[ad_1]

Hey Bud, Seen A Sheep Come By Right here?

CaseyHillPhoto

The REIT & Its Historical past

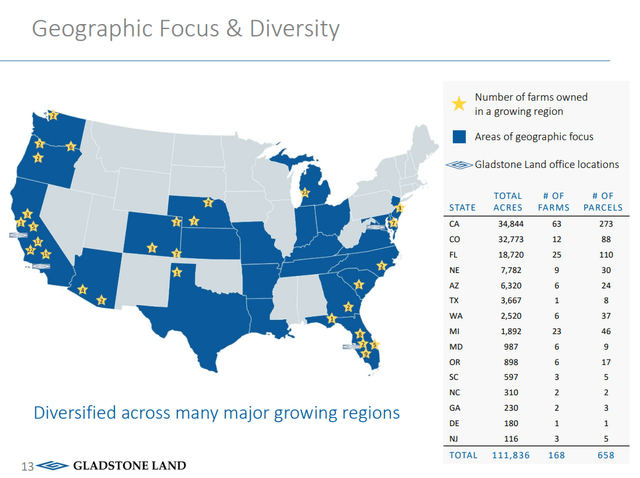

Gladstone Land (NASDAQ:LAND) is a farmland proudly owning REIT that owns 111,836 acres throughout the US. These farms are additionally diversified by utilization and produce grains, fruits, tree nuts, and wine grapes. Whereas the REIT is diversified, about two-thirds of the complete parcels of land are in 3 states, California, Florida and Colorado.

Gladstone Land Presentation

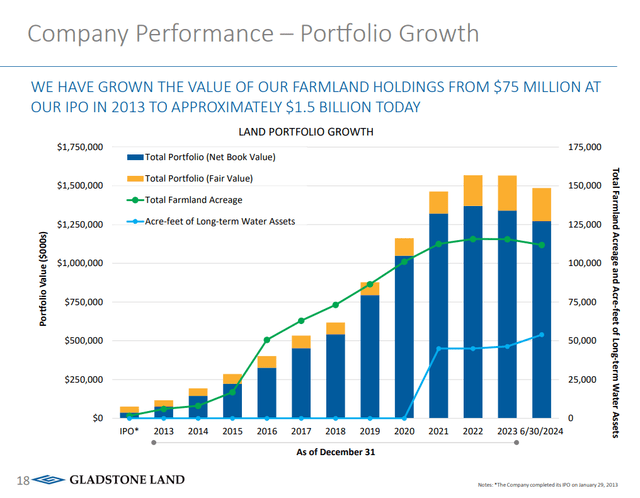

The corporate has been a hit at enlargement and the overall portfolio worth is 15-fold what it was on the IPO greater than a decade again.

Gladstone Land Presentation

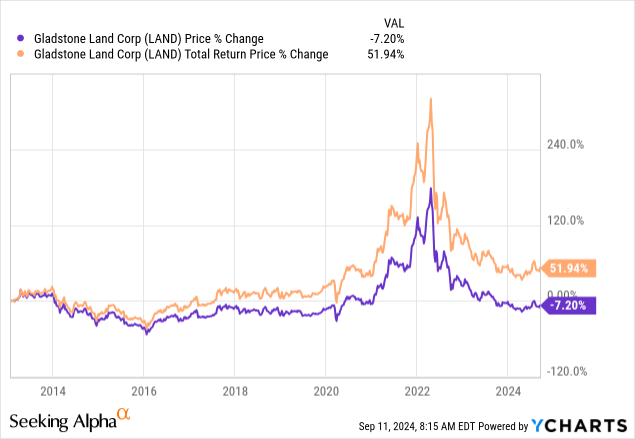

With 15-fold numbers being quoted above, you most likely anticipated to see a high-flyer inventory. Maybe one that may remind you of the glory days of Tremendous Micro Laptop, Inc. (SMCI). You’ll be significantly fallacious. Gladstone Land has produced a destructive 7.2% value return since its IPO. Because of dividends, complete returns have been modestly constructive.

