[ad_1]

Gerasimov174

Introduction

I simply broke a number of of my guidelines.

I purchased an organization that doesn’t pay a dividend. That firm has extraordinarily restricted historic knowledge. This firm is majority-owned by a small investor group.

But, I nonetheless invested nearly all of my money reserves, making it a 4.1% holding of my dividend progress portfolio, which now contains nearly my total internet price.

I solely do that when coping with high-conviction investments.

The corporate we’re speaking about is LandBridge Firm LLC (NYSE:LB), an organization that’s so younger that the majority monetary web sites don’t even present particulars but.

LandBridge Firm LLC

On this article, I am going to clarify why I’ve very excessive hopes for this firm, because it suits completely what I am searching for in an funding.

Nevertheless, I’ll begin by discussing a special firm, as that is essential to perceive the larger image and my funding methodology.

So, as we now have loads to debate, let’s get proper to it!

Why I Purchased Texas Pacific Land

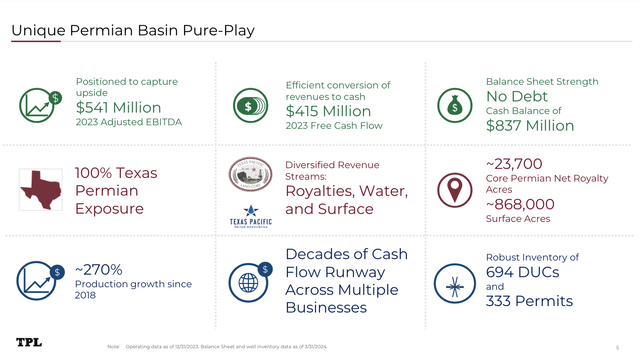

I’ve to confess that I’ve been investing much more capital than I initially deliberate this yr. I began new positions in a lot of firms, together with the Texas Pacific Land Company (TPL), which is now my largest holding, accounting for 13% of my portfolio.

On Might 11, I wrote an article titled “Texas Pacific Land: I am So Bullish It Hurts.”

See, Texas Pacific Land is a landowner in Texas, the place it owns roughly 870 thousand floor acres. These belongings are situated within the Permian, the largest oil basin in the USA. It is also one of many few basins able to constant progress.

Texas Pacific Land Company

What makes TPL so particular is its capacity to learn from oil and gasoline manufacturing with out having to speculate substantial quantities of capital. It lets oil companies drill on its land in alternate for royalties.

This makes it one of the worthwhile firms in the marketplace, with a internet earnings margin of 64% final yr – method above the S&P 500’s 11-12% internet revenue margin.

Furthermore, as a result of it owns the floor and water rights as nicely, it additionally makes cash from water gross sales, pipelines, and all the things that occurs on its land.

Therefore, I purchased the corporate for a lot of causes:

I wished to personal inflation safety, as I imagine in above-average inflation on a protracted foundation. Power and actual property are two of one of the best protectors in opposition to inflation. TPL combines one of the best of two worlds, because it advantages from oil and gasoline and the worth of its land. Whereas most of its land is desert in Texas, the worth is rising as TPL is capitalizing on the rising want for water administration within the Permian. On high of promoting water for drilling functions, it may quickly clear water and begin extra value-adding operations on its land.

The corporate’s largest investor is Murray Stahl’s Horizon Kinetics. In a latest round-table, which a follower despatched to me (thanks!), Mr. Stahl famous his intent to put money into LandBridge, which he briefly mentioned as a TPL-like firm.

I instantly went to work and determined that LB was the proper addition to my portfolio. I preferred it a lot that I broke a few of my guidelines, which I discussed in the beginning of this text.

With out Water, There’s No Oil

If I needed to reply this query of why I purchased LandBridge with only one sentence, I’d say one thing like: “LandBridge is a mini-TPL.”

Like Texas Pacific Land, LandBridge is a landowner within the Permian.

Nevertheless, it’s much less depending on oil and gasoline royalties and has an even bigger deal with floor operations, together with the water growth within the Permian.

