[ad_1]

primeimages/E+ through Getty Pictures

Introduction

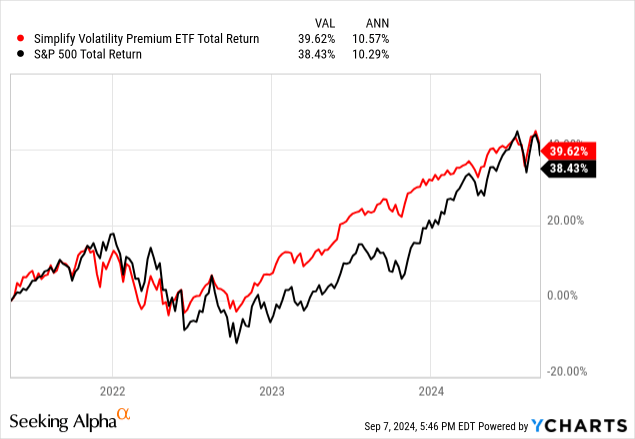

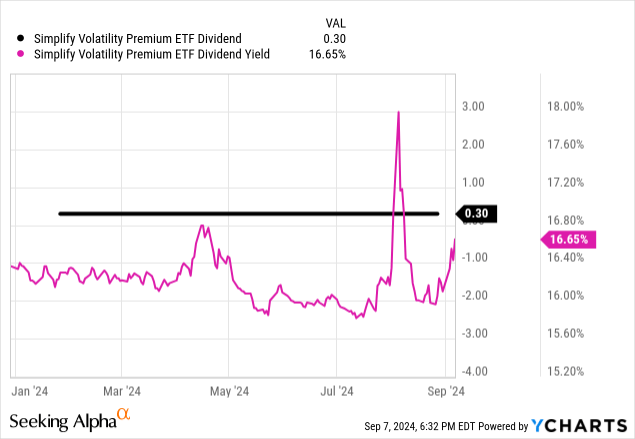

The Simplify Volatility Premium ETF (NYSEARCA:SVOL) is a brief volatility fund aiming to supply 15% annual returns, primarily through month-to-month earnings distributions. It’s a fund that depends on the talent and timing of its managers, and the sensible of us over at Simplify have confirmed themselves over the previous couple of years.

The fund operates as a buying and selling automobile, whereby the ETF wrapper, the fund managers promote futures in opposition to the VIX. Additionally they mess around with the fund’s collateral in bond positions and promote choices spreads. It’s a very complicated fund with plenty of transferring elements, however the chart under will communicate for the worthwhileness of its complexity.

Background

I’ve been a public proponent of SVOL since I started writing on Searching for Alpha again in October 2023. In my final article, I advisable including as much as a 15% allocation to SVOL in an earnings portfolio; that’s to say that I’m very bullish on this fund and its technique.

I’ve lined SVOL a number of occasions earlier than this, and I encourage you to take a look at the timeline of my previous protection and the place I’ve stood previously. This text is simply the most recent replace within the SVOL saga. For the reason that fund is actively managed and is charting new territory, it’s important that now we have the context. Right here is the timeline of my earlier protection, for reference:

SVOL: Adjustments In Bond Holdings Are A Boon – October 2023

SVOL: Downgrading Due To Regarding Developments – November 2023

SVOL: Developments Reverse, Reinstating My Purchase Ranking (Improve) – January 2024

SVOL: I Am Happy With The New Holdings (Improve) – April 2024

Since then, I’ve been pretty quiet, however have maintained my “sturdy purchase” ranking on SVOL. Up till just lately, there wasn’t a lot to speak about. The fund was churning alongside as anticipated, and performing like a well-oiled machine.

Catching Up from April to Now

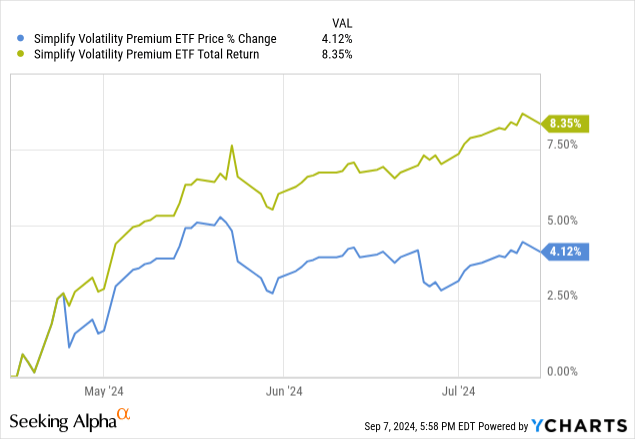

It was April fifteenth once I issued the sturdy purchase ranking on SVOL. For just a few weeks, my name was well-timed and carried out as anticipated.

