[ad_1]

Terraxplorer/E+ through Getty Photos

Capital Group Core Fairness ETF (NYSEARCA:CGUS) is an actively managed fund with a method that, based on its web site, mixes “progress and earnings to doubtlessly present a smoother experience.” CGUS represents a reasonably uncommon instance of an ETF that I’ve rated a Purchase. Again in February 2024, there have been two key causes for that, particularly its spectacular previous efficiency and the steadiness of fashion elements I discovered completely sound for the dominating market narrative and, therefore, able to securing extra positive aspects. And at this time, I wish to focus on why this ranking ought to be maintained.

What are the integral elements of CGUS technique?

As described within the prospectus, CGUS is managed actively, favoring

…widespread shares of corporations that the funding adviser believes show the potential for appreciation and/or dividends.

Although U.S. targeted, the ETF

… might make investments as much as 15% of its belongings, on the time of buy, outdoors the US. The fund is designed for buyers looking for each capital appreciation and earnings.

The next is alleged concerning the securities choice:

The fund depends on the skilled judgment of its funding adviser to make choices concerning the fund’s portfolio investments. The fundamental funding philosophy of the funding adviser is to hunt to put money into attractively valued corporations that, in its opinion, characterize good, long-term funding alternatives. Securities could also be bought when the funding adviser believes that they now not characterize comparatively engaging funding alternatives.

CGUS efficiency: an outperformer proves its fame

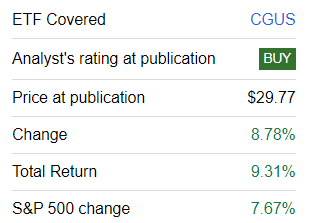

First, since my earlier notice revealed on February 9, CGUS has outpaced the S&P 500 index.

Searching for Alpha

Wanting a bit nearer at month-to-month efficiency, we see that CGUS has overwhelmed the iShares Core S&P 500 ETF (IVV) in three out of 8 full months. Because of spectacular efficiency in July (1.49% outperformance), it was forward of the S&P 500 ETF by 27 bps in January-August.

Second, through the March 2022-August 2024 interval (CGUS was launched in February 2022), CGUS beat IVV by 1.37% (annualized return), additionally delivering decrease volatility and, as a consequence, stronger risk-adjusted returns.

Metric CGUS IVV Begin Stability $10,000 $10,000 Finish Stability $13,833 $13,420 CAGR 13.86% 12.49% Normal Deviation 16.84% 18.14% Finest Yr 27.71% 26.32% Worst Yr -9.49% -11.02% Most Drawdown -20.37% -20.28% Sharpe Ratio 0.62 0.52 Sortino Ratio 0.93 0.78 Benchmark Correlation 0.99 1 Upside Seize 95.97% 100% Draw back Seize 89.95% 100% Click on to enlarge

Information from Portfolio Visualizer. IVV was used as a benchmark

CGUS present issue combine: largely sturdy, minor disadvantages over IVV

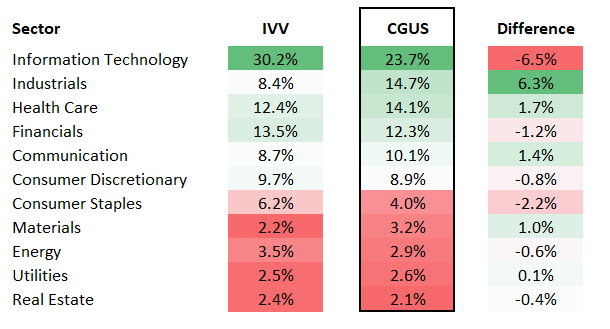

As of September 4, there have been 91 equities within the CGUS portfolio, with the important thing sector being data know-how (23.7%), adopted by industrials (14.7%) and well being care (14.1%). As talked about above, the fund can enterprise outdoors of the U.S. in pursuit of promising shares, and the present model of the portfolio does have some abroad publicity. Extra particularly, within the holdings dataset from the ETF’s web site, I discovered 15 shares (11.7% of the online belongings) with a rustic code apart from ‘US.’ Most of them are Canadian corporations (4 shares, 3.3%, together with Canadian Pure Assets (CNQ)), however there are additionally Swiss, French, British, Irish, Japanese, Korean, and Dutch shares. With a LR0008862868 ISIN, Royal Caribbean Cruises (RCL) can also be on that listing; the rationale for that may be discovered on web page 2 of its Type 10-Ok:

…the present mother or father company, Royal Caribbean Cruises Ltd., was included on July 23, 1985 within the Republic of Liberia below the Enterprise Company Act of Liberia.

