[ad_1]

Armed with some knowledge from our buddies at CrunchBase, I broke down the most important world startup funding rounds for Could 2024. I’ve included some extra data similar to business, spherical sort, a quick description of the corporate, buyers within the spherical, firm location, and complete fairness funding raised for the corporate to additional the evaluation.

within the prime NYC Startup Fundings? – The Largest NYC Startup Funding Rounds of Could 2024Interested within the prime London Startup Funding? – The Largest London Startups Funding Rounds of Could 2024Interested within the prime US Startup Funding? – The Largest US Startups Funding Rounds of Could 2024

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

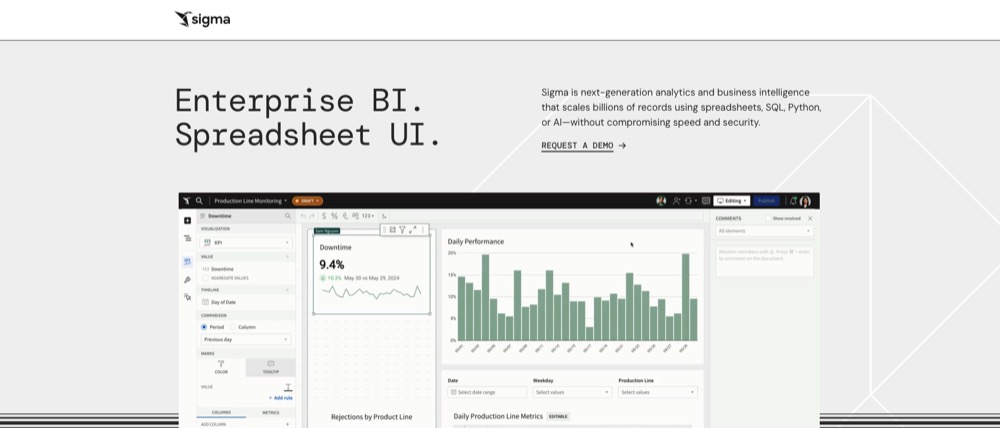

11. Sigma Computing $200.0M

Spherical: Collection DDescription: San Francisco-based Sigma Computing is a enterprise intelligence resolution offering reside entry to cloud knowledge warehouses. Based by Jason Frantz, Mike Speiser, and Rob Woollen in 2014, Sigma Computing has now raised a complete of $558.0M in complete fairness funding and is backed by Sutter Hill Ventures, Avenir Development Capital, XN, NewView Capital, and Snowflake Ventures.Buyers within the spherical: Altimeter Capital, Avenir Development Capital, D1 Ventures, NewView Capital, Snowflake Ventures, Spark Capital, Sutter Hill Ventures, XNIndustry: Analytics, Enterprise Intelligence, Cloud Knowledge Companies, Pc, SoftwareFounders: Jason Frantz, Mike Speiser, Rob WoollenFounding 12 months: 2014Location: San FranciscoTotal fairness funding raised: $558.0M

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

10. NIO Energy ¥1.5B

Spherical: VentureDescription: Wuhan-based NIO Energy is a cell internet-based energy resolution that features large networks for battery charging and swapping. Based by Lihong Qin and William Li in 2014, NIO Energy has now raised a complete of ¥1.5B in complete fairness funding and is backed by Wuhan Optics Valley Industrial Funding.Buyers within the spherical: Wuhan Optics Valley Industrial InvestmentIndustry: Founders: Lihong Qin, William LiFounding 12 months: 2014Location: WuhanTotal fairness funding raised: ¥1.5B

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

9. Vercel $250.0M

Spherical: Collection EDescription: Covina-based Vercel’s frontend cloud offers builders frameworks, workflows, and infrastructure to construct a sooner, extra personalised net. Based by Guillermo Rauch in 2015, Vercel has now raised a complete of $563.0M in complete fairness funding and is backed by Notable Capital, Nat Friedman, Bedrock, Google Ventures, and Buckley Ventures.Buyers within the spherical: 8VC, Accel, Bedrock, CRV, Geodesic Capital, Google Ventures, Notable Capital, SV Angel, Tiger International ManagementIndustry: Apps, Developer Platform, Web, SoftwareFounders: Guillermo RauchFounding 12 months: 2015Location: CovinaTotal fairness funding raised: $563.0M

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

8. Meesho $275.0M

Spherical: VentureDescription: Bangalore-based Meesho is a social commerce platform that permits people and small companies to begin their on-line shops with none funding. Based by Sanjeev Barnwal and Vidit Aatrey in 2015, Meesho has now raised a complete of $1.4B in complete fairness funding and is backed by Constancy, Meta, B Capital, Y Combinator, and Elevation Capital.Trade: E-Commerce, E-Commerce Platforms, FashionFounders: Sanjeev Barnwal, Vidit AatreyFounding 12 months: 2015Location: BangaloreTotal fairness funding raised: $1.4B

