[ad_1]

Robert Method

Lululemon: Bear Market Decline Worsened

Lululemon Athletica (NASDAQ:LULU) (NEOE:LULU:CA) (TSX:LLL:CA) buyers have suffered a horrible 12 months, to say the least, considerably underperforming sector friends. With a 1Y whole return of -26%, LULU appears to have misplaced the market’s confidence as buyers fled from the inventory. My bullish article in April 2024 additionally didn’t work out favorably, as LULU’s tried bottoming wasn’t sustained.

Moreover, the preliminary post-earnings restoration after Lululemon’s Q1 earnings launch has fizzled out. Consequently, buyers are probably more and more involved a few tepid second half. NIKE’s (NKE) latest disappointing efficiency underscores the challenges throughout the business, as Nike’s execution was discovered missing.

Lululemon: Formidable Progress Targets Below Intense Scrutiny

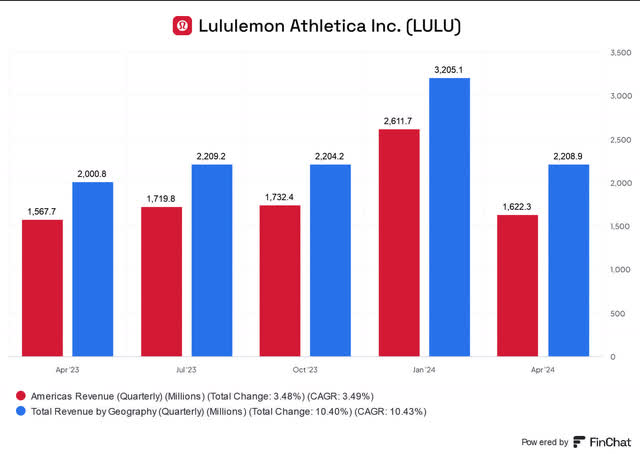

Lululemon Q1 geographical income segments (FinChat.io)

Consequently, I assess that buyers are proper to really feel involved, as Lululemon is navigating a big shift towards bolstering worldwide gross sales. The corporate has an formidable world growth plan, aiming for worldwide gross sales to comprise 50% of its whole income base. Accordingly, Americas accounted for over 73% of its Q1 income base, suggesting we’re nonetheless within the nascent levels. Administration highlighted that “nothing systemic is stopping” LULU from attaining its focused geographical publicity. Nevertheless, worries concerning the slowdown within the Americas are justified, because the phase posted income development of simply 3% (reported) in Q1.

Lululemon’s Q1 earnings commentary underscores the corporate’s stock challenges. The departure of the chief product officer was unlikely a coincidence, as the corporate highlighted execution weak point resulting in “missed gross sales alternatives.” Coupled with the necessity for China and worldwide markets to bolster Lululemon’s second-half development restoration, I imagine the market has mirrored additional potential disappointments.

Lululemon: Dealing with Extra Intense Competitors

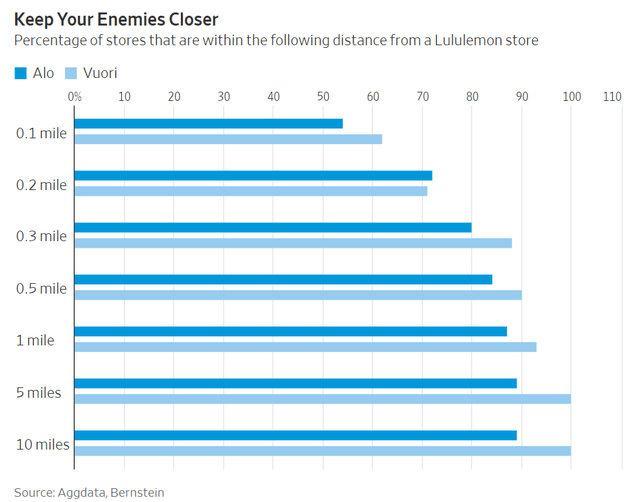

Lululemon retailer proximity from direct opponents (WSJ, AggData, Bernstein)

Lululemon’s direct opponents, resembling “Alo Yoga and Vuori, are gaining momentum.” Accordingly, they “strategically find their shops close to Lululemon’s” retailers, threatening to redirect LULU’s clients with extra aggressive merchandise. As well as, a big majority of Vuori and Alo Yoga shops are positioned close to LULU’s retailers. Their mixed market share can also be anticipated to offer intense competitors towards LULU, “representing about 38% of Lululemon’s measurement out there.”

Due to this fact, I assess that the market has probably thought of larger execution dangers as LULU reshuffled its product administration crew. Coupled with the expansion premium, buyers are probably questioning whether or not the corporate can nonetheless ship on its 2026 strategic targets.

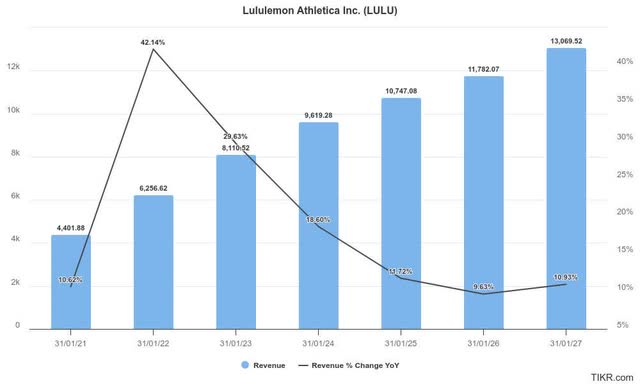

Lululemon income development estimates (TIKR)

Lululemon targets attaining income of $12.5B by FY2026. Wall Road analysts have downgraded their projections. The present estimates counsel LULU may miss the mark by virtually 6% in 2026, suggesting administration would possibly must decrease its steerage subsequently.

