[ad_1]

Contents

The PCE is the Private Consumption Expenditures index launched by the Bureau of Financial Evaluation (BEA), sometimes month-to-month.

It measures inflation in the USA and is carefully watched by traders, merchants, and policymakers because it displays adjustments in client spending patterns and worth ranges.

The report itself could be discovered on the BEA authorities web site.

For instance, the PCE report was launched at 8:30 a.m. EDT on Friday, April 26, 2024 (only one hour earlier than the market opened).

Whereas the report comes out in April, the numbers are private revenue and outlays for March 2024. Compiling all these numbers takes time.

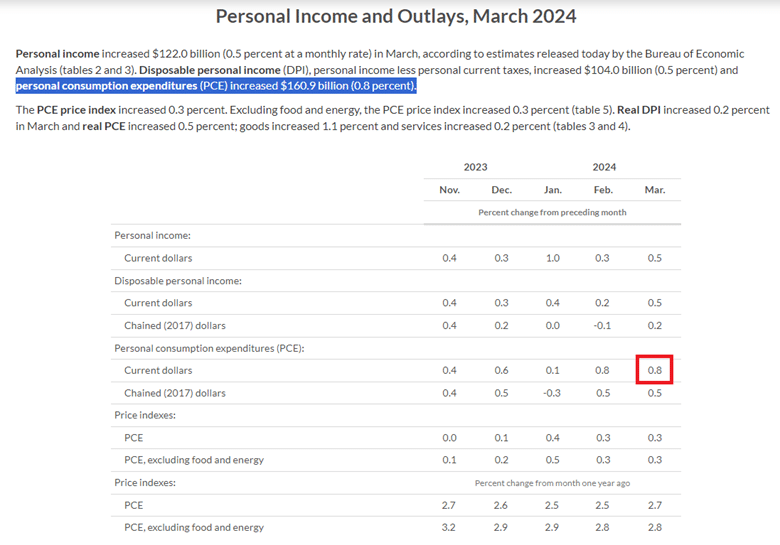

Right here is an excerpt of the report:

The report says that private consumption expenditures elevated by $160.9 billion from the month earlier than.

Assuming that folks purchase the identical issues from month to month on common, a rise in expenditures means the identical issues price greater than earlier than.

That is what is named inflation.

Therefore, these numbers measure the speed of inflation.

This 0.8% enhance is the “present {dollars}” quantity highlighted within the above desk.

The quantity can be reported as “chained {dollars}.”

These are simply two completely different ways in which financial analysts wish to calculate numbers.

Present {dollars} discuss with the nominal worth, whereas chained {dollars} modify for adjustments in worth ranges (inflation) over time, permitting for a extra correct comparability of financial values throughout completely different intervals.

Client expenditures are additionally reported as a PCE index.

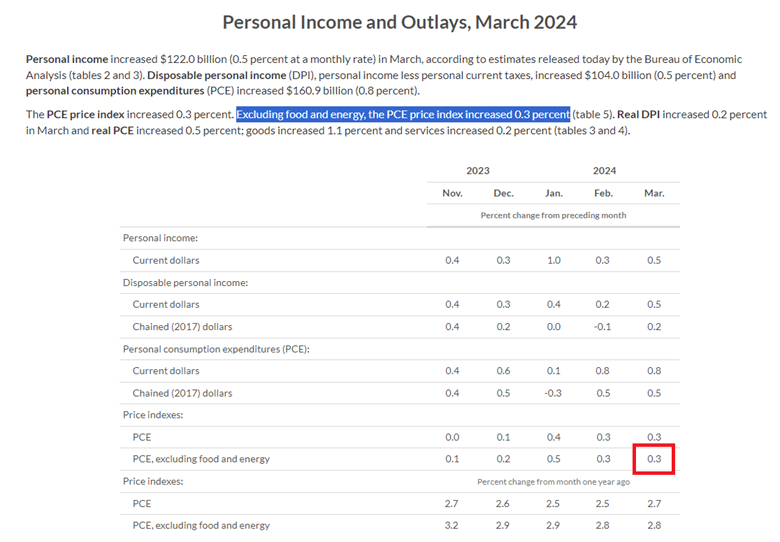

That is the quantity that’s most frequently reported within the media:

It excludes meals and vitality expenditures.