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

7. DeepL $300.0M

Spherical: VentureDescription: Cologne-based DeepL is a deep-learning firm that focuses on language translation. Based by Jaroslaw Kutylowski in 2017, DeepL has now raised a complete of $400.0M in complete fairness funding and is backed by ICONIQ Development, WiL (World Innovation Lab), Lecturers’ Enterprise Development, Bessemer Enterprise Companions, and Benchmark.Buyers within the spherical: Atomico, ICONIQ Development, Index Ventures, IVP, Lecturers’ Enterprise Development, WiL (World Innovation Lab)Trade: Synthetic Intelligence (AI), Generative AI, Machine Studying, Software program, Translation ServiceFounders: Jaroslaw KutylowskiFounding 12 months: 2017Location: CologneTotal fairness funding raised: $400.0M

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

6. Floreon £250.0M

Spherical: VentureDescription: Hull-based Floreon is a specifically formulated compound, which is added to plain bioplastic, polylactic acid (PLA) to create an modern materials with a sustainable origin and a spread of finish of life choices. Based by Shaun Chatterton in 2011, Floreon has now raised a complete of £252.0M in complete fairness funding and is backed by Northern Gritstone, Pitch@Palace, and Centre for Course of Innovation.Buyers within the spherical: Centre for Course of InnovationIndustry: Agriculture, Manufacturing, Packaging Companies, Plastics and Rubber ManufacturingFounders: Shaun ChattertonFounding 12 months: 2011Location: HullTotal fairness funding raised: £252.0M

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

5. Zhipu AI $400.0M

Spherical: VentureDescription: Haidian-based Zhipu AI is an information and data two wheel drive synthetic intelligence firm. Based by Tang Jie and Li Juanzi in 2019, Zhipu AI has now raised a complete of $400.0M in complete fairness funding and is backed by Alibaba Group, Ant Group, Meituan, BOSS Zhipin, and Tencent.Buyers within the spherical: Prosperity7 VenturesIndustry: Synthetic Intelligence (AI), Knowledge Integration, Machine Studying, SoftwareFounders: Tang Jie, Li JuanziFounding 12 months: 2019Location: HaidianTotal fairness funding raised: $400.0M

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

4. Figma $415.7M

Spherical: VentureDescription: San Francisco-based Figma is a design platform that develops net purposes for interface design with offline options. Based by Dylan Subject and Evan Wallace in 2012, Sigma Computing has now raised a complete of $749.1M in complete fairness funding and is backed by Haystack, Daniel Gross, Sequoia Capital, Andreessen Horowitz, and Gasoline Capital.Trade: Collaboration, Developer Instruments, Product Design, Software program, Internet AppsFounders: Dylan Subject, Evan WallaceFounding 12 months: 2012Location: San FranciscoTotal fairness funding raised: $749.1M

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

3. ALKU $960.6M

Spherical: VentureDescription: Andover-based ALKU is a specialised consulting providers agency based mostly in Andover, Massachusetts. Based by Mark Eldridge in 2008, Alku has now raised a complete of $960.6M in complete fairness funding and is backed by WestView Capital Companions.Trade: Consulting, Recruiting, Staffing AgencyFounders: Mark EldridgeFounding 12 months: 2008Location: AndoverTotal fairness funding raised: $960.6M

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

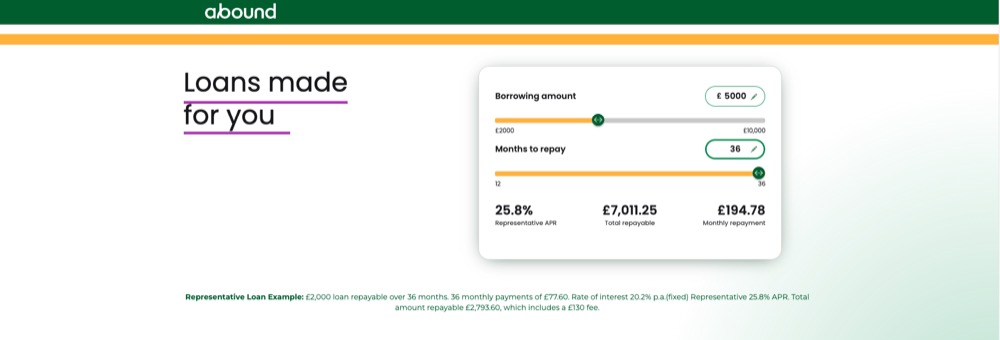

2. Abound £800.0M

Spherical: Collection BDescription: London-based Abound is a client lending monetary agency that gives private loans. Based by Dr Michelle He and Gerald Chappell in 2020, Abound has now raised a complete of £1.3B in complete fairness funding and is backed by Citi, Salica, K3 Ventures, Waterfall Asset Administration, and GSR Ventures.Buyers within the spherical: GSR VenturesIndustry: Client Lending, Monetary Companies, Lending, Private FinanceFounders: Dr Michelle He, Gerald ChappellFounding 12 months: 2020Location: LondonTotal fairness funding raised: £1.3B