Lululemon nonetheless expects to raise its income development in China considerably. Latest efficiency suggests China’s weak financial system has not materially affected LULU’s capacity to realize extra share. As a reminder, Lululemon achieved a forty five% (reported) enhance in China income in Q1. Nevertheless, the goal of attaining an equal break up between US income and worldwide income could possibly be too formidable, as China’s financial malaise appears nowhere near a sustained restoration.

Consequently, I assess that the market’s determination to mirror elevated execution dangers on LULU’s medium-term goal is justified, leading to a steep valuation derating.

LULU: Valuation Much less Costly, However Not Low-cost

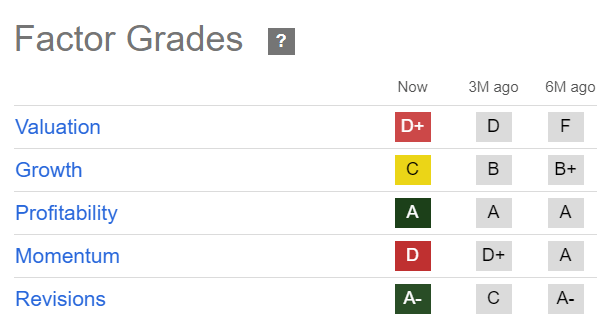

LULU Quant Grades (In search of Alpha)

Given its underperformance, LULU’s valuation has dropped considerably. The ahead adjusted EBITDA a number of of 11.9x has fallen effectively under its 10Y common of 21.2x. Nevertheless, it is nonetheless larger than the sector median of 9.8x, though the valuation bifurcation has narrowed markedly.

In different phrases, the market has considerably derated LULU, as buyers are probably not satisfied by its “C” development grade. Coupled with downgraded estimates, LULU’s “D” shopping for momentum underscores the market’s promoting depth.

The vital query is whether or not additional draw back volatility is assessed to be over.

Is LULU Inventory A Purchase, Promote, Or Maintain?

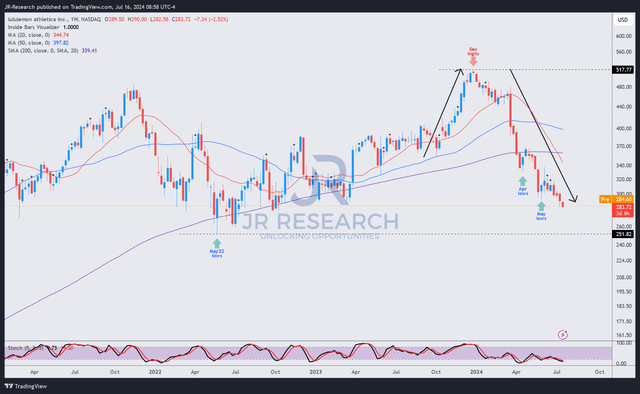

LULU value chart (weekly, medium-term) (TradingView)

There’s little doubt that the inventory’s beautiful collapse from its December 2023 highs has probably taken out plenty of bullish optimism. LULU’s plunge from its December excessive degree of $516 has resulted in a dramatic 45% bear market decline.

Due to this fact, it is nothing in need of a shocking fall from grace for the Athleisure chief because it makes an attempt to reignite its development prospects.

LULU’s value motion has additionally turned bearish. Sellers’ capacity to reverse buy-the-dips setups in April and Might 2024 underscores consumers’ lack of conviction.

LULU’s implied undervaluation relative to its 10Y common may counsel a shopping for alternative for high-conviction buyers. Nevertheless, I discover a lack of sustained shopping for sentiment stunning. Therefore, I would not be shocked if LULU fell additional to the $250 degree earlier than a doubtlessly extra constructive consolidation.

The market has probably mirrored vital dangers to Lululemon’s FY2026 development outlook, suggesting warning have to be heeded. Due to this fact, buyers who determine to purchase on weak point have to be cautious concerning the hazard of catching a falling knife. A medium-term steerage downgrade may be in retailer until LULU can enhance its execution within the US and bolster its worldwide development momentum extra robustly.

With that in thoughts, I assess that my Purchase ranking is not applicable, given the decisive breakdown of a number of help ranges. Nevertheless, a Promote ranking appears too aggressive, as LULU has dropped nearer to the $250 zone.

Ranking: Downgrade to Maintain.

Vital word: Traders are reminded to do their due diligence and never depend on the knowledge offered as monetary recommendation. Take into account this text as supplementing your required analysis. Please all the time apply unbiased considering. Word that the ranking isn’t meant to time a particular entry/exit on the level of writing, until in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a vital hole in our view? Noticed one thing essential that we didn’t? Agree or disagree? Remark under with the goal of serving to everybody locally to be taught higher!

[ad_2]

Source link