[ad_1]

There are as some ways to regulate an iron condor – a lot of which contain transferring strikes of the choices up or down on the identical expiration date.

Immediately, we’ll have a look at an fascinating adjustment that includes including a time unfold with two completely different expirations to the condor.

We are going to add a calendar on the brief strike of the unfold that’s being threatened.

For ease of modeling the expiration graph, it’s best to have the calendar’s near-term expiration be the identical because the iron condor’s.

The calendar’s far-term expiration may be a while after that.

Contents

It can make extra sense once we have a look at an instance.

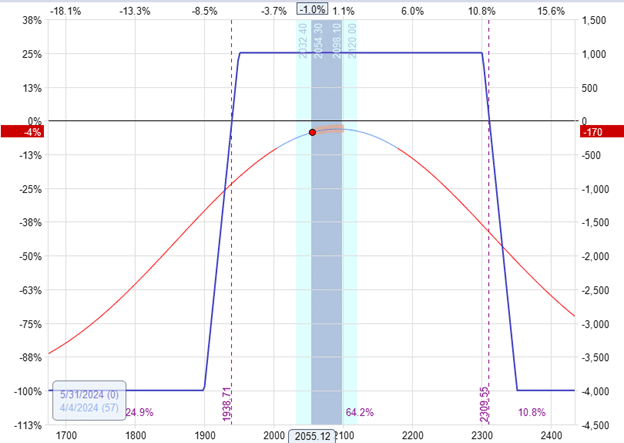

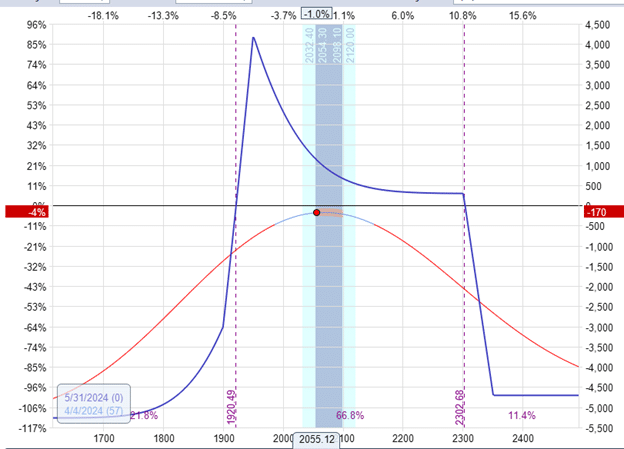

Suppose a dealer has the next iron condor commerce in RUT already in progress:

Date: April 4, 2024

Value: RUT @ 2055

One lengthy Could 31 RUT 2350 callOne brief Could 31 RUT 2300 callOne brief Could 31 RUT 1950 putOne lengthy Could 31 RUT 1900 put

The put unfold is being threatened, with the worth of RUT happening, inflicting the brief put to be on the 24 delta on the choice chain.

The present Greeks are:

Delta: 2.82Theta: 14.03Vega: -93.85

The dealer want to scale back the delta to be a bit nearer to zero by including a calendar with strikes at 1950, the identical because the short-put strike.

Promote one Could 31 RUT 1950 putBuy one June 21 RUT 1950 put

This may price a debit of about $710 and can change the expiration graph to the next:

When working with trades that contain two completely different expirations, the graph all the time exhibits the anticipated P&L on the closest expiration.

You’ll discover that after the adjustment, the worth dot is sitting extra steady on prime of the curved T+0 line than earlier than.

That is additionally mirrored by the development of the Greeks.

Delta: 1.21Theta: 21.22Vega: -40.68

The adjustment decreased the delta by about half.

The calendar will increase the theta.

The quantity of adverse vega additionally decreased.

As a result of the condor dealer is a non-directional premium vendor, the dangers are the directional threat and volatility threat.

Subsequently, getting delta and vega nearer to zero is a profit. Growing theta is the principle revenue technology technique within the commerce.

The iron condor wanted adjustment on this instance as a result of the RUT index was happening. When the market goes down, volatility usually will increase.

As a result of the condor is adverse vega, it doesn’t prefer it when volatility will increase.

Including the calendar decreases the general vega, making the commerce much less delicate to volatility modifications.

The calendar is constructive vega and isn’t bothered by will increase in volatility.

If RUT continues down, the calendar will revenue from its directional motion and the accompanying volatility improve.

The thought is that the calendar can present some features to offset among the losses within the condor.

4 Ideas For Higher Iron Condors

Whereas the calendar does have advantages when positioned under the underlying value, this isn’t to say that it can’t be used above the worth.

