[ad_1]

Compassionate Eye Basis/David Oxberry/DigitalVision through Getty Pictures

Cannae Holdings (NYSE:CNNE) is a holding firm that was based by Invoice Foley, a billionaire and West Level graduate with a long run historical past of making worth for shareholders. CNNE offers you the alternative to “tag alongside” with Invoice Foley. It normally trades at a giant low cost to the “sum of the elements” or mark-to market valuation of the underlying portfolio. Administration has just lately elevated efforts to scale back the low cost.

What Can Shut the CNNE low cost valuation hole?

There are a number of issues that may assist to shut the hole. CNNE administration has already carried out a few of them:

Share buybacks: CNNE has already accomplished a big quantity of share buybacks at vital reductions since 2021. Share distributions: CNNE just lately launched a $0.12 quarterly dividend. They plan to take care of and step by step enhance the dividend over time. Revival within the IPO marketplace for new points. Higher NAV efficiency of the underlying portfolio. CNNE can take into account doing spin-offs of a few of their holdings to their shareholders. An acquirer might resolve to purchase a few of Cannae’s bigger holdings or maybe even “take out” the whole firm. Invoice Foley owns about 8% of the shares and should even take into account taking it non-public himself.

Within the final earnings name, Cannae’s President Ryan Caswell commented on the corporate’s plans to develop NAV and shrink the low cost to NAV:

“We proceed to give attention to executing our strategic plan designed to develop each the web asset worth or NAV of our portfolio whereas additionally working to shut our share worth low cost to NAV. Our technique has three principal levers, together with: bettering the efficiency and valuation of our portfolio corporations; making new investments, primarily in non-public companies that can produce money flows and develop NAV; and offering capital returns to our shareholders by means of both our just lately launched money dividend or share repurchases. We imagine the mixture of those three strategic pillars will shut the worth hole between our inventory worth and NAV.”

Cannae Historical past

Cannae started as a holding firm in 2017 when it was spun off from Constancy Nationwide Monetary (FNF). Invoice Foley did job for shareholders at FNF. He typically used the next technique:

Recognized undervalued property Carried out operational efficiencies Used progress methods to ship shareholder worth.

Mr. Foley has led a number of totally different multi-billion greenback public market platforms with over 100 acquisitions throughout numerous platforms. Some examples are Constancy Nationwide Monetary (FNF), Constancy Nationwide Data Companies (FIS), Black Knight (BKI), Ceridian (CDAY), FGL Holdings (FG) and Dun & Bradstreet (DNB).

Market Efficiency

The latest three and 5 12 months efficiency for CNNE has been fairly poor, largely due to the meltdown in SPAC corporations and different venture-style corporations because the bubble interval in 2021. I’ve proven the full return efficiency for varied durations in comparison with shares in Morningstar’s US Market Whole Return benchmark.

Time Interval

CNNE Return

US Market Return

5 years annualized

– 9.16%

14.28%

3 Years annualized

-18.42%

6.48%

1 Yr

– 5.42%

20.73%

YTD

– 6.00%

11.86%

3 Months

-10.75%

2.16%

Click on to enlarge

Supply: Morningstar as of August 12, 2024

The returns from Morningstar above are for a passive purchase and maintain investor.

However an energetic dealer might have accomplished significantly better throughout these time durations by actively buying and selling the March 2024 Modified Dutch Public sale tender provide. Cannae bought $200 million price of inventory utilizing a Dutch public sale with a worth vary of $20.75- $23.75.

The public sale worth was finally decided as $22.95. CNNE shares had been available in late 2023 at a lot decrease costs within the $16 to $20 vary and round $20 within the first few months of 2024.

The wonderful factor about this Dutch public sale is that there was 100% proration. Which means that all the shares tendered within the public sale acquired the $22.95 worth. Lively merchants might have loaded up within the months previous to the Dutch Public sale and earned vital earnings by tendering their shares.

What About Distributions?

Throughout most of its existence, Cannae has not paid out any distributions. It was much like Berkshire Hathaway, and primarily used share buybacks to return worth to shareholders.

However with a purpose to handle the persistent low cost to NAV since inception, Cannae administration has just lately began to pay quarterly distributions. They will even proceed to do some share buybacks when the low cost to NAV is massive.

Right here is how administration described the brand new dividend coverage within the final earnings name:

“In the present day we introduced a dividend of $0.12 per share, per quarter payable on June twenty eighth to offer an extra return of capital to our long-term shareholders.

We initially will fund the dividends together with the one subsequent month by means of the sale of property however extra time want to make money circulate generative acquisitions. There can be a supply of money to fund the dividend. Within the first quarter we offered 10 million shares of D&B for about $101 million and a pair of.55 million shares of Dayforce for whole proceeds of $177 million.

