[ad_1]

Hiroshi Watanabe

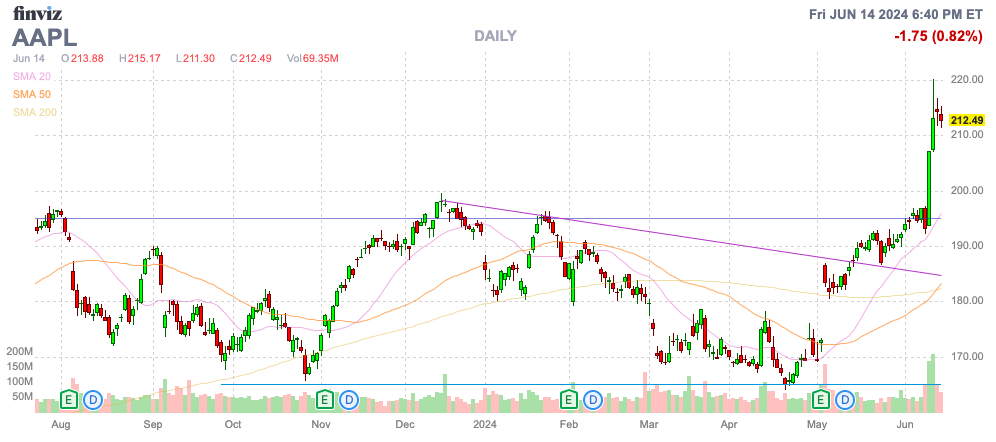

Whereas the inventory market was hyped in regards to the AI portion of the annual WWDC, Apple (NASDAQ:AAPL) didn’t ship a compelling product. The inventory rapidly jumped to all-time highs, although the tech large is not even releasing a killer AI app. My funding thesis stays ultra-Bearish on the inventory hitting all-time highs with none justification for the present inventory worth, a lot much less greater costs.

Supply: Finviz

Unintelligent Telephone

On the WWDC, Apple launched new options for the iPhone, iPad and Mac primarily based on AI. A number of the important thing parts of the service will depend on ChatGPT from OpenAI.

Apple introduced the AI service as Apple Intelligence, a personalised intelligence system for the iPhone, iPad and the Mac. The service usually permits for the creation of pictures and messages alongside the strains of different generative AI companies and can embrace superior options to supercharge Siri.

The tech large is principally taking part in meet up with the options already out there from Google (GOOG, GOOGL) and Microsoft (MSFT), however the service will solely be out there on the iPhone 15 Professional and 15 Professional Max and different gadgets with an M1 or later chip when the iOS 18 is rolled out. In essence, Apple remains to be behind the competitors for a number of extra months and most customers might want to purchase new merchandise so as to use the brand new AI options.

The corporate would not seem to offer any monetization of the AI options outdoors of upgrading gadgets with Apple’s management of the ecosystem as the one main benefit. The corporate is working with OpenAI to include ChatGPT into Apple merchandise for gratis with the obvious hopes of in the end sharing subscription revenues with the chatbot service that expenses $20/month to subscribers.

The large catch is that Apple at the moment collects as much as $20 billion from Google because the default search engine. Any shift in the direction of customers using AI options to supplant search may truly result in a discount in Service revenues, although Apple can also be working with Google’s Gemini in a attainable deal the place Google would possibly present funds because of the capability to monetize visitors by way of search options.

Regardless of how one slices the numbers, the AI iPhone would not result in materials development charges for the tech large. The brand new AI options will usually solely apply to the iPhone 16 being launched in September, pushing any income contribution to FY26.

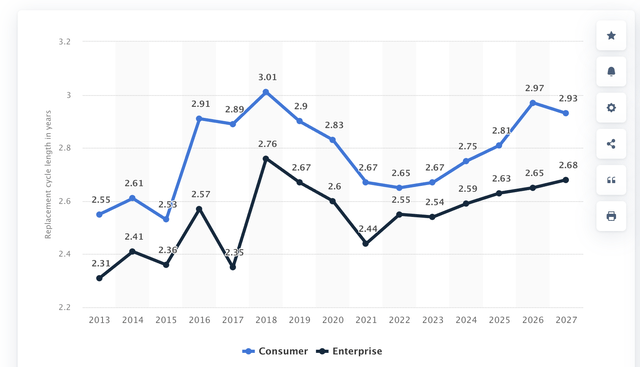

The market is making a giant deal in regards to the iPhone improve cycle. For years, the cycle has been extending far past the unique 2-year improve cycle primarily based on the incentives from wi-fi carriers.

The upper ASPs and improved know-how have restricted the necessity and want of customers to improve iPhones with the everyday substitute cycle as much as almost 3 years now with lots of people holding smartphones for greater than 4 years. In response to Statista, the smartphone substitute cycle peaked at 3.01 years in 2018 previous to Covid and the 5G iPhone in 2020 decreased the charges briefly.

Supply: Statista

The substitute cycle is again at almost 3 years for customers heading into the discharge of the AI iPhone. A giant key to this cycle is knowing that Covid will not present the additional kicker and any cycle enhance is barely a one-time occasion.