That is the “Core PCE Index,” and the field is highlighted within the above desk.

The road above it (generally referred to as “headline PCE”) contains all gadgets within the index, together with unstable elements like meals and vitality costs, which fluctuate considerably.

The core PCE excludes these unstable elements to offer a extra secure measure of underlying inflation tendencies.

It excludes meals and vitality costs, which could be affected by many different elements not associated to inflation (similar to seasonal and geo-political elements).

The PCE index is usually reported relative to a base 12 months, which is assigned the worth of 100. Value adjustments are then mirrored as a proportion of this base 12 months’s worth.

For instance, if the index is 110, it means costs have elevated by 10% for the reason that base 12 months.

We’re much less involved with the worth of the index itself and extra involved with the % change of this index.

This report says the Core PCE worth index elevated by 0.3 % from the earlier month.

Free Coated Name Course

Monetary markets carefully monitor PCE index releases for insights into potential financial coverage actions by the Federal Reserve.

Increased-than-expected inflation readings could result in hypothesis of tighter financial coverage, similar to rate of interest hikes, which might impression asset costs and market sentiment.

Analysts additionally assess whether or not precise inflation is in step with the inflation goal the Federal Reserve goals to realize over the medium time period.

Typically it does, and generally it doesn’t.

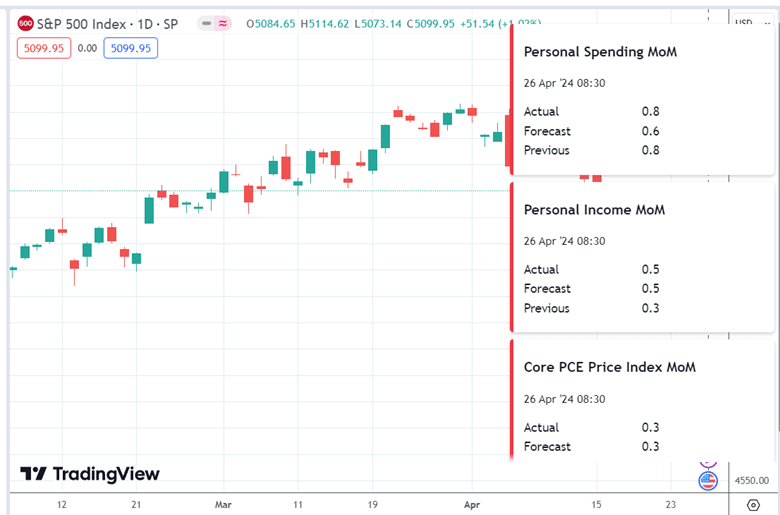

This report is critical sufficient that it’s included within the financial calendar information occasion on some charting software program.

Under is an instance from TradingView:

On this case, the March PCE index got here out as forecasted.

The ” Precise ” and “Forecasted” numbers confirmed a 0.3% enhance.

So, did this transfer the markets?

The Friday on which the report got here out, the SPX did hole up and continued to shut greater that day…

It’s troublesome to say whether or not that was as a result of PCE report, different information, or simply regular market motion.

Many merchants who routinely monitor the financial calendar are conscious of the potential that the PCE report can set off a big transfer within the S&P 500 in a single route or the opposite.

Whether or not it would or not is unknown.

The important thing phrase right here is “potential”.

We hope you loved this text on the PCE report.

You probably have any questions, please ship an e-mail or depart a remark beneath.

Commerce protected!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique introduced wouldn’t be appropriate for traders who aren’t aware of alternate traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link