[ad_1]

Key Takeaways

BlackRock’s Bitcoin ETF attracted $318 million in internet inflows regardless of a 4% Bitcoin value drop.

IBIT’s latest development contributes to US spot Bitcoin ETFs surpassing 1 million Bitcoin in holdings.

Share this text

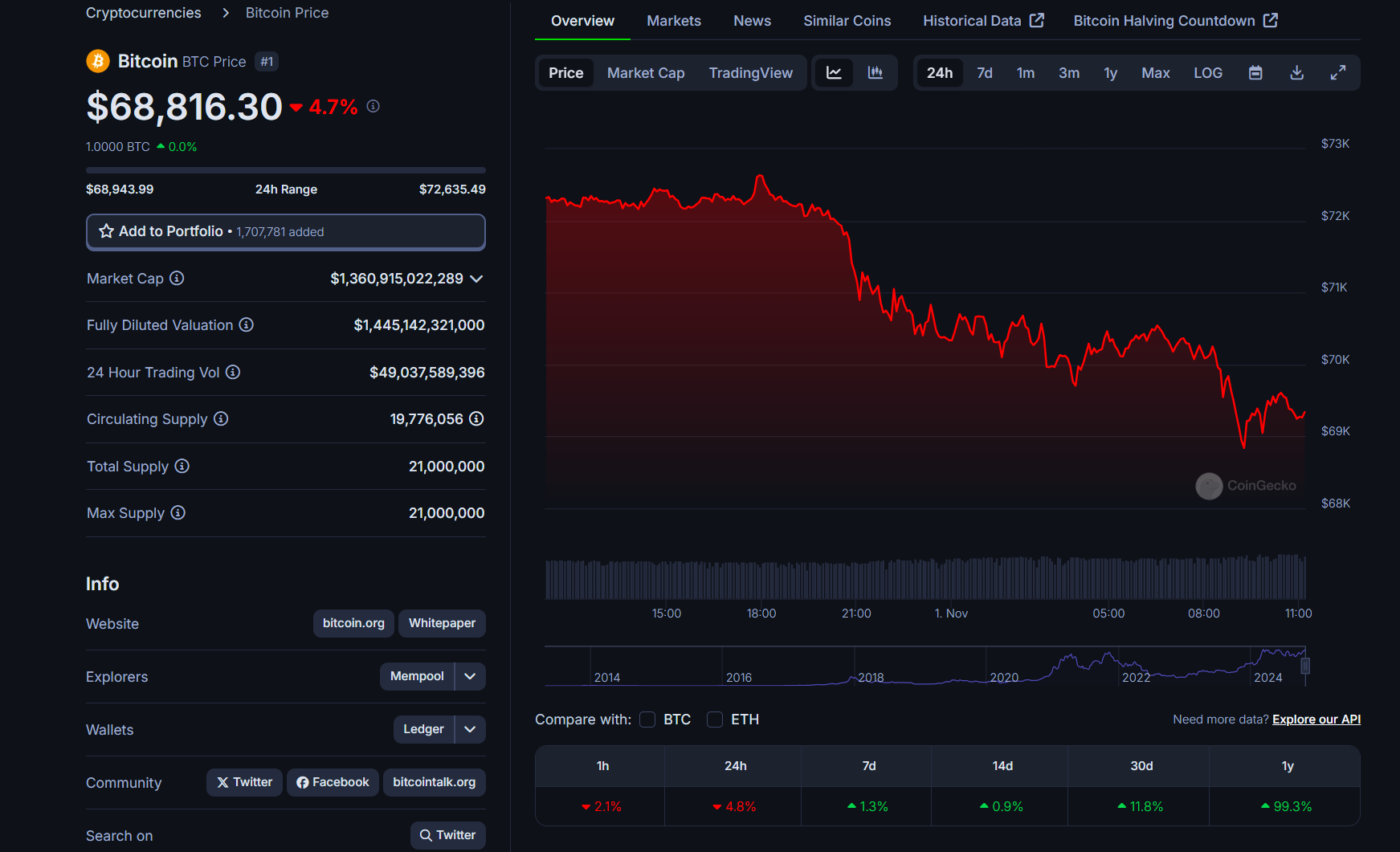

BlackRock’s spot Bitcoin ETF, the IBIT fund, continues to be a most well-liked choice for monetary buyers. The fund attracted round $318 million in internet inflows on Oct. 31 regardless of Bitcoin’s value falling 4% to $68,800.

