[ad_1]

Este artículo también está disponible en español.

Amid its historic value motion, Bitcoin (BTC) has quietly hit a brand new all-time excessive (ATH) towards gold. The perception was highlighted by veteran dealer Peter Brandt in an X publish.

Bitcoin Hits New ATH In opposition to Gold: Room For Additional Progress?

Brandt’s evaluation revealed that the BTC-to-gold ratio has reached a brand new ATH of 32.19 ounces of gold per BTC. In his publish, the seasoned dealer additionally took a refined dig at long-time gold advocate Peter Schiff, a vocal Bitcoin critic.

Associated Studying

For these unfamiliar, the BTC-to-gold ratio measures Bitcoin’s efficiency relative to gold, exhibiting what number of ounces of gold are wanted to buy one complete BTC. This metric underscores Bitcoin’s rising dominance as a retailer of worth.

Brandt additional famous that the following goal for Bitcoin is 89 ounces of gold per BTC, suggesting vital room for Bitcoin to develop towards the valuable metallic. This aligns with the broader narrative inside the crypto business that Bitcoin is poised to problem gold’s $15 trillion market cap.

It’s value recalling that Brandt beforehand predicted Bitcoin would rise 400% relative to gold by 2025. Again in October, he projected that BTC might attain the equal of 123 ounces of gold based mostly on historic market patterns.

A latest report by buying and selling agency Bernstein added weight to this narrative, forecasting that Bitcoin is on observe to exchange gold as the popular safe-haven asset inside the subsequent 10 years. As of now, BTC boasts a market cap of $2.11 trillion, steadily closing in on gold’s dominance.

Related forecast was made by one of many earliest Bitcoin advocates, Eric Voorhees. The CEO of ShapeShift crypto trade made a daring prediction, saying that not like gold or oil, BTC’s digitally-programmed provide shortage will drive its value upwards.

Moreover, Nate Geraci, President of the ETF Retailer, predicts that Bitcoin-based exchange-traded funds (ETFs) might surpass gold ETFs in whole property beneath administration inside the subsequent two years. Supporting this outlook, knowledge from SoSoValue signifies that cumulative web inflows into all spot BTC ETFs at the moment stand at $35.6 billion, in comparison with gold ETFs, which sit at $55 billion.

Implications Of A Potential BTC Strategic Reserve

With BTC surpassing the pivotal $100,000 value degree, hypothesis has grown relating to President-elect Donald Trump’s strategy to digital property. Trade consultants imagine that Trump might prioritize Bitcoin adoption early in his second time period, additional boosting BTC’s value.

Associated Studying

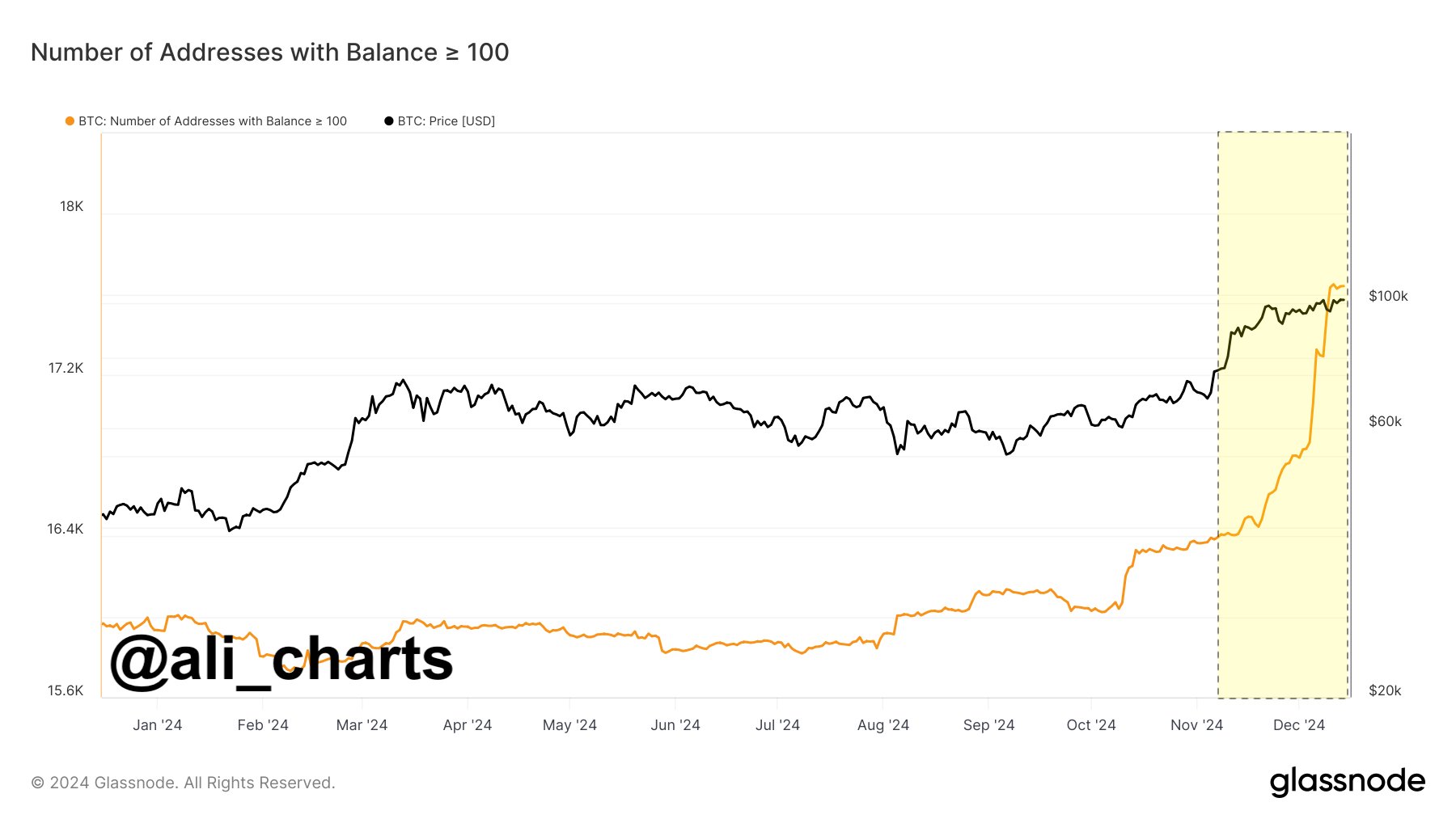

Information helps this optimistic view. In response to crypto analyst Ali Martinez, the variety of BTC whales – pockets addresses holding greater than 1,000 BTC – has skyrocketed since Trump’s election victory.

This optimism is additional fuelled by hypothesis surrounding a possible US strategic Bitcoin reserve. Outstanding financiers argue that if the US had been to create such a reserve, China and different nations would seemingly comply with swimsuit to stay aggressive. At press time, BTC trades at $106,909, up 3.7% prior to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com

[ad_2]

Source link