[ad_1]

amanalang/iStock by way of Getty Pictures

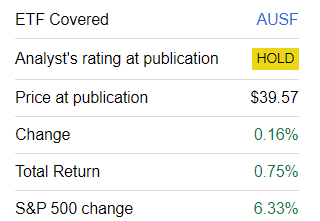

At present’s article is meant to supply an replace on the International X Adaptive U.S. Issue ETF (NYSEARCA:AUSF), a fund that leverages a classy factor-rotation strategy. My preliminary evaluation offered in March this yr was lukewarm, with the principle purpose for that being its relatively disappointing efficiency. For readability, at the moment’s notice is just not introducing a ranking improve, as returns stay properly in need of fascinating. Another excuse for skepticism is AUSF’s issue combine, which, as per my evaluation, is dominated by low volatility and worth, one thing I consider has little likelihood, if any, of maximizing returns within the current market setting.

What’s the concept on the crux of AUSF?

As we all know from the paperwork out there on the International X web site, AUSF is a passively managed car, with the Adaptive Wealth Methods U.S. Issue Index being the cornerstone of its technique. The index itself is an amalgamation of at the least two of the three sub-indices, particularly

the Solactive U.S. Giant & Mid Cap Worth 100 Index TR, the Solactive U.S. Giant & Mid Cap Momentum 100 Index TR, and the Solactive U.S. Giant & Mid Cap Minimal Draw back Volatility 100 Index TR,

with the proportions contingent on their returns. In response to the actual fact sheet:

AUSF both allocates to 2 elements with a 50% / 50% weighting, or all three elements with a weighting of 40% / 40% / 20% relying on the trailing returns of every issue.

Relating to the adjustment schedule, the index methodology abstract says that

The composition of the Index is adjusted quarterly on the primary Wednesday in February, Could, August, and November.

AUSF returns: underperformance persists

Briefly, I’m largely disillusioned by AUSF. One of many causes is that since my earlier evaluation offered on March 18, it has considerably underperformed the S&P 500 index.

Looking for Alpha

It’s considerably complicated that AUSF trailed IVV even in April this yr regardless of low beta of its portfolio (weighted-average 24-month beta of 0.79 as of March 17). The difficulty right here is that April was a largely difficult month for shares as buyers had been mulling over the destiny of the long-duration equities rally amid bearish inflation knowledge. So much less unstable portfolios largely did higher than the S&P 500 throughout that sluggish interval. To corroborate, beneath are the returns delivered by a couple of ETFs that concentrate on the low volatility issue:

ETF April 2024 return AUSF -4.62% IVV -4.05% iShares MSCI USA Min Vol Issue ETF (USMV) -3.74% Franklin U.S. Low Volatility Excessive Dividend ETF (LVHD) -2.69% Invesco S&P 500 Low Volatility ETF (SPLV) -3.13% Click on to enlarge

Knowledge from Portfolio Visualizer

As we all know from its web site, AUSF

seeks to outperform conventional market capitalization weighted indexes by allocating throughout three elements – minimal volatility, worth, and momentum – which have traditionally demonstrated benefits in comparison with broad benchmark indexes.

Nevertheless, over the September 2018–Could 2024 interval (it was incepted in August 2018), AUSF delivered an annualized return 1.2% decrease than that of IVV, with the principle purpose for that being its small upside seize.

Metric AUSF IVV Begin Stability $10,000 $10,000 Finish Stability $18,844 $20,035 CAGR 11.65% 12.85% Normal Deviation 19.42% 18.39% Greatest Yr 27.45% 31.25% Worst Yr -10.63% -18.16% Most Drawdown -31.57% -23.93% Sharpe Ratio 0.56 0.64 Sortino Ratio 0.81 0.97 Upside Seize 86.13% 100.42% Draw back Seize 83.86% 96.55% Click on to enlarge

Knowledge from Portfolio Visualizer

However, in protection of AUSF, it’s nonetheless price remarking that the image was a bit brighter over different intervals, largely as a result of the ETF delivered strong efficiency in the course of the 2022 bear market. Allow us to evaluate the October 2020–Could 2024 interval, which was chosen as a result of the Constancy U.S. Multifactor ETF (FLRG) was incepted in September 2020.

Metric AUSF IVV VFMF OMFL FLRG Begin Stability $10,000 $10,000 $10,000 $10,000 $10,000 Finish Stability $19,700 $16,624 $18,676 $18,333 $16,425 CAGR 20.31% 14.87% 18.57% 17.97% 14.49% Normal Deviation 15.88% 17.41% 18.80% 20.12% 15.60% Greatest Yr 27.45% 28.76% 29.61% 29.12% 28.92% Worst Yr -0.78% -18.16% -5.66% -13.97% -10.98% Most Drawdown -10.19% -23.93% -16.78% -22.11% -18.99% Sharpe Ratio 1.09 0.75 0.87 0.8 0.79 Sortino Ratio 2.27 1.2 1.58 1.47 1.31 Upside Seize 89.22% 101.86% 95.85% 106.63% 89.77% Draw back Seize 58.37% 97.86% 74.86% 91.51% 83.43% Click on to enlarge

Knowledge from Portfolio Visualizer

Over that timeframe, AUSF beat IVV in addition to a couple of friends that leverage multi-factor methods, together with the Vanguard U.S. Multifactor ETF (VFMF), the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL), and FLRG.