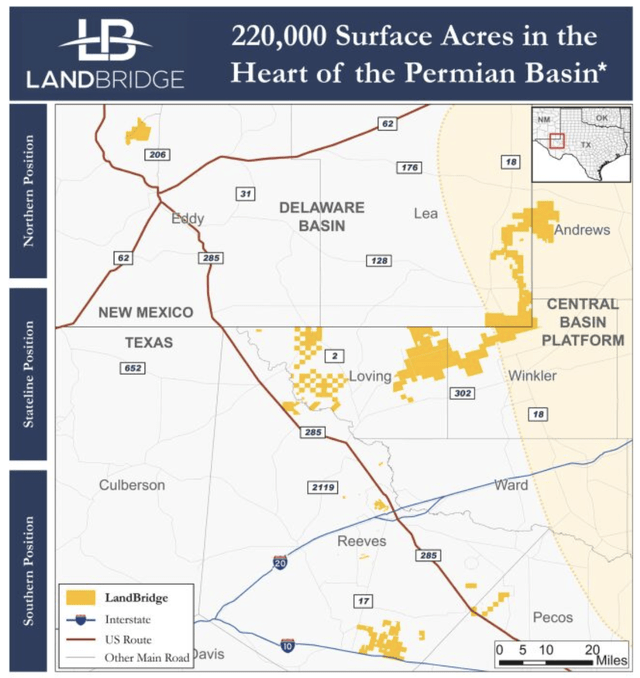

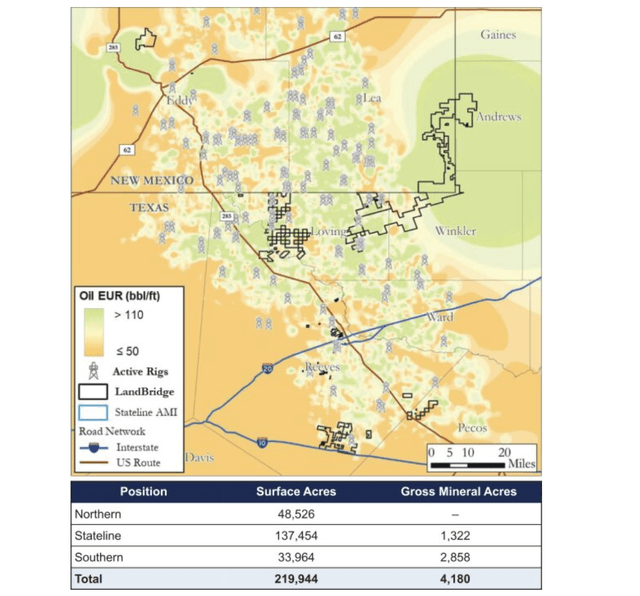

Based in 2021 (when it began shopping for land), LandBridge owns roughly 222 thousand floor acres within the Delaware, which is a sub-basin of the Permian Basin.

The key profit of those acres is that the majority of them are related, which is able to permit the corporate to have interaction in greater initiatives with out having to take different stakeholders under consideration.

LandBridge Firm LLC

The corporate went public on June 28 at a value beneath its preliminary goal.

Bloomberg

Initially, the corporate went public at $17 after advertising and marketing shares within the $19 to $22 vary. At the moment, shares are buying and selling at $24.00. I bought in at $23.09.

To cite Bloomberg (I added emphasis):

The corporate owns about 220,000 floor acres in and across the Delaware sub-basin within the Permian Basin, the largest US oil patch, the filings present. It has contracts with WaterBridge Holdings LLC, a supplier of water to the fracking trade that shares administration with each LandBridge and 5 Level.

