[ad_1]

maybefalse

Earlier this yr, I wrote a bullish article about Chinese language e-commerce large Alibaba Group Holding Restricted (NYSE:BABA). In that article, I drilled down into the agency’s completely different operations, focusing totally on the most important a part of the enterprise. I additionally mentioned a few of the progress areas of the enterprise and valued the agency to see what sort of upside could be obtainable for buyers. Finally, I concluded that shares have been attractively priced. This led me to charge the enterprise a “purchase,” regardless that I made clear that the corporate deserves to commerce discounted in comparison with American companies due to variations in regulation, the prevalence of corruption, and different components.

Quick-forward to as we speak, and the corporate continues to develop at an honest tempo. It may not be the quickest rising firm on the planet lately. However key elements of the enterprise are doing extremely nicely. Add on prime of this how low-cost shares stay, regardless that the inventory is up 7.3% since I final wrote about it, which beats out the 5.3% enhance seen by the broader market, and it’s troublesome to not like what I see. Finally, till the image modifications for the more serious or shares recognize, I have to stay slightly bullish on the enterprise.

A mandatory observe

Until in any other case specified, all monetary information on this article is quoted utilizing US {dollars}. For the newest information supplied, I took the figures that administration supplied within the firm’s monetary statements. Nonetheless, I made some changes to prior interval outcomes based mostly on the purpose of presenting the information on a relentless forex foundation. This helps us to look solely on the general monetary efficiency of the enterprise, no matter what foreign currency echange may do to the image.

Drilling down

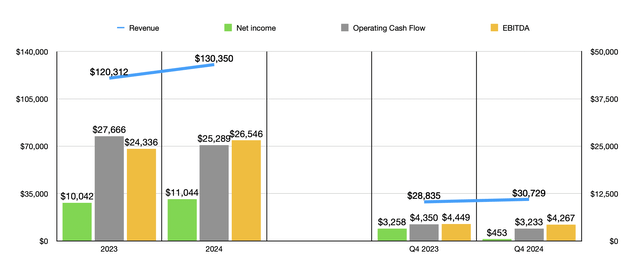

Essentially talking, issues have been going fairly nicely for Alibaba. Once I final wrote concerning the firm, we had information protecting by the third quarter of the 2024 fiscal yr. Information now extends by the ultimate quarter of that yr. Income for 2024 in its entirety got here in sturdy at $130.35 billion. That represents a rise of 8.3% in comparison with the $120.31 billion the corporate generated in 2023. With income rising, two of the three profitability metrics for the enterprise additionally improved. Web revenue, for example, rose from $10.04 billion to $11.04 billion. And EBITDA managed to rise from $24.34 billion to $26.55 billion. The one profitability metric that worsened throughout this window of time was working money stream. It managed to fall from $27.67 billion to $25.29 billion.

Writer – SEC EDGAR Information

Since this information consists of three of the 4 quarters that I had beforehand reported on, it might be useful to check out outcomes for the ultimate quarter of 2024 by itself. The image right here was a bit extra blended. Income did handle to rise by 6.6% from $28.84 billion to $30.73 billion. Nonetheless, profitability metrics for the corporate took a success. Particularly, internet earnings plunged from $3.26 billion to $453 million. Working money stream dropped from $4.35 billion to $3.23 billion, whereas EBITDA declined from $4.45 billion to $4.27 billion.