How considerably has the CGUS portfolio modified since February? Its basket is definitely not static, and it does add and take away shares on occasion. For instance, as I used to be engaged on this notice for just a few days, I observed that the ETF added Sanofi (SNY) in some unspecified time in the future between September 2 and September 4. And since February, greater than 20% of its portfolio has been changed, and the rely of equities went from 120 to simply 91. The three key deletions are proven under:

Inventory Weight as of February 7 Hilton Worldwide (HLT) 0.78% ConocoPhillips (COP) 0.75% Northrop Grumman (NOC) 0.75% Click on to enlarge

Information from the ETF

Essentially the most important additions had been as follows:

Inventory Weight as of September 4 Constancy Nationwide Info Companies (FIS) 1.42% Air Merchandise and Chemical compounds (APD) 1.31% S&P World (SPGI) 0.91% Click on to enlarge

Information from the ETF

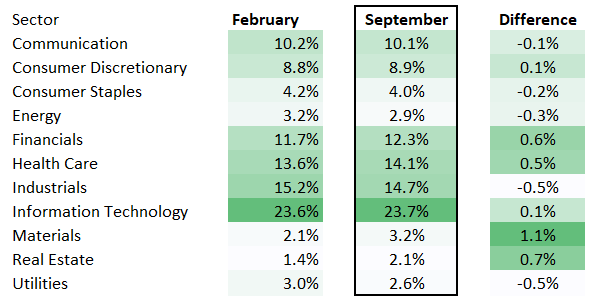

Regardless of a couple of fifth of the basket changed, CGUS’ sector allocation modified solely slightly.

Created by the creator utilizing information from Searching for Alpha, CGUS, and ITOT

For readability, getting ready the sector evaluation tables, I additionally used information from the iShares Core S&P Complete U.S. Inventory Market ETF (ITOT).

The following desk illustrates how CGUS’ sector combine compares to that of IVV. The image is just like the one we noticed in February. The important thing takeaway is that CGUS underweights IT and overweights industrials.

Created by the creator utilizing information from Searching for Alpha and the ETFs

What has modified by way of issue story? Allow us to begin with worth.

Valuation: some expensiveness to tolerate

Maybe the primary query price asking right here is whether or not CGUS’ opinion on the Magnificent Six differs from that of the S&P 500 fund. Or on the trillion-dollar league general, together with Apple (AAPL), Amazon (AMZN), Berkshire Hathaway (BRK.B), and many others.? In actual fact, I’d say that its stance on these bellwethers is simply barely totally different, as all seven trillion-dollar corporations are current in its portfolio, so it appears the fund is bullish on all of them. Nevertheless, they nonetheless have a lot smaller weight, 26.6% vs. 30.3% in IVV.

Metric CGUS IVV Market Cap $803.52 billion $906.47 billion Adjusted EY 3.45% 3.82% P/S 6.89 7.57 EV/EBITDA 21.73 22.47 Quant Valuation B- or larger 5.22% 5.93% Click on to enlarge

Calculated by the creator utilizing information from Searching for Alpha and the ETFs. Monetary information as of September 5

Its smaller allocation to probably the most richly valued corporations on the planet is likely one of the the explanation why its weighted-average market cap is decrease than that of IVV. A bit extra comfy Enterprise Worth/EBITDA and Value/Gross sales are additionally the consequence of that. Nevertheless, the adjusted earnings yield is, surprisingly, decrease, and publicity to shares with the Quant Valuation rankings of B- or larger is smaller as effectively. As a reminder, the adjusted EY was 3.9% as of February 8, so it appears it has retreated on the again of capital appreciation, plus modifications within the inventory combine have additionally impacted it. Nonetheless, whereas I would like to see higher worth traits, I see that is an inadequate argument to downgrade the ranking.

Development traits

Turning to progress, at first look, it appears CGUS provides a bit much less interesting progress profile. Nevertheless, upon extra attentive inspection, it seems that it has one important benefit: it has smaller publicity to corporations which are forecast to ship decrease gross sales and/or earnings per share going ahead.

Metric CGUS IVV EPS Fwd 16.08% 17.16% Income Fwd 9.74% 11.51% EBITDA Fwd 14.78% 18.60% Quant Development B- or larger 45.30% 43.20% Forecast EPS contraction 9.9% 14.73% Forecast income contraction 6.39% 10.56% Click on to enlarge

Calculated by the creator utilizing information from Searching for Alpha and the ETFs

Profitability and capital effectivity

On the standard entrance, it additionally appears IVV is a bit forward. Nevertheless, I wish to emphasize that, exactly like in February, CGUS provides a powerful story as effectively, as all of the metrics under are confidently above the extent I take into account needed for big/mega-caps-focused portfolios (i.e., Return on Belongings above 10% and adjusted Return on Fairness above 20%, and many others.).

Metric CGUS IVV ROA 10.78% 14.14% Adjusted ROE 20.17% 20.20% Web Revenue Margin 18.61% 21.20% Quant Profitability B- or larger 91.61% 94.93% Web CFFO-negative corporations 1.6% 3.2% Click on to enlarge

Calculated by the creator utilizing information from Searching for Alpha and the ETFs

Aside from that, it has a bit smaller publicity to corporations that outspent their web working money flows within the final twelve months.

Ultimate ideas

CGUS represents an lively technique with spectacular returns and strong high quality. I consider the ETF is on observe to ship one more alpha yr. In January-August, it has already outperformed IVV by 27 bps, and I see no materials purpose why it ought to lose its edge even regardless of variations in charges (3 bps vs. 33 bps).

Nevertheless, it doesn’t indicate dangers don’t exist. In my earlier notice, I defined that in case of a market-wide correction (and we’re most likely watching one within the making because the S&P 500 is down by 1.73% as I’m penning this on September 6, possible due to the comfortable August jobs report), CGUS can also be weak. However even right here it has a bonus—a meaningfully decrease historic draw back seize ratio, implying that if IVV goes south, CGUS will fare a bit higher. This level continues to be related at this time.

[ad_2]

Source link