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

2. Wayve £800.0M

Spherical: Collection CDescription: London-based Wayve is a developer of Embodied AI know-how for automated driving. Based by Alex Kendall and Amar Shah in 2017, Wayve has now raised a complete of $1.3B in complete fairness funding and is backed by SoftBank, NVIDIA, Ocado Group, Baillie Gifford, and Tiny VC.Buyers within the spherical: Microsoft, NVIDIA, SoftBankIndustry: Synthetic Intelligence (AI), Autonomous Automobiles, Electrical Automobile, Machine LearningFounders: Alex Kendall, Amar ShahFounding 12 months: 2017Location: LondonTotal fairness funding raised: $1.3B

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

2. Wiz $1.0B

Spherical: Collection EDescription: New York-based Wiz is a cybersecurity firm that enables corporations to search out safety points in public cloud infrastructure. Based by Ami Luttwak, Assaf Rappaport, Roy Reznik, and Yinon Costica in 2020, Wiz has now raised a complete of $1.9B in complete fairness funding and is backed by Thrive Capital, Wellington Administration, Sequoia Capital, Andreessen Horowitz, and Cyberstarts.Buyers within the spherical: Andreessen Horowitz, Cyberstarts, Greenoaks, Greylock, Howard Schultz, Index Ventures, Lightspeed Enterprise Companions, Salesforce Ventures, Sequoia Capital, Thrive Capital, Wellington ManagementIndustry: Cloud Safety, Cyber Safety, Enterprise Software program, SecurityFounders: Ami Luttwak, Assaf Rappaport, Roy Reznik, Yinon CosticaFounding 12 months: 2020Location: New YorkTotal fairness funding raised: $1.9B

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

2. Scale AI $1.0B

Spherical: Collection FDescription: San Francisco-based Scale AI supplies a data-oriented platform that assists within the improvement of AI purposes. Based by Alexandr Wang and Lucy Guo in 2016, https://www.alleywatch.com/wp-content/uploads/2024/06/altruist.jpg has now raised a complete of $1.6B in complete fairness funding and is backed by Meta, Amazon, NVIDIA, Thrive Capital, and Dragoneer Funding Group.Buyers within the spherical: Accel, Amazon, AMD Ventures, Cisco Investments, Coatue, DFJ Development, Elad Gil, Founders Fund, Greenoaks, Index Ventures, Intel Capital, Meta, Nat Friedman, NVIDIA, Qualcomm Ventures, ServiceNow Ventures, Spark Capital, Thrive Capital, Tiger International Administration, WCM Funding Administration, Wellington Administration, Y CombinatorIndustry: Synthetic Intelligence (AI), Knowledge Assortment and Labeling, Generative AI, Picture Recognition, Machine LearningFounders: Alexandr Wang, Lucy GuoFounding 12 months: 2016Location: San FranciscoTotal fairness funding raised: $1.6B

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

1. xAI $6.0B

Spherical: Collection BDescription: Burlingame-based XAI is an AI firm that develops a platform to speed up human scientific discovery. Based by Elon Musk in 2023, https://www.alleywatch.com/wp-content/uploads/2024/06/scale-ai.jpg has now raised a complete of $6.4B in complete fairness funding and is backed by Constancy, Kingdom Holding Firm, X (previously Twitter), Vy Capital, and Redstone.Buyers within the spherical: Alwaleed Bin Talal, Andreessen Horowitz, E1 Ventures, Constancy, Kingdom Holding Firm, Web page One Ventures, Redstone, Sequoia Capital, Valor Fairness Companions, Vy CapitalIndustry: Synthetic Intelligence (AI), Generative AI, Data Expertise, Machine LearningFounders: Elon MuskFounding 12 months: 2023Location: BurlingameTotal fairness funding raised: $6.4B

The TechWatch Media Group viewers is driving progress and innovation on a worldwide scale. With its regional media properties (New York Tech, London Tech) TechWatch Media Group is the freeway for know-how and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which shall be learn by the overwhelming majority of key decision-makers within the world enterprise neighborhood and past. Be taught extra about how a digital marketing campaign will return your funding right here.

[ad_2]

Source link