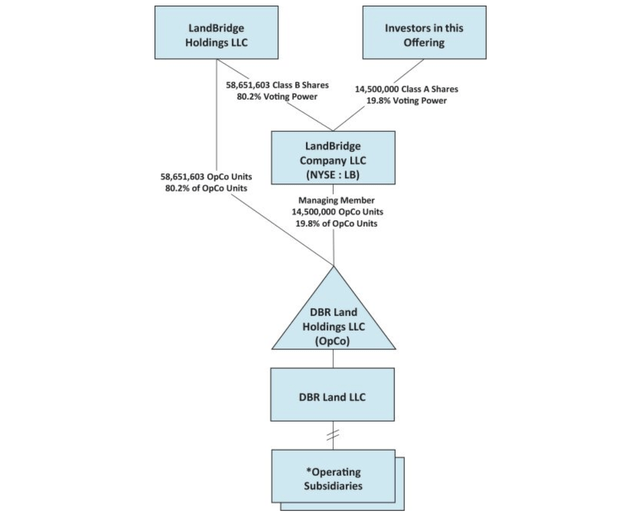

This half is essential. After the IPO, buyers owned 14.5 million shares of the corporate, which is nineteen.8% of its worth. All of those are Class A shares, that are entitled to a future dividend (extra on that later).

LandBridge Holdings LLC owns 80.2% of complete shares via nearly 59 million Class B shares. These shares usually are not entitled to a dividend however include equal voting rights.

LandBridge Firm LLC

As we will see within the Bloomberg quote, LandBridge shares a administration group and a monetary sponsor (5 Level Power) with WaterBridge.

WaterBridge can be an organization of 5 Level Power, which focuses on value-adding firms within the power area. WaterBridge is the biggest midstream firm in the USA targeted on water infrastructure. It handles near 2 million barrels of water per day from oil and pure gasoline manufacturing.

Primarily, LandBridge was fashioned by 5 Level and its administration group to amass and handle land within the Delaware Basin, supporting WaterBridge’s water infrastructure.

Personally, I imagine water is among the most ignored funding alternatives within the power area.

What we’re coping with right here is water as a by-product of oil and gasoline manufacturing, and water wanted to provide oil and gasoline. So-called produced water comes out of wells throughout the manufacturing of oil and gasoline.

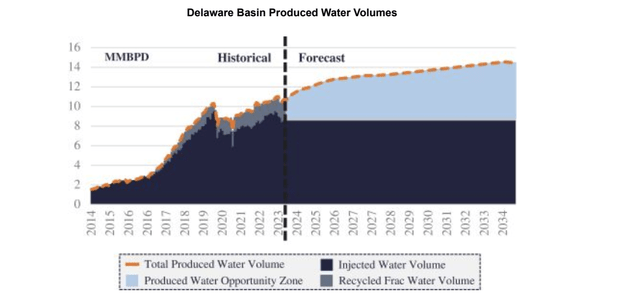

The Delaware Basin is thought to have a really excessive water/oil ratio. On the whole, as much as 4 gallons of water are produced per gallon of oil, which means via the 2030s, knowledge counsel we’re taking a look at greater than 14 million gallons of produced water per day.

LandBridge Firm LLC

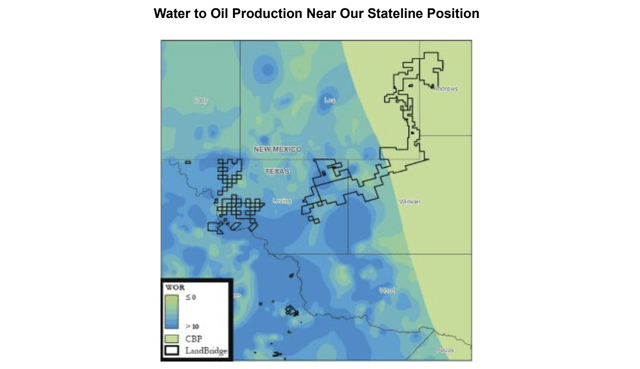

Some belongings of LandBridge have a water-to-oil ratio of virtually 10x, as we will see within the overview beneath.

LandBridge Firm LLC

Final yr, WaterBridge signed a contract with Devon Power (DVN), certainly one of America’s largest onshore producers of oil and gasoline, to cope with its water.

In reference to the transaction, Devon and NDB Midstream entered right into a long-term settlement pursuant to which Devon has dedicated all of its produced water inside a big space of mutual curiosity, together with an preliminary dedication of ~52,000 acres, and contributed to NDB Midstream 18 SWDs with ~375,000 bpd of permitted capability and ~210 miles of produced water pipelines for gathering, transportation, disposal and reuse. As a part of the transaction, Devon acquired a 30% fairness curiosity in NDB Midstream in addition to a dedication by 5 Level to fund a portion of the preliminary construct of the system growth. – WaterBridge (emphasis added)

WaterBridge additionally has a cope with Texas Pacific Land.