Writer – SEC EDGAR Information

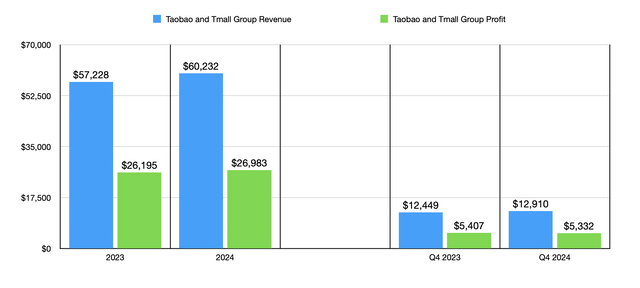

This does counsel an general weakening because the 2024 fiscal yr got here to a detailed. However it might be useful to dig a bit deeper into the monetary situation of the corporate. The easiest way to try this, I consider, is to have a look at the completely different working segments and the roles that they performed in outcomes for the yr. And what higher place to start out than with the Taobao and Tmall Group? This set of operations consists of the home Chinese language client and enterprise to enterprise operations. That is, by far, the most important a part of the corporate. In 2023, income for the phase totaled $60.23 billion. This was up from the $57.23 billion reported only one yr earlier. Even within the ultimate quarter, progress continued, with income of $12.91 billion coming in 3.7% decrease than the $12.45 billion generated within the ultimate quarter of 2023.

To be completely sincere with you, administration shouldn’t be as clear as I would love them to be in terms of income figures. Having mentioned that, they did say that the agency benefited from a 5% year-over-year enhance in on-line GMV. This refers back to the worth of paid orders of services and products throughout the corporate’s marketplaces. That is inclusive of transport prices which are paid by consumers to the agency’s sellers. Direct gross sales progress was even stronger, coming in at 6% year-over-year, because of elevated purchases of client electronics and home equipment. The phase additionally benefited on the wholesale facet, with income leaping 15% as clients engaged extra with the agency’s value-added providers.

With income rising, you’d anticipate profitability to enhance. And this ended up being the case to some extent. For the yr as a complete, phase earnings of $26.98 billion got here in solidly above the $26.20 billion generated in 2023. Nonetheless, within the ultimate quarter of the yr, we noticed a decline from $5.41 billion to $5.33 billion. At first look, this would appear like a internet unfavourable. Nonetheless, administration attributed this primarily to elevated investments within the person expertise, in addition to to investments in expertise infrastructure. This can be a good motive to see a decline in profitability. You’ll be able to consider it as short-term ache for long-term acquire. The truth is, within the firm’s quarterly launch, it even mentioned that the investments in person expertise improved buyer retention and raised buy frequency.

Writer – SEC EDGAR Information

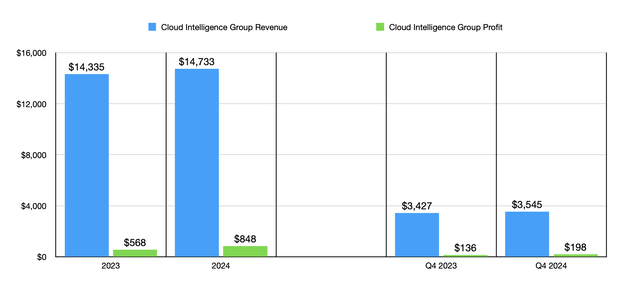

Subsequent in line, we have now the Cloud Intelligence Group. For those who’re not conversant in the enterprise, it is most likely not too troublesome to guess that that is the facet of the corporate that gives cloud providers to its clients. The truth is, along with being the most important cloud computing firm within the Asia Pacific area, it’s the fourth-largest cloud computing agency on the planet. The 2 leaders, by a slightly important margin, occur to be Microsoft (MSFT) and Amazon (AMZN). In the meantime, Google mother or father Alphabet (GOOG, GOOGL) is in a distant third place. As I wrote about in a previous article about Alphabet and its cloud operations, this can be a large market, anticipated to develop from round $680 billion this yr to $1.44 trillion by 2029. I consider that the most important handful of corporations will come to dominate this house. So though Alibaba may not be the winner out there, it ought to do fairly nicely.

Income in 2023 for this phase got here in at $14.73 billion. This was solely 2.8% above the $14.34 billion generated one yr earlier. Development within the ultimate quarter by itself was solely marginally higher at 3.4%, taking income from $3.43 billion to $3.55 billion. That is really disappointing, particularly when you think about that, had it not been for the income generated by Alibaba’s personal subsidiaries, gross sales would have “decreased barely” for the yr. Administration did acknowledge that this was due to a deliberate choice to maneuver away from low margin project-based revenues. In addition they mentioned that they anticipate sturdy income progress shifting ahead. However contemplating how fast progress on this house has been, I nonetheless discover this to be a disappointment. For context, in its newest quarter, Alphabet reported progress of 28.4% yr over yr, with income leaping from $7.45 billion to $9.57 billion. And in its most up-to-date accomplished fiscal yr, income jumped 25.9% in comparison with what it was within the 2022 fiscal yr.

