[ad_1]

Dr_Microbe

Consolidated Water Co. Ltd. (NASDAQ:CWCO) is a Cayman Islands-based water utility targeted on the manufacturing of ingesting water via desalination and the remedy of wastewater. The corporate’s primary goal markets are the Caribbean and the southwest US, areas recognized for his or her water shortage and which might be essential long-term progress drivers, as mentioned within the Veolia article.

FY23 was a really sturdy yr for CWCO, which achieved a 91.5% YoY improve in income and reached all-time excessive margins and profitability, a pattern confirmed by Q1 FY24 outcomes. The corporate additionally presents a strong stability sheet, with web debt of $-43.7m as of March 2024, anticipated to lower in FY24 because of a decline in NWC, at the moment at $95m. Though administration’s technique is based totally on natural progress, this money reserve can enhance new strategic acquisitions, such because the $4.2m

Ramey Environmental Compliance (REC) deal closed in November 2023, and help a share buyback plan, as recommended by administration on the Q1 FY24 Convention name. CWCO’s enterprise mannequin has some vital points, primarily the chance of dropping its water gross sales license within the retail section, whose renewal has been underneath negotiation since 2018. Regardless of these and different dangers mentioned within the article, I assign CWCO a purchase ranking, justified by its monetary power and structural progress tendencies in desalination and water remedy within the Caribbean and the southwest US.

Enterprise Overview

CWCO SEC Filings and Writer’s Evaluation

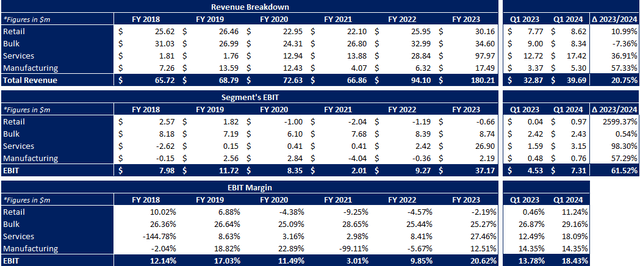

Consolidated Water’s operations are divided into 4 enterprise models:

(1) The Retail section is engaged within the manufacturing of ingesting water, obtained from the desalination course of, and equipped to residential, business, and authorities prospects within the Cayman Islands via a license granted immediately by the nation’s authorities. Income was steady between FY18 and FY23, accounting for 17% of complete income in FY23 (21.7% in Q1 FY24). Nonetheless, EBIT margin tended to be adverse, significantly after Covid-19, regardless of exhibiting indicators of restoration in Q1 FY24 with an EBIT margin of 11.24%, as a result of return of tourism to 2019 ranges. Probably the most vital danger dealing with this enterprise unit is the renewal of the license, which expired in 2018 and continues to be underneath negotiation. There’s a chance of much less favorable phrases or, within the excessive situation, the license withdrawal.

(2) The Bulk section can be concerned within the manufacturing of ingesting water via desalination. Nonetheless, on this case, it’s equipped on to authorities owned distributors in each the Cayman Islands and The Bahamas. Income tendencies have been steady between FY18 and FY23, with a slight decline in FY20 and a return to progress in subsequent years, pushed by the resurgence of tourism within the area. The section has an working margin above 20%, making it the biggest contributor to CWCO’s EBIT, besides in FY23. The enterprise unit accounted for 19% of complete income in FY23 (21% in Q1 FY24). The first concern arises from the biggest buyer in The Bahamas, the Water and Sewerage Company of The Bahamas (WSC), which had accounts payable to CW-Bahamas totaling $26.9m, 80% of which have been delinquent as of December 2023. Regardless of this, WSC has by no means defaulted and plans to scale back its payables by the top of FY24.

(3) Probably the most attention-grabbing enterprise section is Companies, the place, via subsidiaries PERC, Desalco, and REC, it builds and sells water manufacturing and water remedy vegetation, in addition to offers O&M and consulting providers for third-party firms. Actions are targeted on the southwestern area of the US, which has a rising demand for water. In FY23, gross sales grew by 239%, making it the highest section by way of income, accounting for 54.3% of complete gross sales (44% in Q1 FY24), in addition to the primary part of EBIT. This progress is attributable to the development of an $82m wastewater remedy plant in Arizona, scheduled for completion in Q2 FY24, and a $20m desalination plant within the Cayman Islands, of which $8m is attributable to FY23. On the O&M facet, the acquisition of REC and new contracts obtained by PERC boosted the section’s share of recurring income to $17.5m, up 36.9% in comparison with FY22. I additionally count on a strong efficiency from the enterprise unit in FY24 and FY25 as a result of growth of a desalination plant in Hawaii, scheduled for development in Q3 FY25, value $204m, together with $150m associated to development and $54 million to O&M actions underneath a 24-year contract.

