[ad_1]

SimonSkafar

The ARK Innovation ETF (NYSEARCA:ARKK) has been round since 2014. I wasn’t conscious of the fund till Cathie Wooden, the CEO and CIO of Ark Make investments, began displaying up on CNBC touting the outcomes of her fund.

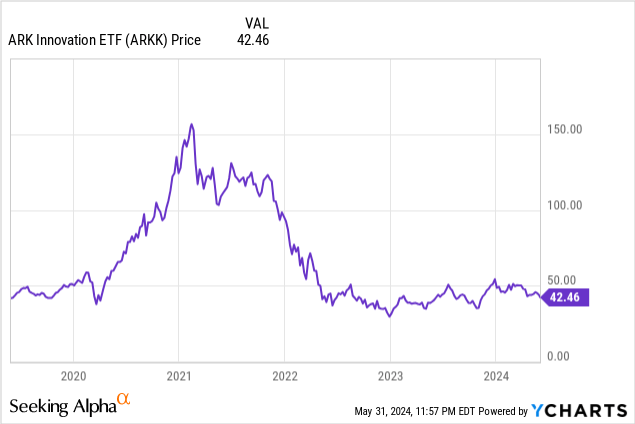

As you’ll be able to see under, ARKK’s outcomes have been stellar within the early 2020’s however have considerably lagged lately because the ETF’s value has fallen:

I’m not as unfavourable on Woods and ARKK as many different analysts however I do consider buyers could be higher suited allocating funds elsewhere. Let’s dig into the main points of the ETF and I’ll clarify why I’m not bullish on this specific funding.

Danger Doesn’t Equal Reward

As many know, the ARK Innovation ETF focuses on investing in “disruptive innovation.” Within the fund’s description, it goes on to state the fund invests in services or products that may probably change the best way the world operates. I’ll get into the particular areas the fund likes to put money into afterward, however I feel buyers can inform from this description most of these investments are excessive threat. The general public corporations ARKK invests in have the “potential” to vary the world, but in addition have the next probability of failing.

A simplified investing take is that in case you are allocating funds to a riskier asset, you’ll count on the next reward.

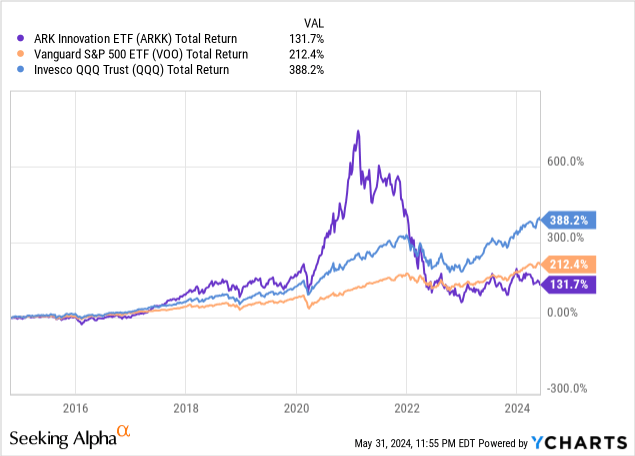

For those who can examine ARRK’s efficiency to what I might describe as much less dangerous ETFs such because the Vanguard S&P 500 ETF (VOO) and Invesco QQQ Belief (QQQ), you’ll see ARKK isn’t offering superior returns:

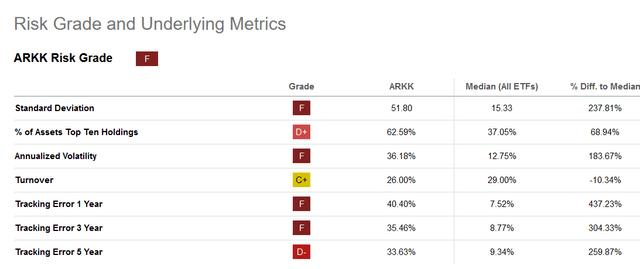

Moreover, when you assessment In search of Alpha’s threat grade and related metrics you’ll be able to see Wooden’s ETF has been given a “F” grade:

In search of Alpha

One in all these metrics, I’d particularly like to debate in additional depth is turnover. At present the turnover share of ARKK is 26% which is near the median for all ETFs. For those who examine ARKK to the opposite two ETFs I’ve listed above, ARK is greater than QQQ which has a turnover share of roughly 22% and far greater than VOO which has a turnover share of two%.

