[ad_1]

Information up to date dailyArticle up to date on September twenty seventh, 2024 by Bob Ciura

The patron staples sector is dwelling to a number of the most well-known dividend development shares on the planet.

There may be additionally a large physique of proof that implies that the buyer staples sector outperforms over lengthy intervals of time.

With that in thoughts, we’ve compiled a database of all 77 shopper staples shares, which you’ll entry beneath:

The record of shares was derived from just a few main shopper staples ETFs:

Shopper Staples Choose Sector SPDR ETF (XLP)

Invesco Dynamic Meals & Beverage ETF (PBJ)

Invesco S&P Small Cap Shopper Staples ETF (PSCC)

Maintain studying this text to be taught extra in regards to the deserves of investing in shopper staples shares.

Desk of Contents

This text offers our full record of all shopper staples shares, a tutorial on the right way to use the spreadsheets to create screens of shopper staples shares, and the highest 7 shopper staples shares now.

The highest 7 record was derived from the anticipated returns of every inventory. We calculate anticipated returns primarily based on a projection of earnings-per-share development, dividend yields, and modifications within the valuation a number of.

The 7 shopper staples shares are ranked by 5-year anticipated returns, from lowest to highest.

The desk of contents beneath permits for straightforward navigation:

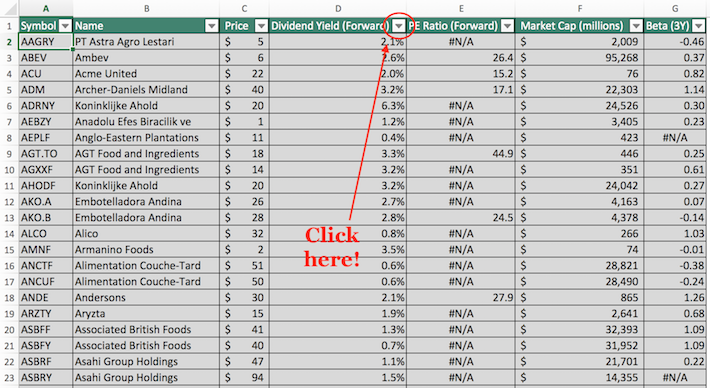

How To Use The Shopper Staples Shares Listing To Discover Funding Concepts

Having an Excel doc containing every dividend-paying shopper staples shares could be very helpful.

This instrument turns into much more potent when mixed with a strong, basic data of the right way to manipulate knowledge with Microsoft Excel. Quantitative investing screeners enable buyers to take away lots of the cognitive biases that impair long-term investing returns.

With that in thoughts, this part will present a step-by-step rationalization of the right way to use the dividend-paying shopper staples shares record to search out one of the best shopper staples funding concepts through the use of easy screening strategies.

The primary display screen that we are going to implement is for shares with price-to-earnings ratios beneath 25,

Display screen 1: Avoiding Overvalued Shares

Step 1: Obtain your free spreadsheet of all 71 shopper staples shares right here.

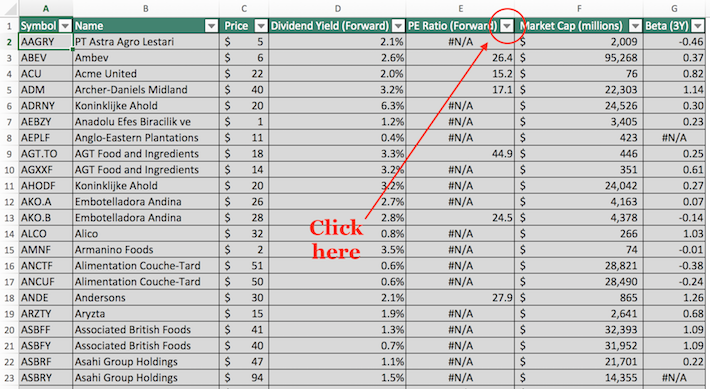

Step 2: Click on on the filter icon on the prime of the price-to-earnings ratio column, as proven beneath.

