[ad_1]

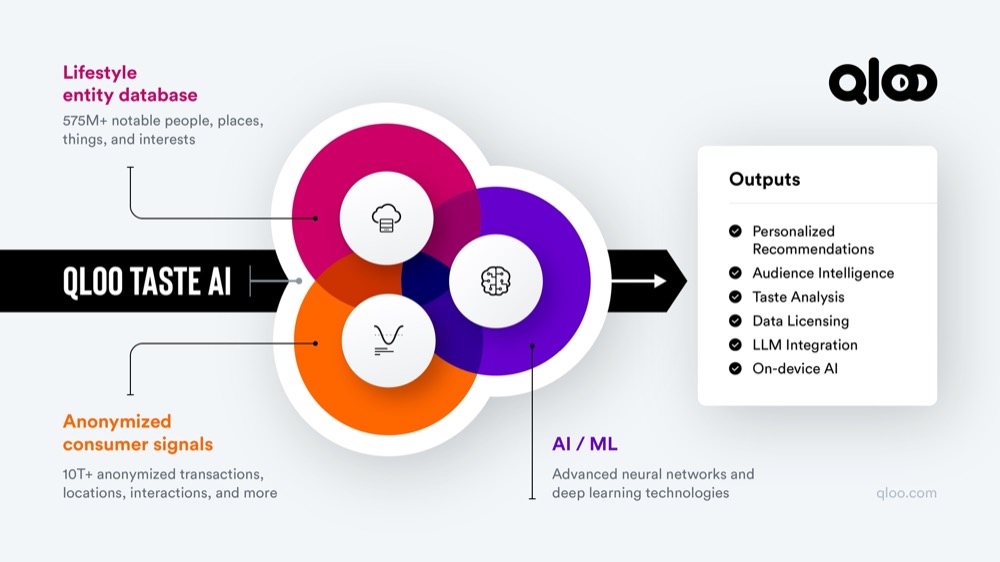

Understanding your viewers is key to success in enterprise. The digital age has ushered in unprecedented entry to client insights. Enter Qloo, an AI-driven analytics platform that processes over half a billion information factors associated to client habits and preferences. Qloo’s core expertise, Style AI, integrates data throughout numerous client touchpoints together with manufacturers, media, sports activities, occasions, movie, journey, and eating – all whereas sustaining consumer privateness by avoiding personally identifiable information. This complete strategy permits for nuanced insights into client tastes and habits. By providing API entry to this wealthy dataset, Qloo allows companies to spice up income and improve buyer engagement seamlessly with a single line of code. The platform has attracted a formidable roster of shoppers spanning varied industries, together with leisure giants like Netflix, meals and beverage leaders resembling Starbucks and PepsiCo, music powerhouse Common Music Group, promoting agency JCDecaux, hospitality suppliers like Pill Motels, the famend Michelin information, and ticketing chief Ticketmaster.

AlleyWatch caught up with Qloo Cofounder and CEO Alex Elias to study extra concerning the enterprise, the corporate’s strategic plans, newest spherical of funding, which brings the corporate’s complete funding raised to $77M, and far, way more…

Who have been your traders and the way a lot did you increase?

We raised a $20M progress funding from Bluestone Fairness Companions (“Bluestone”), the institutionally-backed international personal fairness agency centered on the Sports activities, Media & Leisure business.Qloo marks the fourth funding for Bluestone from its inaugural $300M fund launched in a single closing through the first quarter of 2023. Bluestone is differentiated inside Sports activities, Media & Leisure personal fairness by means of its mixture of blue-chip business working and funding expertise, expansive worldwide community, institutional capital base, and collaborative synergistic strategy with portfolio corporations.

Inform us concerning the services or products that Qloo gives.

Qloo operates a classy AI-powered intelligence engine, generally known as Style AI, composed of extremely correct behavioral information detailing how shoppers across the globe work together with greater than half a billion way of life entities together with manufacturers, media, sports activities, dwell occasions, movie, journey, eating, and extra. For over a decade, Qloo has curated this unmatched information set and developed an applied-AI expertise to assist corporations higher perceive and predict client preferences, whereas preserving buyer privateness.Qloo’s proprietary AI fashions are able to figuring out trillions of connections in milliseconds, aiding companies small and enormous – from native companies to a number of the world’s largest and most well-known manufacturers – to make higher selections and personalize buyer experiences in actual time, with out utilizing personally identifiable data. Qloo providers a number of the main corporations on the planet, together with Netflix, Starbucks, Common Music Group, PepsiCo, JCDecaux, Pill Motels, Michelin, and Ticketmaster.

What impressed the beginning of Qloo?

Qloo started in 2012 to revolutionize suggestion applied sciences. Whereas learning for a J.D. at NYU Regulation College, I recognized a market hole in unified style prediction throughout totally different domains with out utilizing identity-based information. With a ardour for tradition and music, I observed the fragmentation in style data regardless of corporations like Spotify and Netflix creating information silos.

Qloo started in 2012 to revolutionize suggestion applied sciences. Whereas learning for a J.D. at NYU Regulation College, I recognized a market hole in unified style prediction throughout totally different domains with out utilizing identity-based information. With a ardour for tradition and music, I observed the fragmentation in style data regardless of corporations like Spotify and Netflix creating information silos.

