[ad_1]

Jacob Wackerhausen/iStock through Getty Photos

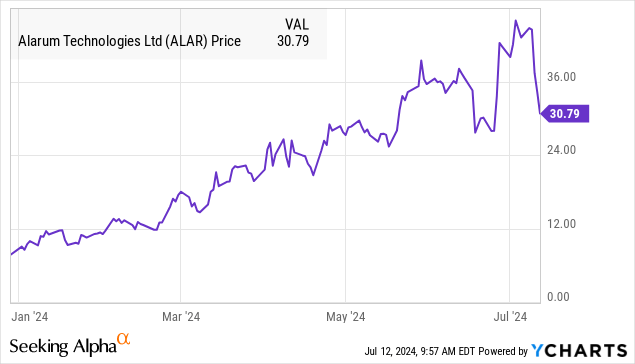

Shares of Alarum Applied sciences Ltd. (NASDAQ:ALAR) offered off sharply following preliminary Q2 outcomes which got here in beneath consensus estimates. The inventory is presently down about 30% from its 52-week excessive.

Whereas that headline is regarding, this is a case the place context is necessary. Alarum has emerged as a implausible development story with shares nonetheless up greater than 1000% over the previous yr.

We highlighted the corporate’s momentum with its “NetNut” net knowledge assortment SaaS platform in a bullish article earlier this yr, noting spectacular elementary tendencies together with surging profitability and a compelling valuation.

In our view, the large image hasn’t modified with the present spherical of volatility merely reflecting a consolidation of latest good points. The corporate’s outlook stays constructive with the inventory well-positioned to rebound.

ALAR Preliminary Q2 Outcomes

Alarum Applied sciences up to date the market with early second quarter outcomes forward of ultimate and audited figures set for late August. The corporate anticipates Q2 income of $8.8 million, representing a 25% year-over-year development price. However, printed Wall Road estimates had been searching for a barely increased determine at $8.9 million.

This small unfold was probably the catalyst for the inventory value decline on the information launch. The opposite nugget from the preliminary figures was the estimated $3.1 million in money movement from operations this quarter, marking a tick decrease from $3.2 million in Q1, but additionally reversing the money bleed within the interval final yr.

We’re seeing a normalization of development developing towards powerful comparables into the second half of 2023. The Q2 25% top-line improve is a slowdown from the 47% development price in Q1.

A significant theme for the corporate has been its focus particularly on the NetNut platform which presently represents the majority of the enterprise at 96% of whole revenues. This follows the exit of its enterprise cybersecurity phase in 2023 which was the launch level for firming financials.

On this case, administration expects Q2 NetNut standalone income of $8.6 million this quarter, up 70% y/y, implying the firm-wide outcomes are being dragged decrease by the smaller peripheral providers together with consumer-oriented on-line instruments.

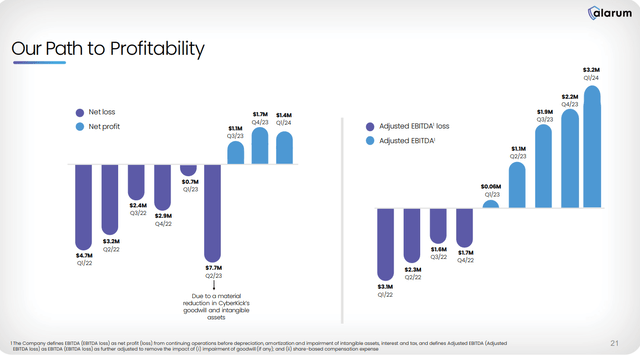

The high-level tendencies stay very constructive with the expectation for an additional worthwhile quarter and the sixth consecutive quarterly improve in adjusted EBITDA.

supply: firm IR

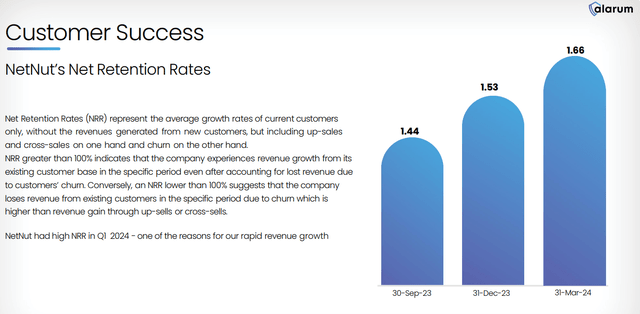

What’s lacking from the Q2 preview is knowledge associated to margins and the client internet retention price (NRR) which has been a key efficiency metric for Alarum in latest quarters.