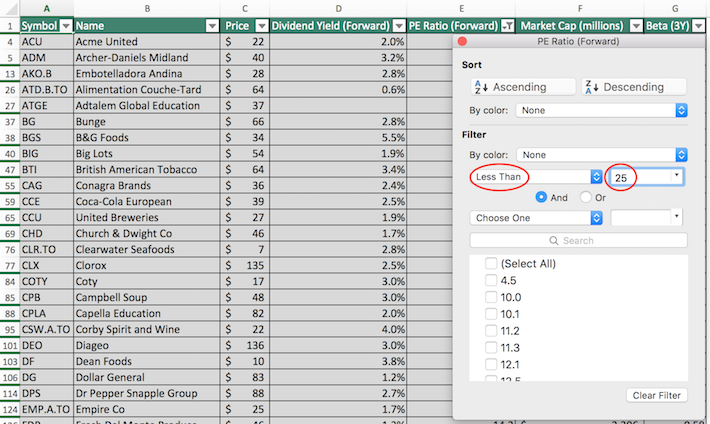

Step 3: Change the filter setting to “Much less Than” and enter 25 into the sphere beside it, as proven beneath.

The remaining shares within the spreadsheet are shopper staples with price-to-earnings ratio lower than 25.

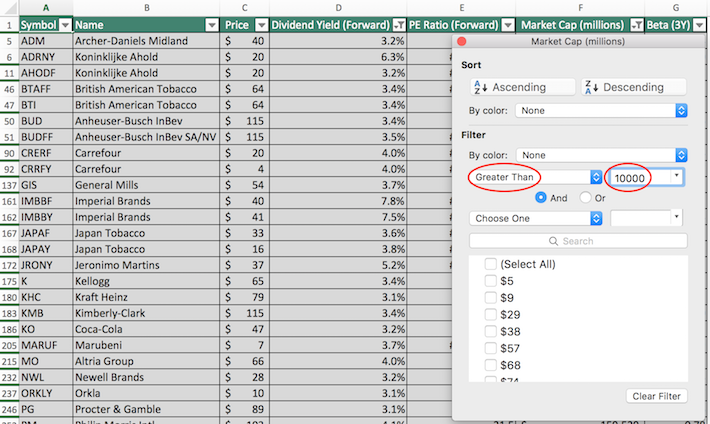

The subsequent display screen that we’ll implement is for ‘blue chip shares’ – these with dividend yields above 3% and market capitalizations above $10 billion.

Display screen 2: Blue Chip Shares

Step 1:Obtain your free spreadsheet of all 71 shopper staples shares right here.

Step 2: We’ll first filter by dividend yield after which by market capitalization. Importantly, order doesn’t matter – you possibly can additionally filter by market capitalization after which dividend yield and the display screen would output the identical outcomes.

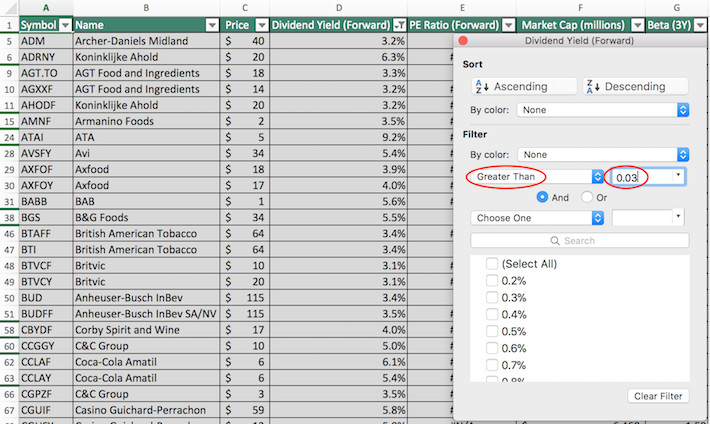

To filter by dividend yield, click on the filter icon on the prime of the dividend yield icon, as proven above.

Step 3: To filter for dividend yields better than 3%, change the filter setting to ‘Higher Than’, and enter 0.03 into the sphere beside it.

