[ad_1]

Sundry Pictures

Since I final wrote about CrowdStrike (CRWD) on January 15, 2024, with a purchase advice, the inventory is up 22.47% in comparison with the S&P 500 Index (SPX) returns of 12.19%. One motive the inventory has carried out higher than the S&P 500 is that buyers had been happy by the corporate’s first quarter fiscal yr (“FY”) 2025 outcomes launched on June 4, primarily since cybersecurity corporations and software program/cloud corporations, generally, have produced blended outcomes this quarter in a difficult financial setting. The corporate beat consensus analysts’ income forecasts for the primary quarter by 2% and exceeded non-GAAP (Typically Accepted Accounting Ideas) earnings-per-share estimates by 4%. The inventory rose 12% the day after the corporate launched earnings.

One of the crucial vital secular developments in cybersecurity in the present day is clients’ want to consolidate multiple-point options onto one platform to save lots of on prices. Over the past a number of years, the weaker financial setting has pushed corporations in direction of extra effectivity, that means higher methods of doing issues at a lower cost. In the event you hearken to sufficient earnings calls or investor days from different corporations within the cybersecurity business, lots of them will focus on among the forces behind the consolidation of the cybersecurity business onto platforms. As an illustration, Chief Govt Officer (“CEO”) Nikesh Arora from Palo Alto Networks (PANW) stated on its third quarter FY 2024 earnings name:

On the accelerated tempo of change in cyber, even with wholesome will increase in cybersecurity funding, many organizations goal to merely preserve tempo with the amount of menace exercise they see. Most can’t do that and are more and more receptive to a greater manner of monitoring their safety challenges — tackling their safety challenges, home windows sprawl and architectural complexity. We firmly imagine that reply is platformization of cybersecurity over time.

Though the administration of a number of cybersecurity corporations has reached that very same conclusion, only some corporations will probably have the ability to execute the imaginative and prescient of making a viable cybersecurity platform. The market has awarded CrowdStrike one of many highest valuations of all cloud corporations, probably as a result of buyers imagine it will likely be one of many winners of the approaching cybersecurity business consolidation.

CrowdStrike’s newest outcomes exhibiting fast adoption of its options point out that cybersecurity clients could have concluded that the Falcon Platform offers them significantly better outcomes for a decrease value. Aggressive development buyers ought to put this firm on their watch record. If enterprises proceed to undertake modules on the Falcon at a comparatively fast fee, the inventory value will probably proceed larger. I preserve my purchase advice on CrowdStrike.

This text will briefly focus on the cybersecurity business consolidation pattern, the introduction of its generative AI product, Charlotte AI, a overview of first-quarter earnings, a dialogue of the dangers and valuation, and an evidence of why this inventory is a purchase for aggressive development buyers.

Enterprises consolidate onto the Falcon platform

The next picture from the corporate’s first quarter FY 2025 investor presentation exhibits a number of cybersecurity and Data Expertise (“IT”) merchandise that administration believes the Falcon platform can substitute. TCO stands for Complete Value of Possession, which incorporates the price of shopping for, working, and eradicating a product from service. One potential motive clients are adopting its modules may be as a result of they’ve proof that CrowdStrike’s claims of decreasing TCO are legitimate. CrowdStrike CEO stated on the primary quarter FY 2025 earnings name (emphasis added), “A latest IDC report quantifies CrowdStrike’s excessive value financial savings. For each $1 invested in Falcon Options, our clients acknowledged $6 of value financial savings.” If clients are literally seeing that stage of value financial savings, they’ve a tangible motive to undertake CrowdStrike modules.

CrowdStrike First Quarter FY 2025 Investor Presentation.

You may discover that Microsoft (MSFT) is on the record of level options that CrowdStrike needs to interchange. Microsoft is a major participant within the cybersecurity business, providing merchandise like Defender and different companies. For these unaware, Microsoft bore the brunt of a vital intrusion of Microsoft Change in 2023, through which a gaggle related to the Chinese language authorities breached a number of massive accounts, together with the emails of a number of U.S. authorities officers who’ve labored on nationwide safety issues. Microsoft misplaced a lot belief inside the authorities and within the accounts that the hacker breached. CrowdStrike created a product referred to as Falcon for Defender that protects Microsoft Defender merchandise. Microsoft combines its Defender license with its productiveness apps license right into a service referred to as Microsoft 365 E5. The CrowdStrike CEO stated the next about E5 licensing and its new module designed to guard Defender on the primary quarter earnings name (emphasis added):

And extra lately, following yet one more main Microsoft breach and CISA, Cyber Security Evaluation Board’s findings, we acquired an outpouring of requests from the marketplace for assist. We determined sufficient is sufficient. There is a widespread disaster of confidence amongst safety and IT groups inside the Microsoft safety buyer base. On the request of organizations saddled with Microsoft E5 licensing, we delivered Falcon for Defender, a platform on-ramp to assist organizations of all sizes begin using Falcon to safe their Microsoft Defender utilization.