We used the proceeds from these gross sales to fund the Tender Supply in addition to for common company functions. Going ahead, once we want capital to fund potential enterprise share buybacks and the dividend we count on to promote parts of our public holdings.”

Throughout the earnings name, an analyst requested how lengthy the dividend coverage can be in place. Invoice Foley answered by saying the brand new dividend coverage can be everlasting:

“It should be in place for so long as we’re round. The objective, in fact, is to begin modestly with a $0.12 per share per quarter dividend. Then as we have accomplished with FNF, as you recognize, enhance that dividend as money circulate permits. We’re dedicated to the dividend going ahead on a constant foundation”

Share Repurchases

The CNNE administration has persistently accomplished share repurchases when the shares commerce at a big low cost to NAV or the sum of the elements honest worth. A complete of $31.4 million shares or about 34% of excellent shares in March 2021 have been repurchased for $733 million.

Cannae Share Repurchase Exercise

Yr

Repurchase Amt

Avg. Low cost

2021

$167 Million

28%

2022

$225 Million

44%

2023

$119 Million

45%

2024

$222 Million

31%

Click on to enlarge

Given the current weak point within the CNNE inventory worth and pretty excessive low cost, I imagine we will count on to see administration proceed to make use of share buybacks as a software to assist slender the low cost to honest worth. However they’ve additionally added the quarterly distribution as one other software.

Insider Possession and Latest Insider Shopping for

There’s appreciable possession of CNNE inventory by the administration staff. Here’s a checklist of govt officers and administrators of CNNE who personal greater than 30,000 shares of the inventory. The information is taken from a current proxy assertion as of April 22, 2024:

Identify

Shares Owned

Proportion

William P. Foley, II

4,834,113

7.6%

Frank P. Willey

438.768

*

Ryan R. Caswell

424,791

*

Frank R. Martire

322,712

*

Richard N. Massey

274,367

*

Michael L. Gravelle

155,521

*

Peter T. Sadowski

140,461

*

Erika Meinhardt

124,685

*

Bryan D. Coy

99,589

*

Hugh R. Harris

47,793

*

C. Malcolm Holland

30,796

*

Click on to enlarge

* Underneath 1%

Portfolio Holdings

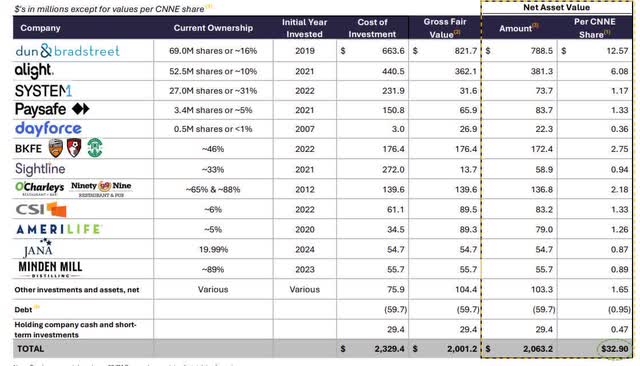

CNNE runs a extremely concentrated portfolio. The primary 5 positions listed beneath are publicly traded. The opposite points are non-public the place % possession is listed as an alternative of variety of shares owned.

CNNE Sum of The Components (CNNE Net Web site)

Cannae gives each a Gross Honest Worth and a Web Asset Worth. The Web Asset Worth represents the Gross Honest Worth much less taxes (21% company price). For the Dayforce holding (DAY), ISIP charges are utilized (10% of achieve on DAY above $29.58 per share). This method might end in a tax profit when an funding’s price exceeds gross honest worth.

The Debt consists of $59.7M excellent on the 7.0% FNF word maturing in November 2025. Cannae additionally has a $150M margin mortgage (with curiosity price of 3-month adjusted SOFR + 3.10%) maturing March 2027. There’s a $500M incremental debt function which permits Cannae to extend the mortgage dedication below sure circumstances.

The honest worth per share was $32.90 as of August 8, 2024 in comparison with the closing share worth of $19.95 or a 39% low cost to NAV.

Cannae normally gives their Sum of the Components evaluation on the finish of every month, however they generally gives an extra replace like they did on August 8. I preserve a watch checklist of the 5 publicly traded Cannae points. For publicly traded points, Cannae makes use of the closing worth of their NAV calculation. The watch checklist gives a solution to estimate adjustments within the NAV from the final reported worth.