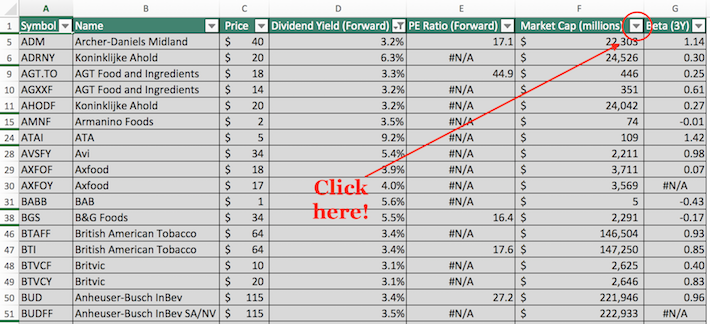

Step 4: Subsequent we’ll execute the display screen for market capitalization. Shut of out of the earlier window (by clicking exit, not by clicking ‘clear filter’ on the backside of the filter window). Then, click on the filter icon on the prime of the market capitalization column, as proven beneath.

Step 5: Change the filter setting to ‘Higher Than’ and enter 10000 into the sphere beside it. Discover that since market capitalization is measured in hundreds of thousands of {dollars} on this spreadsheet, then filtering for shares with market capitalizations above ‘$10,000 million’ is equal for screening for securities with market capitalizations above $10 billion.

The remaining shares on this spreadsheet are these with dividend yields above 3% and market capitalizations above $10 billion.

You now have a strong understanding of the right way to use the dividend-paying shopper staples shares spreadsheet to search out compelling funding concepts. The subsequent part will present a abstract of why the buyer staples sector deserves an allocation in your funding portfolio.

Why Make investments In Shopper Staples Shares?

Shopper staples shares are an interesting funding class for various causes.

To start with, shopper staples shares are very recession-resistant by definition. Shopper staples firms make merchandise or ship providers which are thought-about to be ‘staples’ – in different phrases, customers can’t do with out them.

Meals shares throughout the shopper staples sector are a superb instance of this. Shoppers are doubtless to purchase extra meals merchandise throughout recessions as they reduce on eating out to preserve funds throughout tough financial instances.

Alcohol shares are one other instance. Individuals are inclined to drink at the least the identical quantity (if no more) when instances get powerful.

Which means that shopper staples shares have a tendency to carry up very nicely in periods of financial turmoil. This may be seen by finding out the sector’s efficiency throughout the 2007-2009 monetary disaster.

Throughout 2008, for instance, the buyer staples sector returned -15%. Whereas this appears unhealthy on the floor, it’s truly excellent on a relative foundation. Right here’s the efficiency of another sectors throughout the identical calendar 12 months:

Financials: -55%

Supplies: -44%

Expertise: -41%

Clearly, the efficiency of the buyer staples sector beat these different industries by a large margin regardless of being unfavourable itself. Actually, shopper staples was the only greatest performing sector throughout calendar 12 months 2008.

The patron staples sector stands up nicely throughout instances of recessions, implying that the sector presents much less threat than a lot of its counterparts.

Amazingly, the sector’s long-term efficiency has additionally been among the finest. The sector has demonstrated a exceptional capability to generate constantly excessive returns on invested capital, avoiding the imply reversion skilled by many different extremely worthwhile industries.

Whereas conventional tutorial idea tells us that buyers should assume further threat to generate incremental returns, the outperformance of the recession-resistant shopper staples sector tells us that this isn’t true in observe.

The sector’s mixture of excessive returns and low threat make it a uniquely interesting sector for conservative whole return buyers.

