[ad_1]

On-chain knowledge reveals that Bitcoin traders have not too long ago been scooping up provide equal to five.5 instances what the miners have produced.

Bitcoin Investor Cohorts Have Been Busy Accumulating Just lately

In a put up on X, analyst James Van Straten mentioned the buildup that Bitcoin investor cohorts have been collaborating in and the way it compares with the latest spot exchange-traded fund (ETF) inflows.

The investor cohorts right here discuss with teams of holders divided based mostly on the quantity of cryptocurrency they maintain. Within the context of the present matter, not any specific group is of curiosity, however all of them collectively are.

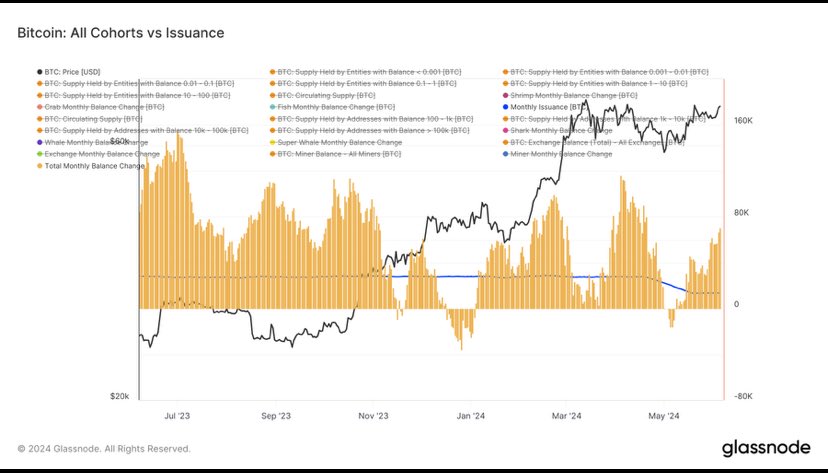

Under is the chart shared by Straten, which reveals how the web flows into the wallets of BTC traders have regarded not too long ago.

The worth of the metric appears to have been constructive in latest weeks | Supply: @jvs_btc on X

Because the above graph reveals, Bitcoin traders as a complete have been making internet inflows into their wallets, suggesting that accumulation has been their dominant habits.

The analyst has additionally connected the info for the community’s Month-to-month Issuance in the identical chart. The “Issuance” right here refers back to the quantity of BTC the miners produce by fixing blocks. The Month-to-month Issuance is a measure of this quantity over the previous month.

From the graph, it’s obvious that Bitcoin investor accumulation has not too long ago been larger than the Month-to-month Issuance. This is able to imply that traders have been shopping for BTC quicker than the miners can produce it.

Extra particularly, the BTC traders have purchased 71,000 BTC during the last thirty days, nearly 5.5 instances what the miners minted in the identical interval: round 13,000 BTC.

The chart additionally reveals that, through the previous yr, the holder cohorts have repeatedly been scooping up BTC greater than what miners have been producing, bar a couple of stretches.

How is it doable that the traders have been capable of purchase greater than what’s being minted? The place is the additional Bitcoin coming from? The reply is exchanges. Centralized exchanges aren’t included with the investor cohorts and are the place holders have been withdrawing cash.

As one other analyst identified in a CrypotQuant Quicktake put up, the Bitcoin Alternate Reserve has been going by means of a steep decline for some time now.

Seems to be like the worth of the indicator has been caught in a downwards trajectory during the last couple of years | Supply: CryptoQuant

As for a way the Bitcoin investor demand compares towards the latest ETF inflows, Straten has famous that these funding autos have added $1.4 billion value of BTC to their inventories within the newest spree. However, the month-to-month internet accumulation from the traders stands at greater than $5.1 billion.

Thus, the market’s demand has been fairly sizeable not too long ago, even whatever the dramatic inflows that the ETFs have seen.

BTC Value

Following its surge earlier within the week, Bitcoin has gone a bit stale as its worth remains to be buying and selling round $71,000.

The worth of the coin seems to have been shifting sideways throughout the previous few days | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, Glassnode.com, chart from TradingView.com

[ad_2]

Source link