[ad_1]

Editor’s word: Searching for Alpha is proud to welcome Alan Galecki as a brand new contributing analyst. You possibly can turn into one too! Share your finest funding thought by submitting your article for evaluation to our editors. Get revealed, earn cash, and unlock unique SA Premium entry. Click on right here to seek out out extra »

jittawit.21

Brief abstract

Movement Merchants (OTCPK:FLTLF) has been seen as an fairness play to “hedge” towards volatility, i.e. stress within the markets. This has even labored for some time, just like the outcomes and big dividends for the yr 2020 present.

Nevertheless, since then, Movement Merchants has been dropping market share in its most essential area. Paired with an unfavorable market surroundings that has seen painfully low volatility, Movement Dealer’s outcomes have been in backwardation, additionally pushing down the inventory. With the most recent outcomes, administration totally eradicated the dividend – one of many core funding incentives for a lot of traders – to formally swap to progress mode. Nevertheless, it’s not out of energy, fairly the alternative.

On this article, I’m going to steer you thru the latest developments and let you know why the previous thesis probably would not work anymore.

When the circulation dried up

I’ve been masking the inventory of Movement Merchants since 2019, i.e. for 5 years. What the Dutch firm does is it acts as a so-called liquidity supplier for alternate traded merchandise (“ETPs”), i.e. the intermediary bringing collectively consumers and sellers of ETFs for shares and their derivatives for bonds, money, commodities and cryptos. The unfold – the distinction between the promoting and shopping for value – is their income.

In instances of calm bull markets or sideways durations, the enterprise shall be doing okay, however nothing to freak out about. Usually, volatility is low and trending decrease. Bid / ask spreads are low, both. Then you definitely even have durations with little buying and selling exercise, like summer season holidays (often, not this yr 🙂 ).

Nevertheless, it will get fascinating when markets right and even tank. Then, as a result of concern and uncertainty, buying and selling volumes shoot up and in addition bid / ask spreads widen, creating a number of tailwinds that propel gross sales, margins and earnings for this enterprise up, as prices of the underlying enterprise are comparatively fastened.

Normally, this was a enterprise with good margins in much less thrilling instances, however distinctive margins in extremely risky durations.

The thesis has been that Movement Merchants is an effective decide for a partial and contrarian portfolio hedge, as the corporate in instances of market stress merely earns disproportionately extra money.

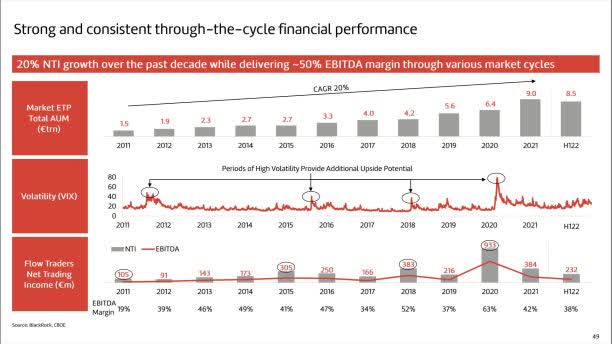

Under, you’ll be able to see from their final Capital Markets Day in 2022 that in years of excessive turbulence, particularly 2018 and 2020, EBITDA margins and internet buying and selling revenue (their income, not internet revenue!) have been spiking alongside the volatility index VIX.

Supply: Capital Markets Replace 2022

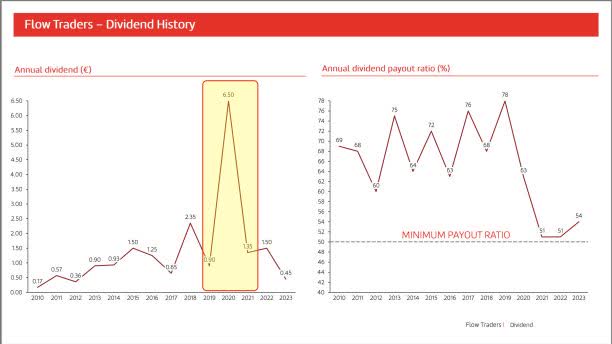

After such profitable durations, they paid out hefty dividends.