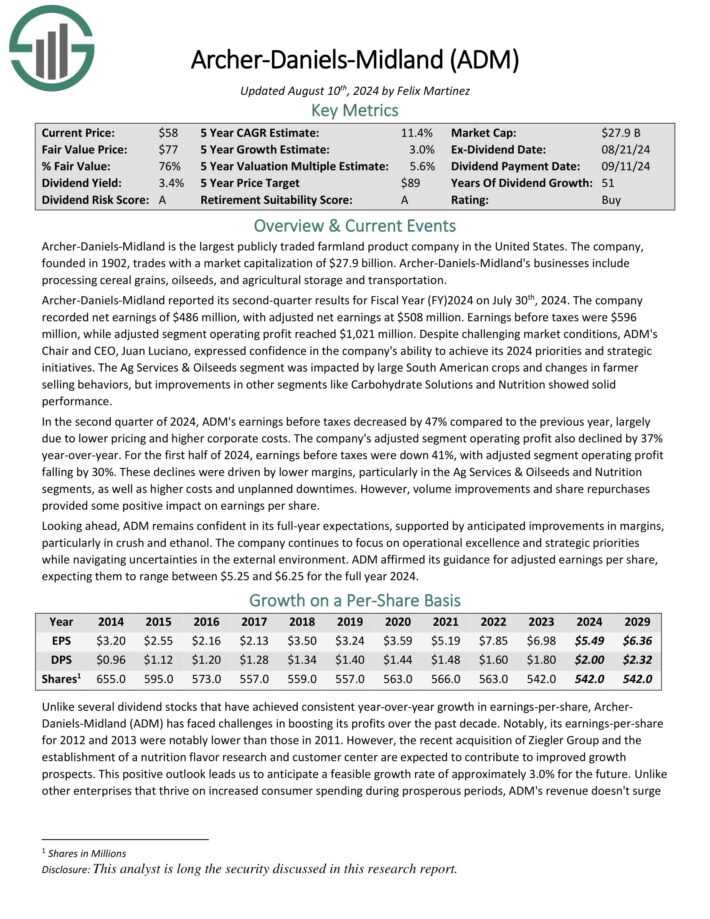

Shopper Staples Inventory #7: Archer Daniels Midland (ADM)

Anticipated Annual Returns: 11.0%

Archer-Daniels-Midland is the most important publicly traded farmland product firm in the US. Archer-Daniels-Midland’s companies embody processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its second-quarter outcomes for Fiscal Yr (FY) 2024 on July thirtieth, 2024. The corporate recorded internet earnings of $486 million, with adjusted internet earnings at $508 million. Earnings earlier than taxes had been $596 million, whereas adjusted section working revenue reached $1,021 million.

The Ag Companies & Oilseeds section was impacted by giant South American crops and modifications in farmer promoting behaviors, however enhancements in different segments like Carbohydrate Options and Vitamin confirmed strong efficiency.

Within the second quarter of 2024, ADM’s earnings earlier than taxes decreased by 47% in comparison with the earlier 12 months, largely attributable to decrease pricing and better company prices.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADM (preview of web page 1 of three proven beneath):

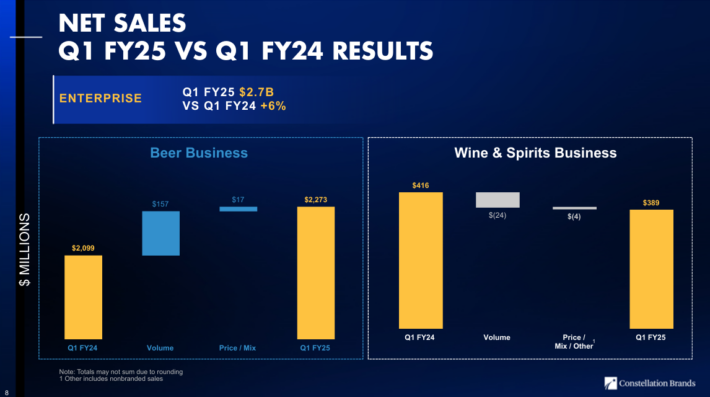

Shopper Staples Inventory #6: Constellation Manufacturers Inc. (STZ)

Anticipated Annual Returns: 11.1%

Constellation Manufacturers was based in 1945, and immediately, it produces and distributes beer, wine, and spirits. It has over 100 manufacturers in its portfolio, together with beer manufacturers akin to Corona.

As well as, Constellation’s wine manufacturers embody Robert Mondavi and Clos du Bois. Its liquor manufacturers embody SVEDKA Vodka, Casa Noble Tequila, and Excessive West Whiskey.

One of many largest causes for Constellation Manufacturers’ spectacular development lately, is its concentrate on the premium section, which continues to develop.

On July third, 2024, Constellation Manufacturers reported first quarter fiscal 2025 outcomes for the interval ending Might thirty first, 2024.

Supply: Investor Presentation

For the primary quarter, the corporate recorded $2.66 billion in internet gross sales, a 6% improve in comparison with the identical prior 12 months interval. Beer gross sales improved by 8% year-over-year, whereas wine and spirits gross sales declined by 7%.

Comparable earnings-per-share equaled $3.57 for the quarter, which was a 17% improve in comparison with Q1 2024, and 12 cents forward of analyst estimates.