CrowdStrike sells 28 modules that present options for Endpoint safety, Cloud safety, Id safety, SIEM (Safety Data and Occasion Administration), Menace Intel, Information Safety, Publicity Administration, and extra. The corporate makes use of a “land and increase” gross sales mannequin to market these modules. It lands a buyer with an preliminary deal, and new clients are more and more touchdown with increasingly modules. Previous the preliminary land, an important a part of the platform’s development is satisfying these new clients and getting them to undertake extra modules.

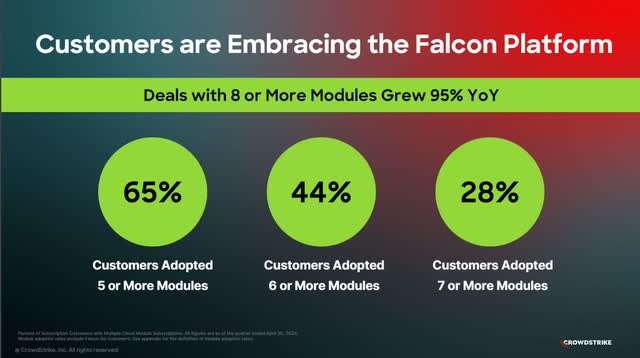

One measure that exhibits that CrowdStrike’s “land and increase” gross sales mannequin works is the variety of clients who undertake modules. The next picture exhibits the proportion of shoppers adopting extra modules. When these metrics rise every quarter, it is a signal that CrowdStrike’s enterprise mannequin is working. Clients adopting 5, six, and 7 modules rose 1% every since final quarter.

CrowdStrike First Quarter FY 2025 Investor Presentation.

The extra clients undertake CrowdStrike’s modules, the extra the cybersecurity market consolidates onto the Falcon platform. CEO Kurtz stated on the corporate’s first-quarter earnings name (emphasis added):

By means of consolidation, the Falcon platform delivers innovation to unravel tomorrow’s cybersecurity in addition to broader IT and information issues. Our place as cybersecurity’s consolidation platform retains CrowdStrike innovating to steer the business ahead. This focus has allowed us to ship sport altering merchandise at fast tempo.

Throughout the firm’s earnings name, CEO Kurz mentioned a number of of the corporate’s newer modules which can be gaining buyer traction. In future articles, I’ll focus on lots of these modules the CEO reviewed throughout the first quarter earnings name. This text will solely briefly focus on its new generative AI product, Charlotte AI.

Charlotte AI

The World Financial Discussion board printed an article in April 2024 that said, “4 million professionals are urgently wanted to plug the expertise hole within the international cybersecurity business.“ CrowdStrike created Charlotte AI as an AI-powered assistant to assist bridge the hole between the variety of cybersecurity professionals wanted globally and the variety of these professionals out there. CrowdStrike’s generative AI assistant sits on prime of the collective information of the Falcon platform, automating numerous security-related duties and making it so entry-level cybersecurity analysts have the capabilities of among the most superior cybersecurity specialists.

CrowdStrike Fourth Quarter FY 2024 Investor Presentation.

With Charlotte AI, Tier 1 analysts, low-level analysts who normally monitor the community for threats and escalate safety occasions to extra skilled analysts, can now examine essentially the most advanced safety incidents and implement superior safety measures. The corporate’s CEO George Kurtz stated on the Morgan Stanley Expertise, Media & Telecom Convention:

So if in case you have a Tier 1 analyst within the SOC [Security Operations Center] otherwise you’ve received Tier 1, 2 and 3, how do you’re taking that Tier 1 [entry level] analyst and how do you flip it right into a Tier 3 [most experienced] analyst? And so the purpose for Charlotte wasn’t to be a chatbot. It was to be a digital SOC assistant. And what meaning is it takes the collective information of CrowdStrike. So we have instrumented Charlotte to perceive our intel. All of our intel for over a decade is in Charlotte. We have instrumented to grasp the property in a company particular to that firm. We instrumented to grasp the vulnerabilities and how they work and how the assaults work.

