[ad_1]

Smile

Shares of Massive Heaps (NYSE:BIG) have fallen by practically 90% over the previous three years as the corporate has struggled to ship constant profitability.

The corporate isn’t anticipated to ship full-year profitability in FY 2024 or FY 2025. Regardless of this, the inventory is at present rated a Purchase by Looking for Alpha analysts and a Maintain by Wall Avenue analysts.

The bulls consider that the corporate will have the ability to ship on its turnaround plan and finally return to profitability. I’m extra skeptical of the corporate’s turnaround potential as I view turnarounds in retail as particularly troublesome. I additionally view the corporate’s steadiness sheet as a headwind given the excessive diploma of leverage. For these causes, I charge the inventory a Promote and consider it’s poised to underperform the market extra broadly going ahead.

Looking for Alpha

Turnaround Plan Replace

BIG CEO Bruce Thorn not too long ago offered a progress replace concerning its turnaround plan on the Q3 earnings name:

We consider these enhancements are being pushed by the 5 key actions that underlie our technique. As a reminder, these are to personal bargains, to speak unmistakable worth, to extend retailer relevance, to win with omnichannel, and to drive productiveness…

Progress on the 5 key actions, decrease freight prices, and a decreased degree of markdown supported by an applicable stock place drove the development within the third quarter…

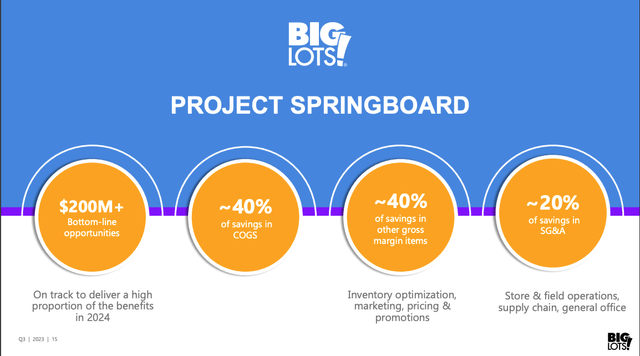

To assist our ongoing turnaround, our efforts to aggressively handle prices, stock, and capital expenditures, in addition to monetize owned property have enabled us to considerably strengthen our steadiness sheet. We’re on observe to realize over $100 million of SG&A price financial savings objectives for the yr, previous to venture springboard financial savings. Challenge springboard is off to a powerful begin and on observe to ship $200 million of bottom-line alternatives, most of which we count on to appreciate in 2024…

The third quarter marked an essential milestone on our journey to offer unimaginable worth. Our mixture of bargains, that are closeout gadgets, opportunistic buys, and different supply merchandise the place now we have a major comparable worth benefit was practically 50% of gross sales in Q3, nicely exceeding our aim of over one-third by the tip of the yr.

Whereas I view this progress as a optimistic, I consider the corporate has already taken benefit of the bottom hanging fruit and additional progress could also be harder. For instance, the overall SG&A financial savings aim for 2023 was $100 million however the firm expects to save lots of a further $200 million through venture springboard in FY 2024 and past.

Moreover, the corporate accomplished a sale and leaseback transaction leading to asset monetization of $306 million. Whereas this transaction helped enhance the corporate’s steadiness sheet, it was comparatively low-hanging fruit vs different actions to enhance the steadiness sheet.

One space through which I consider the corporate must make extra progress is in regard to closing underperforming places. As of January 28, 2023, the corporate had 1,425 complete shops and as of October 28, 2023, the corporate had 1,428 complete shops. That mentioned, the corporate is predicted to shut some shops in 2024 which I view as a optimistic.

BIG Investor Presentation

BIG Investor Presentation

Monetary Efficiency Stays Week

Regardless of making vital progress on its turnaround plan, the corporate continues to report weak monetary outcomes. Q3 2023 gross sales declined 14.7% on a year-over-year foundation and same-store gross sales declined 13.2% on a year-over-year foundation. One vivid spot is that gross margins improved by 240bps in Q3 2023 in comparison with the identical interval a yr in the past. Nevertheless, the corporate nonetheless reported an adjusted internet lack of $4.38 per share in comparison with an adjusted internet lack of $2.99 per share throughout the identical interval a yr in the past. On its Q3 name, the corporate blamed the disappointing outcomes on a cautious client and intense competitors:

That mentioned, we’re clearly not blissful that comps have been detrimental. Clients proceed to be cautious on excessive ticket purchases, corresponding to furnishings, and traffic-driving classes corresponding to meals and consumables have been impacted by fierce competitors within the area, the place there may be much less product differentiation

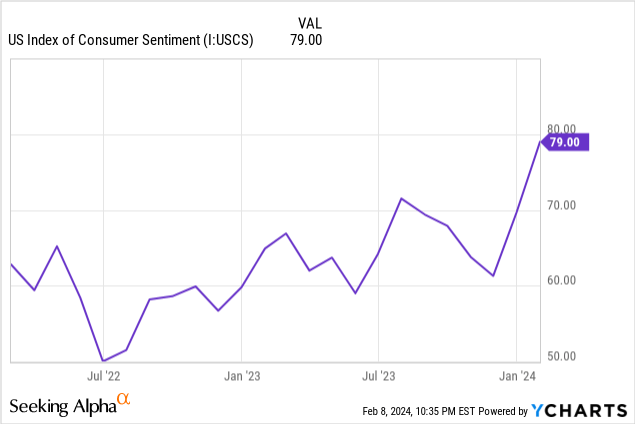

I’m considerably skeptical of this rationalization because the financial system stays fairly sturdy. Opponents corresponding to TJX Firms and Walmart have not too long ago reported stable income will increase and client sentiment has been pretty sturdy vs ranges seen a yr in the past.

