[ad_1]

small smiles

In my earlier article on Blue Owl Capital (NYSE:OBDC) I plotted a reasonably conservative thesis on this BDC – Blue Owl Capital: There Are 2 Basic Showstoppers.

Within the article I made it clear that OBDC has certainly some strong fundamentals in place resembling diversification throughout many large-scale companies, favorable bias in direction of first lien and senior secured merchandise, and, importantly, a really wholesome dividend protection degree that’s underpinned by prime quality earnings.

Nonetheless, because the title implies, there have been two challenges that I observed, which made me much less bullish on OBDC.

The primary and most crucial one was associated to the underlying portfolio high quality, the place the weighted common curiosity protection of its investments stood at 1.6x, which is definitely not on the excessive finish within the context of how different friends have structured their exposures. Given the pressures within the BDC sector resembling unfold compression, subdued M&A exercise, growing non-accruals and the rise of systematic threat as a consequence of weakening of economic system, investing in BDCs that carry common and even under common high quality belongings is simply too dangerous for me.

The second facet that held me again from assigning a transparent purchase ranking on OBDC was truly the scale difficulty. Whereas there are a number of advantages from having a sizeable AuM determine because it permits to entry low cost financing and diversify, it additionally comes with a drawback of being pressured to deal with excessive ticket dimension offers for which there’s an enormous competitors from institutional capital. For the reason that regional banking disaster, many BDCs and huge scale non-public credit score gamers have emerged disrupting the availability and demand dynamics within the higher center market house. On prime of this, we’ve got a subdued M&A and LBO exercise, which decreases additional the demand for personal credit score merchandise. All of this results in two issues: 1) yields coming down and a couple of) securing of adequate deal quantity turning into tougher. We of those two dynamics we may observe in Q1, 2024 and in a number of of the prior quarters.

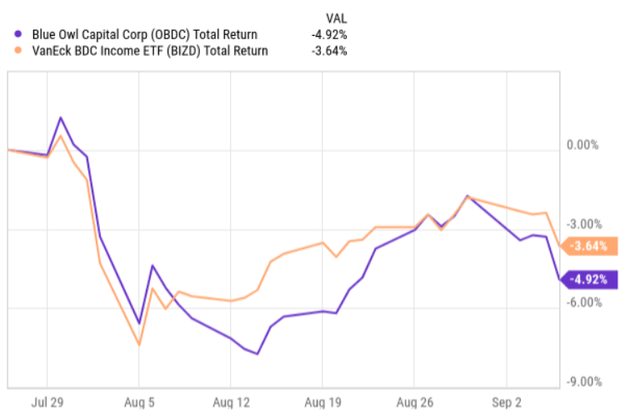

For the reason that publication of my article the inventory value has gone down, registering a slight unfavourable alpha.

Ycharts

Nonetheless, my thesis was clearly not about shorting OBDC or anticipating to see a right away unfavourable alpha. As an alternative, my intention was to underscore these structural challenges in order that buyers may rethink their present (or potential) stakes in OBDC and resolve whether or not the place is balanced sufficient provided that the chance of OBDC underperforming increased high quality BDCs will not be immaterial.

Now, comparatively lately, OBDC circulated Q2, 2024 earnings deck and introduced a merger. Let’s now digest these knowledge factors to see whether or not the case has strengthened or additional weakened.

Thesis overview

If we take a look at the Q2, 2024 earnings knowledge, we’ll discover that OBDC continued to ship secure outcomes throughout the board, and in some cases even registering slight enhancements relative to the prior quarter.

The NII per share got here in at $0.48, which marks a $0.01 of a rise in comparison with Q1, 2024. Most of this was pushed by increased leverage and to a big extent by reimbursement associated earnings. If we adjusted for the one-off earnings objects (like reimbursement charges), the end result can be virtually completely flat relative to the earlier quarter.

What was stunning to me was that OBDC managed to attain notable web funding funding surplus quantities despite the fact that the higher center market transaction exercise has not but actually opened. Throughout Q2, OBDC originated huge quantity of contemporary offers (near $3.3 billion) that was offset by $1.1 billion of repayments, leaving a really good surplus that has already elevated OBDC’s portfolio asset base from which accretive unfold seize may happen. As a consequence of this, OBDC’s leverage has ticked up accordingly, reaching 1.2x, which is on the increased finish of the capital construction coverage.

