[ad_1]

Marko Hannula/iStock by way of Getty Photos

Greater than a 12 months handed since beforehand overlaying Enel (OTCPK:ENLAY), when the assertion was made the expansion plan was too formidable. Secondly, it was highlighted the Italian Treasury division pushed for a change within the board to exert extra affect over the decision-making. Quick-forward and each the expansion plan has been lowered and investments have been shifted in direction of Italy and Iberia. This didn’t withhold the corporate from posting spectacular ends in the primary half of 2024, nevertheless. But, I stay cautious and can await weak point within the inventory worth earlier than contemplating an growth of my place.

Efficiency

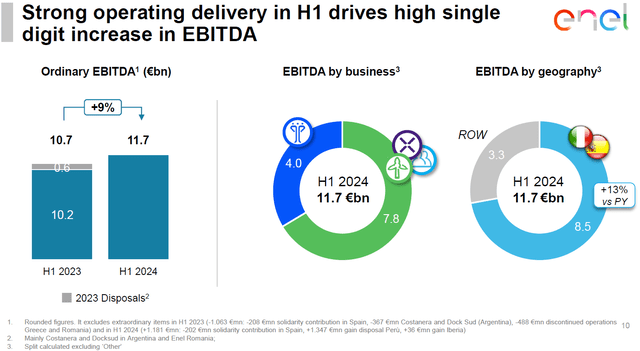

On the twenty fifth of July, Enel introduced a robust set of numbers for the primary half of 2024. Regardless of disposals, the corporate managed to develop earnings by 9 p.c, see determine 1.

Determine 1 – 1H24 EBITDA, 1H24 outcomes presentation (enel.com)

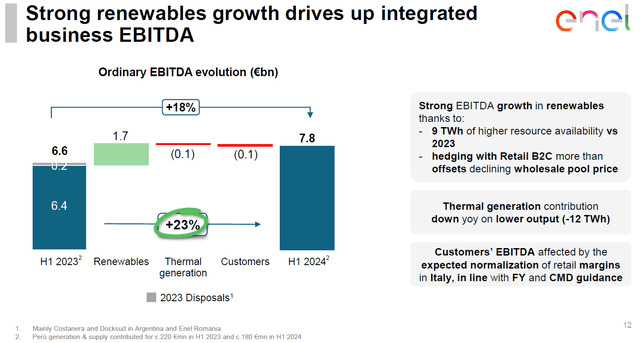

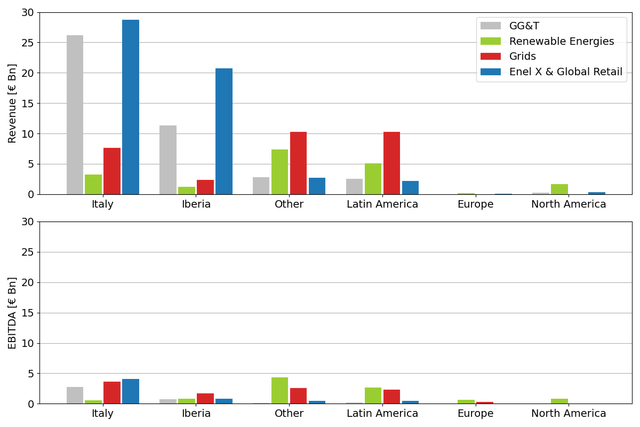

This sturdy efficiency was primarily pushed by the Renewables phase, the place EBITDA rose by €1.7Bn, see determine 2. It’s worthwhile to notice the contribution to earnings from the Grids enterprise line remained flat year-over-year.

Determine 2 – Renewables single-handedly boosted EBITDA, 1H24 outcomes presentation (enel.com)

To place EBITDA enhance in perspective, it’s worthwhile to notice this quantity was solely €2.2Bn in 1H21. For 1H24 the overall contribution to EBITDA of Renewables was €3.7Bn, that means this contribution rose by 68% over three years’ time. Clearly, the large capability growth in Renewables now begins to bear fruit. To this point, the corporate is proving me incorrect on my thesis the EBITDA goal for 2024 was too formidable.

