[ad_1]

Keep away from Fairness Bear Markets with a Market Timing Technique – Revisiting Our Analysis

In March, we posted a sequence of three articles the place our aim was to assemble a market timing technique that will reliably sidestep the fairness market throughout bear markets. Every article targeted on buying and selling indicators based mostly on a particular group of indicators, particularly, price-based indicators, macroeconomic indicators, and a number one indicator, a yield curve, that may predict recessions and bear markets prematurely. After incorporating concepts from all three teams, we offered our last buying and selling technique that yields an annual return above that of the inventory market whereas doubling its Sharpe ratio and lowering maximal drawdown by two-thirds. The technique used indicators from the Treasury unfold, a 200-day SMA, and another threat metric, the Rachev ratio, as development indicators, whereas Actual Retail Gross sales Development, Industrial Manufacturing Development, and S&P Composite dividends as macroeconomic indicators.

On this article, we revisit our analysis to handle the forward-looking bias in our last market timing technique, TrendYCMacro. We’re grateful to Allocate Well for declaring this limitation in our evaluation. Upon cautious examination, we recognized a bias in our macroeconomic buying and selling sign based mostly on the U.S. S&P Composite dividends, which we additionally utilized in our last technique. The bias arose from information sourced from Robert Shiller’s web site, the place the month-to-month dividend sequence was constructed by interpolating quarterly information. As we evaluated the sign on a month-to-month foundation, we inadvertently made funding selections based mostly on future info with out being conscious of the interpolation.

To eradicate the difficulty, we’ve changed the sign from U.S. S&P Composite dividends with Housing Begins Development sourced from FRED, guaranteeing the technique is now not biased. The buying and selling rule for the Housing Begins sign is as follows: HOUSE buys or stays lengthy the MKT if Housing Begins Development (YoY) within the prior month is constructive.

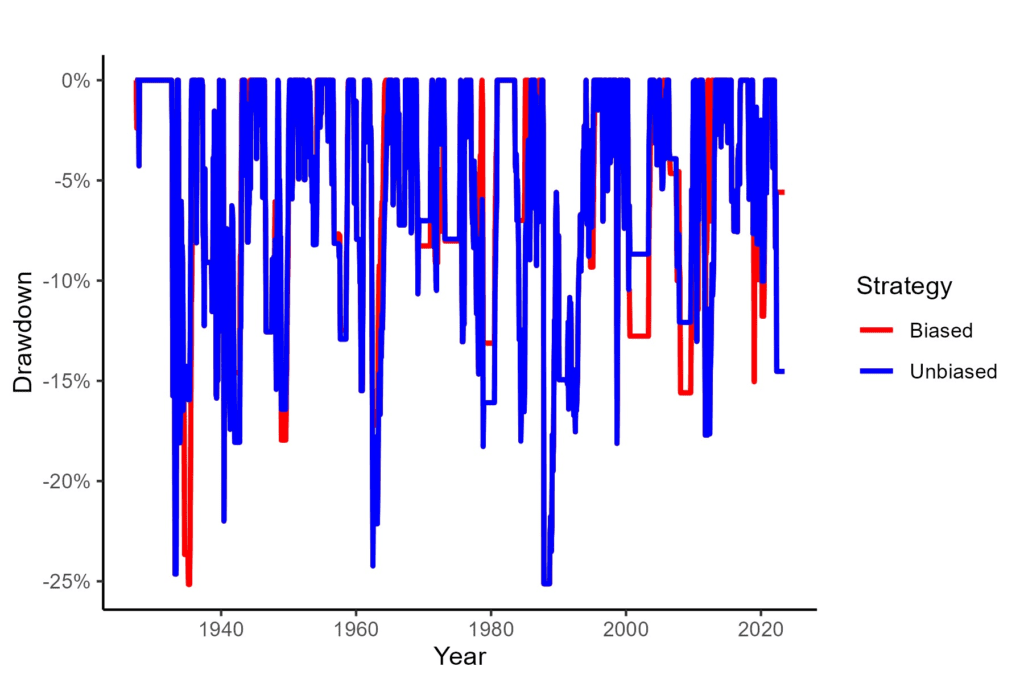

The unbiased model of our TrendYCMacro technique, which makes use of the HOUSE sign, yields an annual extra return of 6.59%, barely under the 7.10% of the biased model with the DIVIDEND sign. Apparently, the unbiased model experiences barely decrease annualized volatility at 11.87% in comparison with the 11.89% of the biased model. Each variations have suffered the identical maximal drawdown of -25.13% and exhibit comparable risk-adjusted returns, with the unbiased model having a Sharpe ratio of 0.56 and the biased model having a Sharpe ratio of 0.60.

The drawdown chart under clearly illustrates that each variations skilled main drawdowns equally, highlighting that the HOUSE sign is an appropriate substitute for the biased DIVIDEND sign.

For these considering our full analysis, we offer a hyperlink to our revised paper, which incorporates an prolonged pattern interval ending in June 2023.

Authors: Ladislav Durian and Radovan Vojtko

Title: Keep away from Fairness Bear Markets with a Market Timing Technique

Hyperlink: https://ssrn.com/summary=4397638

Summary:

On this paper, our aim is to assemble a market timing technique that will reliably sidestep the fairness market throughout bear markets and thereby cut back market volatility and enhance risk-adjusted returns. We construct buying and selling indicators based mostly on price-based indicators, macroeconomic indicators, and a number one indicator, a yield curve, that may predict recessions and bear markets prematurely. Our greatest-performing technique makes use of indicators from the Treasury unfold, a 200-day SMA, and another threat metric, the Rachev ratio, as development indicators, whereas Actual Retail Gross sales Development, Industrial Manufacturing Development, and Housing Begins Development as macroeconomic indicators. Primarily based on the pattern interval from 1927 to 2023, it yields a market-beating annual extra return of 6.59% whereas practically doubling the market Sharpe ratio to 0.56 and slicing the maximal drawdown by two-thirds to -25.13%.

Creator:Ladislav Durian, Quant Analyst, Quantpedia

Are you searching for extra methods to examine? Join our e-newsletter or go to our Weblog or Screener.

Do you wish to study extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing provide.

Do you wish to study extra about Quantpedia Professional service? Test its description, watch movies, assessment reporting capabilities and go to our pricing provide.

Are you searching for historic information or backtesting platforms? Test our checklist of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookCheck with a good friend

[ad_2]

Source link