[ad_1]

Kobus Louw/E+ by way of Getty Photographs

In case you’re a concentrated investor like me, you’d wish to decide the {industry} chief, quite than achieve pointless publicity to lower-quality names.

Reserving Holdings (NASDAQ:BKNG) is without doubt one of the most outstanding names in the web journey market, which I view as a beautiful option to capitalize on the ever-growing demand for experiences, because the world’s GDP continues to rise and other people’s need for journey by no means ends.

Is Reserving the very best horse to select on this race? Let’s discover out.

On-line Journey Market

Journey is arguably folks’s most desired expertise. It is one of the simplest ways to create pleased recollections, and regardless of its discretionary nature, I do not know too many individuals who remorse spending their hard-earned cash on journey.

It is then no shock that journey as a share of world GDP is on a secular rise, as folks develop into wealthier and have extra spare cash out there for journey. In 2019, the journey & tourism share of GDP reached an all-time excessive of 10.4%, a degree that is anticipated to be surpassed in 2024.

To know the underlying development drivers of this {industry}, I will use a quote from Glenn Fogel, Reserving’s CEO:

If we agree that over time, world GDP will proceed to extend and per capita GDP will proceed to extend, it is pretty logical that as folks get wealthier, they are going to spend extra of their cash on issues which can be providers or experiences. As soon as you’re wealthy sufficient to have, for example an condominium, or you will have one couch, you are not going to purchase a settee or an condominium every year. What you are going to do is you’ll journey both extra incessantly or in the next degree otherwise you’ll do each. We see that time and again, as GDP per particular person goes up, journey will increase, too.

— Reserving Holdings Q3’23 Earnings Name [edited by author].

Usually, the journey worth chain consists of transportation, lodging, and points of interest. Each hyperlink on this chain represents a extremely fragmented and aggressive market, with diversified buyer cohorts from all ranges of revenue and completely different sorts of preferences.

For instance, transportation contains dozens of airways, some low-cost, some luxurious, some are business-oriented, and a few are a mixture between all of these. Lodging is comparable, with resorts, hostels, tenting, residences, and extra.

In right this moment’s related world, marketplaces like Reserving present a singular alternative to seize worth from many hyperlinks throughout the worth chain, as they provide a variety of lodging choices, transportation, and all kinds of points of interest.

Not solely does Reserving have essentially the most expansive presence within the worth chain, nevertheless it’s additionally technology-driven, with low capital necessities and comparatively excessive revenue margins, in contrast to the precise end-product suppliers.

Subsequently, as a foundation for dialogue, I discover it as an incredible car to put money into the journey {industry}.

Enterprise Overview

Reserving Holdings owns a number of manufacturers within the on-line journey company market, together with the title model Reserving.com, in addition to Priceline, Agoda, Rentalcars.com, Kayak, and OpenTable. The overwhelmingly important a part of the enterprise is Reserving.com.

Reserving Holdings 2022 10-Okay

Reserving operates as a web-based company by means of which vacationers can ebook lodging, and over the past couple of years, the corporate expanded its providing to flights, points of interest, and transportation.

Constant Share Taker From Expedia And Airbnb

For the sake of this part, I compiled the numbers of Airbnb (ABNB), Reserving, and Expedia (EXPE), three of the most important on-line journey marketplaces on this planet, which additionally occur to be public firms. Subsequently, that is completely based mostly on their public information, quite than third-party numbers that are much less coherent and troublesome to depend upon.

One other essential be aware, when you take heed to their incomes calls, you may see their respective managements all say they’re taking share and outgrowing their rivals. This can be true if we embody the smaller gamers within the area, but when we glance solely at these three, clearly, they can not all be share-gainers.

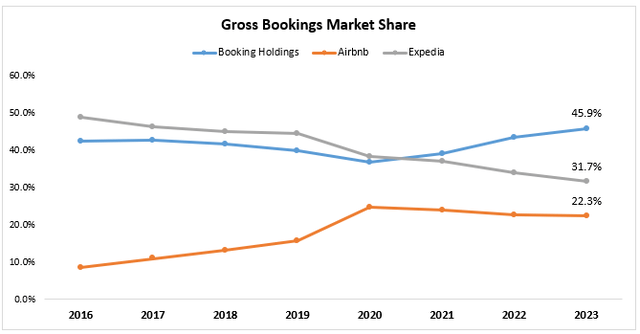

Gross Bookings

In 2023, Reserving had gross bookings of $150.6 billion, Airbnb had $73.3 billion, and Expedia had $104 billion, for a mixed $328.0 billion.

Created by the creator utilizing information from the businesses’ monetary studies.

As we will see, Reserving achieved a forty five.9% share, an eight-year file, with each Expedia and Airbnb shedding share. On an extended timeline, we will see that between 2016-2019, Airbnb took share from each Reserving and Expedia, with the latter being the first loser. Then, Covid-19 got here, throughout which most resorts had been shut down, resulting in an uncommon 12 months within the {industry}.

Submit-pandemic, from 2021 to right this moment, Airbnb stalled within the 22%-23% vary, whereas Expedia is bleeding share to Reserving.