The settlement permits TPL and WaterBridge to supply full-cycle water options to prospects all through an expansive, outlined area across the Stateline space by facilitating infrastructure and water companies growth and asset optimization. The mixed land positions of TPL and WaterBridge present unmatched entry to an unlimited growth space for every firm. TPL will ship its supply water capabilities throughout an underutilized developmental space, and WaterBridge will broaden its produced water administration and infrastructure operations. As well as, TPL and WaterBridge are creating next-generation, sustainability-focused disposal and reuse options. – Texas Pacific Land Company

The deeper oil firms drill, and the extra oil the Permian produces, the upper the necessity for water infrastructure – particularly as a result of volumes are actually so excessive that conventional water trucking is usually not enough anymore.

Going again to the WaterBridge and LandBridge relationship, Landbridge’s land place supplies the mandatory floor acreage and subsurface reservoirs for large-scale-produced water dealing with options.

WaterBridge wants this land to develop, which places LandBridge in a improbable spot to learn from it, which brings me to the subsequent half.

How LandBridge Makes Cash

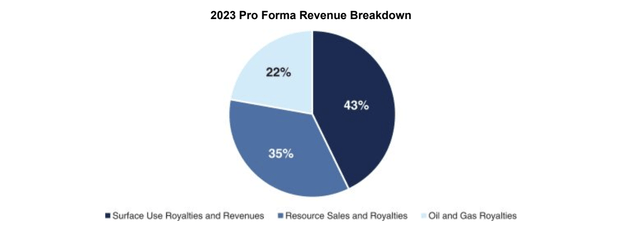

Zooming out once more, LandBridge makes cash from three segments.

Floor Use Royalties and Revenues: This section contains floor use royalty agreements (“SURAs”) and sure floor use agreements (SUAs). SURAs contain dealing with produced water, skim oil restoration, and different infrastructure makes use of, which offer regular earnings over preliminary phrases that usually vary from 5 to 10 years. In the meantime, SUAs embrace easements and rights-of-way for infrastructure like pipelines and roads, with Landbridge incomes fastened funds and extra charges throughout renewal durations. In different phrases, if something occurs on LandBridge land, it makes cash from it.

Useful resource Gross sales and Royalties: Landbridge sells brackish water for nicely completions, which permits it to earn charges per barrel. The corporate additionally leases land for sand mining operations, receiving royalties per ton of sand that’s extracted and charges for water utilized in mining operations. Moreover, Landbridge sells caliche for building functions, permitting it to earn a set price per cubic yard.

Oil and Fuel Royalties: The corporate makes cash from oil and gasoline manufacturing on its land. It doesn’t produce oil and gasoline itself however will get royalties from third-party oil and gasoline manufacturing.

LandBridge Firm LLC

On a pro-forma foundation, the corporate generated roughly 22% of its revenues from oil and gasoline royalties, making it much less depending on the worth of those commodities than its greater peer, Texas Pacific Land.

LandBridge Firm LLC

On the whole, the corporate’s enterprise technique is to maximise shareholder worth by rising free money circulation in a sustainable method by increasing its income streams with minimal capital investments.

This contains diversified revenues past water, oil, gasoline, and sand, as the corporate is exploring alternatives in power transition infrastructure corresponding to photo voltaic and hydrogen initiatives along with next-gen applied sciences like knowledge facilities for the AI “revolution.”

At the moment, two photo voltaic services are being constructed on LandBridge land. In accordance with the corporate, additionally it is being approached by hydrogen challenge builders trying to construct on its land.

Why is that?

LandBridge has a number of issues entering into its favor:

It has land in a really distant space. This area comes with very low cost power. Earlier this yr, pure gasoline was so low cost that it had damaging costs in some areas as a consequence of elevated manufacturing volumes and infrastructure shortages. Its land is generally related, which is nice for large-scale initiatives because it reduces the involvement of different events.

