[ad_1]

zorazhuang

Notice: All quantities referenced are in Canadian {Dollars} until specified in any other case.

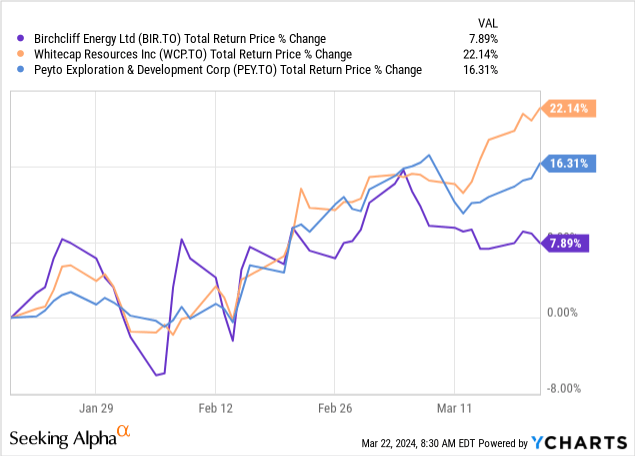

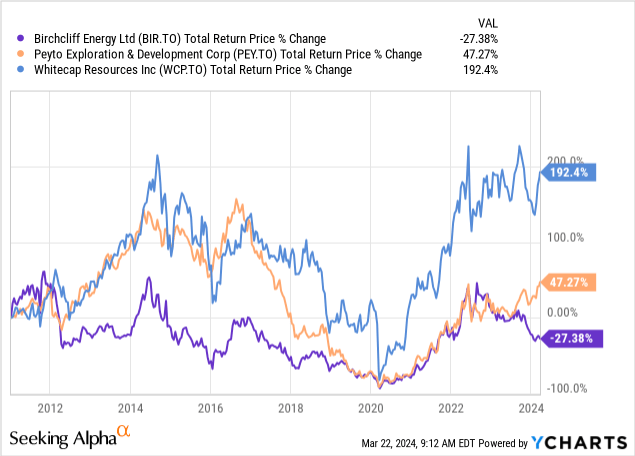

On our first protection of Birchcliff Vitality Ltd. (BIREF, TSX:BIR:CA) we went with a “maintain” score and urged that buyers look elsewhere for pure fuel publicity. We provided two nice selections.

The Birchcliff Vitality’s valuation is simply too wealthy right here to benefit a purchase. If you would like a pure fuel play, then Peyto Exploration & Improvement Corp. (PEY:CA) makes extra sense. If you would like fuel publicity, then there are a number of fuel weighted medium-sized corporations which are cheaper right this moment, even after Birchcliff’s drop. Whitecap Sources Inc. (WCP:CA) can be another right here for high quality stock depth and good administration.

Supply: “Dividend Yield Falls, Peyto And Whitecap Make Extra Sense.”

You didn’t even should learn the article for that, as we gave you the punchline proper within the title. We went with corporations that had a superb pure fuel publicity, however had used hedges to guard themselves.

Properly, that labored out. However the level we need to make right this moment is that there are extra draw back dangers for Birchcliff than there have been two months again. Their lowered dividend additionally seems to be extraordinarily unsafe.

This autumn 2023 Outcomes

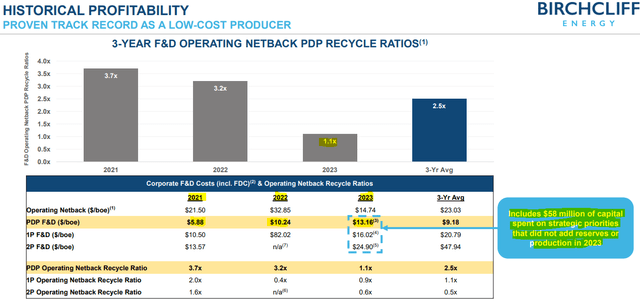

Birchcliff had preannounced its This autumn 2023 manufacturing alongside the dividend reduce. So when the official This autumn outcomes got here out, there have been no actual surprises. However these numbers did present one other difficulty, and that was the price of changing reserves.

BIR Presentation

Administration harassed (and we’ve highlighted above), that some spending didn’t actually add reserves. Okay, that’s high-quality. However these are actually weak numbers, even in the event you exclude that $56 million. The fee improves to round $11.00/BOE from $13.16/BOE in the event you exclude that whole quantity. What precisely is $11.00/BOE right here? BOE is barrels of oil equal and whereas Birchcliff has some liquids manufacturing, the majority is tied to the weak pure fuel value. For 2023, Birchcliff’s income per BOE was about $26.75 and netback per BOE was about $11.00. So basically the corporate had zero full-cycle revenue for the yr. In that yr, the corporate paid out $213 million in dividends.