CrowdStrike defines the SOC inside an organization as “the nerve middle of a corporation’s cybersecurity operations, the place specialists monitor, analyze, and defend towards cybersecurity threats.” A chatbot is merely an AI algorithm that simulates a dialog with human finish customers, and Charlotte AI does greater than have interaction in dialogue and reply to consumer questions. It might automate tedious duties, analyze information, establish threats, counsel actions, carry out menace searching, and start remediation throughout a breach.

The firm introduced the final availability (“GA”) of Charlotte AI in February 2024. This generative AI product continues to be in its adoption part, however the early suggestions has been optimistic. George Kurtz stated on the primary quarter FY 2025 earnings name (emphasis added):

And lastly, Charlotte AI, each CISO [Chief Information Security Officer] is keen to see their workers change into extra productive. Each CISO needs their cybersecurity to be sooner. The productiveness beneficial properties are actual and the advantages of creating cybersecurity simpler conversational and prompt multiply the cybersecurity outcomes the Falcon platform creates. Whereas nonetheless early, our POV [Proof of Value] shut fee is near 90%, reflecting pleasure for Charlotte AI.

One bearish argument that CrowdStrike buyers may encounter is that “Generative AI is simply hype.” Nonetheless, if sufficient clients discover worth in Charlotte AI, that objection could change into out of date so far as CrowdStrike is anxious, briefly order. It is nonetheless early days. Charlotte AI has the potential to change into successful product and should symbolize a possible upside to income development.

First quarter FY 2024 outcomes

CrowdStrike First Quarter FY 2025 Investor Presentation.

One space that the market keys onto with this firm in quarterly outcomes is Annual recurring income (“ARR”), because the metric is important to understanding whether or not its land and increase gross sales mannequin is succeeding. Software program-as-a-Service companies like CrowdStrike typically measure their monetary well being and estimate future income utilizing ARR. As an illustration, a subscription-based firm could have points if ARR development considerably lags income development. Traders need to see that ARR development matches or exceeds income development. Within the first quarter, CrowdStrike elevated its ARR by 33% year-over-year to $3.65 billion, exceeding analysts’ ARR estimates of $3.63 billion. The ARR development fee can be near matching its subscription development fee, an indication that income development ought to proceed at a comparatively excessive fee.

One other normal benchmark for subscription companies is Internet New ARR, the full annual recurring income an organization collects that yr. Internet New ARR excludes ARR taken in throughout earlier years. Some use this metric as an much more exact instrument for estimating future income development. CrowdStrike grew its first quarter FY 2025 internet new ARR 22% year-over-year to $212 million—a wholesome signal. A great portion of the rationale buyers bid the refill the day after earnings is that these numbers point out the corporate has stable income development forward.

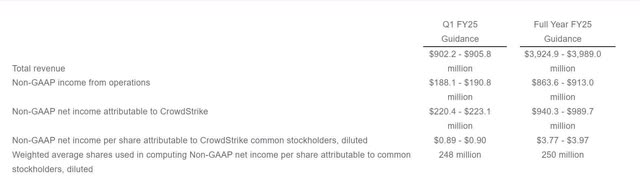

The next exhibits CrowdStrike’s steerage for the primary quarter of FY 2025. Let’s evaluate steerage with the corporate’s precise outcomes.

CrowdStrike Fourth Quarter FY 2024 Earnings Launch.

CrowdStrike’s whole income throughout the quarter blew previous firm steerage to succeed in $921 million, growing 33% year-over-year. Subscription income grew 34% year-over-year to $872 million. The corporate emphasizes subscription metrics, because it makes up round 95% of its income.

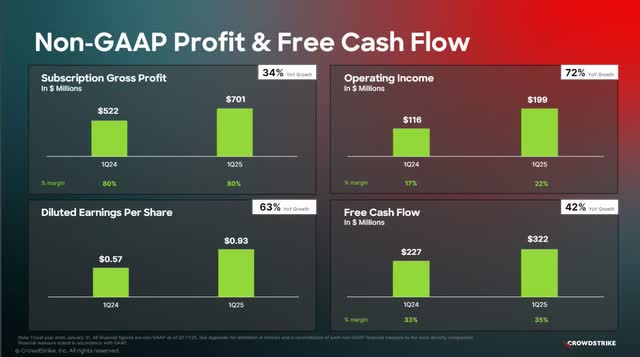

First quarter FY 2025 non-GAAP subscription gross margins remained flat year-over-year at 80%, under its long-term goal of 82 to 85%. GAAP gross margins additionally remained flat over the earlier yr’s comparable quarter at 78%. Within the first quarter of FY 2025, non-GAAP revenue from operations grew round 71% year-over-year to succeed in $198.7 million, beating firm steerage. Non-GAAP working margin was 21.6%, up 490 foundation factors (“bps”) from the earlier yr’s comparable quarter. These numbers are wonderful as CrowdStrike continues progressing in direction of its long-term non-GAAP working margin goal of 28% to 32%.

