[ad_1]

ozgurcankaya/E+ by way of Getty Photos

Funding thesis

My earlier bullish thesis about Crown Fort (NYSE:CCI) aged nicely because the inventory’s return since April was in keeping with the broader market. As we speak I need to replace my thesis in gentle of the upcoming Q2 earnings launch deliberate for July 17.

I stay optimistic about CCI earlier than the Q2 earnings launch as a result of two earlier quarters had been above consensus estimates from income and EPS views. The corporate not too long ago upgraded its full-year FFO steering on account of some price saving initiatives. I count on the administration’s forward-looking feedback in the course of the Q2 earnings name to be fairly optimistic and sharing extra insights concerning the deliberate cost-control endeavors. With the FFO steering bettering, I believe that CCI’s stellar 6% ahead dividend yield is now a lot safer. My valuation evaluation suggests that there’s nonetheless a 23% upside left. All in all, I reiterate a “Purchase” score for CCI.

Crown Fort – Latest developments and Q1 earnings preview

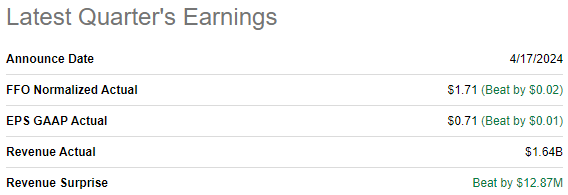

The most recent quarterly earnings had been launched on April 17. Q1 income decreased by 7.5% YoY. The FFO adopted the highest line and declined from $1.92 to $1.71. The nice facet is that regardless of the difficult setting, the administration reiterated its full-year 2024 outlook in the course of the earnings name. In accordance with consensus estimates, FY 2024 income is predicted to say no by 6%. The FFO is predicted to shrink quicker with a 9.2% YoY lower.

Searching for Alpha

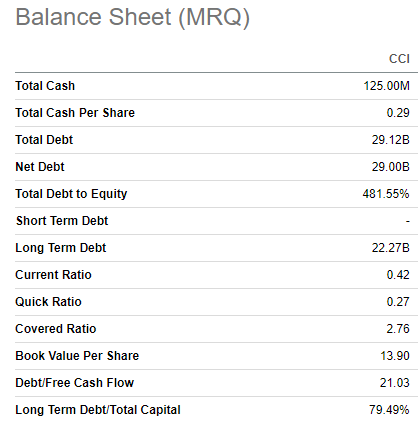

CCI’s stability sheet is very leveraged, which is a weak point within the present tight financial setting. Excessive debt ranges weigh on the underside line by way of elevated curiosity prices. However, excessive leverage is inherent to any REIT as funding cycles are lengthy. The energy of CCI’s stability sheet is underscored by its BBB+ investment-grade credit standing from Fitch.

Searching for Alpha

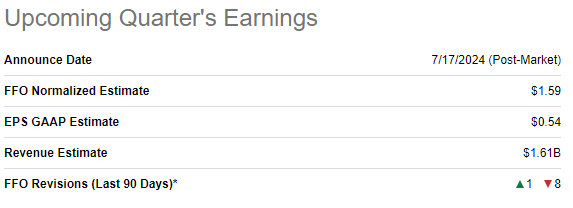

The upcoming earnings launch is scheduled for July 17. Wall Avenue analysts count on Q2 income to be $1.61 billion, which might be round 14% decrease on a YoY foundation. The FFO is predicted to comply with the highest line and to say no YoY from $2.08 to $1.59. Wall Avenue’s sentiment across the upcoming earnings launch is kind of destructive with eight FFO downward revisions during the last 90 days.

Searching for Alpha

CCI’s earnings shock historical past just isn’t flawless, however it not often misses consensus earnings estimates. The REIT delivered constructive earnings surprises during the last two quarters, which is kind of a constructive dynamic. The inventory isn’t an enormous mover after it releases its earnings with demonstrating single-day actions normally inside mid-single digit.

One more reason why traders may be optimistic across the upcoming earnings launch is that the administration is engaged on driving profitability by means of price effectivity initiatives. On June 11 the administration upgraded its FFO steering for the total yr 2024. The agency now expects 2024 AFFO per share of $6.91-$7.02, up from its earlier vary of $6.85-$6.97. The FFO enchancment might be achieved with reducing deliberate curiosity bills as the corporate trimmed its CAPEX funds and with a ten% headcount lower. With these price management initiatives, I consider that CCI’s ahead 6% dividend yield is protected.

To conclude, CCI’s sturdy efficiency in opposition to consensus within the final two quarters will increase possibilities of delivering constructive shock once more. I count on the administration’s forward-looking feedback in the course of the Q2 earnings name to be optimistic as nicely because the administration will seemingly share extra particulars about its price efficiencies plan. I don’t count on CCI to be an enormous mover after earnings, contemplating its a number of earlier quarters.

