[ad_1]

6 analysts have expressed a wide range of opinions on Cousins Props CUZ over the previous quarter, providing a various set of opinions from bullish to bearish.

The desk beneath summarizes their latest scores, showcasing the evolving sentiments throughout the previous 30 days and evaluating them to the previous months.

Bullish

Considerably Bullish

Detached

Considerably Bearish

Bearish

Whole Scores

0

4

2

0

0

Final 30D

0

0

1

0

0

1M In the past

0

2

0

0

0

2M In the past

0

1

0

0

0

3M In the past

0

1

1

0

0

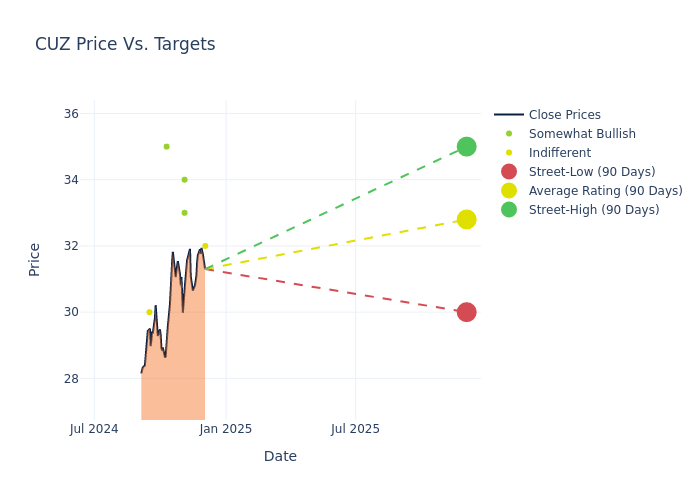

Analysts have not too long ago evaluated Cousins Props and offered 12-month worth targets. The common goal is $32.5, accompanied by a excessive estimate of $35.00 and a low estimate of $30.00. Marking a rise of 9.54%, the present common surpasses the earlier common worth goal of $29.67.

Investigating Analyst Scores: An Elaborate Research

The standing of Cousins Props amongst monetary consultants turns into clear with a radical evaluation of latest analyst actions. The abstract beneath outlines key analysts, their latest evaluations, and changes to scores and worth targets.

Analyst

Analyst Agency

Motion Taken

Score

Present Worth Goal

Prior Worth Goal

John Kim

BMO Capital

Raises

Market Carry out

$32.00

$31.00

Blaine Heck

Wells Fargo

Raises

Chubby

$34.00

$31.00

David Rodgers

Baird

Raises

Outperform

$33.00

$31.00

Anthony Powell

Barclays

Raises

Chubby

$35.00

$30.00

Steve Sakwa

Evercore ISI Group

Raises

In-Line

$30.00

$29.00

Blaine Heck

Wells Fargo

Raises

Chubby

$31.00

$26.00

Key Insights:

Motion Taken: Analysts adapt their suggestions to altering market situations and firm efficiency. Whether or not they ‘Keep’, ‘Increase’ or ‘Decrease’ their stance, it displays their response to latest developments associated to Cousins Props. This data supplies a snapshot of how analysts understand the present state of the corporate.

Score: Unveiling insights, analysts ship qualitative insights into inventory efficiency, from ‘Outperform’ to ‘Underperform’. These scores convey expectations for the relative efficiency of Cousins Props in comparison with the broader market.

Worth Targets: Analysts navigate by changes in worth targets, offering estimates for Cousins Props’s future worth. Evaluating present and prior targets provides insights into analysts’ evolving expectations.

Seize precious insights into Cousins Props’s market standing by understanding these analyst evaluations alongside pertinent monetary indicators. Keep knowledgeable and make strategic selections with our Scores Desk.

Keep updated on Cousins Props analyst scores.

About Cousins Props

Cousins Properties Inc is an actual property funding belief principally concerned within the possession, administration, and growth of properties within the Southern United States. Cousins Properties’ actual property portfolio primarily includes places of work and mixed-use developments that embody each residence and retail area. Places of work make up the overwhelming majority of the portfolio by way of complete sq. footage. Cousins’ belongings are primarily situated in Texas and Georgia, with North Carolina additionally enjoying host to a smaller quantity of rental area. The corporate derives practically all of its income within the type of rental earnings from its properties, nearly all of which comes from its workplace areas. A various set of tenants within the cities of Houston and Atlanta signify the corporate’s key markets.

Understanding the Numbers: Cousins Props’s Funds

Market Capitalization Evaluation: Above trade benchmarks, the corporate’s market capitalization emphasizes a noteworthy measurement, indicative of a powerful market presence.

Income Progress: Cousins Props’s income progress over a interval of three months has been noteworthy. As of 30 September, 2024, the corporate achieved a income progress price of roughly 5.21%. This means a considerable enhance within the firm’s top-line earnings. When in comparison with others within the Actual Property sector, the corporate excelled with a progress price greater than the common amongst friends.

Web Margin: Cousins Props’s web margin surpasses trade requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 5.35% web margin, the corporate successfully manages prices and achieves sturdy profitability.

Return on Fairness (ROE): Cousins Props’s ROE surpasses trade requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 0.25% ROE, the corporate successfully makes use of shareholder fairness capital.

Return on Property (ROA): Cousins Props’s ROA stands out, surpassing trade averages. With a powerful ROA of 0.14%, the corporate demonstrates efficient utilization of belongings and robust monetary efficiency.

Debt Administration: The corporate maintains a balanced debt method with a debt-to-equity ratio beneath trade norms, standing at 0.61.

The Fundamentals of Analyst Scores

Analysts work in banking and monetary methods and usually focus on reporting for shares or outlined sectors. Analysts could attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish “analyst scores” for shares. Analysts usually price every inventory as soon as per quarter.

Some analysts publish their predictions for metrics comparable to progress estimates, earnings, and income to supply extra steering with their scores. When utilizing analyst scores, it is very important take into account that inventory and sector analysts are additionally human and are solely providing their opinions to traders.

If you wish to maintain observe of which analysts are outperforming others, you’ll be able to view up to date analyst scores alongside withanalyst success scores in Benzinga Professional.

Which Shares Are Analysts Recommending Now?

Benzinga Edge offers you prompt entry to all main analyst upgrades, downgrades, and worth targets. Kind by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

[ad_2]

Source link