[ad_1]

The Bitcoin market has witnessed vital shifts just lately, influenced by macroeconomic components and altering investor sentiments. Final week, digital asset funding merchandise noticed substantial outflows, which CoinShares attributed to a number of key financial updates.

These included the discharge of US CPI knowledge, the Federal Open Market Committee (FOMC) assembly, and Producer Worth Index (PPI) figures. These occasions appeared to spark a speedy surge in Bitcoin value, pushing it briefly in the direction of the $70,000 mark earlier than a swift downturn adjusted the valuation again to round $65,000.

Associated Studying

Market Shifts: BTC Faces Main Outflows Whereas Some Altcoins Appeal to Funding

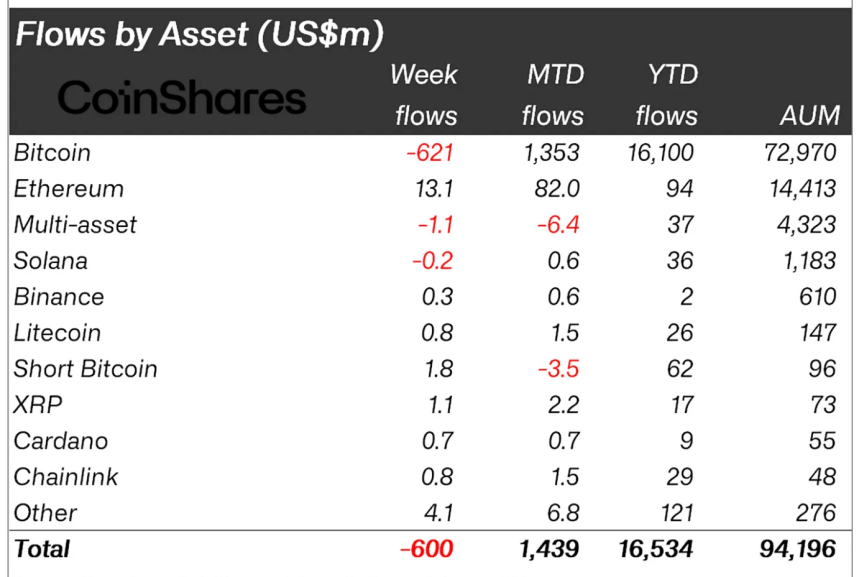

Thus far, this fluctuation in Bitcoin’s value is a part of a broader sample of volatility that has characterised the digital foreign money market. Simply final week alone, institutional and retail buyers pulled again roughly $600 million from crypto funds, marking a big retreat.

CoinShares means that this might sign a rising pattern of warning, amplified by a “hawkish stance” on the latest FOMC assembly, which can have inspired buyers to scale back their publicity to risky belongings like cryptocurrencies.

Bitcoin, notably probably the most impacted, confronted outflows totaling $621 million. Regardless of this, there was a silver lining as altcoins like Ethereum, Litecoin, and others noticed minor inflows. Ethereum led with a $13 million improve, suggesting divergent investor confidence in altcoins in comparison with Bitcoin.

This state of affairs presents a blended view the place Bitcoin struggles below promoting strain whereas choose altcoins achieve marginal traction. In the meantime, the general affect in the marketplace has been palpable, with whole belongings below administration dropping from over $100 billion to $94 billion inside per week.