Regulation over Renewables

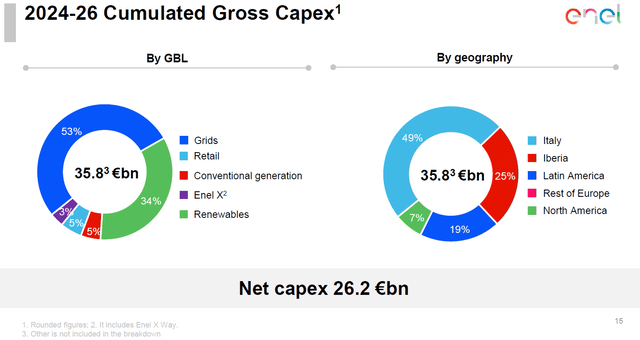

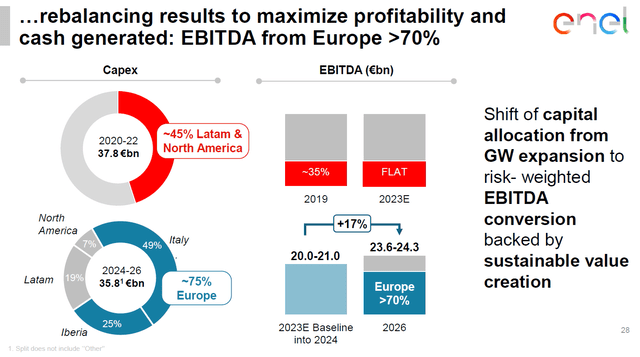

The present technique of Enel is to scale back annual capex from a earlier stage of €12.5Bn per 12 months to about €11.9Bn (or €35.8Bn over three years), see determine 3.

Determine 3 – Envisioned capex spending, CMD23 (enel.com)

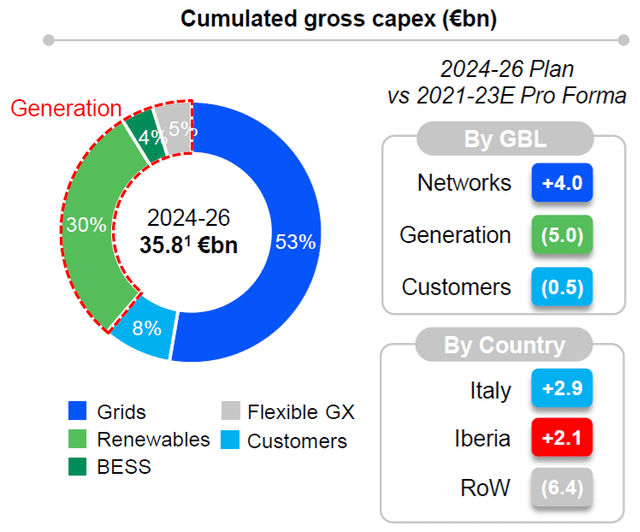

Tying this again to the earlier technique, the primary adjustments are the lowered investments, elevated deal with the normal core markets Italy and Iberia and a choice to put money into grids reasonably than renewables, additionally see determine 4.

Determine 4 – Anticipated capex spending versus earlier professional forma plan, CMD 23 (enel.com)

The investments performed in Technology, or Renewables, is lowered by €5Bn and virtually utterly diverted to the Enterprise Line Networks (Grids). This plan of action is just not according to the spectacular contribution of the Renewables phase to EBITDA as famous earlier than. Furthermore, the mixed funding in Italy and Iberia (Spain and Portugal) is elevated by €5Bn, on the expense of investments exterior Europe.

The administration group underneath the steering of CEO Flavio Cattaneo clearly determined to go for progress of the Regulated Asset Base with a transparent deal with Italy and Iberia.

The place to place your cash

Nonetheless it stays stunning the investments in Renewables are lowered in favor of Regulated Property because the returns of the previous are superior, see determine 5.

Determine 5 – 2023 Income and earnings per Enterprise line, AR23 (knowledge from enel.com, chart by creator)

From the determine it follows, the Enterprise Line ‘International Technology & Buying and selling’ captures a small quantity of income as earnings. The identical holds for the Retail enterprise. Firm-wide, the earnings drivers are the Grids and Renewable segments. In 2023, 34% of income from the Grids enterprise was transformed into (gross) revenue, whereas this quantity was even larger at 52% for the Renewables enterprise. On this respect, the earlier technique to deal with this enterprise made sense.

The yield

The present plan of action taken by administration, favoring Regulated Property over Renewables, might be defined if the potential yield of investments for each enterprise traces is assessed. A ballpark comparability might be given subsequent.

Renewables

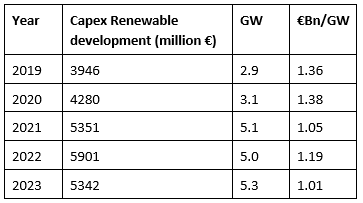

Everybody is aware of previous outcomes are not any assure for future returns. This turns into clear when the potential yield on investments in Renewables is assessed.

Based mostly on FY2023 manufacturing figures, 55.5 GW gigawatt (GW) of internet renewable capability generated 127,000 gigawatt hours (GWh) of renewable electrical energy. This implies on common 1GW of put in capability was working for 2288 hours per 12 months, or an general effectivity of about 26%.

