[ad_1]

Onchain Highlights

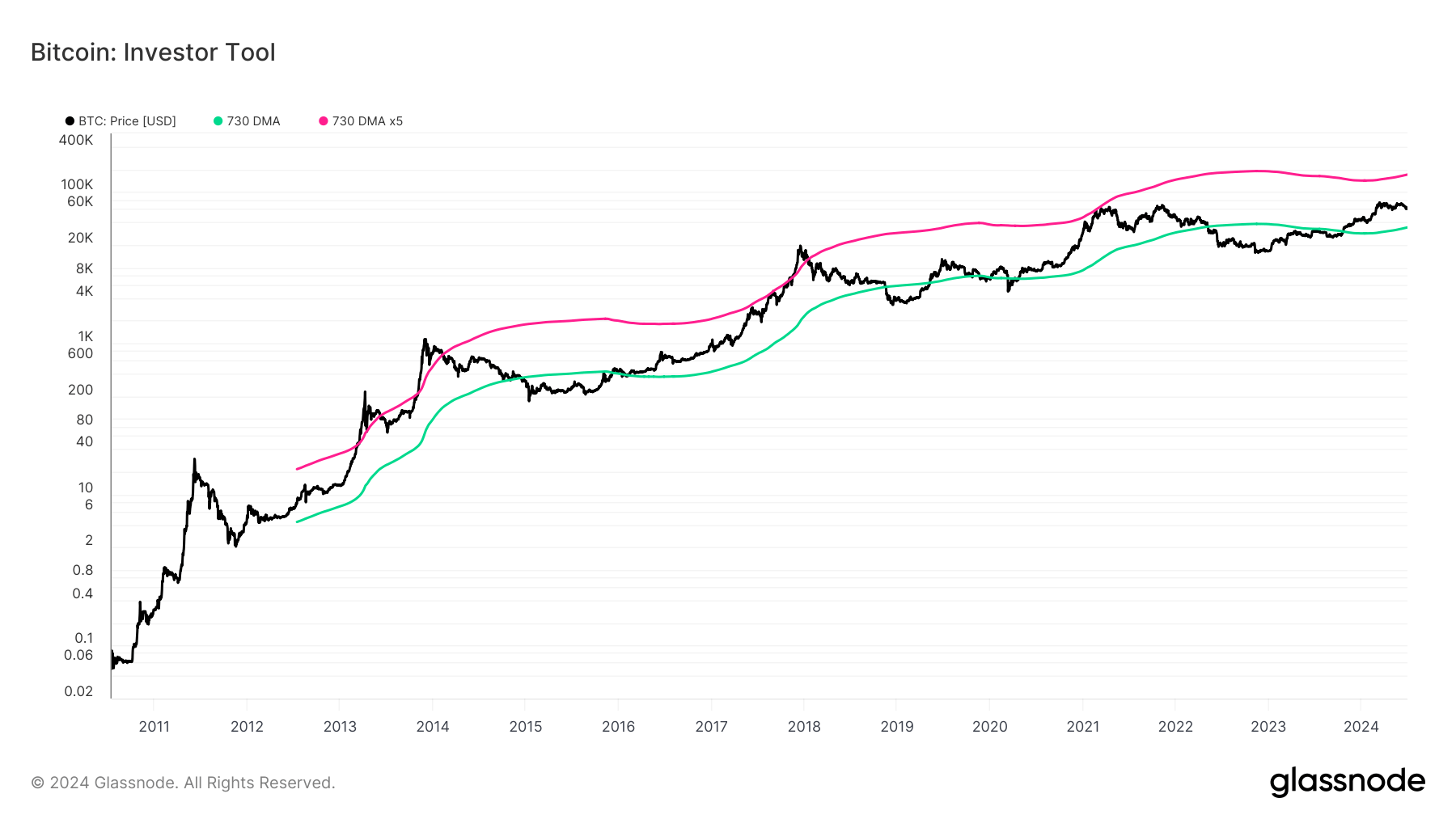

DEFINITION: The Investor Software is meant as a software for long-term holders, indicating intervals when costs are doubtless approaching cyclical tops or bottoms. The software makes use of two easy transferring averages of worth as the idea for below/overvalued situations: the 2-year MA (inexperienced) and a 5x a number of of the 2-year MA (purple).

Worth buying and selling beneath the 2-year MA has traditionally generated outsized returns, and signalled bear cycle lows. Worth buying and selling above the 2-year MA x5 has traditionally signaled bull cycle tops and a zone the place buyers de-risk.

Since November 2023, Bitcoin’s worth has fluctuated inside key transferring averages, reflecting its cyclical nature. Glassnode’s Investor Software illustrates Bitcoin’s worth motion relative to its 2-year easy transferring common (SMA) and a 5x a number of of the 2-year SMA. Traditionally, the 2-year SMA has served as a assist stage throughout bear markets, whereas the 5x a number of has indicated potential market tops the place buyers would possibly de-risk.

Bitcoin’s worth has remained above the 2-year SMA all through 2024, suggesting a section of market power. Nonetheless, it’s nonetheless beneath the 5x a number of, indicating room for potential development earlier than reaching a historic de-risking zone. This alignment means that the present market won’t but be at a cyclical peak.

Earlier cycles, as proven within the chart beneath, present that sustaining positions above the 2-year SMA has correlated with intervals of serious worth appreciation. Buyers are prone to monitor these indicators carefully to gauge optimum entry and exit factors available in the market. Bitcoin’s persistence above the 2-year SMA reinforces the continuing bullish sentiment, whereas the house beneath the 5x a number of suggests cautious optimism amongst market members.

[ad_2]

Source link