For instance, in 2020, whenever you purchased the inventory on the finish of 2019 / starting of 2020 at then pretty depressed costs of round and briefly even under 20 EUR (I did at my former employer), the following dividend in spring of 2020 was 2.50 EUR and later in summer season of the identical yr one other 4 EUR per share – a return of 32.5%!

Supply: Movement Merchants dividend historical past

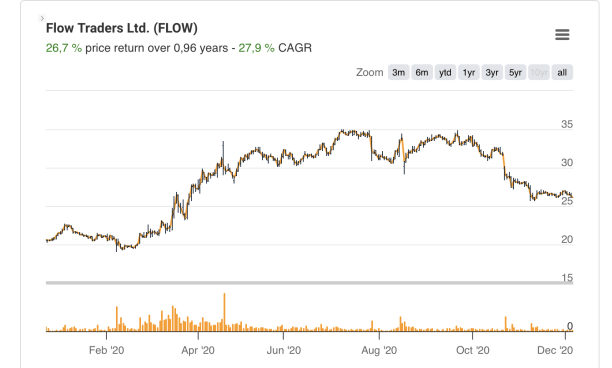

On prime, the inventory additionally appreciated by 75% and didn’t take part within the 2020 meltdown!

Supply: TIKR

This was probably a once-in-a-lifetime occasion. Nevertheless, it reveals how this concept labored and was to work, although with much less drama, sooner or later throughout extra regular corrections. And with out an expiration date in comparison with derivatives as a giant plus.

The issue is, volatility has been fairly low since then. There have been short-term excessive spikes throughout 2022, however in regular instances the enterprise appears to have misplaced momentum. That is evidenced by the truth that they’re constantly dropping market share of their largest market, Europe / EMEA – one of many causes I made a decision to tug away.

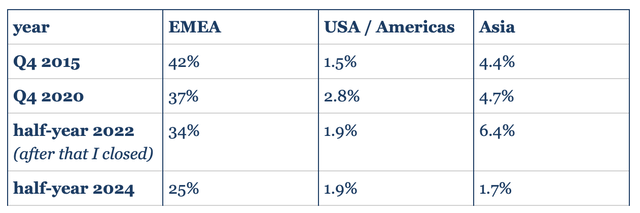

Right here’s a desk I created utilizing information from their revealed outcomes, exhibiting the respective market shares (Movement Merchants ETP worth traded / ETP market worth traded):

Sources: respective annual studies, Writer’s Compilation

Whereas I’m not so certain concerning the Asia information, as in some unspecified time in the future Movement Merchants began buying and selling operations in China, this isn’t the deciding issue (they disclose their internet buying and selling revenue / income information solely on an Asia ex China foundation, however market information for each, with and with out China).

Whereas a diversification technique doesn’t have to be unhealthy and if executed effectively, it will possibly complement a portfolio and ignite some extra progress, this hasn’t been the case at Movement Merchants.

It issues me that their by far the strongest market up to now has been melting away.

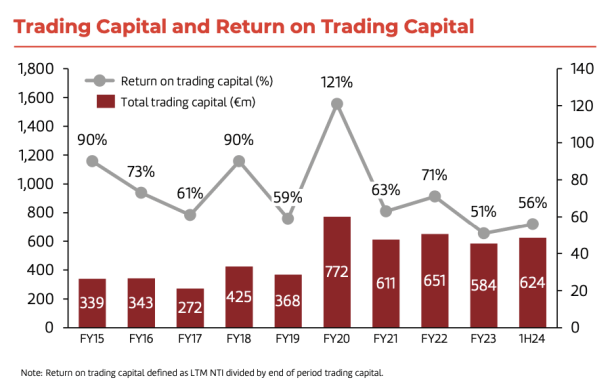

Under, you’ll be able to see that this reshuffle additionally introduced large margin declines with it. Buying and selling situations have been robust as of recently, I do know. However discover that the swings during the last ten years have seen decrease lows – with 2023 and H1 2024 being new lows (FLOW turned a publicly traded firm in 2015).