Alternatively, one might state each put in gigawatt of capability will generate, 2288 GWh of vitality. Based mostly on the supplemental data to the FY23 earnings presentation, the typical spot worth in Italy and Iberia was 100 €/MWh, practically double the pre-pandemic quantity. Working underneath the idea the electrical energy market will additional normalize, a lot of 50 €/MWh (50k €/GWh) might be used.

Now, the set up of a further gigawatt of renewable capability will generate annual revenue of €114 million. This interprets right into a return on funding of 10% based mostly on the typical development price of 1.1Bn/GW of the final three years, see determine 6.

Determine 6 – Renewable improvement prices (knowledge from enel.com, desk by creator)

The idea of costs reverting to pre-pandemic ranges is doubtlessly too conservative given the transition challenges and the following demand for vitality Europe is dealing with. If electrical energy costs of 100 €/MWh are the brand new regular, the annual revenue really will increase to €228 million, which might suggest a return of about 20%. Clearly, the identical holds for adjustments in effectivity or ‘useful resource availability’ because it was referred to as in determine 2.

Grids

An analogous train might be performed for the Grids enterprise line, the place future returns are estimated based mostly on the previous efficiency of the Grids phase.

With reference to the Regulated Asset Base (RAB) the European enterprise was valued at €32.6Bn in 2023 (2022: €31.4Bn). In the identical 12 months, the Grids phase accounted for €5.5Bn in EBITDA (2022: €5.3Bn). For each years, the yield of the Grids phase, solely accounting for the European belongings, was 16.8%.

Whereas merely ballpark figures, these instance spotlight the dilemma administration is dealing with; investing in additional risky Renewable Technology with the potential for larger returns or go for growth of the Regulated Property for which returns are extra sure? The choice made is obvious, see determine 7.

Determine 7 – Capex to deal with Italy and Iberia, CMD 2023 (enel.com)

Extra regulation

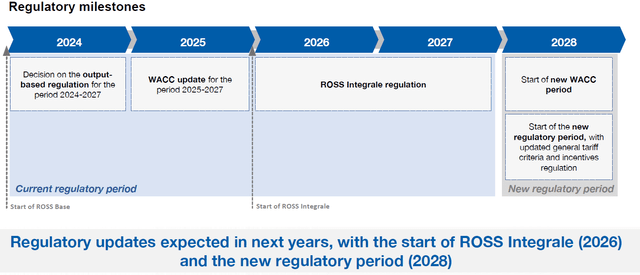

ARERA is the Italian Regulatory Authority for Power Networks and Surroundings. Evidently, Enel falls underneath the supervision of this authority, which has the objective to advertise ‘competitors and effectivity in public utility companies and defend the pursuits of customers and customers’.

In 2021, this regulatory physique began investigating a brand new regulatory course of to set price and high quality targets:

…the regulatory course of for the introduction of a brand new method in setting allowed revenues of the electrical energy and fuel infrastructure companies regulated by (…) ARERA. Total, the brand new method is a part of a broader regulatory reform based mostly on setting expenditure and output targets (so referred to as ‘regolazione per obiettivi di spesa e di servizio’, ROSS).

The rationale for this intervention is the so-called ‘capex bias’ launched by present regulation:

ARERA adopts a ‘hybrid’ method, with a price-cap utilized to OPEX, and cost-of service regulation utilized to CAPEX. Below cost-of-service regulation, allowed revenues are linked on to the underlying prices: precise prices are handed by into the allowed revenues with no lengthy delay.

Below the reign of former CEO Francesco Starace, investments in Renewables had been favored, capability growth was most well-liked and rising debt ranges taken as a right, a chief instance of ‘capex bias’. It’s this bias that ARERA desires to deal with by tying allowed revenues to complete expenditures:

In recognition of the potential that regulatory incentives present a bias in direction of extreme CAPEX, some nationwide regulatory authorities launched TOTEX-based regulation. (…) An method based mostly on complete expenditure goals to deal with each OPEX and CAPEX symmetrically, thereby decreasing the chance of any CAPEX bias. (…) TOTEX-based method and ‘ROSS-base’ are used interchangeably—that’s, they discuss with an method of setting allowed revenues based mostly on complete expenditure.

Whereas the attain of the regulatory physique ARERA could also be confined to Italy, the present technique of Enel favors investments in Italy and already aligns with impending (nationwide) regulation. As turns into clear from determine 8 the TOTEX-based (ROSS) method is at the moment being initiated with a begin of the brand new regulatory interval in 2028 solely.

Determine 8 – ARERA regulatory milestones, CMD24 Terna (terna.it)

As an apart, determine 8 is taken from the slide deck of the Capital Markets Day presentation from Terna. Terna is the transmission system operator of Italy that was divested from Enel in 2004 as a part of deregulation within the vitality sector and led by present Enel CEO Flavio Cattaneo till 2014.

