 and at present has 32.5% in money, 25% place in Nasdaq, 25% in world shares, and 12.5% in gold. The full efficiency distinction during the last 4 years is roughly 3%. The amended PAA model outperforms the unique PAA a bit of, as Nasdaq outperformed gold over the earlier six months, however the complete distinction isn’t something that stands out as extraordinary.

In fact, the query is: What model is best – the unique YC sign or the amended YC sign? There isn’t a definitive reply to that. By amending the YC sign, the amended PAA permits for the earlier funding in equities. Nonetheless, we must base our present choice on one knowledge level; we would not have sufficient knowledge to say that’s the appropriate factor to do, as the one time the amended mannequin ignored inverted YC was in 1929 (and it positively wasn’t a good suggestion). In the previous few months, dangerous property have outperformed hedging portfolio, however will the outperformance persist? No one is aware of. But when our expertise with buying and selling taught us one thing, then it’s to stay versatile.

So, on this case, the reply in all probability lies in every particular person’s tolerance for threat and FOMO feeling. For growth-oriented people, it’s in all probability higher to amend the YC sign and regularly go into equities, even when it will increase threat. For the people preferring protection, it’s in all probability higher to nonetheless maintain money (which nonetheless provides attention-grabbing yield) and gold. Within the quick time period, the efficiency of each variations will barely differ; in the long run (a long time), each variations will in all probability carry out roughly the identical.

Are you in search of extra methods to examine? Join our e-newsletter or go to our Weblog or Screener.

Do you need to be taught extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing provide.

Do you need to be taught extra about Quantpedia Professional service? Test its description, watch movies, overview reporting capabilities and go to our pricing provide.

Are you in search of historic knowledge or backtesting platforms? Test our listing of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookConsult with a good friend

[ad_2]

Source link