As painful because the weak income progress was to see, a minimum of profitability managed to develop. For the yr in its entirety, phase earnings rose from $568 million to $848 million. And within the ultimate quarter, earnings of $198 million handily surpassed the $136 million reported within the ultimate quarter of 2023. Contemplating that Alphabet’s cloud operations solely simply grew to become worthwhile within the final a number of quarters, I do think about this a constructive.

Writer – SEC EDGAR Information

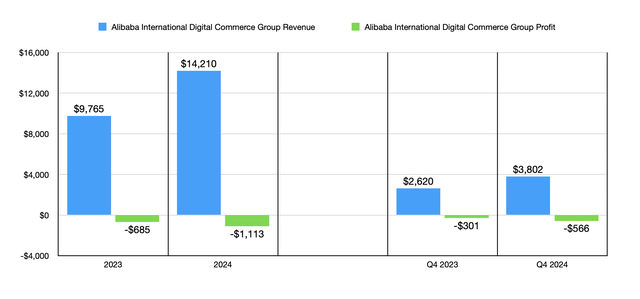

The operations already lined on this article are what I feel you may appropriately name the core elements of the corporate. Nonetheless, other than the earnings that they bring about to the image, they do not excite me all that a lot. Somewhat, what excites me can be the smaller however quicker rising elements of the corporate. The quickest rising of those in the newest fiscal yr was the Alibaba Worldwide Digital Commerce Group. That is the a part of the corporate that gives worldwide commerce retail and wholesale operations, most notably AliExpress. For 2024, income for the phase got here in at a formidable $14.21 billion. This was 45.5% above the $9.77 billion generated one yr earlier. The quickest progress, by a mile, was on the retail facet of operations, with income hovering by 60%, not solely due to increased site visitors, but in addition because of what administration describes as enhancements in monetization.

Naturally, you’d anticipate this to point out up positively on the underside line. However that is not the case. Profitability really worsened from a lack of $685 million to a lack of $1.11 billion. Even for the newest quarter, the $566 million hit that the enterprise took dwarfed the $301 million loss generated one yr earlier. However simply as was the case with the corporate’s Taobao and Tmall Group operations, the weak spot on the underside line was attributable to bigger investments that the corporate made, together with in AliExpress’ Alternative program that permits shoppers to get their merchandise instantly from producers. Along with this, there have been different investments, akin to in Trendyol’s cross-border operations and in Miravia.

Writer – SEC EDGAR Information

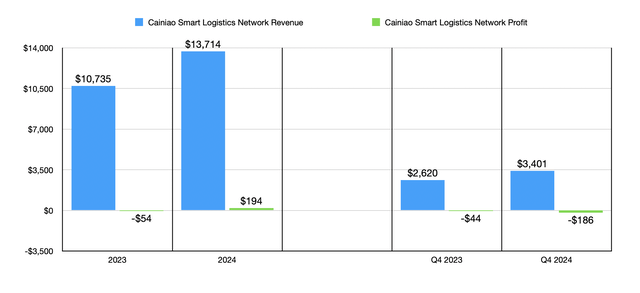

One other key progress a part of the corporate throughout this window of time was the Cainiao Good Logistics Community phase. That is the a part of the corporate that focuses on buyer success, with the purpose of doing so inside 24 hours to clients situated in China, and inside 72 hours elsewhere on the planet.