All the charts on this part start on April fifteenth.

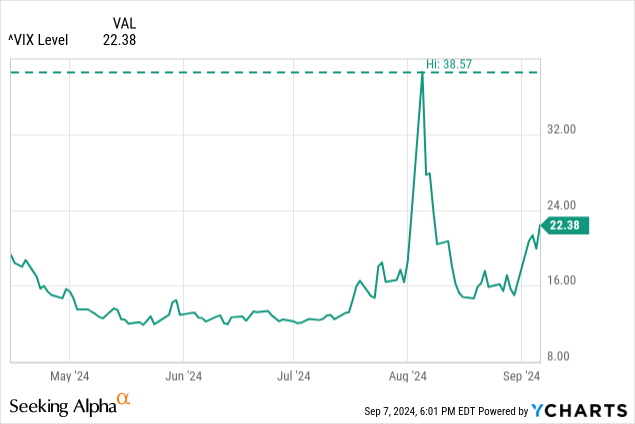

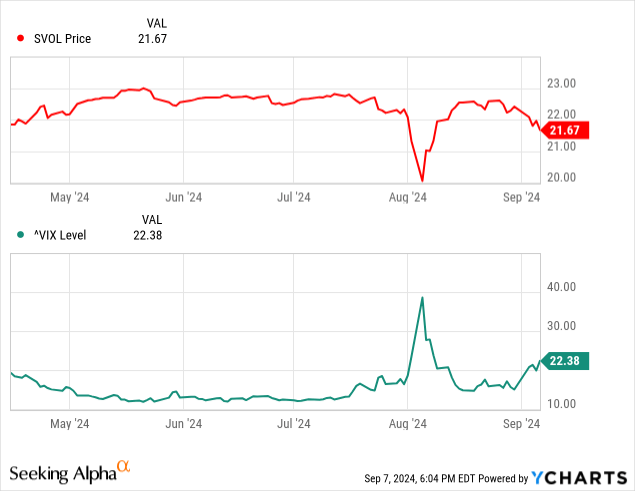

Then the VIX exploded…

…however only for a bit bit.

Like most VIX spikes previously, this one was sudden, sudden, however over with rapidly.

As I’ve predicted previously, within the occasion of a spike within the VIX, SVOL will see an instantaneous crash in value. Then, the hedge will kick in, and the fund will get well a lot of its value loss by promoting off the VIX name choices they maintain.

That is precisely the way it performed out.

The precise mechanics of what occurred listed here are fascinating. I like to recommend studying Simplify’s breakdown of the crash and the way they navigated it. The fund’s danger administration performed out precisely as anticipated, and shareholders have been by no means too far within the gap in the course of the spike. The restoration was very fast, and the fund stayed intact.

