[ad_1]

Second Makers Group/iStock through Getty Photographs

Funding Thesis

Amazon’s (NASDAQ:AMZN) inventory reached its all-time excessive final week, buoyed by its AI progress optimism. In my earlier evaluation, I upgraded the inventory from maintain to purchase in August 2023, pushed by an inexpensive valuation and potential rebound in retail gross sales and value administration. Since then, the inventory has surged 37%, beating S&P 500 index’s 21.5%. Nevertheless, given the current enlargement in valuation multiples, I consider this AI hype is a bit untimely. The corporate’s main progress driver remains to be its retail enterprise. Whereas the current enhance in capital investments in AWS infrastructures will enhance its long-term progress trajectory for its cloud phase, I don’t consider AWS can considerably transfer the needle to enhance its top-line progress within the close to time period.

The over 200% YoY enchancment in earnings final 12 months was not largely pushed by income progress, however by working effectivity on account of large layoffs and cuts in advertising spending. Due to this fact, I downgrade the inventory to carry from purchase as the present risk-reward is getting much less engaging, particularly given the potential cyclical weak point in shopper spending, which might create headwinds for its retail and promoting enterprise.

Nonetheless Extra Than 80% Income Comes from Retails

The corporate mannequin

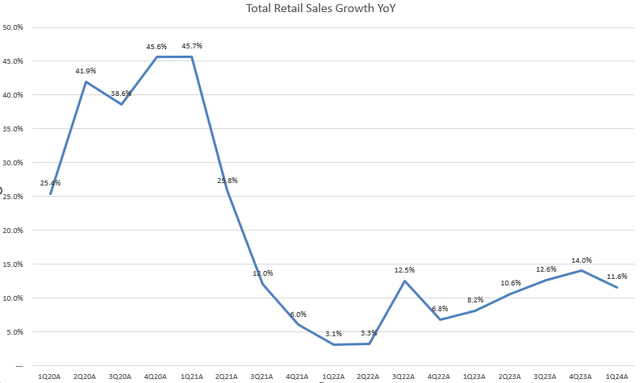

Many individuals are discussing how GenAI will enhance the expansion trajectory of AWS and its promoting enterprise. In accordance with Bloomberg article, AMZN reached a $2 trillion market cap final week, largely on account of its AI optimism. Nevertheless, we have now but to see a robust progress rebound in its whole income but. We all know that AMZN’s web retail gross sales (82.5% of its whole income) stay on a low teenagers progress trajectory. Notably, its On-line Shops gross sales preserve excessive single-digit progress. The corporate is strategically prioritizing high-growth cloud enterprise associated to AI expertise, because the income combine from on-line shops decreased from 49% in Q1 FY2021 to 38.1% in Q1 FY2024. In the meantime, AWS’s income combine has elevated, reaching almost 20% of its whole income within the final quarter. Regardless of this shift, the corporate nonetheless largely depends on retail gross sales to keep up its progress trajectory. As proven within the chart above, whole retail gross sales progress has reaccelerated since Q1 FY2023, supporting my earlier bullish view on the inventory over the previous months.

Though 1Q FY2024 whole income topped estimates, the expansion charge skilled a gentle QoQ slowdown. Moreover, the corporate is predicted to see a continued QoQ slowdown in 2Q FY2024, primarily based on its 7% to 11% progress outlook, which is beneath the market consensus. Administration within the earnings name attributed this to a roughly 60 bps headwind from FX influence. Due to this fact, we might even see retail gross sales progress sluggish within the subsequent earnings consequence in comparison with Q2 FY2023, justifying my cautious view after the inventory reached its all-time excessive.

Earnings Progress Pushed by Layoffs and Advertising and marketing Cuts

The corporate mannequin

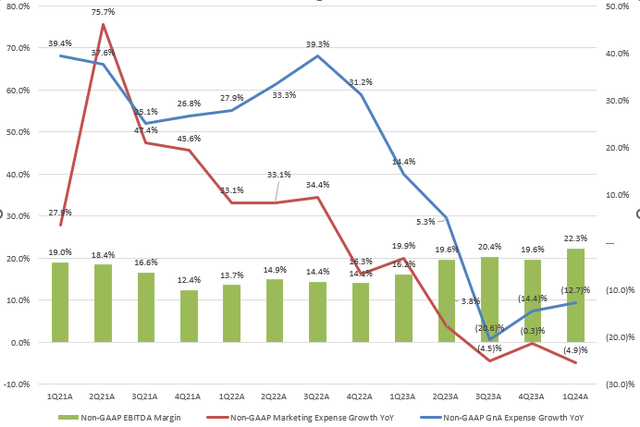

The corporate’s backside line has considerably improved over the previous quarters. Let’s concentrate on the inexperienced columns within the chart, we see that comparable margin ranges in Q1 FY2021 and Q1 FY2024. I consider that the important thing distinction between these two durations is that the excessive EBITDA margin in Q1 FY2021 was pushed by robust income progress, whereas the margin in Q1 FY2024 was on account of decreased working bills.