Whereas all of this might be positively deemed as a constructive signal, the difficulty round unfold compression has not disappeared. Provided that the lion’s share of the brand new funding originations have been related to refinancing and lending extra capital to primarily current portfolio firms, the spreads have confronted a good better strain. For instance, the weighted common unfold over relevant base fee of latest floating fee funding commitments continued to lower for already fifth quarter in a row. What this implies is that the elevated portfolio turnover degree that was registered this quarter will push down the general portfolio yield, which in flip will make it tougher to develop the NII from right here – particularly contemplating the exhausted leverage profile. But, for Q3, 2024 I nonetheless count on to see both secure or barely increased NII era because the uptick in portfolio dimension has been massive sufficient to offset the unfavorable portfolio turnover (i.e., decrease yielding turnover), the place full quarter results haven’t but been reported in Q2.

All in all, this isn’t one thing that ought to set off an exit from OBDC. As an example, the distribution protection degree stay protected at 116% and adjusting for the supplemental dividend, the bottom dividend protection lands at 129%, which is likely one of the highest within the BDC sector. For conservative dividend buyers having so large margin of security on the dividend protection is an actual asset.

Nonetheless, there are nonetheless some essential negatives in place. Right here under I’ve mirrored probably the most important ones in a condensed method:

The truth that the leverage profile is basically exhausted limits OBDC’s capability to meaningfully broaden its portfolio with out issuing fairness, which at present appears like a suboptimal resolution given the low cost to NAV. Increased leverage will increase the danger within the system, which isn’t what we would like throughout unsure and risky instances like this. The unfold compression imposes direct challenges on the long run NII era, which given the elements above will doubtless result in a diminished dividend protection This quarter we may already see how increased leverage magnifies the unfavourable dynamics within the books – i.e., a slight enhance in non-accrual and several other minor underperforming positions precipitated NAV contraction despite the fact that the OBDC was capable of retain a part of the NII era through a wholesome dividend distribution degree. In 2025 OBDC must refinance $925 million of fastened fee debt that at present yields between 3.75% and 4.0%, which is materially under the present market degree financing prices. As soon as these proceeds get refinanced, the spreads are more likely to endure even additional.

Furthermore, lately Raymond James downgraded the BDC from Outperform to Market Carry out. The explanation for this lied within the OBDC’s announcement to merge with Blue Owl Capital Corp. III (NYSE:OBDE) that would extremely doubtless trigger some technical drags (e.g., elevated one-off prices, integration dangers) on the underlying efficiency.

I might personally not base my determination to speculate (or not) in OBDC as a consequence of momentary integration dangers that would theoretically render a unfavourable influence on NII outcomes for one or two quarters.

Nonetheless, by digesting the important thing facets of the proposed merger, I simply don’t any motive to alter my funding stance. As we noticed within the first chart above, the market appeared to not give any extra profit to OBDC both.

The thought is that OBDC buyers will now profit from elevated scale and diversification that might enable to supply cheaper capital. But, there are not any plans of this merger being instantly accretive to OBDC shareholders, and as a substitute the one quantitative advantages which are anticipated to be captured over the primary couple of quarters after the merger are associated to operational synergies (i.e., financial savings on administration payment). This isn’t that materials.

Whereas there are certainly some implicit advantages to this, we’ve got to contextualize this with the truth that now OBDC will probably be pressured to supply even better volumes and discover even bigger ticket dimension funding to maintain the portfolio dimension in steadiness. Will probably be doubtless much more troublesome to keep away from unfold compression as for bigger ticket dimension transactions, there’s better quantity of establishment capital (together with conventional banks and public capital markets) which are within the search of huge sufficient investments that produce above common yields.

The underside line

The Q2, 2024 earnings knowledge largely confirmed my thesis that was outlined within the earlier article that OBDC is a essentially sound BDC with comparatively unattractive NII era prospects.

Whereas there are a number of drivers for that, probably the most important one is said to its deal with higher center market mortgage section, the place after the proposed merger with OBDE the mixed BDC may have it much more troublesome to safeguard the present unfold ranges as a consequence of a extra intense competitors in increased ticket dimension mortgage (transaction) house.

Because of this I’m sustaining my maintain or impartial view on Blue Owl Capital.

[ad_2]

Source link