[ad_1]

Kwarkot

With NAREIT’s REITweek convention subsequent week, now is an effective time to see which REIT shares display screen the perfect by the SA Quant system. Of the 114 shares that seem when together with each REIT class within the SA inventory screener, two of the high three SA Quant rankings are cannabis-focused REITs.

Hashish REIT NewLake Capital Companions (OTCQX:NLCP) ranks highest of the SA Quant’s Sturdy Buys, adopted by retail REIT CTO Realty Development (NYSE:CTO) and Progressive Industrial Properties (NYSE:IIPR), one other hashish REIT.

NLCP will get high marks in profitability, momentum, and EPS revisions below the SA Quant system, whereas IIPR scores A+ on development and momentum.

CTO, which additionally owns a stake in web lease REIT Alpine Earnings Property Belief (NYSE:PINE), will get high marks in development and EPS revisions.

InvenTrust Properties (NYSE:IVT), an proprietor of multi-tenant retail properties within the Sunbelt usually anchored by a grocery retailer, ranked fourth within the screening, with A+ marks in EPS revisions.

Rounding out the highest 5, Important Properties Realty Belief (NYSE:EPRT), which owns and leases single-tenant properties to middle-market corporations corresponding to eating places, automobile washes, gear corporations, and medical and dental companies, shines the brightest on development and profitability.

these 5 corporations’ common Wall Avenue rankings, NewLake Capital (OTCQX:NLCP), CTO Realty (CTO), and Important Properties (EPRT) all rank Sturdy Buys.

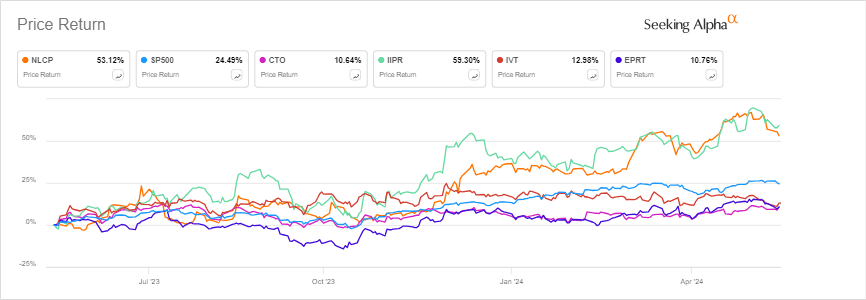

Of the 5 shares, the hashish REITs carried out the perfect prior to now yr, with IIPR climbing 59% and NCLP leaping 53%, simply beating the S&P 500’s 24% enhance.

Of the 5 corporations, two are presenting at REITweek — InvenTrust (IVT) on June 4 at 9:30 AM ET and CTO Realty (CTO) on June 5 at 3:30 PM.

In all, 14 REITs have been rated Sturdy Buys by the SA Quant system. The others are: Host Resorts & Resorts (HST), Nationwide Well being Buyers (NHI), Kite Realty Group (KRG), Cousins Properties (CUZ), Vici Properties (VICI), Alpine Earnings Property Belief (PINE), NetstREIT (NTST), and EPR Properties (EPR).

Extra on NewLake, Progressive Industrial

[ad_2]

Source link