That is completely improbable for energy-intensive operations, together with hydrogen manufacturing, storage, and knowledge facilities.

Knowledge heart demand is exploding because of the AI revolution, which requires a whole lot of power.

As “no one” desires to reside shut to an information heart and since constructing these knowledge facilities comes with power challenges, it is sensible to construct them in distant locations the place power is reasonable.

Moreover, as a result of the Permian has a lot water, it may be used to chill these knowledge facilities!

It simply retains getting higher.

As reported by HartEnergy on June 28, LandBridge is engaged on a 100-year lease settlement with a developer that would outcome within the building of a 1 GW knowledge heart over the subsequent two years.

HartEnergy

So, what does this imply for shareholders?

Dividends & Valuation

LandBridge is a really younger firm. It simply went public, and most offers are nonetheless in very early levels.

Therefore, as one can think about, the corporate doesn’t but pay a dividend.

Nevertheless, there’ll probably be a dividend sooner or later. I added emphasis to the quote beneath:

We intend to pay dividends on our Class A shares in quantities decided every so often by our board of administrators.

[…] Assuming OpCo makes distributions to us and the OpCo Unitholders, together with LandBridge Holdings, in any given yr, we intend to pay dividends in respect of our Class A shares out of some or all of such dividends, if any, remaining after the cost of taxes and different bills. Nevertheless, as a result of our board of administrators might decide to pay or not pay dividends in respect of our Class A shares based mostly on the elements described above, holders of our Class A shares might not essentially obtain dividends, even when OpCo makes such distributions to us. – LandBridge Firm LLC

Primarily, the corporate is saying it intends to pay a dividend if it receives dividends from OpCo, which is a special identify for DBR Land Holdings. That is the umbrella beneath which its working subsidiaries work, because the overview on this article sowed.

This implies if the corporate makes cash, it may possibly pay a dividend. Nevertheless, it additionally famous that dividends are topic to different points as nicely. This is sensible, because it can not legally make any guarantees relating to its dividend – no firm can do this. Even an organization like Coca-Cola (KO) writes in its 10-Okay that its dividend relies on the Board of Administrators and plenty of monetary selections.

Personally, I imagine the corporate will begin paying a dividend within the first three years of its post-IPO existence. That is an informed guess. CapEx necessities will likely be very low, because it primarily holds the land, and its margins are sky-high.

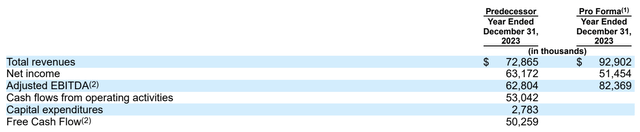

For instance, in 2023, the corporate’s “predecessor” (that is OpCo) generated $73 million in revenues. It turned these revenues into $63 million price of internet earnings. That is an 86% internet earnings margin.

It additionally generated $50 million in free money circulation, that is 80% of internet earnings.

LandBridge Firm LLC

The professional-forma numbers embrace a 2024 acquisition of the East Stateline Ranch of roughly 103 thousand floor acres, which was a serious a part of re-shaping the fashionable LandBridge firm.

With regard to progress, the predecessor firm generated $52 million in 2022 revenues. This means 43% progress between 2022 and 2023.

Having mentioned all of this, LandBridge is at present price $1.76 billion. That is based mostly on 73.2 million shares (58.7 million Class B + 14.5 million Class A shares) and a $24.00 inventory value.

This interprets to 28x its 2023 earnings. I think about this to be an important deal.

Texas Pacific Land, which is the one comparable firm, trades at 40x earnings.

To be sincere, LandBridge doesn’t need to commerce at 40x earnings. Whereas “elevated” P/E ratios make sense for firms with ultra-high margins, TPL has a confirmed enterprise mannequin. LandBridge doesn’t.