What I discovered surprising was that, along with seeing income leap 27.8% yr over yr as cross-border success providers grew, the corporate additionally noticed its lack of $54 million rework right into a revenue of $194 million for the yr. The rationale why I discover this shocking is buyer success is usually pricey. For those who do not consider me, have a look at the monetary historical past of Amazon and the way lengthy it took for these operations to develop into the money cows they’re as we speak. Clearly, the administration staff at Alibaba is doing a superb job in terms of this.

Writer – SEC EDGAR Information

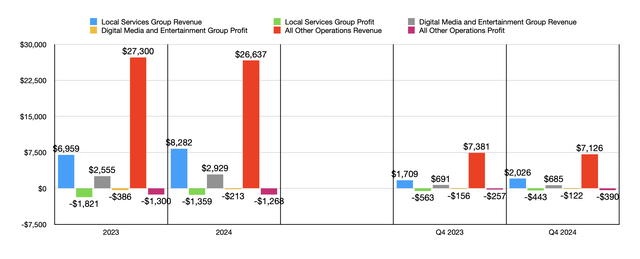

There are another operations underneath the Alibaba company umbrella as nicely. These are usually not as important because the others that I’ve spoken about. The Native Providers Group, which helps shoppers to order meals and drinks, to not point out different merchandise, for supply to their properties, and in addition offers shoppers with the flexibility to ship the identical forms of items to different locations they could be, accounted for less than 6.4% of the agency’s general gross sales final yr.

Nonetheless, income for 2024 was 19% above the $6.96 billion generated one yr earlier. And this got here at a time when the agency’s loss narrowed from $1.82 billion to $1.36 billion. Then you could have the Digital Media and Leisure Group, which is a set of media and leisure platforms that the corporate runs. This accounts for less than 2.2% of the corporate’s general income. However gross sales progress yr over yr was a formidable 14.6%.

Writer – SEC EDGAR Information

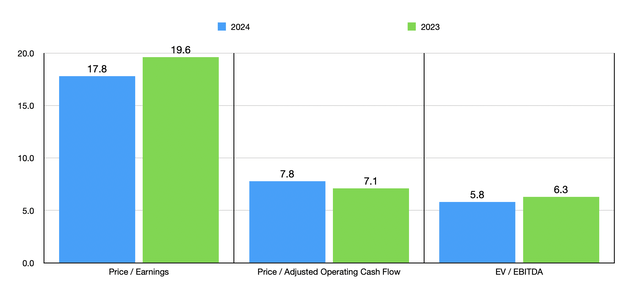

By and enormous, I might say that 2024 was a reasonably good yr for Alibaba. Regardless that progress was not as sturdy as some may need it to be, the corporate continues to increase. Along with this, shares of the corporate look slightly low-cost. Within the chart above, I valued the enterprise utilizing historic outcomes for 2023 and 2024. I did this utilizing the worth to earnings a number of, the worth to working money stream a number of, and the EV to EBITDA a number of.

Though relative to earnings, the inventory does not look terribly low-cost, it does look low-cost relative to the opposite profitability metrics. In terms of comparable companies, I feel an argument might be made that another corporations like Microsoft (MSFT) might be included. This might be largely the results of the cloud operations that the companies have in frequent. However I feel it might be most applicable to check it to Alphabet (GOOG) and Amazon (AMZN). And within the desk under, you’ll be able to see simply how less expensive Alibaba than both of them.

Firm Value / Earnings Value / Working Money Stream EV / EBITDA Alibaba 17.8 7.8 5.8 Alphabet 27.3 21.8 19.1 Amazon 51.0 19.4 18.8 Click on to enlarge

Takeaway

Operationally talking, Alibaba may not be doing the very best, nevertheless it’s actually not doing poorly. The agency continues to increase and shares look filth low-cost. As I discussed at first of this text, I do assume that the enterprise deserves to commerce discounted to American companies. But it surely’s troublesome to think about any situation the place the inventory would commerce at solely round a 3rd of what different comparable companies are going ahead. That is very true when you think about the agency has internet money of $60.74 billion on its books. Due to all of this, I do assume that protecting Alibaba Group Holding Restricted inventory rated a “purchase” makes essentially the most sense at this level.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link