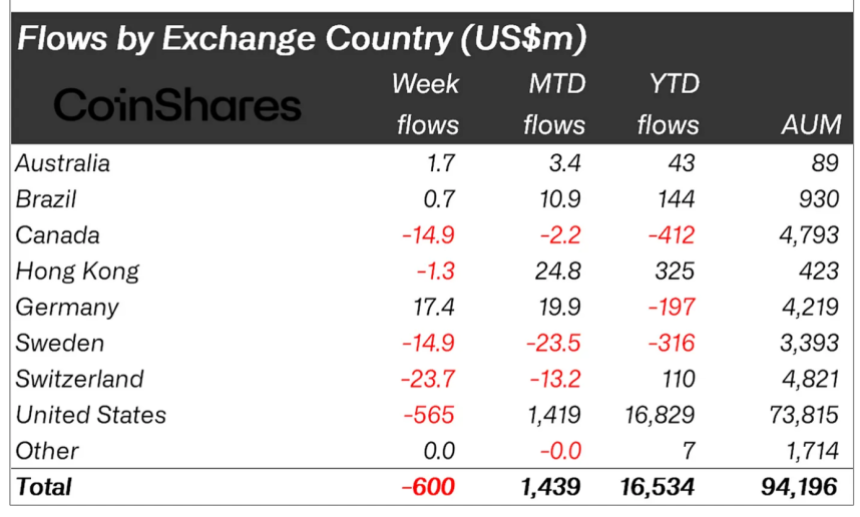

Buying and selling volumes additionally dipped considerably from their annual common, indicating a cautious strategy by merchants throughout the board. Regionally, whereas the US skilled the brunt of the outflows, international locations like Germany noticed inflows, suggesting a different international response to the present financial local weather.

Bitcoin ETFs See Blended Fortunes

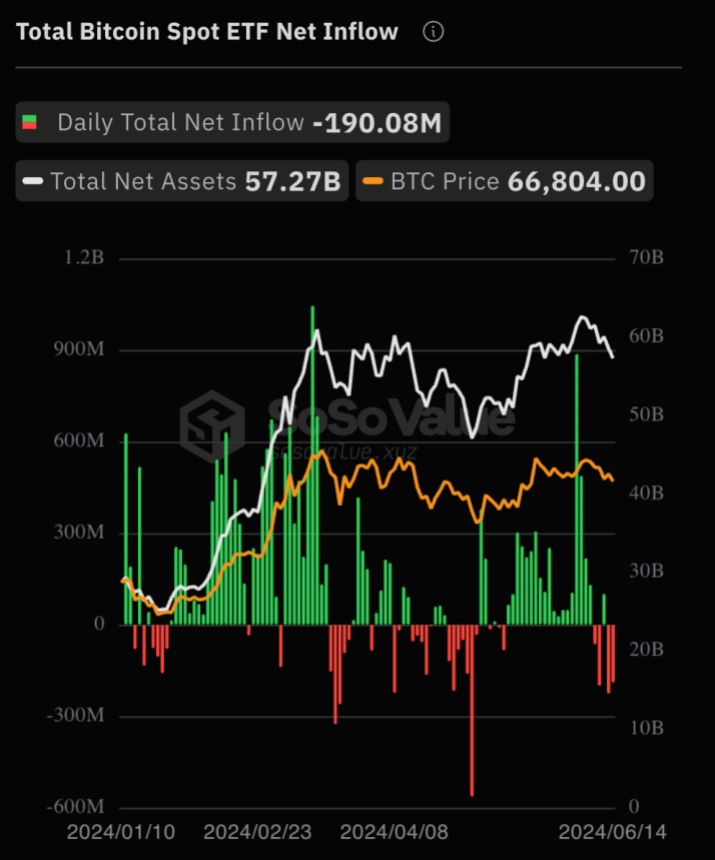

Regardless of a gentle improve within the general internet inflows into US spot Bitcoin exchange-traded funds (ETFs), which reached $15.11 billion in latest weeks, the sector skilled a downturn final week with a internet outflow of $190 million per day, primarily based on knowledge from SoSoValue.

By way of market efficiency, Bitcoin’s worth sharply declined, hitting a low of $65,398 final Friday. Nonetheless, as of immediately, Bitcoin’s value has barely recovered to $65,552, although it nonetheless reveals a decline of 1.1% up to now day and 5.5% over the week.

Talking on Bitcoin spot ETFs, BlackRock’s Chief Funding Officer, Samara Cohen, has noticed a gradual however regular curiosity in them regardless of their slower-than-expected uptake.

In keeping with Cohen, presently, nearly all of Bitcoin ETF transactions, roughly 80%, are carried out by “self-directed buyers” utilizing on-line brokerage platforms.

Cohen added that the iShares Bitcoin Belief (IBIT) is likely one of the ETFs launched this yr, attracting consideration from particular person buyers and hedge funds and brokerages, as indicated within the latest 13-F filings.

Associated Studying

Nonetheless, participation from registered funding advisors stays comparatively low, Cohen mentioned throughout the latest Crypto Summit.

Featured picture created with DALL-E, Chart from TradingView

[ad_2]

Source link