Furthermore:

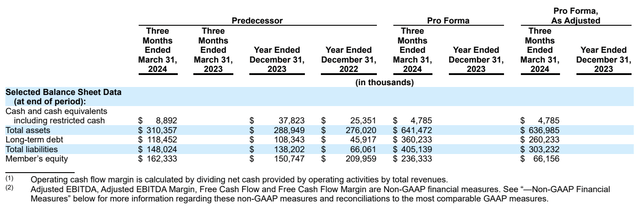

TPL has no monetary debt. LandBridge has roughly $255 million in pro-forma debt as of March 31, 2024. That is 3.1x pro-forma 2023 EBITDA. It targets a 2.5x internet leverage ratio. This can be a wholesome steadiness sheet.

LandBridge Firm LLC

That mentioned, I imagine the present valuation is a good deal, as we’re excluding any future progress.

Though I can not estimate how excessive progress will likely be because of the uncertainty of ongoing negotiations in hydrogen, knowledge facilities, and photo voltaic (amongst others), I believe two issues for positive:

The Permian is in an important place to spice up long-term oil and gasoline output. This tremendously advantages water volumes. WaterBridge, for instance, handles 2 million barrels of water per day. The capability on LandBridge land is roughly 3.5 million barrels. That is extra progress with out elevated CapEx necessities. Even when it takes time, the Permian will see extra curiosity from suppliers of photo voltaic, knowledge facilities, hydrogen, and different initiatives.

The issue I’ve is that I simply can not but put a quantity on it. The identical goes for analysts, as no official expectations are public but.

That mentioned, I am very bullish, as I think about 28x 2023 earnings to be a steal, because it’s based mostly on 2023 numbers and excludes any future progress.

As I’m very bullish on water demand, oil manufacturing/costs, and its negotiations with photo voltaic/hydrogen/knowledge heart operators, I’ll give the corporate a Robust Purchase ranking and preserve shopping for on potential dips, as LandBridge has change into a high-conviction funding of mine.

Nonetheless, please concentrate on the dangers we’re coping with right here. As a lot as I like LandBridge, as a consequence of its age and up to date IPO, uncertainty is elevated. Watch out and do your personal due diligence.

No matter how a lot I like this firm, this text was not written to push anybody into an organization that simply went public.

Aside from that, my sincere opinion is that we could also be coping with a particularly promising long-term funding right here. A mini-TPL with belongings that would permit us to learn from a variety of long-term secular tailwinds.

Takeaway

I broke my guidelines and invested closely in LandBridge regardless of the absence of a dividend, an absence of historic knowledge, and being majority-owned by a small group.

Why?

That is as a result of LB is a “mini-TPL” with substantial land within the Permian Basin, which is essential for water infrastructure and comes with oil and gasoline royalty advantages.

Furthermore, partnered with WaterBridge, LB is primed to capitalize on the excessive water volumes in oil manufacturing and broaden into power transition initiatives like photo voltaic and hydrogen. It’s also in a chief place to learn from the info heart growth.

Regardless of its latest IPO and related dangers, I imagine LB’s progress potential and diversified income streams make it an thrilling, high-conviction addition to my portfolio.

Professionals & Cons

Professionals:

Prime Location: LB owns substantial land within the Permian Basin, which comes with a variety of royalty and royalty-like earnings flows. Partnerships: Robust ties with WaterBridge present long-term progress alternatives and visibility. Diversified Income Streams: The corporate has earnings from floor use royalties, useful resource gross sales, and oil/gasoline royalties. Future Potential: LB is exploring alternatives in photo voltaic, hydrogen, and knowledge facilities as a consequence of favorable land situations. Excessive Margins: This enterprise mannequin comes with spectacular internet earnings margins and low CapEx necessities.

Cons:

Lack of Historical past: The corporate has been public for lower than two weeks. Debt Load: LB is de-leveraging its steadiness sheet. Whereas its steadiness sheet is wholesome, debt discount will probably be a headwind for dividend funds. No Dividends But: Associated to the purpose above, LB doesn’t at present pay a dividend, with future dividend funds being unsure. Excessive Focus: The corporate is majority-owned by a small investor group. Whereas which will include dangers, I imagine 5 Level Power is a superb investor with a deep data of the market and progress alternatives.

[ad_2]

Source link