Supply: Movement Merchants Q2 2024 investor presentation

I can do not forget that in 2017 and 2019, which each noticed large bull runs for equities, the VIX was briefly even within the single digits in 2019 – a brutal surroundings for an organization like Movement Merchants which wants market motion. Nonetheless, even again then, EBITDA margins have been increased than now.

With the most recent earnings launch two weeks in the past, administration introduced a strategic shift to extend buying and selling capital. This implies, they find out about their unfavorable place and attempt to make up for the compressed margins and market share decline by way of extra quantity.

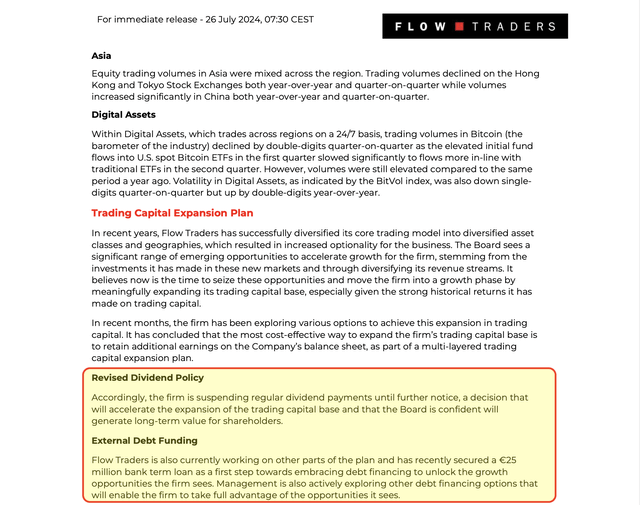

Nevertheless, first they suspended their dividend and second – and worse – they introduced to make use of leverage any longer to ignite progress.

Supply: H1 2024 earnings launch

They’ve secured EUR 25 million financial institution time period mortgage “as a primary step”, so we are able to no less than assume that extra will observe. This EUR 25 million is the equal of 4% of present buying and selling capital (EUR 524 million, see under). Whereas this isn’t a lot, I’m a bit averse in direction of regular leverage to play volatility.

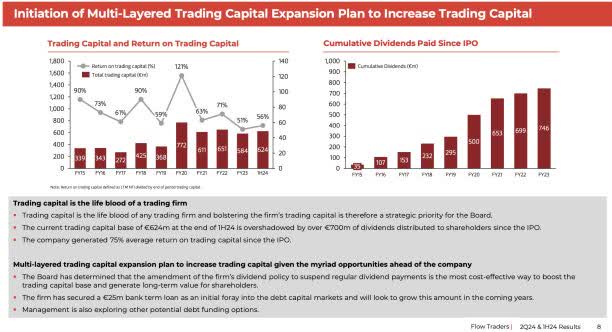

On the precise chart under, you’ll be able to see that they paid out EUR 746 million since Movement Merchants has been a publicly traded firm – that’s greater than their present buying and selling capital. It reads someway that this capital has been wasted and shall now be reinvested into the enterprise.

Supply: Movement Merchants Q2 2024 investor presentation

Whereas it’s debatable or may very well be even seen as a constructive to sacrifice the dividend within the quick time period for longer-term positive aspects, I’ve issues with this transfer because it is available in a state of weak spot, not energy. It someway has a determined style to it for me. That is probably the trigger why the inventory tanked by 20% subsequently – the market appears to not be trusting the administration.

