[ad_1]

Up to date on June twenty eighth, 2024 by Bob Ciura

Antero Midstream (AM) inventory at the moment has a pretty dividend yield of 6.0%. It is without doubt one of the high-yield shares in our database.

We’ve created a spreadsheet of shares (and intently associated REITs and MLPs, and so on.) with dividend yields of 5% or extra.

Antero is a part of our ‘Excessive Dividend 50’ collection, the place we cowl the 50 highest yielding shares within the Certain Evaluation Analysis Database.

You possibly can obtain your free full checklist of all excessive dividend shares with 5%+ yields (together with essential monetary metrics corresponding to dividend yield and payout ratio) by clicking on the hyperlink under:

On this article, we are going to analyze the prospects of Antero Midstream.

Enterprise Overview

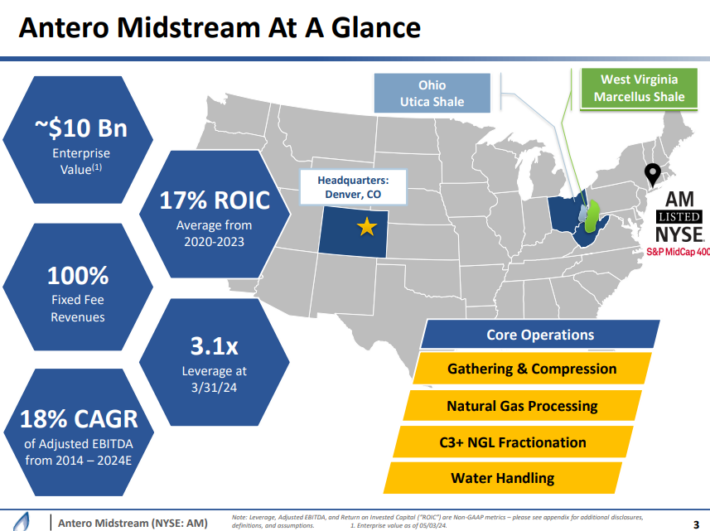

Antero Midstream Company is a midstream firm offering gathering and compression, processing and fractionation, and pipeline providers on a captive foundation to Antero Sources (AR).

AR is the fifth largest pure gasoline producer and 2nd largest NGL producer within the nation, working fields primarily in West Virginia.

As appears typical for these midstream companies, the publicly traded entity is a pass-through for the income from the underlying working entity.

Supply: Investor Presentation

Within the 2024 first quarter, Antero Midstream’s gathering and processing volumes elevated 4% and 6% respectively in comparison with the prior yr quarter.

Web earnings reached an organization report of $104 million, or $0.21 per diluted share, marking a 17% per share improve from the earlier yr quarter.

Adjusted EBITDA additionally elevated by 10% in comparison with the prior yr quarter. Capital expenditures decreased by 11% from the prior yr quarter.

Income for the primary quarter was $279 million, with important contributions from the Gathering and Processing section and the Water Dealing with section.

Progress Prospects

Antero Midstream’s major development catalyst transferring ahead is paying down its debt, which it plans to do aggressively within the coming years. Within the 2024 first quarter AM’s leverage declined to three.1x, down from 3.3x on the finish of 2023.

It has additionally accomplished a reasonably aggressive capital spending program and these tasks at the moment are coming on-line, producing elevated EBITDA.

It additionally might proceed to opportunistically pursue small development tasks as they develop into accessible to it by its shut partnership with Antero Sources.

Antero Midstream can be investing in development by optimizing its asset footprint.

Supply: Investor Presentation

For instance, within the first quarter the corporate positioned the Grays Peak compressor station into service with an preliminary capability of 160 million cubic toes per day.

In any other case, it’ll look to extend dividend per share payouts and/or purchase again shares if they continue to be attractively priced. Antero at the moment has a $500 million share repurchase authorization in place.

Shopping for again shares will function a development catalyst by lowering the entire share depend, thereby growing distributable money move per share over time.

Aggressive Benefits

Antero Midstream’s major aggressive benefits are present in its multi-decade underlying stock through its partnership with Antero Sources, its just-in-time strategy to capital investments, and its peer main returns on invested capital.

It’s the major midstream service supplier to Antero Sources, an organization with a premium core drilling stock that exceeds 20 years.

Its just-in-time and versatile capital funding philosophy helps it to reduce dangers on its capital expenditures whereas additionally minimizing the time from spend to money move on its development tasks.

In consequence, it is ready to generate constant and repeatable natural development together with peer-leading returns on invested capital.

Dividend Evaluation

Antero Midstream is unlikely to develop its dividend in 2024, as administration is laser centered on deleveraging the steadiness sheet proper now. Fortuitously, the corporate has no near-term maturities in 2024 or 2025.

As soon as it achieves its leverage goal of at or under 3.0x (anticipated by the top of 2024), it might improve the dividend, or proceed to additional pay down debt, relying on market and trade circumstances on the time.

Nonetheless, given the 6% present dividend yield, there isn’t a want for dividend development to generate a pretty yield, and the dividend seems to be fairly secure as nicely.

AM has a projected dividend payout ratio of 53% for 2024, which signifies a safe dividend.

Last Ideas

Antero Midstream is without doubt one of the least expensive C-Corp midstream corporations out there right this moment, and likewise provides a really enticing dividend yield that seems secure for a few years to come back.

It has a steady, commodity worth resistant money move profile with an extended demand timeline forward of it. Moreover, its fundamental counter-party is quickly deleveraging its steadiness sheet, additional strengthening Antero Midstream’s security profile.

Whereas Antero Midstream is unlikely to be a fast grower of its money move or its dividend within the coming few years, we view AM inventory as enticing for earnings traders.

If you’re focused on discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Certain Dividend assets might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link