However with 2022 eliminated, AUSF’s returns once more look relatively weak, because it trailed IVV by greater than 5% as equities had been recovering from the sell-off. Anyway, it did higher than the chosen friends over the interval involved.

Metric AUSF IVV VFMF FLRG OMFL Begin Stability $10,000 $10,000 $10,000 $10,000 $10,000 Finish Stability $13,268 $14,061 $12,929 $13,086 $12,798 CAGR 22.09% 27.20% 19.88% 20.91% 19.02% Normal Deviation 15.44% 13.94% 16.97% 12.25% 18.72% Greatest Yr 22.23% 26.32% 18.53% 18.33% 21.52% Worst Yr 8.55% 11.31% 9.07% 10.60% 5.31% Most Drawdown -5.39% -8.32% -8.92% -5.78% -12.94% Sharpe Ratio 1.05 1.44 0.85 1.2 0.75 Sortino Ratio 2.16 2.93 1.69 2.18 1.35 Upside Seize 81.49% 101% 83.62% 78.53% 96.98% Draw back Seize 79.3% 93.88% 99.74% 79.73% 137.38% Click on to enlarge

Knowledge from Portfolio Visualizer. The interval assessed is January 2023–Could 2024

AUSF issue combine: what has modified?

Since March 15, AUSF has changed about 13.4% of its portfolio. As of June 20, there have been 191 shares in its portfolio, in comparison with 192 as of the earlier evaluation. Among the many most notable shares that had been ousted had been PNM Sources (PNM), Tapestry (TPR), and Advance Auto Components (AAP), collectively accounting for two.7%. Among the many firms AUSF welcomed are The GAP (GPS), Texas Devices (TXN), and KB Dwelling (KBH), with a mixed weight of 1.7%. As a consequence, AUSF’s sector combine has modified barely. Extra particularly, financials remained the important thing sector as they gained 3.2%, now accounting for 26.4% of the web belongings. Industrials added 2.5%, continuing from sixth place to 4th. In distinction, shopper discretionary allocation is now 2.6% decrease than in March, because the sector now accounts for six.5% of the portfolio. Additionally, publicity to utilities was trimmed by 1.5%, so the sector now has a diminutive 40 bps weight.

Regardless of the recalibration, AUSF’s portfolio continues to be dominated by comparatively high-quality worth shares, largely with low beta coefficients.

Worth publicity

As of June 21, the weighted-average market cap of the ETF’s portfolio stood at $104.3 billion, as my calculations present. That is about $9.2 billion increased than in March. Regardless of that, its earnings yield has improved, now standing at roughly 7.1% vs. 6.6% in March. The monetary sector stays the important contributor to that determine, with its common EY being as excessive as 9.9%, adopted by 8.3% of the buyer discretionary sector. In addition to, the share of firms with a B- Quant Valuation ranking or increased has reached 37.7% vs. 36.6% in March.

Progress issue

With a worth tilt, AUSF’s portfolio stays growth-light, although my calculations present that the weighted-average ahead development charges have superior slightly. For instance, the WA ahead EPS development price has reached 6.2%, in comparison with 5.2% in March. One of many drivers is that fewer firms at the moment are forecast to ship earnings declines going ahead. In addition to, the ahead income development price inched to 4% from 3.6%. However, I’m of the opinion that to reach the present market setting, a portfolio ought to have each development charges in double digits at a minimal.

High quality

High quality is generally strong, as illustrated by the 87.3% allocation to shares with a B- Quant Profitability ranking or higher. That is an enchancment from the 84.5% degree seen in March.

However, there’s nonetheless one thing to dislike on the capital effectivity entrance, as financials once more detract from the Return on Property, which stands at 6.5%, virtually unchanged from the March degree. Normally, I take into account ROA beneath 10% an unsatisfying outcome.

On the similar time, the adjusted Return on Fairness (figures above 100% and beneath 0% had been eliminated to make it look extra real looking and to easy the influence of the over-leveraged firms on the ultimate outcome) improved a bit, from 17.2% to 17.7%.

Low volatility

The AUSF portfolio continues to be dominated by shares with 24-month and 60-month beta coefficients beneath 1. As a consequence, the weighted-average coefficients stand at 0.79 and 0.95, respectively.

Investor takeaway

In sum, AUSF presents a dynamic portfolio that will increase or decreases publicity to worth, momentum, and low-volatility elements contingent on the returns of the respective indices. Within the present iteration, it is a largely large-cap portfolio providing a wholesome however not good high quality, ample worth publicity, low beta, and pretty tender development. The expense ratio is modest at 27 bps.

I’m largely pessimistic about AUSF’s factor-rotation technique, because it has been unable to constantly outmaneuver the market since inception, though it had an edge over sure friends over shorter intervals. As I’ve already mentioned within the earlier notice, 2022 was a shiny spot, but as the information counsel, AUSF has been incapable of capturing ample upside in the course of the bull market. Additionally, the expansion traits of its portfolio are relatively muted, which is an obstacle. All in all, a ranking improve is unjustified.

[ad_2]

Source link