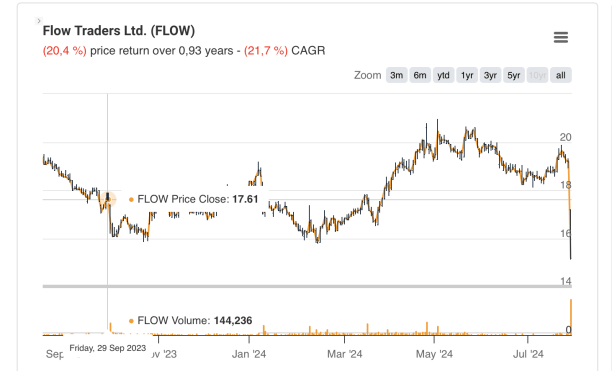

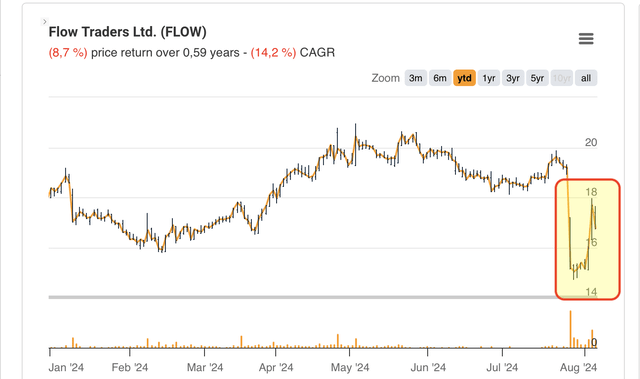

Under, you’ll be able to see to the precise the present response – it is a new all-time low for the inventory, likewise not an indication of energy.

Supply: TIKR

Taking a look at all of this unemotionally and with a free thoughts, it appears to point that this firm is experiencing robust headwinds. All in all, I’m completely happy to have closed this case, because the thesis has been altered dramatically. Generally it’s good to attract a line underneath it and transfer on.

I do know that the inventory of Movement Merchants tried a rebound, as we had preferrred market situations for them to interrupt free out of the weak final one and half years. However is that this actually a powerful signal or a extra a dead-cat bounce?

Supply: TIKR

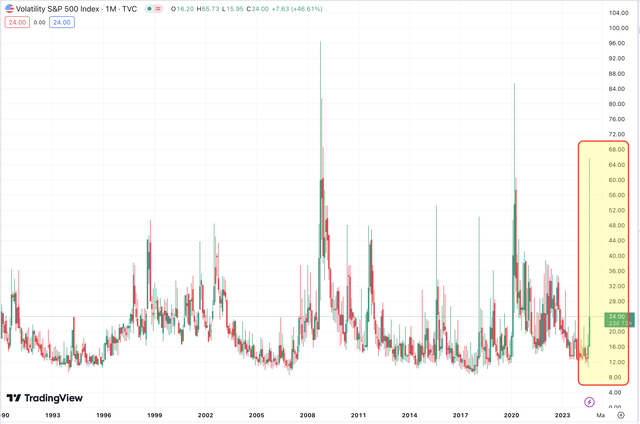

As a reminder, we have now seen one of many strongest rises within the VIX during the last days ever – to the third-highest level the chart of TradingView reveals! Solely the 1987 crash noticed a very totally different degree, however most charts do not present it.

Supply: TradingView

Dangers to my thesis

In fact, I may very well be flawed with my evaluation. The principle dangers I see, are:

1. Administration might have success with its technique and switch the corporate round to achieve former glories.

2. Although not within the fingers of administration, markets might get loopy (credit score occasion, stronger-than-expected recession, blow-up of a beforehand unknown hedge fund, and so on.) like we noticed final Monday. Both another big volatility spike or a protracted interval with above-average volatility (VIX > 20), can be helpful for enterprise, enabling it to both develop certainly, or to reinstate the dividend (or provoke a one-time particular payout which often results in constructive surprises).

3. Buyout: Regardless of the founders (not energetic in on a regular basis enterprise) nonetheless holding collectively ~23% of the inventory, it’s attainable {that a} bid might arrive. This might be, in fact, constructive for traders lengthy the inventory, however it might make my thesis void.

Conclusion

Prior to now, Movement Merchants was an virtually preferrred instrument to get publicity to an entire contrarian fairness story, enabling an investor to profit in instances of market stress. Nevertheless, for the reason that highs of 2020, the previous story appears to not be working anymore, evidenced by the truth that Movement Merchants has been dropping market share strongly – even in its most essential market. That is why I’m detrimental about this inventory. The latest high-volatility occasion on Monday, 05 August 2024, has not pulled the inventory again up sufficient for me to point out any signal of energy.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link