[ad_1]

On this article, we mentioned the elemental steps required to craft and develop an knowledgeable advisor (EA) rooted within the Truthful Worth Hole (FVG) technique, enhanced by the Good Cash idea method. This journey merged artwork and science, demanding a dealer’s skill to investigate candlestick patterns and visualize idea ranges successfully. We unraveled the mysteries of sensible cash and harnessed its transformative energy throughout the realm of algorithmic buying and selling. Our EA growth journey lined important subjects such because the imbalance definition, buying and selling technique description, technique blueprint, MQL5 buying and selling system, and technique tester outcomes.

Instance:

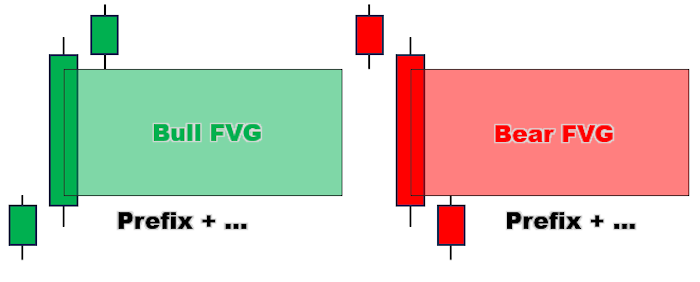

We first explored the Truthful Worth Hole (FVG) to focus on the imbalances brought on by shopping for and promoting pressures during times of excessive volatility. These imbalances manifested as important uni-directional actions out there, usually characterised by lengthy candlesticks. By figuring out these gaps, we exploited potential buying and selling alternatives and created a sturdy technique. We mentioned the strategies for recognizing FVGs on value charts, specializing in figuring out giant candlesticks and inspecting adjoining ones to find out the truthful worth variations.

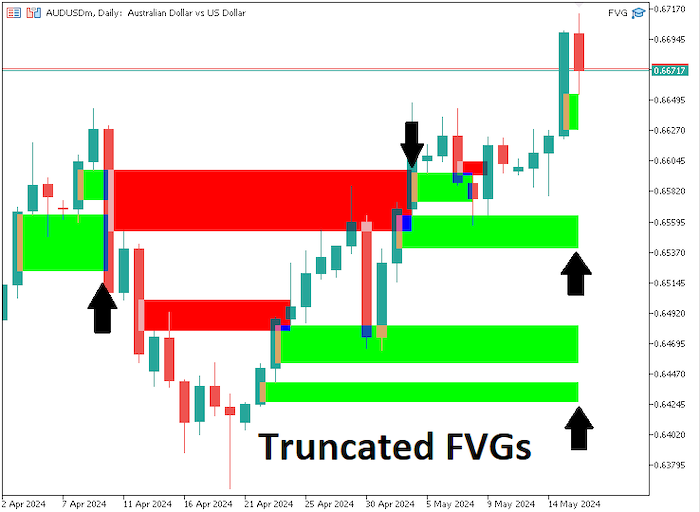

Instance of illustrative figures used is as under:

Our FVG buying and selling technique built-in truthful worth assessments with candlestick imbalances to establish buying and selling alternatives. We performed complete analyses, using patterns similar to bullish and bearish engulfing and doji, to find out market sentiment and potential shifts in momentum. Entry and exit alerts have been executed primarily based on the recognized truthful worth gaps and important candlestick imbalances, with danger administration methods employed to mitigate potential losses. The technique distinguished between bearish and bullish FVGs, every indicating totally different market situations and buying and selling alternatives.

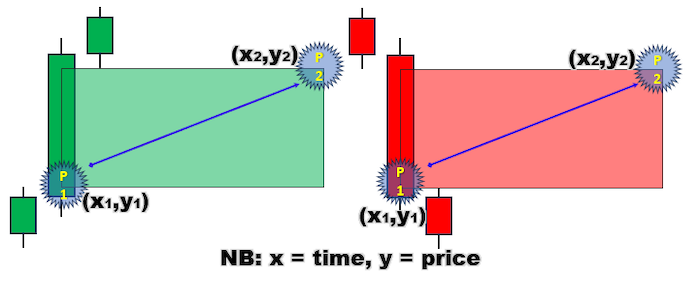

After outlining the technique, we developed an in depth blueprint to commerce the FVG technique successfully. This concerned figuring out bullish or bearish candlesticks with important value actions and assessing neighboring candles. As soon as an FVG was recognized, it was documented within the algorithm, and visible cues have been added to the chart for straightforward identification. Trades have been executed primarily based on predefined situations, with particular take revenue and cease loss ranges set to keep up a good risk-to-reward ratio.