Click on right here to obtain our most up-to-date Positive Evaluation report on STZ (preview of web page 1 of three proven beneath):

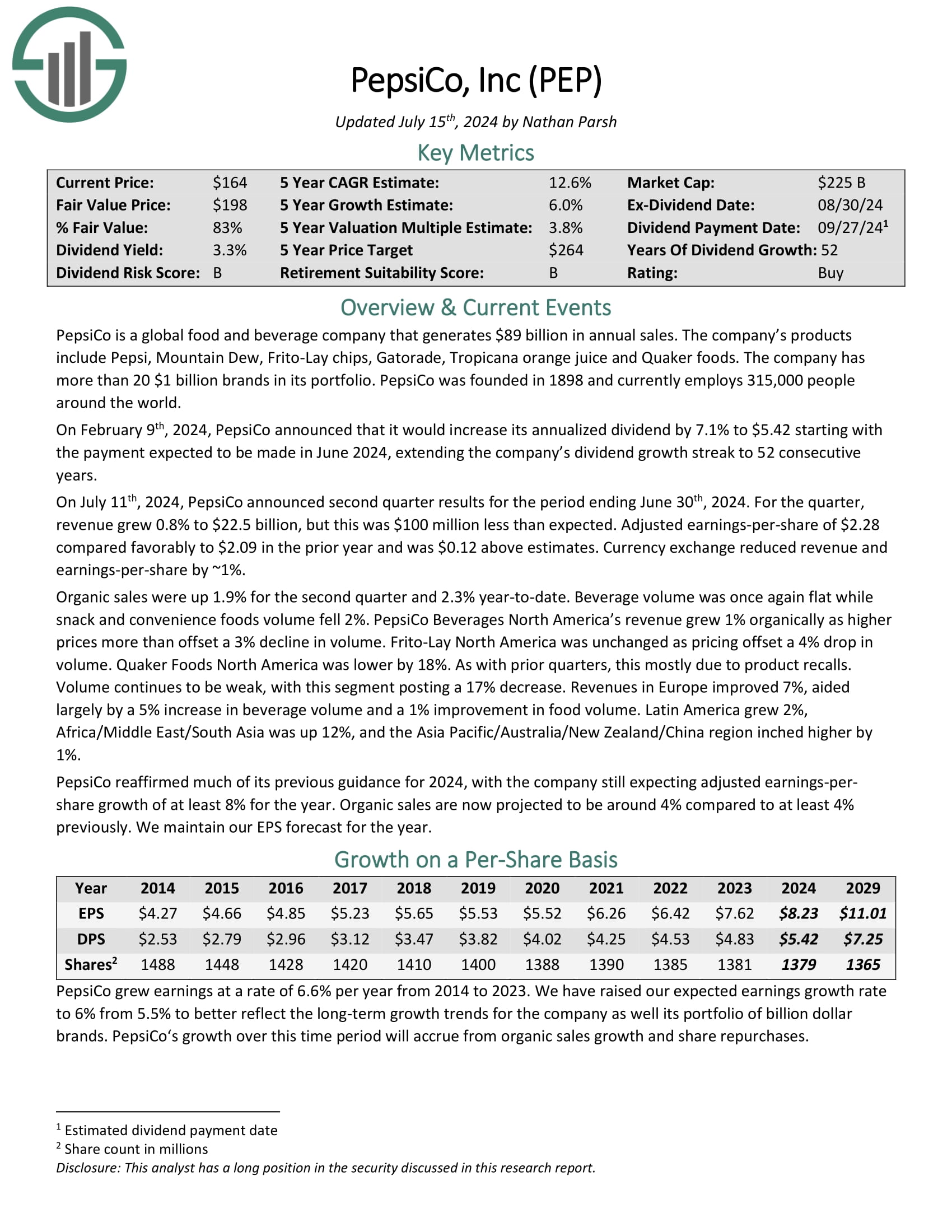

Shopper Staples Inventory #5: PepsiCo Inc. (PEP)

Anticipated Annual Returns: 11.9%

PepsiCo is a world meals and beverage firm that generates $89 billion in annual gross sales. The corporate’s merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals. The corporate has greater than 20 $1 billion manufacturers in its portfolio.