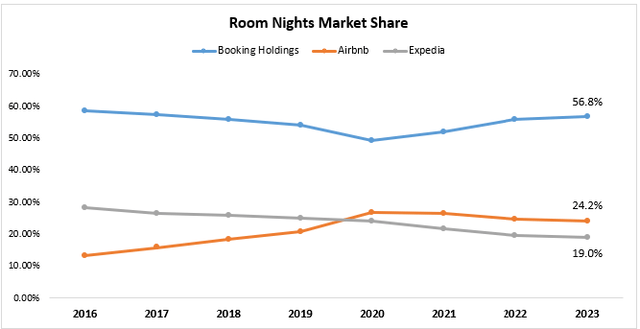

Room Nights

Gross bookings embody all types of bookings made on the platforms, which in Expedia’s and Reserving’s case means flight and transportation as effectively. Subsequently, room nights ought to present one other angle as to the market place of the businesses, particularly in lodging, and likewise make up for worth variations.

In 2023, complete room nights booked on the three platforms amounted to 1.84 billion, with Reserving at 1.05 million nights, in comparison with Airbnb and Expedia at 448 million and 351 million, respectively.

Created by the creator utilizing information from the businesses’ monetary studies.

Equally to the gross bookings development, Reserving achieved a seven-year file by way of share, coming in at 56.8%, whereas Airbnb had 24.2% and Expedia at 19.0%. Whereas Airbnb regressed to its pre-pandemic development, Expedia has been shedding market share constantly since 2016.

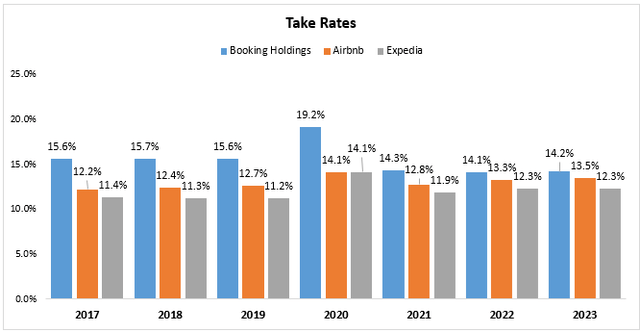

Take Charges

With Reserving’s aggressive share features, one may anticipate declining take charges, which means that the platform is giving up revenues to amass prospects. Nevertheless, that isn’t the case.

Created by the creator utilizing information from the businesses’ monetary studies.

Calculated as complete income divided by gross bookings, we will see that Reserving has the best take charge among the many three traditionally. That being mentioned, Reserving is the one one between the three with a decrease take charge in 2023 in comparison with 2021, albeit very marginally.

The decline in Reserving’s take charge, in my opinion, is primarily attributed to the additions of merchandise like flights, which have a decrease take charge.

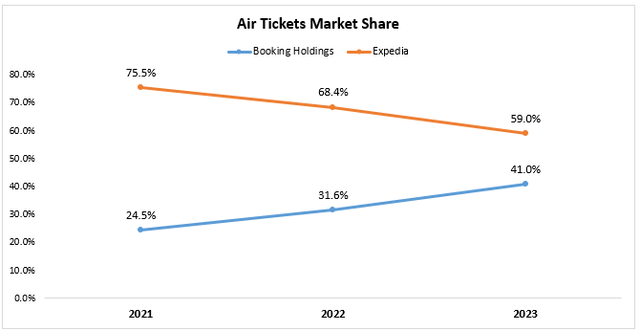

Flights

That is solely related to Reserving and Expedia.

Since Reserving began reporting the variety of flight tickets booked on its platform in 2021, we have seen important development in that space. Reserving facilitated 36 million air ticket transactions in 2023, which is greater than double the quantity it booked in 2021.

Created by the creator utilizing information from the businesses’ monetary studies.

Expedia has been rising a lot slower throughout this era, resulting in important share losses. In 2021, Reserving had under a 25% share, and in 2023, it reached 41%.

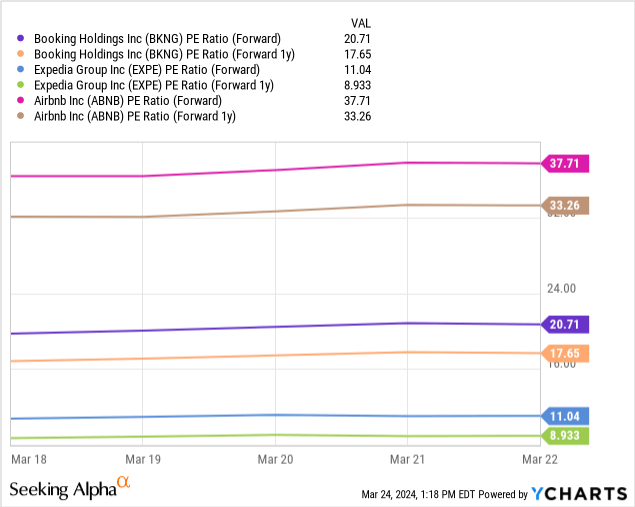

Regardless of Being A Chief, Reserving Trades At A Low cost To Airbnb

Operationally, I believe we will conclude Reserving is the primary participant out there. The corporate constantly takes market share throughout each line merchandise, whereas sustaining industry-leading take charges.