We noticed that AMZN’s whole income progress in 1Q FY2021 was 45.7% YoY, whereas in 1Q FY2024, it was solely 11.6% YoY. I believe that attaining robust earnings progress by slicing Basic and Administrative and Advertising and marketing bills is unsustainable in the long run. The damaging YoY progress development in these bills since Q3 FY2023, as proven by the blue and pink traces above, additional helps this.

In accordance with one other Bloomberg article, AMZN is slicing tons of of jobs together with 27,000 company roles, as a part of a price administration plan following a pandemic-era hiring increase. Due to this fact, I am skeptical {that a} additional inventory rally from right here will likely be largely pushed by value cuttings. The administration additionally implied an 8.2% GAAP EBIT margin in Q2 FY2024, beneath the ten.7% seen in Q1 FY2024. Nevertheless, might AI increase structurally form the corporate’s general progress outlook? Let’s try its AI cloud enterprise.

Progress Drivers: AWS and Promoting Enterprise

The corporate mannequin

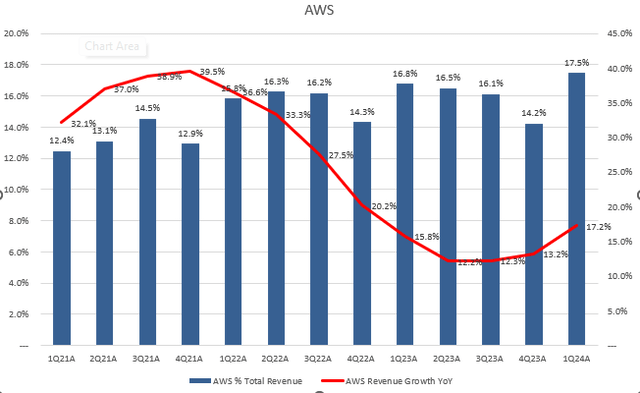

AWS’s income combine has steadily expanded over the previous years, from 12.4% of whole income in Q1 FY2021 to 17.5% in Q1 FY2024. Nevertheless, important progress rebound as a result of present AI frenzy has but to be seen. Nonetheless, it is encouraging to see AWS’s GAAP EBIT margin attain an all-time excessive of 37.6%. Whereas job cuts within the Cloud computing division might have contributed to this enchancment, administration defined that it was primarily on account of managing infrastructure and glued prices.

In the meantime, promoting income continues to keep up over 20% YoY progress within the final quarter. The administration attributed this energy to sponsored merchandise and ongoing enhancements in relevancy and measurement capabilities for advertisers. Nevertheless, the promoting enterprise phase presently accounts for under 7.5% of whole income, which isn’t very important.

Vital Capital Investments in FY2024

The corporate mannequin

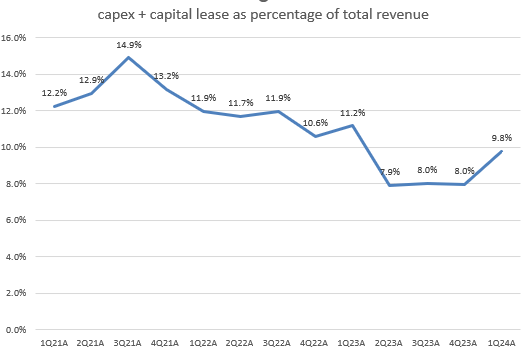

Throughout the earnings name, administration indicated a significant enhance in capital expenditures on a year-over-year foundation in FY2024, primarily pushed by increased infrastructure capex to assist progress in AWS, together with generative AI. They outline capital investments as the mix of capex plus gear finance leases. Wanting on the chart above, we discover that this ratio is beneath the previous three-year common however has began to tick up in 1Q FY2024. I consider AMZN is making the fitting transfer by growing capital investments to assist AWS infrastructure, notably in generative AI efforts. In contrast to different software program firms like Microsoft (MSFT), AWS takes time to turn into a key driver of boosting its top-line income progress.

Valuation

Looking for Alpha

I upgraded the inventory to purchase in August 2023 as AMZN’s valuation a number of was low cost amidst a possible progress rebound in its core retail enterprise. The inventory is presently buying and selling at 3.5x EV/Gross sales TTM, which is almost in-line with its 5-year common of three.46x. In the meantime, in keeping with Looking for Alpha consensus, AMZN is predicted to generate non-GAAP EPS of $5.74, which means 33.6x non-GAAP P/E FY2024. This a number of can be in-line with Nasdaq 100 index. Due to this fact, I believe the inventory is just not buying and selling at a lofty valuation and presently pretty valued.

Conclusion

In conclusion, whereas AMZN’s inventory soared to an all-time excessive fueled by market optimism round its AI cloud enterprise, the corporate’s main progress driver stays its retail gross sales. Regardless of the robust progress potential of AWS, the phase has but to contribute considerably to its top-line progress. Furthermore, the current earnings enchancment has been largely on account of cost-cutting measures fairly than income progress, elevating issues about sustainability. With potential cyclical weaknesses in shopper spending and a average progress outlook, the present valuation seems in-line with my expectation. Consequently, I’m downgrading the inventory from purchase to carry, given the much less engaging risk-reward profile at this second.

[ad_2]

Source link