Its enterprise is cut up roughly 60-40 when it comes to meals and beverage income. It’s also balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On July eleventh, 2024, PepsiCo introduced second quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 0.8% to $22.5 billion, however this was $100 million lower than anticipated. Adjusted earnings-per-share of $2.28 in contrast favorably to $2.09 within the prior 12 months and was $0.12 above estimates. Forex trade diminished income and earnings-per-share by ~1%.

Natural gross sales had been up 1.9% for the second quarter and a couple of.3% year-to-date. Beverage quantity was as soon as once more flat whereas snack and comfort meals quantity fell 2%. PepsiCo Drinks North America’s income grew 1% organically as increased costs greater than offset a 3% decline in quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven beneath):

Shopper Staples Inventory #4: Goal Corp. (TGT)

Anticipated Annual Returns: 12.0%

Goal was based in 1902 and now operates about 1,850 huge field shops, which supply normal merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted second quarter earnings on August twenty first, 2024, and outcomes had been fairly sturdy, sending the inventory leaping after the report. Adjusted earnings-per-share got here to $2.57, which was 39 cents forward of estimates. Income was up 2.7% year-over-year to $25.45 billion, which beat by $240 million.

Comparable gross sales had been up 2% year-over-year, making up many of the whole gross sales acquire. Consensus was for a acquire of 1.1%. Visitors was up 3% year-over-year with all six core merchandising classes seeing optimistic development. Digital comparable gross sales had been up 8.7%, as soon as once more driving development.

Goal has grown its dividend for greater than 5 many years, making it a Dividend King. The corporate is investing closely in its enterprise in an effort to navigate by means of the altering panorama within the retail sector. The payout is now 47% of earnings for this 12 months,

Click on right here to obtain our most up-to-date Positive Evaluation report on TGT (preview of web page 1 of three proven beneath):

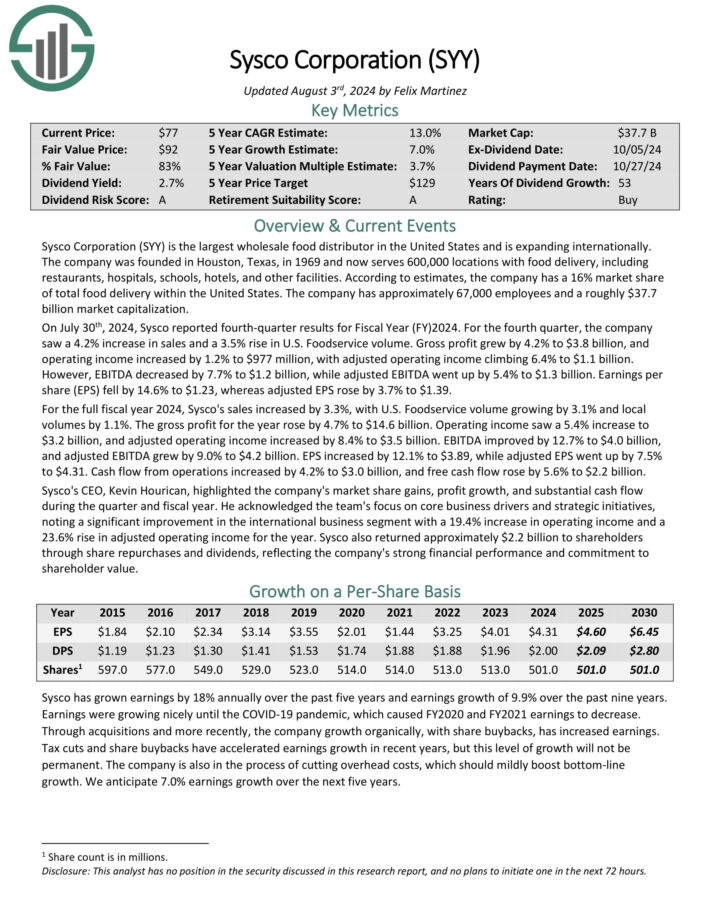

Shopper Staples Inventory #3: Sysco Corp. (SYY)