It additionally has the best working and free money movement margins between the three and had the best development charges over the previous three years (with 2020 as a baseline).

Contemplating all that we mentioned above, I might anticipate Reserving to be buying and selling at a premium. Nevertheless, that isn’t the case.

As we will see, Reserving is buying and selling at a 20.7x P/E over anticipated 2024 EPS, and 17.7x over 2025. Airbnb is buying and selling at 37.7x and 33.3x over 2025, reflecting 82% and 88% premiums, respectively.

Expedia is way decrease than Reserving, however because it continues to lose market share, I discover its decrease valuation justified.

Importantly, in 2025, Reserving’s EPS is predicted to develop by 17.3%, and Airbnb is predicted to develop by 14.1%, leading to respective PEG ratios of 1.0x and a pair of.4x.

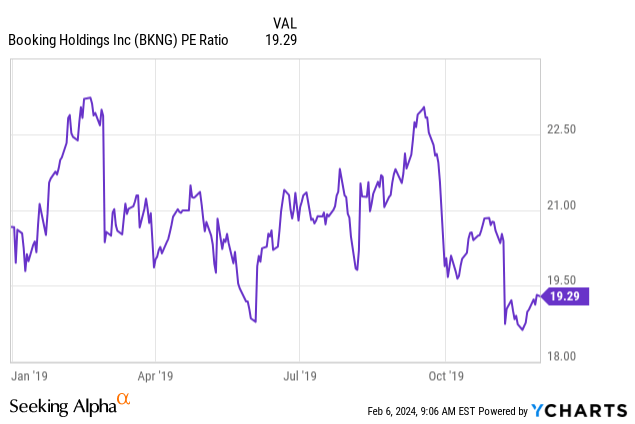

Valuation

So, relative to friends, I discover Reserving engaging. We nonetheless have to estimate whether or not Reserving is a beautiful funding.

Immediately’s 20.7x a number of is a low degree traditionally for the corporate. Previous to the pandemic, the one related 12 months to take a look at by way of historic valuation for Reserving was 2019. We are able to see that again then the inventory was buying and selling within the 20x-23x vary.

Arguably, this reveals us that Reserving is buying and selling on the low finish of its valuation vary. However there’s extra to that story.

Immediately’s Reserving is a distinct firm.

It has extra presence within the worth chain with flights, transportation, and various lodging. It has a stronger model, with greater than half of its bookings coming straight from its app, and a extra expansive buyer loyalty program. Moreover, it constructed a complete cost processing system, which helps it seize extra worth in each transaction.

As such, I imagine Reserving ought to get well again to the high-end of the vary within the close to time period. Based mostly on EPS estimates of $175.0 for 2024, I estimate Reserving’s honest worth at $3,940 a share, based mostly on a 22.5x P/E, offering us a near-term upside of 9%.

Dangers

As I mentioned, I anticipate Reserving will return to the excessive finish of its valuation vary by the tip of the 12 months. That mentioned, there are a number of dangers which may stop that from occurring and are at present weighing down on the inventory.

First, financial slowdown. A looming recession is a 2-year-old story, and whereas it’s but to return, we’re seeing indicators of a extra price-conscious shopper. Journey is a discretionary spend, and it may be crossed off the spending record fairly simply. We have not seen this within the firm’s outcomes thus far, as demand was so sturdy post-pandemic, however the firm’s steerage for 2024 suggests a return to normalized ranges.

Second, growing geopolitical tensions. The corporate mentioned the Center East battle negatively impacted leads to This fall’23, they usually anticipate it to be a 1% drag on income development for 2024. Because the disaster continues to develop, it is potential the affect can be extra important than initially thought, though Reserving’s administration has a monitor file of being very prudent with steerage.

Lastly, regulation. Reserving is dealing with a $530m positive in Spain over anti-competitive habits and is being probed by Italy’s antitrust physique as effectively. Moreover, the corporate, which has a historical past of acquisitions, was blocked by the EU in a current try to amass Etraveli, a web-based flight company.

General, I believe these dangers are the principle purpose Reserving is buying and selling at a 20x P/E, which suggests they’re priced in, and I discover them momentary.

Conclusion

I discover the journey {industry} to be a beautiful place for funding, because it’s approach much less cyclical than folks are inclined to suppose. I might say it is a sector with sequential development, driving the expansion in wealth and digitalization, that experiences occasional cycles.

I view Reserving because the clear chief, with constant market-share features and industry-leading profitability.

With growing worries about an financial slowdown, rising geopolitical tensions, and better regulatory pressures, I discover it cheap that the corporate is buying and selling on the low finish of its valuation vary.

Nevertheless, I imagine Reserving is well-positioned to capitalize on the {industry}’s development as we come out of this momentary downturn.

Subsequently, I charge Reserving a Purchase and encourage traders to begin accumulating shares at these ranges.

[ad_2]

Source link