If the financial system have been to weaken from right here, the corporate would possible expertise way more weak point in excessive ticket purchases than is at present the case.

Meals and Consumables account for 16% and 14% of BIG’s gross sales respectively. It’s troublesome to see how BIG will have the ability to win out right here vs low cost chains with a lot bigger scales corresponding to Walmart (WMT) or Greenback Common (DG).

Consensus estimates name for the corporate to proceed to report detrimental EBITDA and internet losses for FY 2024 and FY 2025.

The magnitude of the latest drop in same-store gross sales together with expectations for detrimental EBITDA and revenue for FY 2024 and FY 2025 (regardless of the corporate guiding in the direction of $200 million in value financial savings) speaks to how vital the challenges the corporate is at present going through are. Finally, I consider it is going to be troublesome for margin enchancment to offset a continued decline in gross sales.

Turnarounds In Retail Are Robust

I consider retail turnarounds are very difficult for numerous causes. Firstly, retail is a extremely aggressive enterprise with restricted product differentiation. BIG competes with low cost gamers with a lot bigger scales corresponding to Walmart, Greenback Common, Greenback Tree, and TJX Firms. BIG additionally faces competitors from on-line retailers corresponding to Amazon, Shein, and Temu.

Second, struggling retail firms usually run into challenges with suppliers as questions on a retail firm’s capability to proceed as a going concern lead to a scenario the place suppliers demand to be paid upfront. The results of that is that struggling retail firms are inclined to face difficult working capital dynamics which put them at an obstacle to stronger retailers. Challenges with provider confidence performed a key position within the money crunch which led JCPenney to hunt chapter safety. To be clear, BIG isn’t at present going through challenges associated to provider confidence however an extra deterioration within the firm’s liquidity place might change this shortly.

Lastly, the retail trade tends to be pretty cyclical. Sometimes firms within the midst of a turnaround face a difficult monetary profile with extra liquidity constraints than stronger rivals. Thus, firms with comparatively weak monetary positions have a tendency to search out it troublesome to trip out cyclical challenges.

Traditionally, even firms with very sturdy manufacturers have failed to show round struggling operations with out the assistance of chapter courtroom. Examples embody Sears, Toys R Us, Lord & Taylor, Circuit Metropolis, Mattress Tub & Past, JCPenney, J. Crew, RadioShack, and Neiman Marcus.

Given this backdrop of retail turnarounds extra broadly, I’m considerably skeptical of the notion that the corporate will have the ability to totally ship on its turnaround plan.

Steadiness Sheet & Liquidity Challenges

At present, BIG has internet accessible liquidity of ~$258 million and gross long-term debt of $533 million within the type of an ABL. BIG has simply ~$46.5 million of money and money equivalents and thus the corporate has a internet debt of ~$486.5 million. I view this degree of debt as extremely difficult for a corporation that’s not anticipated to generate optimistic EBITDA for the subsequent two years and is within the midst of a turnaround.

Throughout Q3 2023, the corporate entered right into a sale/leaseback transaction which resulted in asset monetization of $306 million. Whereas I view the transaction as a optimistic, the corporate’s total liquidity place stays reasonably weak. That is notably true given the corporate’s latest detrimental money generated from working actions. Nevertheless, it ought to be famous that the corporate expects to be free money movement optimistic in This autumn 2023 and to considerably scale back its debt.

I view BIG’s restricted liquidity and excessive debt burden as a key detrimental within the context of the corporate’s turnaround plan as room for error is restricted. Furthermore, the corporate might discover it troublesome to trip out a difficult financial surroundings as a result of a scarcity of liquidity.

For these causes, I consider the corporate’s steadiness sheet and liquidity place signify key negatives.