Portfolio Updates From CNNE Quarterly Report

1) Dun & Bradstreet (DNB):

On August 5, 2024, D&B issued an announcement noting that it has acquired inbound curiosity from third events and retained Financial institution of America to help with these inquiries Reported second quarter 2024 whole income of $576 Million with natural fixed foreign money income progress of 4.3% over the second quarter 2023 Adjusted EBITDA progress continued to exhibit power, rising 5.8% to $218 Million within the second quarter of 2024, up from $206 Million within the prior 12 months second quarter The corporate repurchased roughly 961,000 shares of D&B inventory, almost 10% of their 10 Million share authorization, whereas sustaining their web leverage ratio at 3.7 occasions

2) Alight (ALIT):

Introduced CEO succession plan. Closed on the sale of its Skilled Companies section and its Payroll & HCM Outsourcing companies for as much as $1.2 Billion. Used $740 Million of the proceeds to scale back debt, lowering leverage to 2.8 occasions Repurchased $80 Million of Alight shares and commenced a $75 Million accelerated share repurchase plan Second quarter 2024 income from persevering with operations was $538 Million, down 4% from 2023 Adjusted EBITDA from persevering with operations was $105 Million in Q2 2024, in comparison with $119 Million in Q2 2023, down 12%. The corporate has 97% of 2024 income below contract

3) Dayforce (DAY):

Continued its progress story within the second quarter of 2024, reporting double digit will increase throughout all income metrics, adjusted EBITDA and money circulate from operations Introduced $500 Million share repurchase program Raised full 12 months 2024 steering for income and adjusted EBITDA Because the finish of the primary quarter, Cannae has offered 1 Million DAY shares for mixed proceeds of $57 Million, marking $2.43 Billion in gross proceeds from tendencies since DAY’s IPO in 2018.

4) Paysafe (PSFE):

First quarter 2024 cost quantity and whole income each elevated 8% whereas Adjusted EBITDA elevated 4% year-over-year Administration reaffirmed its 2024 income and adjusted EBITDA steering forecasting income progress of 5.5% to 7.0% and Adjusted EBITDA margins of 28.0% to twenty-eight.5% Paysafe will report its second quarter outcomes on Tuesday, August 13, 2024, earlier than market open

5) System1 (SYS):

Continued to scale back leverage, repaying $155 Million of debt since November 2023 Reported first quarter 2024 whole income of $85 Million, forward of consensus analyst estimates Adjusted EBITDA was $0.4 Million for the primary quarter 2024, exceeding the highest finish of the corporate’s steering System1 reported its second quarter outcomes on Thursday, August 8, 2024 after the market shut. All key monetary outcomes had been above the high-end of steering vary.

6) Black Knight Soccer:

• AFC Bournemouth accomplished the Premier League season in twelfth place (out of 20 groups). The membership’s 48 factors is probably the most the Cherries have ever earned within the Premier League.

• Pushed by the Cherries success on the pitch, revenues elevated 19% over the prior 12 months to $203 Million within the 12 months ended June 30, 2024.

• The membership resigned a number of key gamers and purchased a number of younger and promising gamers, together with Dean Huijsen from Juventus.

7) Different Information

• Within the second quarter 2024, Cannae made its first funding with Jana Companions, which introduced an funding stake and engagement marketing campaign round Rapid7 (RPD), a cybersecurity firm specializing in vulnerability administration.

• In mild of destructive operational money flows, uncertainty in forecasts and a challenged liquidity place, Cannae impaired the worth of its funding in Sightline Funds by $141 Million.

• Minden Mill Distillery expects to launch rye, whiskey and single malt manufacturers within the third quarter 2024, following the profitable launch of Excessive Floor Vodka within the second quarter of 2024.

• Laptop Companies, Inc. introduced a partnership with TruStage Compliance Options, a regulatory expertise firm whose warranted paperwork and compliance expertise are utilized by greater than 5,000 monetary establishments nationwide.

• Restaurant Group reported Adjusted EBITDA of $5.4 Million within the second quarter of 2024, greater than double the $2.5 Million achieved within the second quarter of 2023.

• As of August 7, 2024, Cannae had $30 Million in company money and short-term investments and $150 Million of margin mortgage undrawn capability, offset by $60 Million in excellent revolver debt.

Conclusion

A non-accredited retail investor usually finds it arduous to take part in non-public fairness and enterprise capital investing. Even accredited buyers who make investments immediately in non-public fairness/enterprise capital funds usually sacrifice liquidity and should tie up their cash for years.

CNNE is publicly traded, has a robust administration staff which is pretty shareholder-friendly, and offers you entry to some non-public corporations not usually obtainable to retail buyers. It at the moment trades at a cut price worth, effectively beneath a “sum of the elements” honest worth.

CNNE additionally gives day by day liquidity, which isn’t obtainable to most various non-public fairness/enterprise capital buyers. There are additionally tradable put and name choices which can be utilized for hedging functions.

CNNE has been fairly liquid these days and has a median buying and selling quantity of 466,000 shares a day. The shares might be fairly risky, and it could be worthwhile to begin with a small starter place after which add extra shares opportunistically. A watch checklist of the publicly traded points might be tracked, and extra heaps might be bought when the watch checklist shares are up greater than the CNNE share worth on a proportion foundation.

[ad_2]

Source link