CrowdStrike grew non-GAAP internet revenue by 70% year-over-year to $231.7 million, above administration’s first steerage. Non-GAAP diluted earnings-per-share (“EPS”) was $0.93, above the top-end of administration’s steerage by $0.03. GAAP diluted EPS was $0.17, the corporate’s fifth consecutive quarter of GAAP profitability.

CrowdStrike First Quarter FY 2025 Investor Presentation.

The corporate grew its quarterly free money stream (“FCF”) by 42% year-over-year and achieved a quarterly FCF margin of 35%. Its trailing 12-month (“TTM”) FCF was $1.036 billion. CEO George Kurz stated on the primary quarter earnings name that CrowdStrike reached a “free money stream Rule of 68, making us the one cybersecurity vendor of scale delivering this stage of development and profitability.“

This “free money rule of 68” is a reference to the “Rule of 40,” which is a rule invented by enterprise capitalists to justify an funding in a subscription software program enterprise. The rule states that an organization’s development fee added to its profitability margin ought to equal not less than 40 to attain sustainable development. What Kurz means by his “Rule of 68” assertion is that including CrowdStrike’s income development to its FCF margin equals 68 and that no different cybersecurity firm of scale has reached that stage. When doing relative valuation workouts on this firm in comparison with different cybersecurity corporations, do not forget that CrowdStrike has higher income development and FCF profile than its rivals.

One motive the inventory was up after earnings is that the corporate’s quickly rising FCF of 42% is enticing to buyers, as FCF development represents the potential to reward buyers sooner or later by way of share buybacks, dividend distributions, or debt elimination. A quickly rising FCF additionally represents additional potential income development as administration can reinvest FCF into the corporate by way of analysis and improvement or acquisitions. Final, a quickly rising FCF raises the percentages that elevated earnings are coming down the pike. Moreover, CrowdStrike’s quickly rising FCF is sweet information to buyers who worth the corporate by way of both its FCF or EPS.

CrowdStrike ended its first quarter of FY 2025 with $3.70 billion in money and short-term investments and $742.87 million in long-term debt. Subsequent let us take a look at steerage.

CrowdStrike First Quarter FY 2025 Investor Presentation.

One other potential motive buyers had been happy with this earnings report is that administration’s EPS steerage for the second quarter exceeded analysts’ estimates by 8%, and income steerage exceeded analysts’ estimates by $5.35 million, in keeping with MarketBeat.

The corporate additionally raised its full-year FY 2025 income steerage from $3,924.9 – $3,989.0 million to $3,976.3 – $4,010.7 million. Administration additionally raised its non-GAAP EPS steerage from $3.77 – $3.97 to $3.93 – $4.03.

Dangers

The extra CrowdStrike extends its platform’s capabilities by way of its modules, the extra it might encounter legacy gamers with the assets to struggle again. As an illustration, I already talked about Microsoft, an organization that probably will not make it simple for CrowdStrike to invade its turf. My final article within the “Rivals” part briefly mentioned its different main rivals.

If CrowdStrike experiences a major breach, the corporate might shortly lose its status. As a serious safety firm, there are most likely quite a few hacking makes an attempt towards the Falcon platform. It solely takes one profitable hacking try and halt CrowdStrike’s rising inventory value in its tracks.

The corporate’s valuation is essentially the most vital danger to contemplate, which the article will focus on within the subsequent part.

Valuation

Primarily based on a number of conventional valuation ratios, individuals could argue that CrowdStrike is simply too wealthy for his or her blood. Its price-to-sales (P/S) ratio is 24.54, considerably larger than the Data Expertise sector’s P/S ratio of two.99. The inventory additionally trades significantly larger than among the extra standard names within the Cybersecurity business.

One rule of thumb I typically use when valuing a inventory is evaluating the EPS estimated year-over-year development fee to the inventory’s ahead P/E ratio in the identical fiscal yr. If the 2 values match, I normally take into account the inventory pretty valued. The next desk exhibits that CrowdStrike’s ahead P/E for every fiscal yr exceeds the corresponding EPS development fee—an indication of an overvalued inventory.