2024

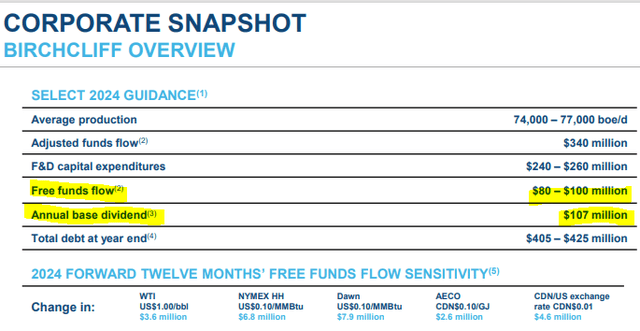

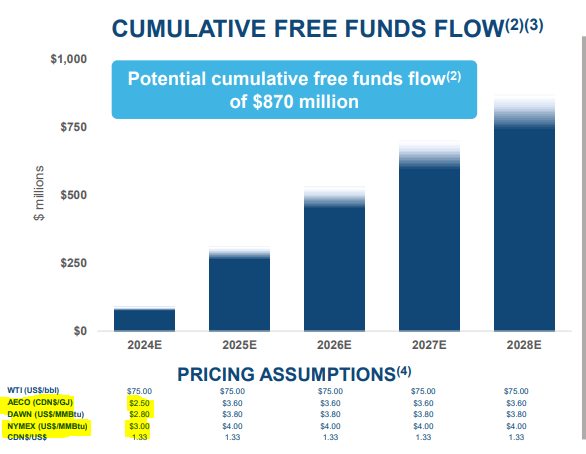

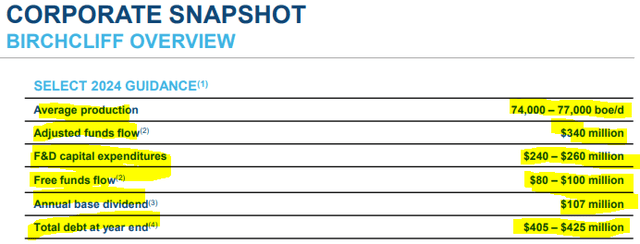

Okay that’s the previous. The place will we go from right here? Birchcliff has not modified something, but. Their newest presentation (March), echoes their steerage from January 2024.

BIR Presentation

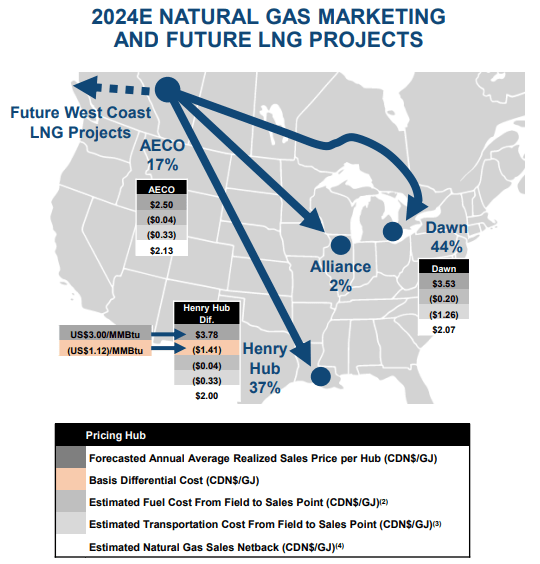

However the 2024 AECO strip has misplaced much more floor since then. We had been roughly $1.90 CAD for the March to September 2024 AECO strip, again in January. As we speak, we’re all the way down to $1.75. That 15 cents could not sound like so much, however it’s a huge chunk of the revenue margin after you extract the extraction prices. Birchcliff shouldn’t be tied simply to AECO, although.

BIR Presentation

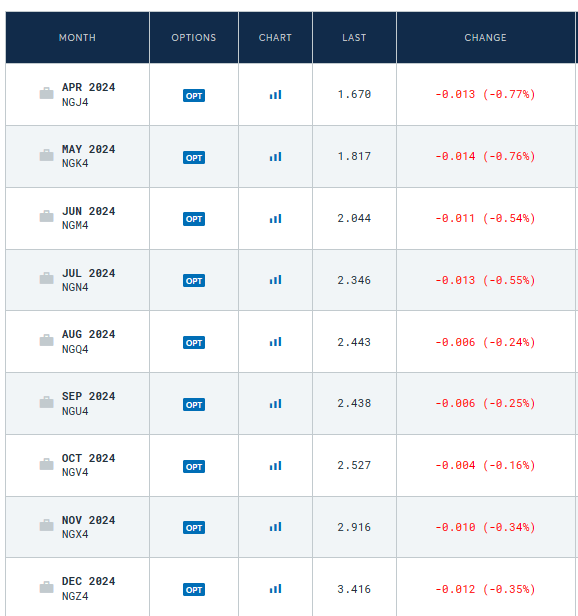

Of their funds, they had been counting for about $3.00 USD for Henry Hub.