As a long-term investor, I desire to have an ETF with a decrease turnover. Legendary investor Terry Smith of Fundsmith acknowledged in his ebook, “Investing for Development” that one among his ten golden guidelines for investing is dealing as occasionally as potential. Albeit Smith’s writings predate Robinhood (HOOD) and the emergence of zero payment buying and selling, however I nonetheless suppose Smith’s rule holds water (Smith nonetheless follows this rule from what I’ve discovered as his fund has a turnover share of 10%). In my view, decrease turnover pertains to greater conviction in an organization and higher due diligence. I perceive unexpected points could come up that change the narrative of an funding thesis reminiscent of administration modifications, macro-economic situations, or new competitors in a market. Nevertheless, it appears Wooden and her crew are making some odd strikes that make you query the choice making of the fund.

As an example, Wooden added Nvidia (NVDA) to her fund a couple of years in the past which I would definitely state is an organization creating “disruptive innovation.” Nevertheless, attributable to her lack of conviction she bought early and missed out on enormous potential earnings.

To offer one other instance of questionable logic, Wooden bought vital shares in one among her high holdings, Uipath (PATH) the day earlier than the corporate reported Q1 2025 earnings. The inventory plummeted the subsequent day as the corporate’s CEO resigned. Clearly, Wooden probably did not know in regards to the resignation however it appears a questionable time to purchase shares.

As acknowledged on the ARK Make investments’s web site, the purpose is to have annual turnover of 15% however Wooden and her crew have clearly been making extra modifications to the fund. This brings into query the fund’s evaluation and filtering course of coupled with the fund’s determination making. I solely shared two examples of Wooden’s latest exercise however by operating a easy Google search or a search inside In search of Alpha, buyers can discover loads extra examples of some head-scratching selections.

Fund Construction

As talked about above, the fund focuses on disruptive modern and has a deal with a number of key areas. These areas embrace, genomics and DNA applied sciences, fintech, robotics, automation, and synthetic intelligence.

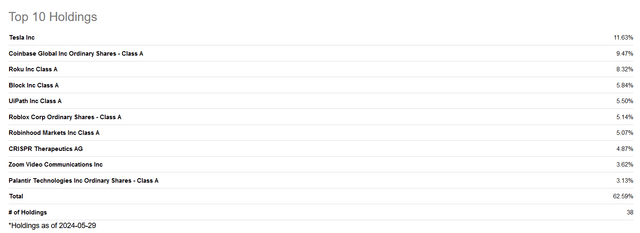

As of Could twenty ninth, the fund’s high ten holdings are as follows:

In search of Alpha

ARKK presently has 38 holdings and as you’ll be able to within the graphic under, the holdings are distributed pretty evenly between 5 sectors:

In search of Alpha

I feel it’s extremely probably that of those 38 holdings, a number of shall be large winners. Nevertheless, my problem is that I’m uncertain if Wooden and her crew have the persistence or the conviction to carry that winner given the fund’s turnover share and up to date efficiency. Slightly than put money into ARKK, that is what I might do as an investor.

Shotgun Method

As one other analyst acknowledged, Wooden goes with a “shotgun” strategy, attempting to hit as many of those disruptive areas as potential. I agree that’s what ARKK is attempting to perform however it hasn’t labored the previous couple of years.

If buyers desire a related strategy, there are two specific ETFs which I feel are extra appropriate for buyers in comparison with ARKK, the Vanguard S&P 500 ETF (VOO) and Invesco QQQ Belief (QQQ).

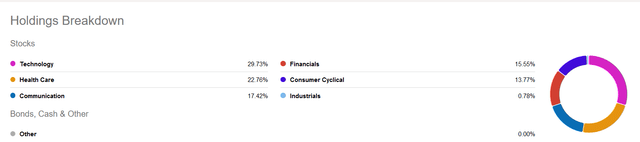

QQQ is nice various for extra threat looking for buyers but as you’ll be able to see from the chance metrics on In search of Alpha it is a barely safer funding with a “C+” ranking:

In search of Alpha

I feel QQQ can present buyers with a possibility to put money into most of the disruptive investing theme classes ARKK does as properly, reminiscent of synthetic intelligence, robotics, fintech and automation.

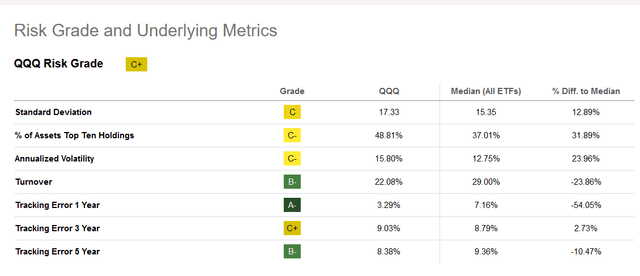

Under are the highest ten holdings for QQQ as of Could thirtieth:

In search of Alpha

Regardless of being giant caps, I nonetheless consider many of those corporations reminiscent of Nvidia (NVDA) and Microsoft (MSFT) shall be leaders in classes reminiscent of AI.