In search of Alpha

The next desk exhibits that CrowdStrike’s price-to-FCF (P/FCF) of 89.68 is above its three-year median and nicely above the Data Expertise sector’s P/FCF of 18.33. Some may conclude that the market overvalues the inventory.

Let’s take a look at a reverse discounted money stream mannequin to see what development charges the present inventory value implies.

Reverse DCF

The third quarter of FY 2024 reported Free Money Stream TTM

(Trailing 12 months in hundreds of thousands)

$1036 Terminal development fee 2% Low cost Fee 10% Years 1 – 10 development fee 27.5% Present Inventory Worth (June 5, 2024, closing value) $342.18 Terminal FCF worth $11.997 billion Discounted Terminal Worth $57.816 billion FCF margin 31.5% Click on to enlarge

Over the following ten years, the implied 27.5% FCF development fee is aggressive since not less than two analysts count on the corporate to solely develop income at a compound annual development fee (“CAGR”) of 24.52% to $27.34 billion over the following ten years. Nonetheless, the corporate solely achieved a trailing 12-month FCF margin of 31.5% on the finish of the primary quarter, nicely under its goal vary of 34% to 38%. If CrowdStrike reaches an FCF margin of 34%, it could must develop by 26.4% over the following ten years. If the corporate achieves an FCF margin of 38%, it could solely must develop FCF at 24.9% over the following ten years. The corporate ought to get off to an excellent begin as analysts estimate that CrowdStrike ought to develop FCF by a compound annual development fee of 32.31% over the following three years.

Nonetheless, if all of the assumptions within the above DCF are legitimate, the corporate would probably have to succeed in or exceed an FCF margin of 38% inside the subsequent a number of years or exceed analysts’ income estimates over the following ten years, which is feasible. Analysts have underestimated CrowdStrike’s alternative up to now, contemplating analysts made many upward revisions to income and EPS estimates over the past a number of years. A latest In search of Alpha article said, “Over the past three months, the corporate’s earnings per share estimates have been revised upwards 32 instances, whereas its income estimates have seen 18 upward revisions vs. eight downgrades.“

I nonetheless fee CrowdStrike a purchase regardless of the valuation

Conservative buyers ought to most likely give CrowdStrike a move. If the corporate makes the slightest stumble in execution or competitors begins to catch up and stunts its income development or squeezes its margins, the inventory value would probably considerably decline. One In search of Alpha analyst believes it’s far too costly to put money into.

Though analysts’ earnings estimates make it onerous to justify the inventory’s valuation based mostly on ahead P/E ratios, Wall Road nonetheless charges CrowdStrike a powerful purchase with a median value goal of $399.37, up 16.71% from the June 4 closing value. Wall Road analysts could give the corporate a excessive value goal regardless of its perceived excessive valuation as a result of its basic efficiency justifies it. A latest In search of Alpha article quotes an Oppenheimer analyst (emphasis added):

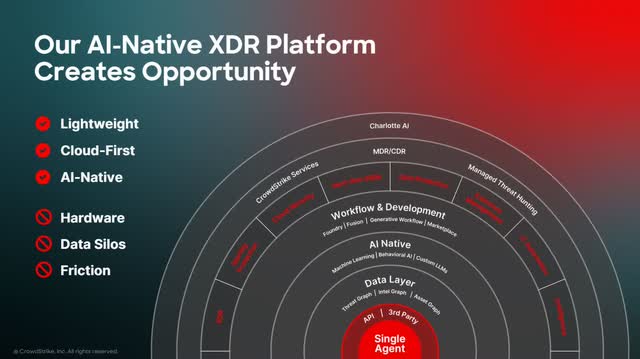

“Amidst a difficult wave of software program earnings, CrowdStrike continued its constant execution and turned in one other stable quarter,“ stated Oppenheimer analyst Ittai Kidron and others in a word. “We imagine the corporate is setting itself other than the pack, and whereas this can definitely drive expectations larger, we imagine the corporate can lean on its single-agent structure and rising platform breadth to maintain its momentum.”

Suppose it’s true that CrowdStrike is separating itself from the pack, will achieve share from rivals, and can proceed upselling present clients; the percentages of CrowdStrike’s future EPS and FCF development ultimately justifying the inventory’s present valuation enhance. In case you are an aggressive development investor excited by one of many highest-quality shares in in the present day’s market, take into account shopping for just a few shares.

[ad_2]

Source link