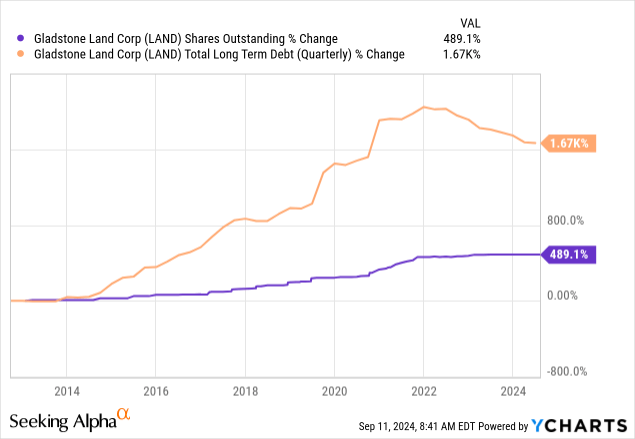

However we’re nonetheless taking a look at circa 4% annual since inception. That could be a robust tablet to swallow with the massive enlargement of belongings, however one we expect is about par for the course for farmland REITs typically. To develop your belongings, it is advisable challenge fairness or debt. This holds true to the utmost extent for farmland REITs over different kinds of REITs. Whereas all REITs typically pay greater than typical widespread shares from different sectors, farmland is the poorest money producer. So that you typically have the least amount of money movement left to develop. So you’re left issuing fairness and debt and that exhibit A is beneath.

So that’s the Cliff Notes as to the place we’re and the way we received right here. We now go into the newer firm setup and let you know how the valuation stacks up in your potential returns. We can even let you know why the popular shares are doubtless to present you higher returns with far decrease threat.

A Profile In Stability

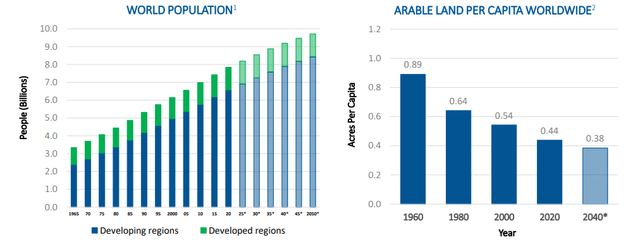

Farmland stays in excessive demand throughout the nation and even globally. Arable land per capita is in a particular downward pattern.

Gladstone Land Presentation

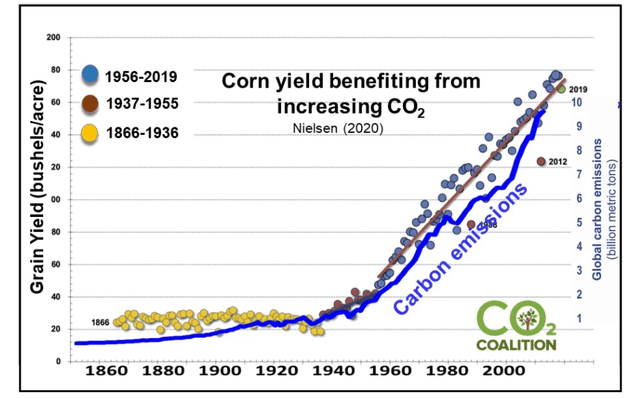

Then again, yields per acre, whether or not they be corn or wheat, proceed to rise relentlessly. Within the ironical class of correlation is causation, we discovered this chart, which was chuckle worthy.

