[ad_1]

Despite the fact that Apple (NASDAQ: AAPL) inventory dipped throughout final week’s sell-off to just about 12% off its 2024 excessive (at Tuesday’s shut), that wasn’t sufficient to make me need to purchase it.

So why am I bitter on a inventory that so many others are bullish on? All of it has to do with valuation.

Apple’s development has been poor

Should you stay within the U.S., chances are high you both personal an iPhone or different Apple product, or know somebody who does. Apple is rather less dominant worldwide, however continues to be a extremely recognizable and standard model.

As a result of Apple’s enterprise is usually centered on high-end electronics, it is extra liable to demand cycles than corporations promoting cheaper electronics. As inflation has taken its toll, Apple’s gross sales have struggled.

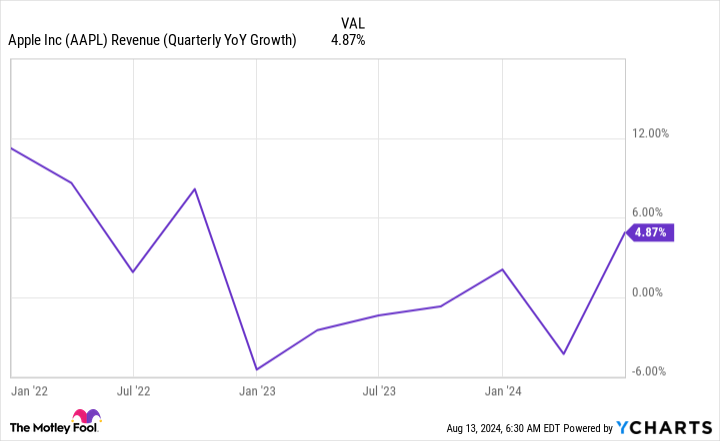

Because the begin of 2022, Apple has struggled to publish double-digit income development and even had a couple of quarters the place gross sales dipped in comparison with the year-ago interval. Its newest quarter noticed income enhance 12 months over 12 months, however gross sales of its flagship product, the iPhone, decreased barely 12 months over 12 months.

The final two and a half years would have been a lot worse for Apple if it weren’t for its companies division. This encompasses income from promoting, the App Retailer, cloud companies, and digital content material like Apple TV and Apple Music. In contrast to its {hardware} income, which fluctuates, companies has extra of a subscription-model really feel to it, which is nice to steadiness out the extra cyclical facet of the enterprise.

However is that sufficient to justify buying the inventory?

The numbers do not add up for the inventory

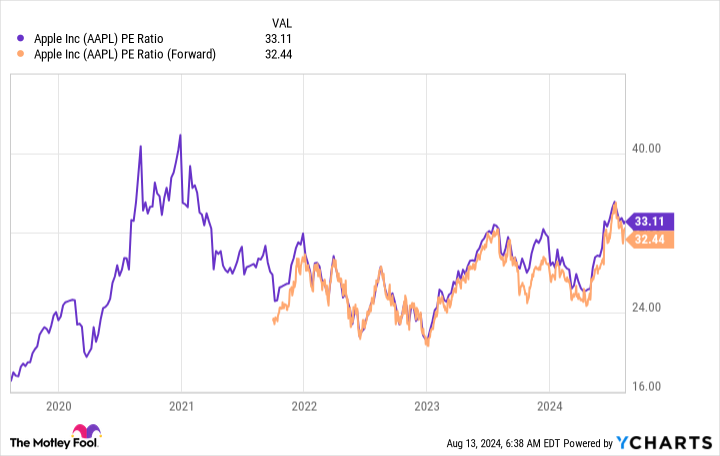

Premium corporations commerce for premium valuations. Some corporations simply have such excessive execution that traders are keen to pay up for them. Apple has been on this place for some time, however I would prefer to problem that notion.

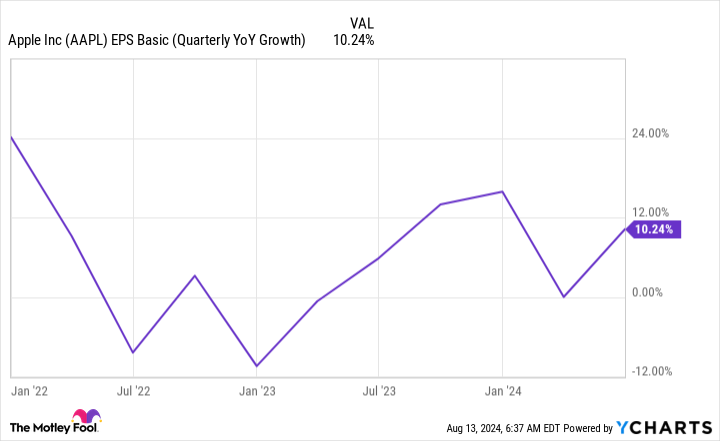

Its income development has been poor, and whereas its earnings development has considerably stored up with the final market, it nonetheless struggles to publish double-digit will increase.

With Apple approaching three years of uninspiring outcomes, I am assured it does not deserve its premium.

At 32 instances ahead earnings estimates and 33 instances trailing earnings, the inventory is as costly because it was in early 2021. At the moment, income was growing by 50%, with earnings doubling 12 months over 12 months. Apple was definitely worth the premium traders paid then, however the present Apple is just not.

Its traders are holding on to the concept Apple Intelligence, the corporate’s generative AI product, shall be a must have and trigger shoppers to improve to the newest iPhone. As a result of this function can solely be run on the newest technology of telephones, it might trigger an improve wave. However that is not assured and would not do a lot for the inventory in addition to a one-time wave of demand.

Story continues

There are significantly better tech investments. Microsoft trades at virtually the identical valuation but has constantly posted double-digit income and earnings development. Or you may take a look at Meta Platforms, which is cheaper and rising extremely shortly (growing income by 22% within the second quarter and earnings by 75%).

Apple is simply too costly and never performing in addition to it must to justify its valuation. At these costs, there are far too many higher corporations to spend money on, and I believe traders ought to put their cash there as a substitute.

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Apple wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Meta Platforms. The Motley Idiot has positions in and recommends Apple, Meta Platforms, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

1 Inventory I Would not Contact With a 10-Foot Pole, Even After the Market Promote-Off Dropped Its Value was initially printed by The Motley Idiot

[ad_2]

Source link