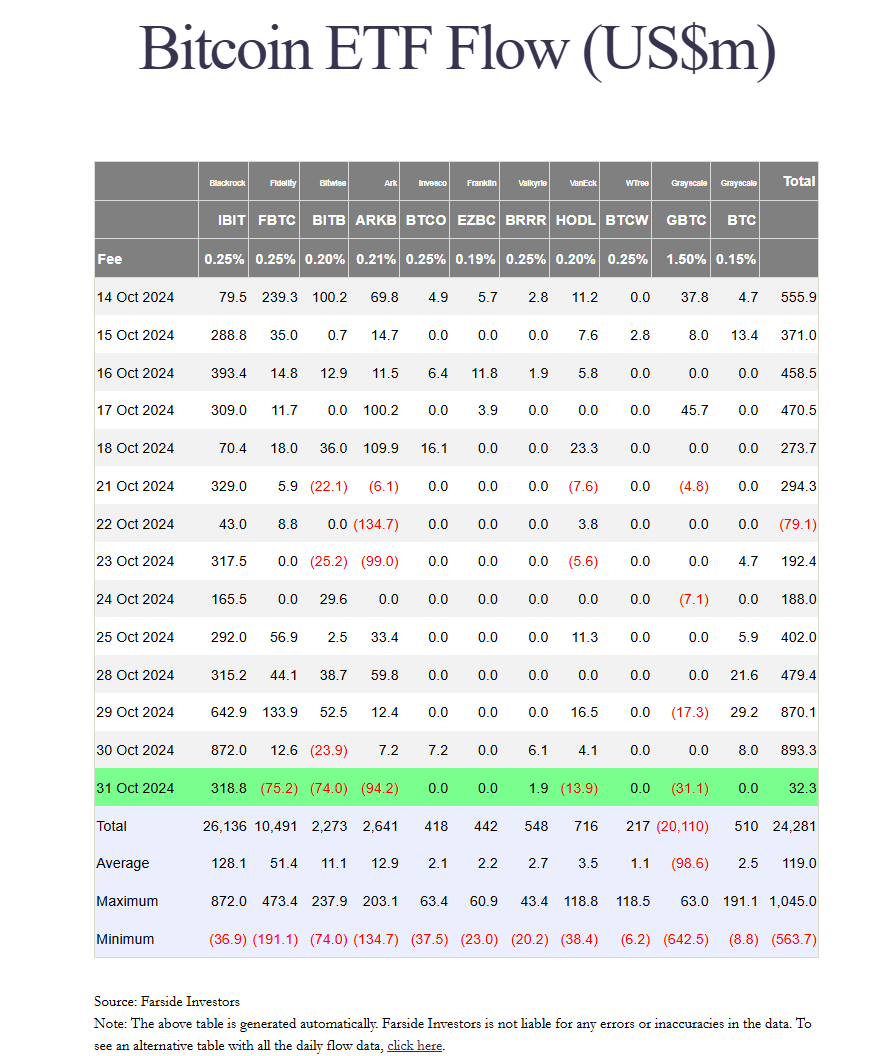

The influx adopted IBIT’s record-breaking efficiency of $875 million on Oct. 30, which exceeded its earlier excessive of $849 million. The fund’s weekly inflows have now surpassed $2 billion, in keeping with Farside Buyers information.

Valkyrie’s BRRR fund additionally added practically $2 million on Thursday. In distinction, different ETF suppliers confronted vital redemptions.

Constancy’s FBTC ended its two-week optimistic streak with over $75 million in internet outflows. ARK Make investments/21Shares, Bitwise, VanEck, and Grayscale ETFs collectively reported $213 million in outflows.

Regardless of the blended efficiency throughout ETFs, IBIT’s huge inflow effectively helped the US spot Bitcoin ETF group preserve optimistic momentum, including over $30 million in new investments. This marks the seventh consecutive day of internet inflows for the sector.

IBIT has gathered virtually $30 billion in belongings since its launch, with roughly half of that quantity gathered prior to now month. The mixed holdings of US spot ETFs have now exceeded 1 million Bitcoin.

Bloomberg ETF analyst Eric Balchunas famous that IBIT has attracted extra funding than some other ETF prior to now week, surpassing established funds like VOO, IVV, and AGG, regardless of launching lower than ten months in the past.

$IBIT took in extra cash than some other ETF on this planet over the previous week. That is out of 13,227 ETFs, which incorporates $VOO $IVV $AGG and many others. It is so onerous to beat these veteran Money Vacuum Cleaners, even for every week, particularly for an toddler ETF (3mo-1yr outdated) pic.twitter.com/S443lUXVQk

— Eric Balchunas (@EricBalchunas) October 31, 2024

Share this text

[ad_2]

Source link