(4) The Manufacturing section is engaged within the manufacturing of water-related merchandise and techniques relevant to business, municipal, and industrial water manufacturing, provide, and remedy. This enterprise unit is characterised by the best volatility by way of each income and working outcomes. In FY23, it contributed about 10% of complete income, attaining an EBIT margin of 12.5%, a transparent enchancment after adverse leads to FY21 and FY22. The section carried out nicely in Q1 FY24, with a 57% YoY improve in income.

The proportion of gross sales generated within the US was 59% of complete income in FY23, up from 35% in FY22, pushed by the Companies section, which primarily targets the southwest US as its primary market.

Progress Drivers

CWCO April 2024 Investor Presentation

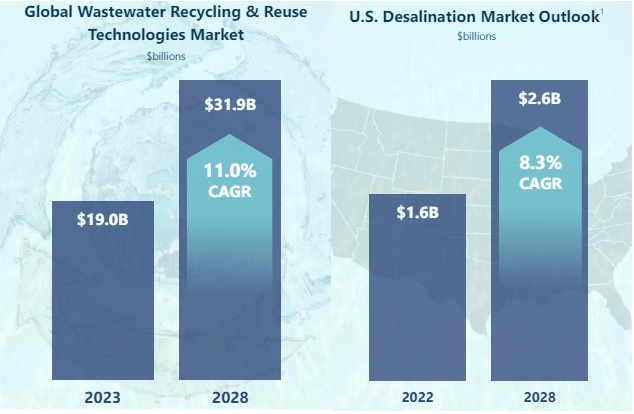

The wastewater recycling and desalination markets are the first sectors the place Consolidated Water’s enterprise is concentrated and, in response to analysts’ estimates, will expertise appreciable progress over the following decade.

US federal and state laws is more and more targeted on managing water provides, aiming to guard residents’ well being and preserve water sources. An instance is California, the place the State Water Board has carried out

Direct Potable Reuse (DPR), a regulation that units particular standards for wastewater remedy to maximise the amount and high quality of reusable water. Though these initiatives are nonetheless of their early levels, they current vital alternatives for firms like CWCO. By its subsidiary PERC, CWCO is investing substantial monetary sources within the area. In response to Analysis and Markets evaluation, reported in CWCO’s April 2024 Investor presentation, the wastewater recycling market value $19B in 2023 and is projected to achieve $31.9B by 2028 with a 11% CAGR.

Alternatively, the water shortage skilled within the western US lately will necessitate the adoption of latest applied sciences reminiscent of desalination, which is already extensively utilized in nations like Saudi Arabia and the UAE. Analysis and Markets examine signifies vital progress within the sector, estimated the US market dimension at $1.6B in 2022, projected to rise to $2.6B by 2028, with an anticipated 8.3% CAGR. As evidenced by the commissioning of a desalination plant in Hawaii, such local weather developments might current an financial alternative for CWCO.

Q1 2024 Snapshot & Forecast

Searching for Alpha and Writer’s Forecast Evaluation

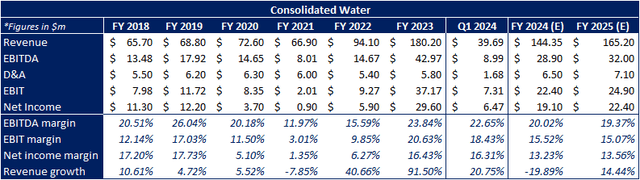

After a robust FY23, CWCO delivered strong financial efficiency in Q1 FY24, with income progress throughout three of its 4 enterprise models. In Q1 FY24, the corporate achieved $39.7m in income, up 20.8% YoY. It ended the quarter with an EBIT margin of 18.43%, decrease in comparison with 20.63% in FY23, however with EBIT up 61.5% in comparison with Q1 FY23. Moreover, web revenue of $6.5m, equal to a 16.3% revenue margin, is in step with what reported in FY23. Analysts estimate a slowdown in income in FY24, however it’s anticipated to stay greater than historic efficiency. FY25 ought to witness a return to progress, attributable to the development of the Hawaii plant. The identical pattern is predicted for EBIT margin and revenue margin, that are anticipated to remain at traditionally excessive ranges however decrease in comparison with FY23. These assumptions lead to a projected FY24(E) PE ratio of 23.1x, anticipated to say no to 19.7x in FY25(E), however nonetheless greater than the 14.7x recorded in FY23.

A powerful stability sheet boosts progress

Consolidated Water had web debt of $-43.7m as of March 2024, because of $46.2m in money and money equivalents, in comparison with simply $2.5m in debt and leases. Nonetheless, essentially the most notable growth considerations web working capital of $95m, of which $26.9m is attributable to commerce receivables from SWC, 80% of which was delinquent as of December 2023. After a number of consultations with SWC and the Bahamian authorities, administration obtained reassurances on the timing of the fee. Reporting what CFO David Sasnett specified within the Q1 2024 Convention Name:

Throughout conferences with the Water and Sewage Company in March 2024 and with representatives of the Bahamas authorities in April 2024, we have been knowledgeable that the Bahamas authorities intends to scale back CW Bahamas accounts receivable to under $20m by June 30 after which to under $10m by the top of this yr.