BIR Presentation

We hate to interrupt it to them, however that appears extraordinarily unlikely now. The subsequent 9 months common round $2.4, and that’s just about December 2024 doing the heavy lifting.

NG CME Futures

For those who exclude December 2024, we’re down to close $2.32. Once more, a giant, huge, hole for the revenue margin.

Dividend Protection For 2024

So these had been the ballpark figures for the commodity pricing and the revenue margin. The place does that depart the dividend? One of many causes we didn’t endorse a purchase after the primary dividend reduce was as a result of Birchcliff’s new dividend was not coated, both. You’ll be able to see the midpoint of free funds movement ($90 million) was properly beneath the annual base dividend of $107 million.

BIR Presentation

Okay, so what’s $17 million between associates? Proper? However in fact we have to regulate the numbers for the delta within the commodity pricing. The brand new EBITDA involves about $310 million at the moment and adjusted funds movement can be near $280 million. You’ll be able to evaluate that to the $340 million above. The free funds movement drops to $30 million roughly. That compares to $107 million being doled out. Clearly problematic right here, to say the least.

Verdict

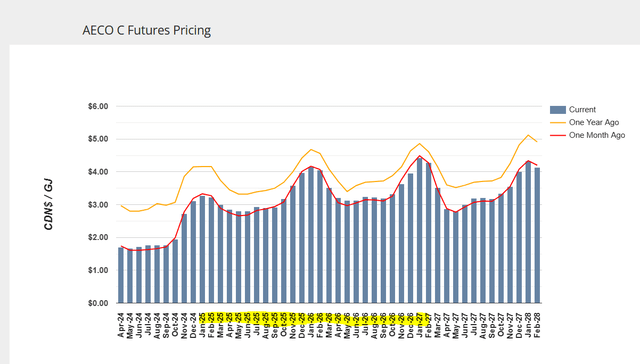

Issues will possible enhance in 2025 because the AECO and NYMEX strips have stayed agency and people estimates should not shifting down. However it’s not like Birchcliff is shifting a muscle to even attempt to lock in some costs on these futures. It is the identical “unhedged” story that many have tried to promote to buyers through the years, with actually poor outcomes. Because the chart beneath reveals, hedgers (Peyto) do higher and oily performs who hedge, do even higher (Whitecap).

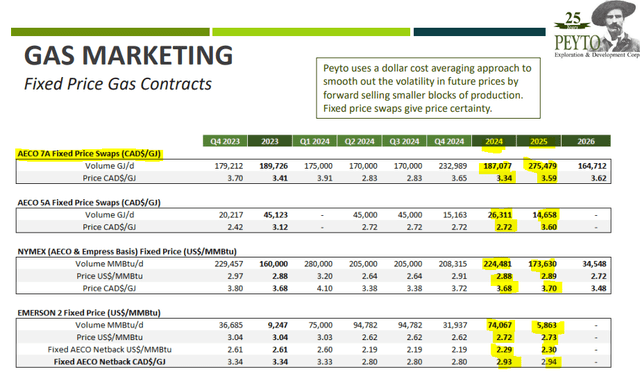

However the huge query right here for buyers is whether or not the dividend will likely be maintained? In idea, Birchcliff might go the entire yr on the unique plan and wind up with a debt to EBITDA of 1.5X-1.6X. That may be nearer to 1.1X primarily based on the 2025 strip costs. That by itself, shouldn’t be deadly and the dividend could possibly be maintained by it. In spite of everything, even our champion Peyto is working at 1.7X at the moment. However Peyto has the understanding of money flows. Simply take a look at how aggressively they’re hedging for 2025.

PEY Presentation

AECO 7A is extra locked in for 2025 than 2024. On high of that their recycle ratio was nearly 3.0X for 2023 versus 1.1X for Birchcliff. So 1.6X debt to EBITDA means various things for these two. Primarily based on that, we predict Birchcliff has two selections right here. The primary will likely be to go aggressive and lock-in 2025 and 2026 costs. They’re nonetheless fairly agency.

AECO

It will not be the equal of promoting on the backside, and the corporate can save face right here. As soon as they’re locked in, their debt to EBITDA blowout will likely be a brief phenomenon. They will pay their dividend and sleep properly at evening. If they do not, then that dividend might want to go, in all probability with one other 75% reduce.

We keep Birchcliff Vitality Ltd. at a “maintain” for now, however the dangers are excessive if the 2025 strip weakens and the corporate insists on sustaining the dividend. Whereas we appreciated Peyto and Whitecap beforehand, they’ve each rebounded so much and we see a extra balanced outlook for them from right here on. We’d get extra constructive on a pullback on these two.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link