CO2 Coalition

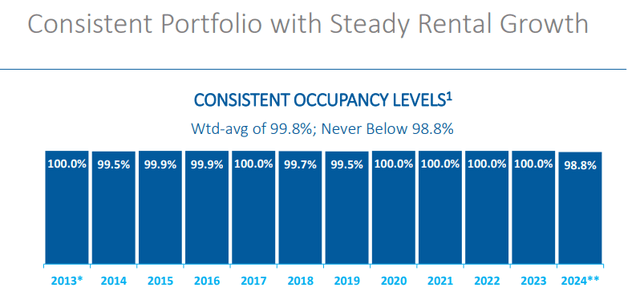

Regardless of the motive for the rise, and it’s extra potash fertilizer than carbon dioxide for certain, the yields per acre have blunted the influence of farmland shortage. You possibly can see that within the occupancy ranges as for Gladstone Land, which hit its lowest ranges for the reason that IPO. Now these are nonetheless at 98.8% ranges, however we’re undoubtedly not working out of farmland.

Gladstone Land Presentation

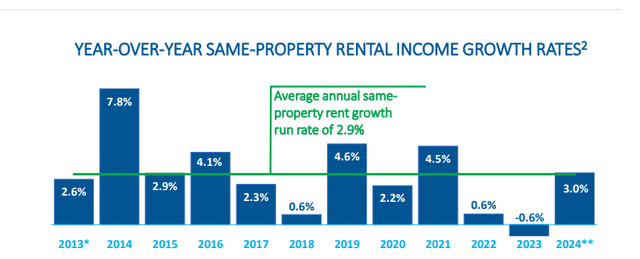

One other image which makes the identical case is rental earnings development. After flying excessive in 2021 at a 4.5% clip, we made zero web positive factors in 2022 and 2023. 2024 is wanting much better, although the drop in occupancy ranges nullify that.

Gladstone Land Presentation

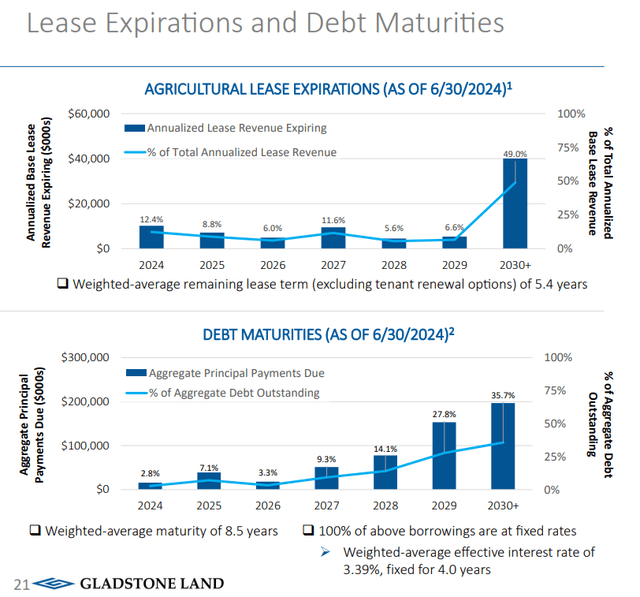

The REIT is ready up slightly properly on each its debt maturities and its lease expirations. There must be no shock on both facet. Now we have seen that to some extent because it navigated the ZIRP (Zero Curiosity Fee Coverage) to five% transfer with out breaking its stride.

Gladstone Land Presentation

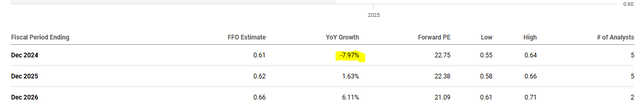

However on the finish of the day, the query whether or not or to not personal it, comes right down to what sort of returns you anticipate and what you’re paying for it immediately. The REIT trades at about 23X funds from operations (FFO) and the image beneath reveals the decline from the earlier yr.

Looking for Alpha

When you mix that with the expectations of the subsequent two years, you possibly can see that we’ll most definitely run flat from 2023 to 2026. In reality, in 2022, Gladstone Land produced 69 cents of FFO per share. Our bigger level is that there’s a lot of proof right here that reveals that you just will not be getting a lot (if any) development.