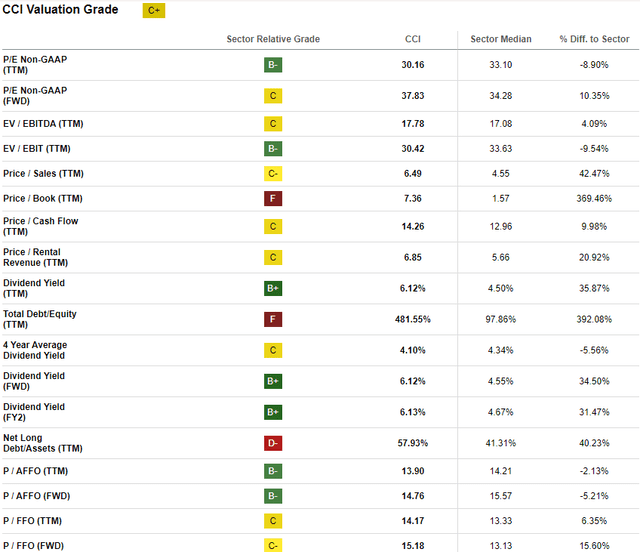

CCI inventory valuation replace

The inventory declined by 11% during the last twelve months, considerably lagging behind the broader U.S. market. The YTD efficiency is nearly the identical with a ten% share worth decline. CCI’s valuation ratios look largely good as most of them are near the sector median.

Searching for Alpha

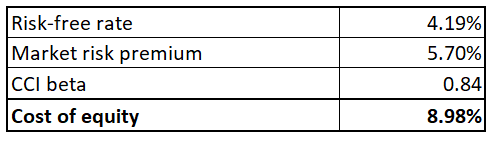

To find out CCI’s justifiable share worth I’m operating the dividend low cost mannequin [DDM] simulation. Value of fairness is the low cost charge for my DDM, which is 8.98% for CCI. All variables within the beneath CAPM calculation are simply obtainable on the Web.

Writer’s calculations

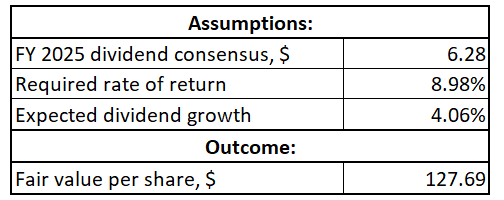

CCI’s FY 2025 anticipated by consensus dividend is $6.28. Sector median’s final three years’ dividend CAGR is 4.06%, which I incorporate into my DDM. In accordance with the DDM simulation, CCI’s honest worth per share is $127.7. This means a 23% upside potential, which I discover compelling.

Writer’s calculations

Dangers replace

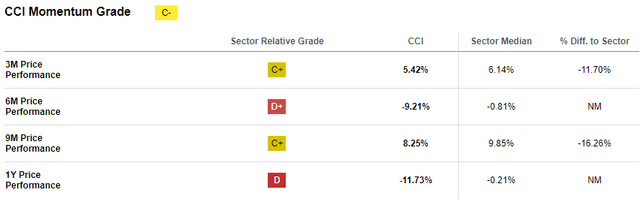

I believe that CCI just isn’t a short-term play for traders who’re in search of for share worth spikes on quick timeframes. As I discussed above, the corporate’s monetary efficiency is predicted to deteriorate in Q2 2024, which is a destructive catalyst for the inventory worth. The market sentiment round CCI is usually destructive and the momentum is weak throughout varied timeframes even regardless of latest rally. Which means a pointy turnaround within the share worth may be very unlikely, and it would begin stagnating once more. Buyers who will finally determine to choose in must be prepared for the weak share worth dynamic and able to preserve shares for longer.

Searching for Alpha

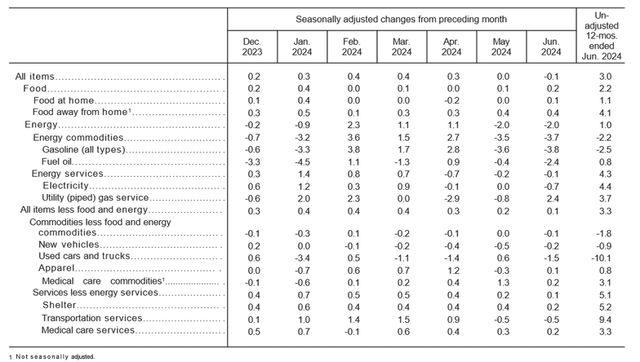

The uncertainty across the Fed’s financial coverage additionally may not add optimism within the quick time period. A month in the past, the Fed signaled no rush to chop charges. I contemplate this as a hawkish message, which was amplified by the contemporary June CPI knowledge. I contemplate inflation knowledge disappointing for traders as a result of shelter inflation continues to be above 5%, which I consider to be an important metric for the Fed because it represents substantial portion of the CPI basket. Since CCI is a extremely leveraged enterprise [which is inherent to the industry it operates], tight financial coverage is a headwind for the corporate. Nevertheless, it’s essential to know that financial coverage is cyclical and softening section of the cycle is only a matter of time.

Bureau of Labor Statistics

Backside line

To conclude, CCI continues to be a “Purchase”. I believe that its stellar 6% ahead dividend yield turned a lot safer after the administration introduced its price saving initiatives. My valuation evaluation means that the inventory continues to be 23% undervalued and I don’t count on CCI to disappoint in the course of the upcoming Q2 earnings launch.

[ad_2]

Source link