Such developments, together with $8m in anticipated contract property from the Arizona venture and $9m from the Cayman Islands venture, ought to lead to money inflows of round $30m in FY24, additional bettering the monetary place.

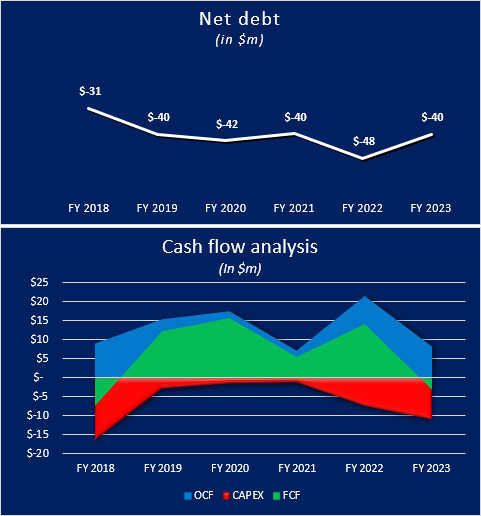

These outcomes have been achieved via a robust OCF between FY18 and FY23, coupled with low CAPEX as a result of firm’s natural progress technique. In recent times, CWCO executed solely small strategic acquisitions, reminiscent of REC, bought for $4.1m, concentrating on progress in core sectors and geographic areas of curiosity, significantly the southwestern US. This enterprise mannequin has facilitated the fast integration of acquisitions whereas creating new funding alternatives and buyer relationships.

Searching for Alpha, CWCO SEC filings and Writer’s Evaluation

Primary Dangers

(1) For my part, the best danger dealing with CWCO pertains to the retail section, which is regulated by a contract that expired in FY18 and has not but been renewed. Though negotiations are ongoing between administration and the Authorities of the Cayman Islands, it appears probably that the scenario will evolve in considered one of two potential eventualities. Within the first situation, the contract might be renewed on much less favorable phrases than the present ones, a circumstance that will have a adverse however minor impression on the corporate’s margins and little impact on income. In distinction, the second situation, involving the withdrawal of the concession, would lead to a 10-20% discount in complete income. However, contemplating the section’s low impression on CWCO’s total working outcomes, such an final result would have a restricted impact on profitability.

(2) Consolidated Water is affected by counterparty danger, as a lot of its income is predicated on long-term contracts, some extending past 10 years. Notably, there’s a focus of gross sales from WSC, which accounted for 17% of complete income in FY23. These concerns are significantly vital because of late funds by WSC. Though these late funds could not trigger insolvency points, they may result in short-term liquidity stress for CW-Bahamas.

About 40% of income is generated within the Cayman Islands and The Bahamas, each of that are characterised by a excessive danger of hurricanes.

Discounted Money Circulation

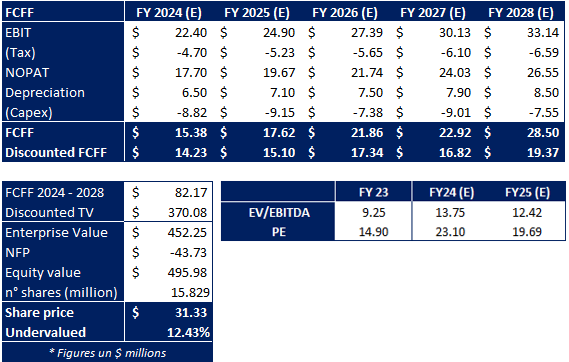

I carried out a DCF evaluation to evaluate CWCO’s intrinsic worth, returning a valuation of $31.33 per share, about 12% above the present market value.

Beta = 0.52x was obtained from utility (water) unlevered beta supplied by Aswath Damodaran.

MRP (6.87%) and Threat-Free price (4.46%) have been obtained utilizing 2024 Fernandez’s knowledge, weighted by the geographic breakdown of the corporate’s income. It resulted in a value of fairness of 8.04%.

WACC = 8.04% and g = 2%.

Writer’s Evaluation & Estimates

Conclusion

Consolidated Water is a small-cap firm with all of the credentials wanted to proceed the expansion trajectory initiated in FY22 and strengthened in FY23. This progress is boosted by elevated demand for brand spanking new desalination and wastewater remedy vegetation, in addition to entry into promising geographic markets such because the southwest US. Because of its technique, which is based totally on natural progress and small acquisitions, the corporate displays regular and strong OCF technology and low CAPEX, together with a web money place of about one-tenth of its market cap. In FY24, higher administration of web working capital and a lower in commerce receivables from WSC, ought to permit an extra $30m in money inflows. These funds may very well be used each to additional enhance enterprise progress and to supply greater remuneration to shareholders, together with share buybacks. Contemplating what mentioned within the article and the outcomes of the DCF evaluation, I assign Consolidated Water a purchase ranking.

[ad_2]

Source link