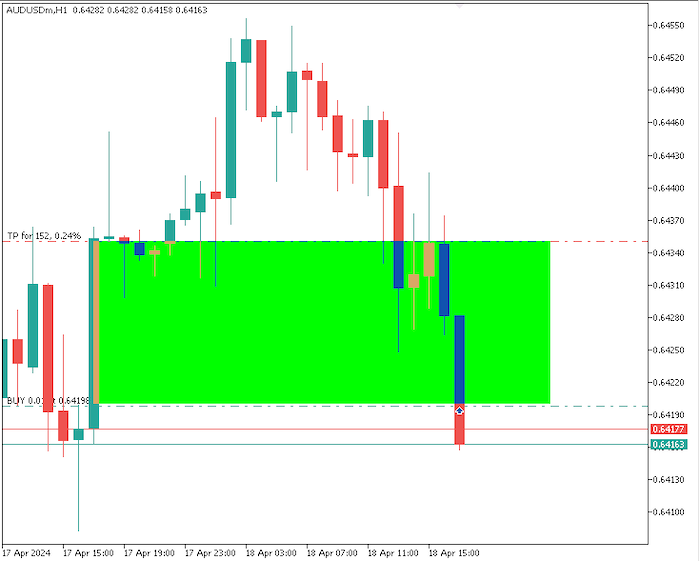

Instance of visible cues thought of for straightforward identification:

Lastly, we automated the FVG buying and selling technique by crafting an Professional Advisor (EA) in MQL5 for MetaTrader 5. The MetaQuotes Language Editor surroundings was used to put in writing the EA, incorporating all of the theoretical features mentioned.

Pattern of the code used of their identification is as under:

for (int i=0; i<=visibleBars; i++){

double low0 = iLow(_Symbol,_Period,i);

double high2 = iHigh(_Symbol,_Period,i+2);

double gap_L0_H2 = NormalizeDouble((low0 – high2)/_Point,_Digits);

double high0 = iHigh(_Symbol,_Period,i);

double low2 = iLow(_Symbol,_Period,i+2);

double gap_H0_L2 = NormalizeDouble((low2 – high0)/_Point,_Digits);

bool FVG_UP = low0 > high2 && gap_L0_H2 > minPts;

bool FVG_DOWN = low2 > high0 && gap_H0_L2 > minPts;

if (FVG_UP || FVG_DOWN){

Print(“Bar Index with FVG = “,i+1);

datetime time1 = iTime(_Symbol,_Period,i+1);

double price1 = FVG_UP ? high2 : high0;

datetime time2 = time1 + PeriodSeconds(_Period)*FVG_Rec_Ext_Bars;

double price2 = FVG_UP ? low0 : low2;

string fvgNAME = FVG_Prefix+“(“+TimeToString(time1)+“)”;

shade fvgClr = FVG_UP ? CLR_UP : CLR_DOWN;

CreateRec(fvgNAME,time1,price1,time2,price2,fvgClr);

Print(“Previous ArraySize = “,ArraySize(totalFVGs));

ArrayResize(totalFVGs,ArraySize(totalFVGs)+1);

ArrayResize(barINDICES,ArraySize(barINDICES)+1);

Print(“New ArraySize = “,ArraySize(totalFVGs));

totalFVGs[ArraySize(totalFVGs)-1] = fvgNAME;

barINDICES[ArraySize(barINDICES)-1] = i+1;

ArrayPrint(totalFVGs);

ArrayPrint(barINDICES);

}

}

for (int i=ArraySize(totalFVGs)-1; i>=0; i–){

string objName = totalFVGs[i];

string fvgNAME = ObjectGetString(0,objName,OBJPROP_NAME);

int barIndex = barINDICES[i];

datetime timeSTART = (datetime)ObjectGetInteger(0,fvgNAME,OBJPROP_TIME,0);

datetime timeEND = (datetime)ObjectGetInteger(0,fvgNAME,OBJPROP_TIME,1);

double fvgLOW = ObjectGetDouble(0,fvgNAME,OBJPROP_PRICE,0);

double fvgHIGH = ObjectGetDouble(0,fvgNAME,OBJPROP_PRICE,1);

shade fvgColor = (shade)ObjectGetInteger(0,fvgNAME,OBJPROP_COLOR);

Print(“FVG NAME = “,fvgNAME,” >No: “,barIndex,” TS: “,timeSTART,” TE: “,

timeEND,” LOW: “,fvgLOW,” HIGH: “,fvgHIGH,” CLR = “,fvgColor);

for (int ok=barIndex-1; ok>=(barIndex-FVG_Rec_Ext_Bars); k–){

datetime barTime = iTime(_Symbol,_Period,ok);

double barLow = iLow(_Symbol,_Period,ok);

double barHigh = iHigh(_Symbol,_Period,ok);

if (ok==0){

Print(“OverFlow Detected @ fvg “,fvgNAME);

UpdateRec(fvgNAME,timeSTART,fvgLOW,barTime,fvgHIGH);

break;

}

if ((fvgColor == CLR_DOWN && barHigh > fvgHIGH) ||

(fvgColor == CLR_UP && barLow < fvgLOW)

){

Print(“Lower Off @ bar no: “,ok,” of Time: “,barTime);

UpdateRec(fvgNAME,timeSTART,fvgLOW,barTime,fvgHIGH);

break;

}

}

We additionally examined it and we obtained the under outcomes:

This automation streamlined the buying and selling course of, permitting for environment friendly execution and monitoring of trades. By means of this journey, we outfitted merchants with the instruments and data wanted to harness the potential of the Truthful Worth Hole technique on this planet of algorithmic buying and selling.

Detailed explanations may be present in Discover ways to commerce the Truthful Worth Hole (FVG)/Imbalances step-by-step: A Good Cash idea method. We do hope you will see the article detailed and simple to grasp. Thanks. Cheers to many extra coming our approach.

[ad_2]

Source link