My Cofounder Jay Alger, with in depth expertise in commercializing expertise and main the digital company Deepend, introduced his experience in scaling companies and understanding enterprise wants. Collectively, we created Qloo to bridge the hole between fragmented style graphs and nuanced, multi-domain suggestions.

Qloo’s preliminary client product laid the groundwork for providing enterprises instruments to know client tastes in a privacy-conscious method. Their imaginative and prescient gained validation when Twitter grew to become one among their first main enterprise shoppers in 2015. As privateness laws like GDPR and CCPA emerged, Qloo’s non-identity-based suggestions grew extra related. The acquisition of TasteDive in 2019 additional solidified their market place.

Right now, Qloo combines cultural understanding with technological experience, creating options that respect particular person privateness and AI ethics whereas providing wealthy, personalised experiences.

How is Qloo totally different?

In contrast to different applied sciences, Qloo’s API goes past mere personalization or location-based insights. With a profound understanding of client habits for over 575 million entities worldwide, our expertise allows contextualized personalization and deep insights into the intricate connections behind individuals’s tastes. From music to movie and past, our specialised information, masking your entire planet, permits for precision right down to lots of of ft. We offer 750+ billion cultural correlations and insights, processing tens of millions of recent cultural information factors day by day to maintain our shoppers on the forefront of evolving tastes, deploying as much as 200 new meta-models every week.

What market does Qloo goal and the way huge is it?

Qloo primarily companions with multinational client corporations to drive progress by powering personalised buyer experiences and enormous language fashions, superior suggestions, data-driven advertising methods, and superior viewers intelligence. Inside this in depth B2C market, Qloo has a particular deal with Monetary Companies, Journey/Hospitality, Sports activities, Leisure, and Media manufacturers.

What’s what you are promoting mannequin?

Qloo grants real-time entry to its Style AI client intelligence engine by means of a versatile API, which is priced on both a hard and fast month-to-month charge or a variable usage-based mannequin. Later this 12 months, Qloo will launch a no-code, self-service perception platform, which will likely be priced on a per consumer foundation.

How are you making ready for a possible financial slowdown?

The tailwinds from privacy-centric options and novel AI purposes have vastly overpowered the headwinds from any potential slowdown. Qloo has seen widespread contract growth from prospects looking for our distinctive Style AI answer, which is a vital part of personalised experiences. Qloo can be seeing rising demand from new addressable markets resembling sports activities, leisure, and dwell occasions — a key a part of our partnership with Bluestone.

What was the funding course of like?

This newest funding happened fairly organically, as each Qloo and Bluestone noticed the super worth that may be unlocked by bringing Qloo’s answer to new industries like sports activities and dwell occasions.

What are the largest challenges that you simply confronted whereas elevating capital?

Qloo is atypical as an AI firm in that we’ve been constructing our expertise and proprietary database for over a decade. This creates appreciable, and necessary, distance between Qloo and the opposite AI corporations gaining consideration through the present AI hype cycle.

What components about what you are promoting led your traders to put in writing the test?

“Qloo’s one-of-a-kind AI successfully and ethically generates added-value for nearly any consumer-facing enterprise,” mentioned Bobby Sharma, Bluestone’s Founder & Managing Accomplice. “It turns huge troves of underutilized present firm information into instantly impactful client insights and actionable alternatives, maximizing income alternatives at scale. We’re excited to assist carry this wonderful expertise deeper into the worldwide Sports activities, Media and Leisure business and its unmatched breadth and depth of significant touchpoints with passionate shoppers and viewers.”

What are the milestones you propose to realize within the subsequent six months?

Deal with and meet demand from new addressable markets, together with actual property, sports activities, leisure and dwell occasions.

Deal with new industrial floor space for Style AI resembling on-device studying and foundational fashions leveraging Qloo.

Introduce an accessible, self-service interface later this 12 months to make client and style analytics out there to small and mid-sized enterprises and people.

Pursue opportunistic M&A utilizing our stability sheet alongside the strains of the TasteDive acquisition, which vastly expanded Qloo’s first-party information moat and corpus of cultural studying.

What recommendation are you able to supply corporations in New York that should not have a contemporary injection of capital within the financial institution?

My recommendation is to deal with one vertical and pursue product market match there. When you do, it’s a lot simpler to draw traders who’ve LPs which can be strategic to that vertical and usually tend to write a test in consequence.

The place do you see the corporate going now over the close to time period?

Within the close to time period, Qloo will make the most of this opportunistic funding for market growth, launching a brand new self-service insights platform, constructing out our crew, and strategically buying novel information sources and applied sciences that improve our core Style AI expertise. We’ll additionally develop into new addressable markets together with actual property, sports activities, leisure and dwell occasions.

What’s your favourite summer time vacation spot in and across the metropolis?

I’m a giant fan of artwork and music. Inside NYC, I really like the sculpture backyard on the Noguchi Museum in Queens, and the summer time live performance collection at MoMA PS1. Outdoors of the town, I get pleasure from visiting Dia Beacon and the Parrish Artwork Museum in Water Mill.

You’re seconds away from signing up for the most popular checklist in NYC Tech!

Join at this time

[ad_2]

Source link