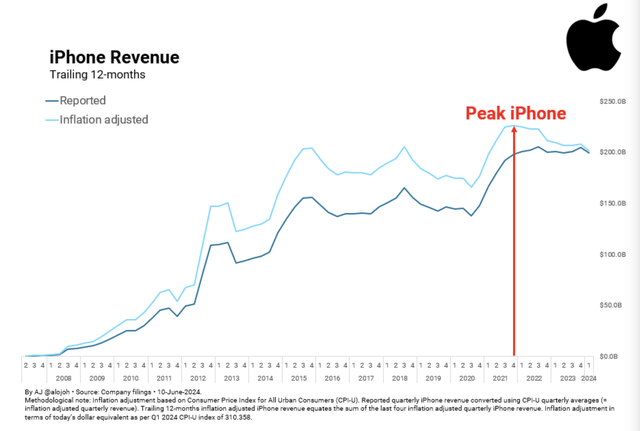

On an inflation adjusted foundation, Apple revenues already peaked again on the finish of 2021. In reality, iPhone revenues have not grown a lot going again to 2015 regardless of new options and superior 5G speeds, possible on account of partly to greater ASPs lowering the need to switch a functioning smartphone.

Sources: @alojah on Twitter

Psychological Gymnastics

After a couple of week of time to replace estimates, analysts nonetheless solely forecast Apple to supply roughly 6% income development and 10% EPS development in FY26. Bear in mind, this comes after an extended interval of restricted to detrimental development, offering for very simple comps.

Supply: Looking for Alpha

Gene Munster from Deepwater Asset Administration supplies an instance of the place the inventory sees upside. His estimates see Apple revenues for FY26 leaping from a road estimate of 6% to 12% primarily based on greater iPhone gross sales with a further goal of 10% in FY25 from road estimates of 6%:

Apple Intelligence is not going to be a brand new income leg just like the iPad or Companies was, however will probably be an accelerator for iPhone and complete income development over the following a number of years, which will probably be helpful for shares of AAPL. I anticipate iPhone gross sales development to reaccelerate in FY24 to five%, in comparison with being down on common 2% over the previous 12 months and a half, and rising 7% in FY25 and 10% in FY26. That signifies that general development goes from about 5% in FY24, to +10% in FY25 and 12-14% in FY26.

By way of Apple’s valuation, traders are possible now anticipating the corporate to earn round $9 in EPS in CY26 (Road is at $7.90). If we’re getting into a 3-5 12 months AI bull market, it is affordable to anticipate a number of enlargement. Buyers are zeroing in on a 35x earnings a number of subsequent 12 months, Apple at the moment trades at 29x subsequent 12 months’s earnings.

The important thing to the story is that Deepwater is forecasting a a number of enlargement to 35x ahead EPS targets versus the present 29x targets. In essence, Munster is predicting a number of enlargement and never Apple rising gross sales and earnings to drive the inventory greater. In any case, the clear driver of development is not a brand new income leg, however simply an accelerator for iPhone substitute gross sales debunked above.

The inventory has already hit an all-time excessive at $220 with Apple buying and selling at almost 30x EPS forecasts ending the week at $212. Even the ultra-bullish Mr. Munster, effectively revered on Wall Road, would not make a case for the inventory buying and selling on the present worth, a lot much less a a lot greater worth to hit his $315 goal for 35x a $9 EPS goal.

Bear in mind, the above evaluation very a lot questions whether or not customers rather well lineup to purchase a brand new AI machine simply because of the AI options, principally already out there by way of different sources. Analysts do not agree with the $9 EPS goal with FY25 EPS estimates at solely $7.22. Even the FY26 EPS goal is barely $7.96.

As highlighted in prior analysis, Apple is not producing the kind of development to warrant way more than a 15x P/E a number of. Even going out 2 years to make use of the almost $8 EPS goal for FY26, the worth goal of the tech large is barely round $120 primarily based on precise numbers.

The AI cycle may undoubtedly present some upside to analyst estimates, however the historical past of Apple actually is not supportive of this case. Apple blew away numbers through the Covid years, however the tech large had restricted development outdoors this era, and my well-known “Useless Cash” article from 2 years in the past highlighted a FY25 EPS goal of $7.32 and the present estimates have truly fallen through the almost 2-year interval since this name.

The one main distinction is the inventory worth has jumped almost $50 through the interval on account of analysts and traders incorporating psychological gymnastics to warrant greater inventory costs. The true worth of the earnings stream of Apple hasn’t modified one bit within the final 2 years, and the corporate has already cancelled the Apple Automotive challenge and the Imaginative and prescient Professional machine has didn’t ship materials gross sales.

Takeaway

The important thing investor takeaway is that Apple hasn’t truly delivered a compelling AI platform, opposite to preliminary inventory momentum. The Apple Intelligence product will fail to ship something apart from a duplicate of options delivered by precise AI leaders over the prior 2 years, and the tech large actually would not have any plan to monetize AI, which is why most analysts have hiked income and earnings estimates.

Buyers ought to use what seems a peak within the inventory worth to exit Apple at reward costs.

[ad_2]

Source link