The inventory does commerce at a small low cost to consensus NAV, however there aren’t any actual catalysts for a catch-up. The chart beneath reveals the worth to NAV ratio, and you’ll see the Bohemian push to 2X NAV throughout 2021 when all merchants misplaced their collective sanity.

TIKR

So total valuation will not be unhealthy for farmland and if you wish to personal this asset, then go for it. Simply do not anticipate any market beating (and even Treasury Invoice beating) returns any time quickly.

The Different

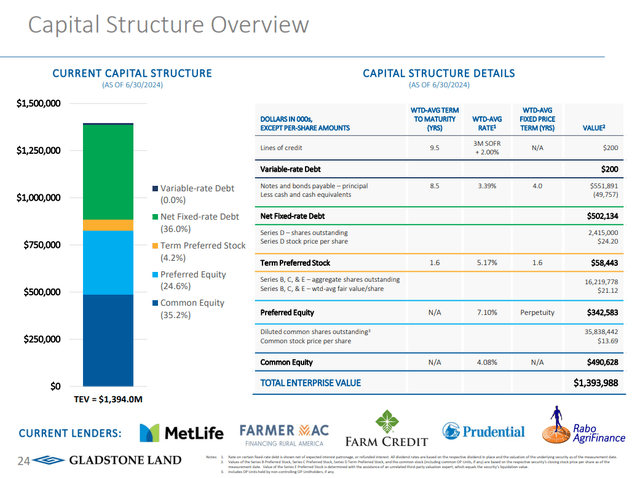

Because the capital construction beneath reveals, LAND has most well-liked shares sitting beneath the debt and above the widespread fairness.

Gladstone Land Presentation

We’re going to simply deal with the perpetual fairness, which is made up of Gladstone Land Company 6% SER C CUM PFD (NASDAQ:LANDP) and Gladstone Land Company 6.00% CUM REDEEMABLE PFD STK SER B (NASDAQ:LANDO).

The 2 are an identical different their slight deviations in value on occasion. The important thing options listed below are that they each are actually nicely beneath par, at round $21.50 (par is $25.00). They at the moment yield 7.1% and so they pay month-to-month. We couldn’t presumably not care much less about preferring a month-to-month payer versus a quarterly payer. If anybody prefers a decrease month-to-month yield, vs an successfully greater quarterly yield, they’ve issues that this web site can’t clear up. We point out this (the month-to-month half) although so traders are clear on their dividend funds and ex-dividend dates.

The important thing motive to personal that is the massive widespread NAV that stands forward and protects of the popular shares. Certain, with farmland most well-liked shares, you will not get the type of money movement overflow that we see with different most well-liked shares. However you do get an asset class that’s extraordinarily resilient. So we see a excessive asset degree safety right here, and we expect these most well-liked shares must be yielding not more than 2.5% over the 10-year Treasury charges. So at the moment, we see them as undervalued. Additionally they yield 3.1% over the widespread shares, and this creates a really huge hurdle for his or her non-preferred brethren. As we’ve seen above, LAND widespread shares returned nearly 4% by a interval which was primarily laced with ZIRP. It appears extremely unlikely that they’d outperform a 7.1% most well-liked charge. Ought to rates of interest transfer considerably decrease over the subsequent 5 years, the widespread shares may recognize. However even right here, LANDO and LANDP would doubtless transfer up 15%-20% to achieve nearer to par. We at the moment personal LANDP, however we’ve switched between the 2 in our portfolio when pricing favored one over the opposite. The 2 even have an awesome change of management safety (web page 16 and 17) in place, and we imagine they’re one of the simplest ways to play farmland immediately.

Please be aware that this isn’t monetary recommendation. It could seem to be it, sound prefer it, however surprisingly, it’s not. Buyers are anticipated to do their very own due diligence and seek the advice of knowledgeable who is aware of their targets and constraints.

[ad_2]

Source link