Valuation Views

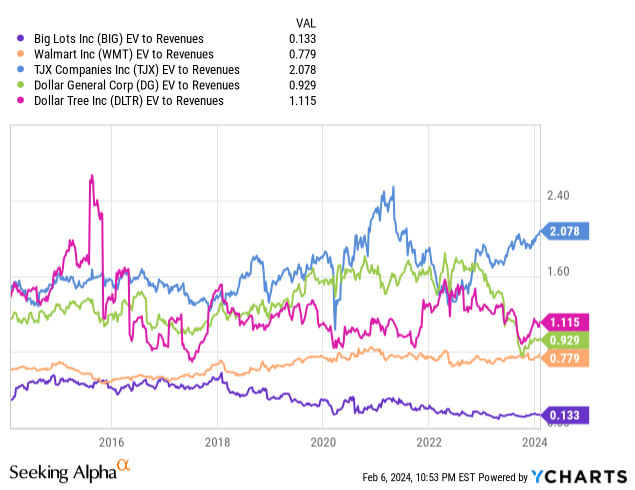

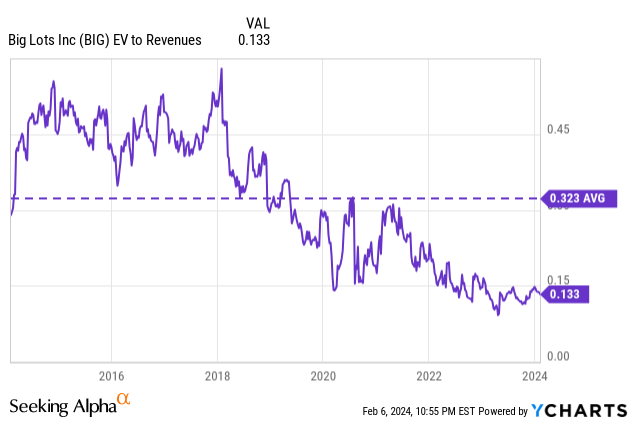

Given BIG’s detrimental anticipated ahead EBITDA and earnings, one valuation metric that’s helpful is EV/ Revenues. As proven by the charts beneath, BIG is buying and selling at a considerable low cost to friends and a considerable low cost relative to its personal valuation historical past.

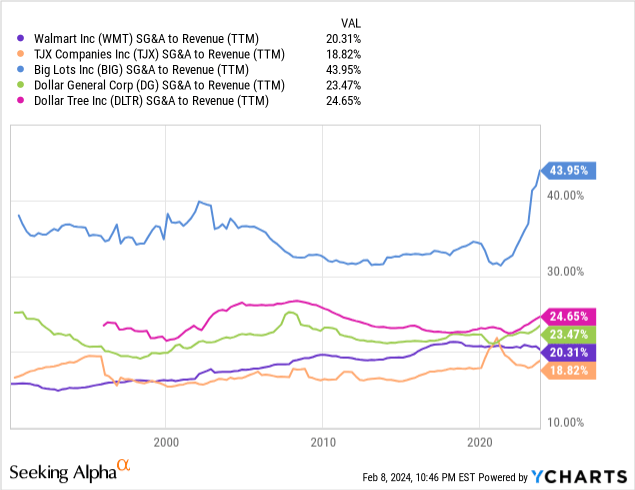

Whereas the inventory is definitely low-cost, I consider it’s low-cost for a cause. The corporate is struggling and isn’t anticipated to be worthwhile for the subsequent two years. Comparably, WMT, TJX, DG, and DLTR commerce at 24x, 24x, 17.8x, and 19.9x FY 2024 EPS respectively. Along with being extra worthwhile, these firms even have a lot larger scale. The smallest of those firms is DLTR which is predicted to publish FY 2023 income of $30.6 billion. Comparably, BIG is predicted to publish FY 2023 income of $4.7 billion. Scale is essential in low cost retail as bigger gamers usually have extra negotiating energy with suppliers and are capable of unfold fastened prices over a a lot bigger income base. Proof for this phenomenon may be seen in the truth that BIG has a a lot increased SG&A to Income ratio vs these firms.

Moreover, I view the corporate’s steadiness sheet and liquidity image as pretty difficult headwinds. Comparably, BIG’s friends are in a a lot better place from a steadiness sheet perspective.

Potential Upside Catalysts

One potential upside catalyst can be if BIG is ready to ship on its turnaround plan and return to profitability extra quickly than is at present anticipated. I view the possibilities of this as pretty low as a result of the truth that retail turnarounds are usually fairly difficult. That mentioned, I plan to proceed monitoring the corporate for indicators {that a} turnaround has taken maintain which might return the corporate to profitability.

Given the present low valuation, the inventory might have materials upside within the occasion the corporate is ready to ship.

One other potential catalyst can be a strengthening of the macroeconomic surroundings which can assist the corporate enhance gross sales of big-ticket gadgets corresponding to furnishings. I view a major enchancment in macroeconomic circumstances as pretty unlikely given the truth that unemployment is already fairly low, asset values are excessive (i.e. inventory market close to all-time highs), and inflation has moderated.

Conclusion

Whereas I consider BIG has laid out an inexpensive turnaround plan, and made stable progress, monetary efficiency has continued to be weak.

I consider turnaround conditions within the retail sector are extraordinarily difficult as a result of excessive competitors, potential challenges with suppliers, and a excessive diploma of cyclicality.

Regardless of a latest enchancment in liquidity as a result of a sale/leaseback transaction, the corporate’s liquidity place stays pretty weak. Moreover, the corporate has a major quantity of debt to deal with.

For these causes, I charge the inventory a Promote proper now. I’d contemplate upgrading the inventory if the corporate is ready to ship on its turnaround plan to return to profitability and enhance its liquidity and steadiness sheet place.

[ad_2]

Source link