Shareholder returns

Towards the backdrop of latest regulation being enacted and a discount in capex, of which the bulk is invested in regulated belongings, traders needn’t be forgotten. To this finish, a flooring of €0.43 dividend per share has been set for the interval till 2026. This quantity could also be elevated if money circulate neutrality is achieved, i.e. when money circulate will cowl capex spending. On the 1H24 presentation, it was indicated the dividend could be above the ground, however additional steering was not given.

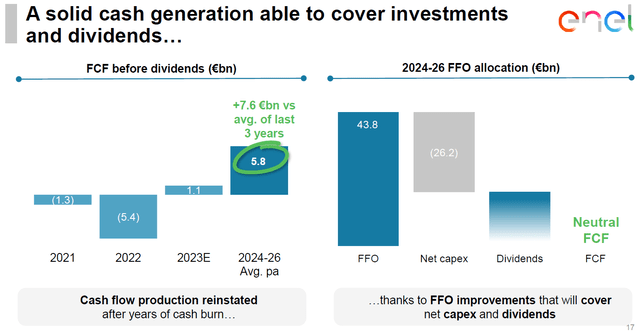

The present annual dividend funds quantity to €5.1Bn. Based mostly on data shared within the newest Capital Markets Day, administration indicated there’s room to develop this worth to €5.8Bn on common, see determine 9.

Determine 9 – Money circulate and dividend, CMD23 (enel.com)

Below the idea the overall dividend fee might be elevated by 13 p.c in direction of, the dividend per share would enhance to €0.49. On the time of writing, this generates a 7.6 p.c ahead dividend yield.

As for the capital good points, Enel is an organization owned for the dividend. This turns into much more true now the technique of fast growth has been ditched for a extra modest method. Furthermore, I might argue that the ‘pull again’ to the roots in Southern Europe will make shareholders extra cautious. Continued improved efficiency could offset this impact, however this may require time.

Dangers

Italian politicians holding sway over Enel have been highlighted as a possible danger earlier than. Whereas the appointment of Flavio Cattaneo is an instance of this, this doesn’t essentially have to be a damaging when the monetary place of the corporate might be propped up and shareholder distributions elevated.

Nevertheless, whereas the corporate does an amazing job driving renewable improvement prices down, spending capex on regulated belongings is most well-liked over renewables. On high of this, investments are diverted to Southern Europe to realize extra predictable returns, which has the aspect impact of a discount in geographic unfold. In different phrases, the focus danger is increase even additional.

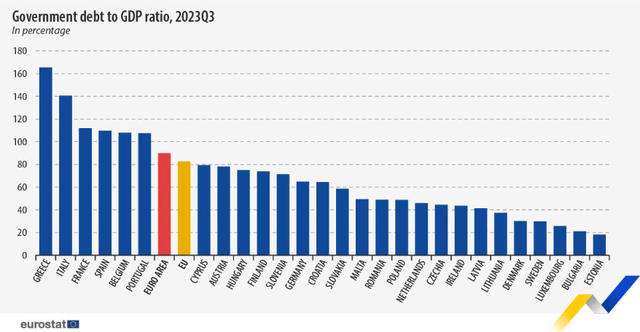

Buyers round lengthy sufficient to vividly bear in mind the European debt disaster will bear in mind the derogatory acronym PIGS (Portugal, Italy, Greece and Spain). Whereas the governments in these nations have been working laborious to enhance funds, the present state of affairs per 3Q23 is proven in determine 10.

Determine 10 – Debt to GDP ratio per 3Q23 (Eurostat)

Towards this backdrop, one ought to understand Enel is spending 75 p.c of its capex in Italy, Spain and Portugal over the approaching three years. To this point, main recessions have been averted lately, however the elevated deal with Southern Europe could impose further hardship on the inventory worth if macroeconomic situations deteriorate.

Conclusion

Enel has been presenting sturdy numbers these days, which underline the incomes capability of the corporate. Whereas that is undoubtedly a bonus, traders ought to be extra serious about future earnings. The present administration group of Enel has taken the choice to scale back investments in Renewables and favor the much less risky enterprise of the Grids phase. As the corporate is now operated in a extra cautious method, upside potential within the inventory worth will solely materialize on account of constant execution and rising dividends.

The draw back potential, nevertheless, is to not be ignored as growing regulation, political interference and focus danger in Southern Europe could enhance volatility in earnings when macroeconomic situations deteriorate.

Regardless of spectacular year-to-date outcomes, I stay cautious and can await weak point in inventory worth earlier than contemplating an growth of my place.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link