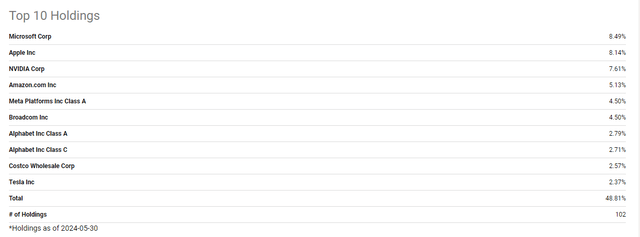

One draw back to QQQ is that it’s totally tech heavy as you’ll be able to see under:

In search of Alpha

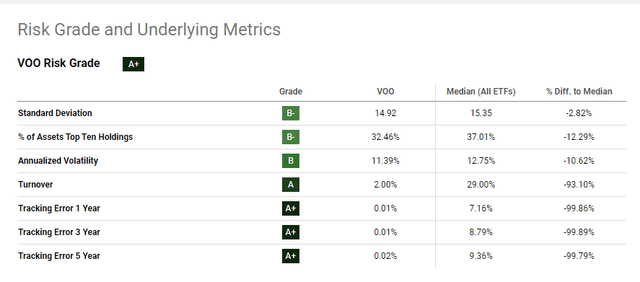

My private favourite ETF to put money into is VOO. As you’ll be able to see from In search of Alpha’s threat metrics, it is a far safer various in comparison with QQQ and particularly in comparison with ARKK:

In search of Alpha

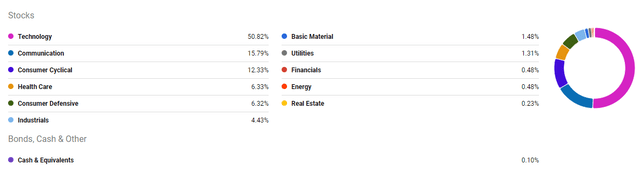

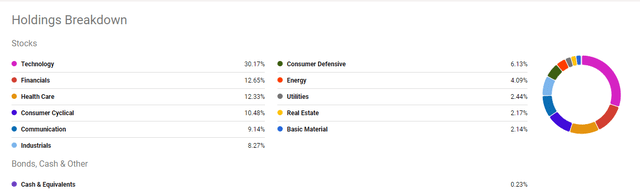

Moreover, though VOO continues to be roughly 30% tech, it is far more various in comparison with QQQ:

In search of Alpha

On the subject of my investing model, I like to take a position most of my capital in additional threat averse investments which makes VOO a wonderful alternative. Because the metrics above point out, it is a much less riskier ETF in comparison with ARKK but this ETF has returned extra to buyers. Moreover, compared to QQQ I like that VOO is much less tech heavy.

Bitcoin & Particular Thematic Investing ETFs

Wooden is a Bitcoin bull and so I consider a few of her investments are proxy Bitcoin performs, Coinbase is the apparent proxy and to some extent Block (SQ) and Robinhood (HOOD) are as properly. Slightly than purchase the proxies I’d merely purchase Bitcoin itself when you’re a believer within the asset. I’ve a small portion of my particular person capital allotted to Bitcoin.

I feel some classes are more durable to put money into. Personally, I feel Genomics and DNA know-how is a very troublesome investing theme given it’s onerous to know which firm shall be efficiently in these early days. I feel the Ark Genomic Revolution ETF (ARKG) is pretty much as good as any ETF in relation to investing on this particular space.

Moreover, Ark Make investments has a number of different extra particular themed ETFs reminiscent of ARK Autonomous Know-how and Robotics (ARKQ) and ARK Fintech Innovation ETF (ARKF). These could also be good alternatives for buyers trying to put money into a selected space. Nevertheless, I am extra inclined to purchase VOO or QQQ as a substitute of one among these particularly themed ETFs.

Conclusion

ARKK ETF is for prime threat, excessive reward buyers and as of the late the rewards haven’t been there.

I feel Wooden and the Ark crew appear to lack conviction and are struggling to determine “disrupters” worthy of holding for a major period of time.

I feel there are higher funds than ARKK reminiscent of QQQ for buyers keen to tackle extra threat or VOO for these looking for much less threat and extra diversification.

Buyers ought to decide their threat tolerance and discover a specific funding or investments that enable that investor to sleep peacefully at evening.

For me, I plan to stay with extra of a positive wager in VOO, put money into a couple of high-quality founder-led corporations and allocate a small share of capital to Bitcoin.

[ad_2]

Source link