The Hedges Labored

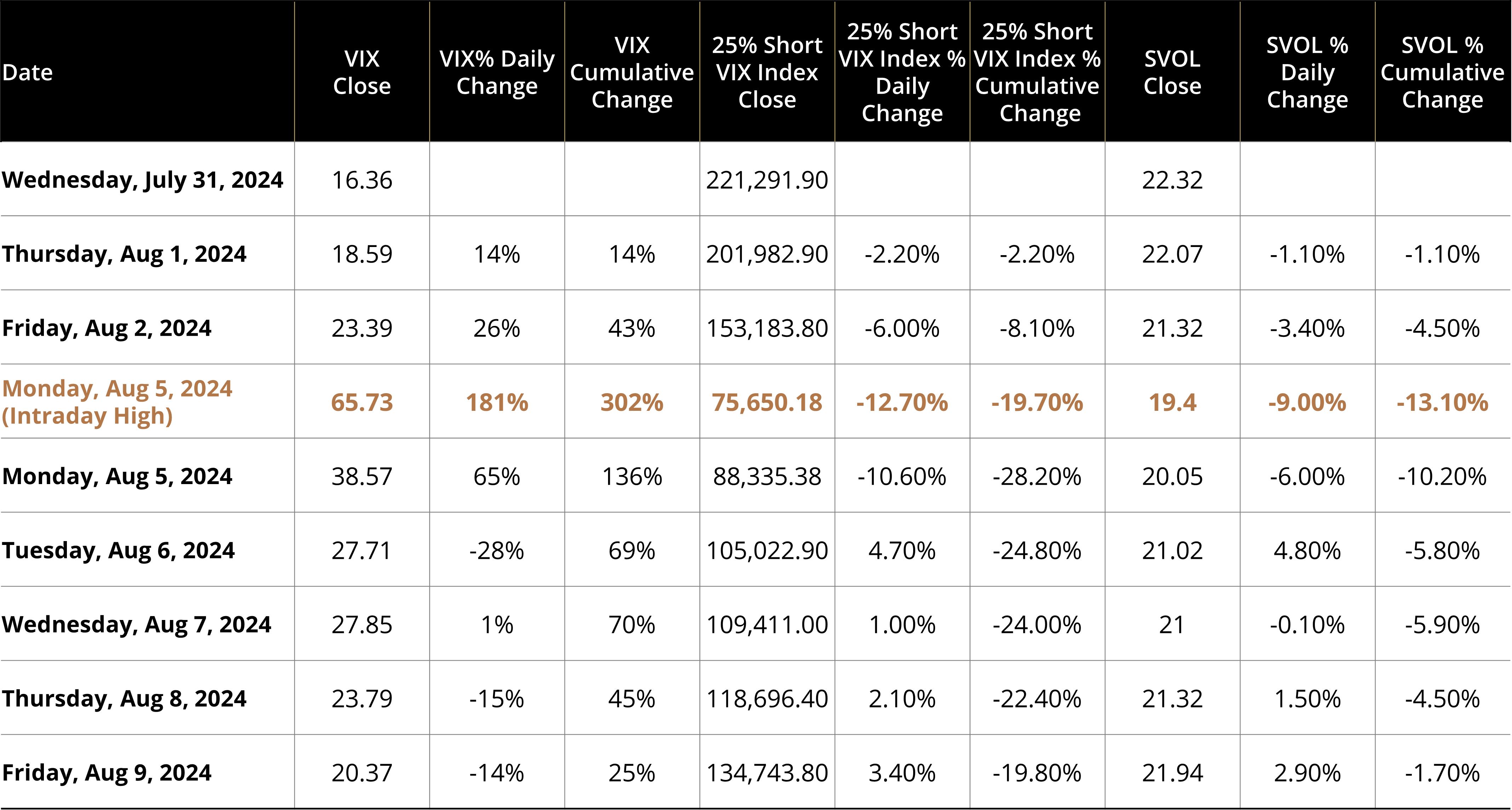

Simplify posted this backtest of their article, and I need to spotlight it right here. That is how SVOL in comparison with a daily-reset 25% quick VIX fund, which means that the comparative information is between a passively managed quick VIX fund and SVOL. Did the energetic administration work?

Bloomberg through Simplify Asset Administration

It completely did. The delta on the overall return between the 2 devices is Grand Canyon sized. This is among the explanation why I’ve been itemizing energetic administration as a boon for this fund, and a constructive that buyers ought to be prepared to pay for. The VIX is a fickle beast, and one I might not need to be passively quick.

This helps justify SVOL’s higher-than-market-average ER of 0.5%.

Notice: SVOL’s administration price is usually reported incorrectly as 1.16%. That’s as a result of leverage bills are lumped into ER. The administration price itself is 0.5%.