Anticipated Annual Returns: 12.7%

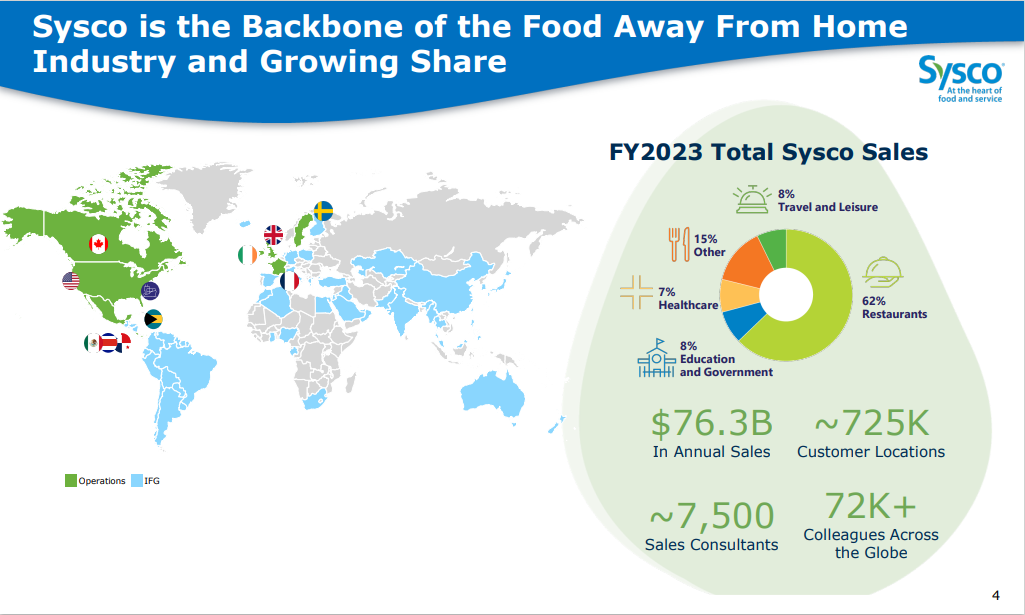

Sysco Company is the most important wholesale meals distributor in the US. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, colleges, lodges, and different amenities.

Supply: Investor Presentation

On July thirtieth, 2024, Sysco reported fourth-quarter outcomes for Fiscal Yr (FY) 2024. For the fourth quarter, the corporate noticed a 4.2% improve in gross sales and a 3.5% rise in U.S. Foodservice quantity.

Gross revenue grew by 4.2% to $3.8 billion, and working earnings elevated by 1.2% to $977 million, with adjusted working earnings climbing 6.4% to $1.1 billion.

Nonetheless, EBITDA decreased by 7.7% to $1.2 billion, whereas adjusted EBITDA went up by 5.4% to $1.3 billion. Earnings per share (EPS) fell by 14.6% to $1.23, whereas adjusted EPS rose by 3.7% to $1.39.

Click on right here to obtain our most up-to-date Positive Evaluation report on SYY (preview of web page 1 of three proven beneath):

Shopper Staples Inventory #2: Albertsons Firms Inc. (ACI)

Anticipated Annual Returns: 12.9%

Albertsons is among the largest meals and drug retailers in the US. With $70 billion in annualized gross sales and a historical past courting again to the 1860s, Albertsons went public in 2020 and has paid a quarterly dividend ever since.

The corporate reported its Q1 2024 outcomes on July twenty third, 2024, and introduced a quarterly dividend of $0.12 per share. With Q1 earnings of $0.41 per share, the corporate’s ahead annualized dividend of $0.48 is nicely lined by their ongoing enterprise.

The primary quarter delivered strong operational outcomes. However because the administration group appears ahead in direction of the total 12 months, they count on to see persevering with headwinds associated to investments in affiliate wages and advantages, an rising mixture of the pharmacy and digital companies which carry decrease margins, and the biking of prior 12 months inflation in meals costs. They count on these headwinds to be partially offset by ongoing productiveness initiatives.

Web gross sales income was $24.3 billion throughout the 16 weeks ended June fifteenth, in comparison with the $24.1 billion reported within the prior 12 months. Through the quarter the corporate spent $543 million in CAPEX, primarily associated to remodels, retailer openings and digital and expertise platforms.