The calendar adjustment may be added if the decision unfold is threatened as the worth of the underlying strikes up.

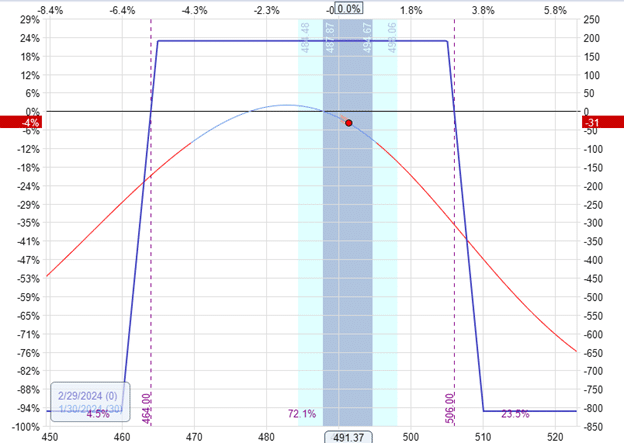

For instance, suppose a dealer has the next iron condor commerce in progress on SPY:

Date: January 30, 2024

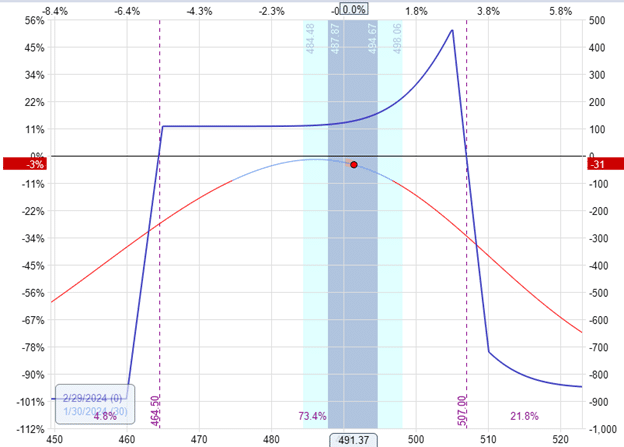

Value: SPY @ $491.37

Lengthy two February 29 SPY $510 callsShort two February 29 SPY $505 callsShort two February 29 SPY $465 putsLong two February 29 SPY $460 places

The value is getting too near the brief name, which is now the 23 delta on the choice chain.

The present Greeks are:

Delta: -11.45Theta: 5.96Vega: -29.14

The dealer provides a calendar centered at $505 (the identical strike because the brief name):

Promote one February 29 SPY 505 name

Purchase one March 8 SPY 505 name

This price a debit of $82.

The Greeks improved to be:

Delta: -7.30Theta: 5.73Vega: -19.14

It decreased the quantity of adverse delta and the quantity of adverse vega.

The theta didn’t change a lot on this occasion.

The brand new expiration graph appears like this:

The calendar decreased the general place delta from -11.45 to -7.30, that means it had 4.15 models of constructive delta.

If the dealer feels that is inadequate to get the delta shut sufficient to zero, the dealer can add two contracts to the calendar (matching the variety of condor contracts).

Two calendars would offer an 8.30 constructive delta and scale back the commerce’s web place delta from -11.45 to -3.50.

If the dealer’s place measurement permits for it, beginning the condor with two contracts is advantageous.

The dealer can higher fine-tune the adjustment, selecting so as to add both one or two calendars as deemed obligatory.

It will assist if you happen to practiced the adjustment for some time to determine the nuances of this system.

For instance, the calendar didn’t improve theta a lot within the second instance as a result of it was too distant from the underlying value.

Attempt to experiment by transferring the calendar nearer to the cash.

Our examples positioned the calendar on the brief strike of the unfold as a result of that’s typically an excellent place to begin to fine-tune the adjustment additional.

However no rule says it’s important to place the calendar there.

Shifting the location of the calendar additionally modifications the quantity of delta it contributes to the place.

One other variable to experiment with is the time distinction between the close to and far-term expiration.

Growing the time unfold distinction between the 2 expirations will price extra however will give your calendars extra energy.

As soon as you determine all of the intricacies, utilizing the calendar to defend the iron condor is an efficient method so as to add as a non-directional delta-neutral dealer.

We hope you loved this text on calendarizing an iron condor.

If in case you have any questions, please ship an electronic mail or go away a remark under.

Commerce protected!

Disclaimer: The knowledge above is for academic functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who should not aware of change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.

[ad_2]

Source link