Simplify ETFs

Present Holdings

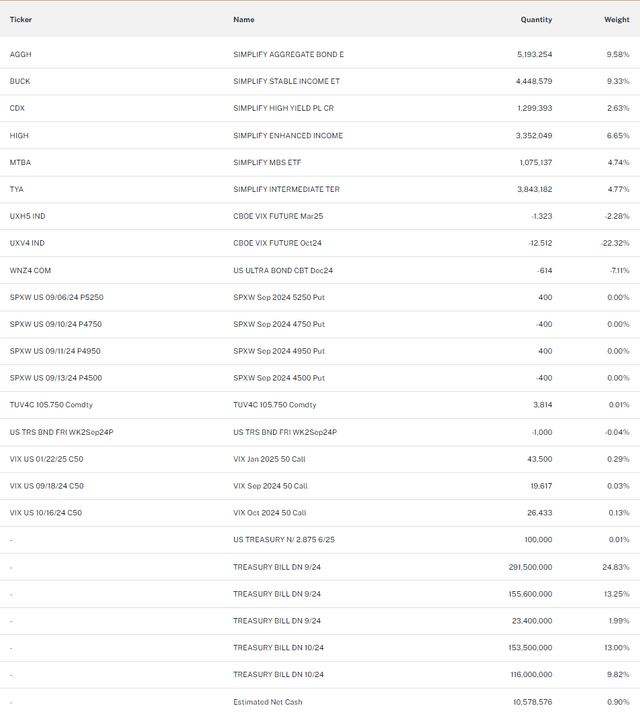

The Simplify Volatility Premium ETF has a really attention-grabbing holdings sheet, chock-full of derivatives and different ETFs, largely different funds owned by Simplify. Whereas this “incestuous” relationship with Simplify’s different funds is a battle of curiosity, I perceive why the fund managers have taken these positions and imagine that the ETFs they’ve chosen simply merely are the most effective positions to take for this fund.

Simplify ETFs

The core positions in ETFs are precisely what I need to see proper now. They’re all funds which are including convexity to their methods. It is a actually shallow overview of those funds, however I’m going to attempt to rapidly give a one-liner of why I imagine every fund is in SVOL and what its benefit could also be primarily based on its building. The place I can, I’ll hyperlink articles I’ve written in additional depth on these funds.

Simplify Mixture Bond ETF (AGGH) – 9.58% AUM Simplify Secure Revenue ETF (BUCK) – 9.33% AUM Simplify Excessive Yield PLUS Credit score Hedge ETF (CDX) – 2.63% AUM Excessive-yield bonds, largely corporates Employs a hedge utilizing credit score default swaps (“CDS”) CDS are institutional instruments and are sometimes unavailable to retail buyers, making this fund particular in that regard Simplify Enhanced Revenue ETF (HIGH) – 6.65% AUM Simplify MBS ETF (MTBA) – 4.74% AUM Newly issued mortgage-backed securities (“MBS”) Since rates of interest have risen, mortgages now yield 6%+, whereas outdated mortgages yield nearer to three% By the fund solely investing in new points, it excludes the entire outdated, low yield mortgages bought in the course of the ZIRP period Simplify Intermediate Time period Treasury Futures Technique ETF (TYA) – 4.77% AUM 3x Leveraged 10YR US Treasury Invoice, secured by T-Payments Offers the yield of T-Payments minus the 10YR UST (presently constructive carry), and length of leveraged 10YR UST (16-20 length) These attributes arrange for a possible 20% CAGR over the subsequent two years, primarily based on what the Fed has projected I wrote about this commerce final week in higher element

These positions all attribute to SVOL’s returns, together with its quick VIX place, and have ensured that the dividend payouts have remained steady.

Some Dangers Are Nonetheless Current

These funds all have one factor in frequent that we have to focus on, the elephant within the room: derivatives are used so as to add alpha.

Each time a fund makes use of an choices overlay, they’re including volatility danger to the portfolio. A few of this danger is obscured via SVOL’s holdings, however once you add all of them up collectively, you could have some giant exposures to very explicit choices trades like quick spreads on the S&P 500 and bond indices. BUCK, HIGH, AGGH, and SVOL might all be stacking comparable trades or choices trades which have comparable exposures, and this stacked danger just isn’t obvious from the skin. It’s virtually unattainable to trace these dangers as a result of the funds commerce every single day, typically intraday, and solely publish their modified holdings on the finish of the day.

Whereas SVOL survived this newest spike, it’s nonetheless not immune from VIX spikes. A far worse spike may inflict way more harm to SVOL’s NAV, and it is unclear how dangerous it may get, doubtlessly a wipe-out.

Conclusion

I’m nonetheless standing by my sturdy purchase advice, and advocate the next:

Don’t worry an excessive amount of about your SVOL value foundation, attempt to purchase beneath $22 Aggressive earnings buyers ought to contemplate as much as a 15% allocation to SVOLThe similar advice I made in April Conservative earnings buyers ought to contemplate as much as a 5% allocation to SVOLUpgrade from my earlier advice of 0%

For now, I contemplate SVOL nonetheless the best-in-class quick volatility ETF and among the best earnings ETFs available on the market. It has confirmed itself within the occasion of tail danger, one thing that has beforehand been a significant danger. Whereas the danger of a fatter tail all the time looms forward, the dangers have been decreased and conservative buyers might discover consolation they did not have earlier than after SVOL’s latest outperformance of passive quick volatility funds.

Thanks for studying.

[ad_2]

Source link