Click on right here to obtain our most up-to-date Positive Evaluation report on ACI (preview of web page 1 of three proven beneath):

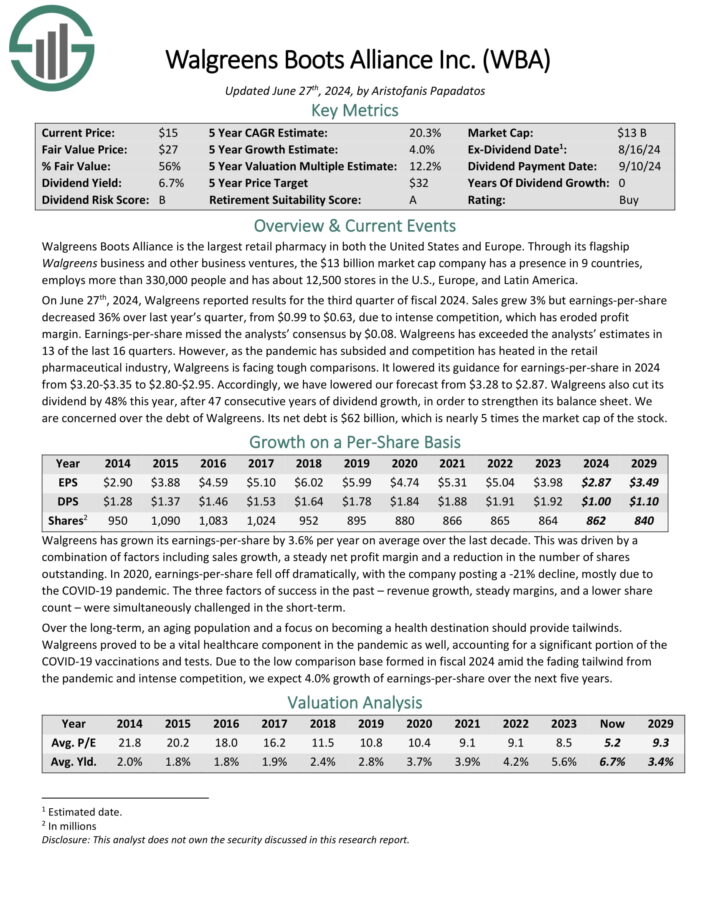

Shopper Staples Inventory #1: Walgreens Boots Alliance (WBA)

Anticipated Annual Returns: 35.0%

Walgreens Boots Alliance is the most important retail pharmacy in each the US and Europe. By means of its flagship Walgreens enterprise and different enterprise ventures, the $13 billion market cap firm has a presence in 9 international locations, employs greater than 330,000 individuals and has about 12,500 shops within the U.S., Europe, and Latin America.

On June twenty seventh, 2024, Walgreens reported outcomes for the third quarter of fiscal 2024. Gross sales grew 3% however earnings-per share decreased 36% over final 12 months’s quarter, from $0.99 to $0.63, attributable to intense competitors, which has eroded revenue margin.

Supply: Investor Presentation

Earnings-per-share missed the analysts’ consensus by $0.08. Walgreens has exceeded the analysts’ estimates in 13 of the final 16 quarters.

Nonetheless, because the pandemic has subsided and competitors has heated within the retail pharmaceutical business, Walgreens is going through powerful comparisons. It lowered its steerage for earnings-per-share in 2024 from $3.20-$3.35 to $2.80-$2.95. Accordingly, we have now lowered our forecast from $3.28 to $2.87.

Click on right here to obtain our most up-to-date Positive Evaluation report on WBA (preview of web page 1 of three proven beneath):

Closing Ideas

The patron staples sector is an intriguing place to appears for high-quality dividend funding concepts.

When you’re prepared to look exterior of this sector whereas trying to find funding alternatives, the next inventory databases are extremely helpful:

Investing is a singular craft as a result of we have now the power to ‘cheat’ off the strikes of the world’s best buyers.

Massive, institutional funding managers with greater than $100 million in property underneath administration are required to reveal their portfolio holdings on a quarterly foundation by means of a regulatory submitting known as a 13F.

With this in thoughts, there isn’t a higher investor than Berkshire Hathaway’s Warren Buffett. We offer an in depth quarterly evaluation on Warren Buffett’s inventory portfolio, which you’ll entry beneath:

When you’re searching for different sector-specific dividend shares, the next Positive Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.

[ad_2]

Source link