The Q1 NRR at 1.66 or 166% climbed from 1.53 within the prior This autumn suggesting the corporate is managing to increase current buyer relationships by cross-selling or up-selling providers. This degree of engagement is an effective indicator of the model’s success and the worth the platform brings to core customers.

supply: firm IR

What’s Subsequent for Alarum Applied sciences?

With a present market capitalization of round $220 million, Alarum Applied sciences stands out as an in any other case distinctive micro-cap with its mixture of sturdy development, recurring profitability, internet money on the steadiness sheet, and a management place on this area of interest software program class.

With that, we imagine the corporate’s outlook and inventory value buying and selling motion will step by step evolve from the early tailwind of breakout development momentum with the market focusing extra on earnings and new development drivers.

Corporations with a significant on-line presence in areas like e-commerce, social media, journey, and promoting want the capabilities of NetNut’s IP Proxy Community (IPPN) which permits corporations to scrap and accumulate numerous knowledge factors like pricing, verification, and competitor positioning via virtualized nameless profiles.

These steps are sometimes essential for efficient market evaluation and monetization methods. Alarum plans to leverage its buyer base and international footprint into areas like commercialized knowledge units and an perception engine built-in with synthetic intelligence capabilities.

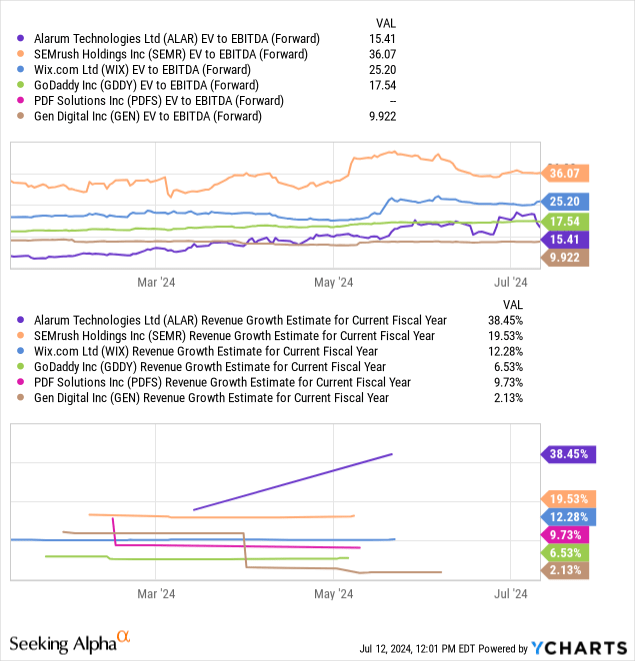

What makes the inventory fascinating proper now’s that the selloff has labored to reset or pull again the valuation. Shares of ALAR are presently buying and selling at an EV to ahead EBITDA a number of of 15, which we imagine compares favorably to a peer group of net knowledge service suppliers like Semrush Holdings, Inc. (SEMR), Wix.com Ltd. (WIX), GoDaddy Inc. (GDDY), and Gen Digital Inc. (GEN).

That is within the context of a consensus estimate for Alarum’s annual income development of 38% this yr, properly above names like SEMR at 19% or WIX at 12%. In the end, the bullish case is that the corporate continues to develop into 2025 and past, permitting EBITDA to speed up making shares seem much more attractively priced.

Ultimate Ideas

We reaffirm a bullish name on ALAR and keep a purchase ranking. The potential for shares to rebound again to the latest excessive above $46.00 is the extent bulls will wish to goal. On the draw back, will probably be necessary for the inventory to carry the June low round $25.00 per share as an space of technical assist.

The primary threat to contemplate is that given ALAR’s micro-cap profile, shares will probably stay extremely delicate to firm updates. Whereas the enterprise has a very good layer of diversification when it comes to prospects and regional publicity, a setback within the improvement of the NetNut product the place it loses relevancy or faces rising market competitors is one thing to observe over the long term.

Buyers can look ahead to the ultimate Q2 figures with margins and money movement being the important thing monitoring factors.

[ad_2]

Source link