[ad_1]

RinoCdZ

Funding Thesis

In my final article on the home of mouse I rated Disney (NYSE:DIS) as a maintain given what I consider to be as foundational points with Disney+ streaming technique. Nevertheless their latest efficiency has led me to change my stance. One among my main considerations is the corporate’s growing reliance on their direct-to-consumer (DTC) segments, such Disney+ which I discussed earlier than, and has not met expectations but in addition different DTC enterprise traces like their parks division. Regardless of the preliminary promise of an enormous library of content material for his or her Disney+ division, Disney has shifted in direction of producing new content material, a technique extra aligned with Netflix but in addition one which eliminates what content material edge they’d.

Being much less depending on enterprise cable gross sales and extra on their DTC phase is extremely dangerous for my part. This avenue for income is extremely delicate to financial downturns particularly given the premium value level they cost for sure merchandise like their parks and leisure packages. Enterprise for Disney has appeared to plateau, seemingly brought on by the slowing shopper spending and tightening of budgets. As an example, Disney+ misplaced 1.6 million worldwide subscribers within the second quarter of 2024. The corporate’s shares, primarily based on their value to earnings ratio ((P/E)), appear to be overvalued.

Taking a look at their opponents, the efficiency of Disney+ considerably lags behind Netflix each in content material and now dealing with new threats of their bodily leisure division. Disney+’s income development doesn’t look promising, with solely a 2.84% year-over-year enhance projected for fiscal yr 2024, in comparison with Netflix’s projections of 13% to fifteen%. Downward revisions in income estimates additional exacerbate this downside, with 19 downward revisions, in comparison with 4 upward, within the final three months alone. It’s clear that Disney appears to be underneath monetary pressure, contemplating the corporate hopes to implement $7.5 billion in price cuts to offset declining revenues.

Given these components, I’m personally downgrading Disney’s inventory to a robust promote. The elevated dependency on the DTC phase throughout an financial downturn, mixed with an overvalued share value and plateauing enterprise development, leaves me involved over the corporate’s future.

Why I Am Doing Followup Protection

Since my final article on Disney in March, share value has dropped by 16.19%, whereas the S&P 500 has outperformed the corporate, leaping by 6.19%.

As I discussed above, Disney+’s unique intent was to function a platform that consisted of years of content material in a single library. Nevertheless, the corporate has lately been turning their focus in direction of investing closely in new content material, operating opposite to the unique worth proposition. Due to this, their enterprise mannequin is pretty much like Netflix, who has additionally been specializing in producing a big amount of recent content material.

The aim of this observe up protection is to not simply harp on poor Disney+ efficiency (despite the fact that I warned of this in March). Moderately, that is to indicate that the entire different divisions that had been imagined to drive working income whereas the corporate pivoted away from cable are actually slowing as nicely.

With a weakening shopper base, and considerations over the corporate’s I believe you will need to do observe up protection.

Efficiency Is Nonetheless Missing

Disney’s efficiency, significantly in its streaming providers, continues to lag behind their opponents, particularly Netflix. As I discussed above, Disney really misplaced about 1.6 million subscribers worldwide of their final quarter. Alternatively, Netflix (NFLX) gained over 9 million of their final quarter.

Throughout the earnings name, there have been some quotes that basically stood out to me relating to their future efficiency. For instance Hugh Johnston, CFO, talked about

we’re forecasting a loss for Leisure DTC within the third quarter, the overwhelming majority of which is because of Disney+ Hotstar’s ICC cricket rights. We additionally don’t count on to see core subscriber development at Disney+ within the third quarter – Q2 2024 earnings name.

In comparison with Netflix’s 9.9 million subscriber acquire in Q1 that is tough.

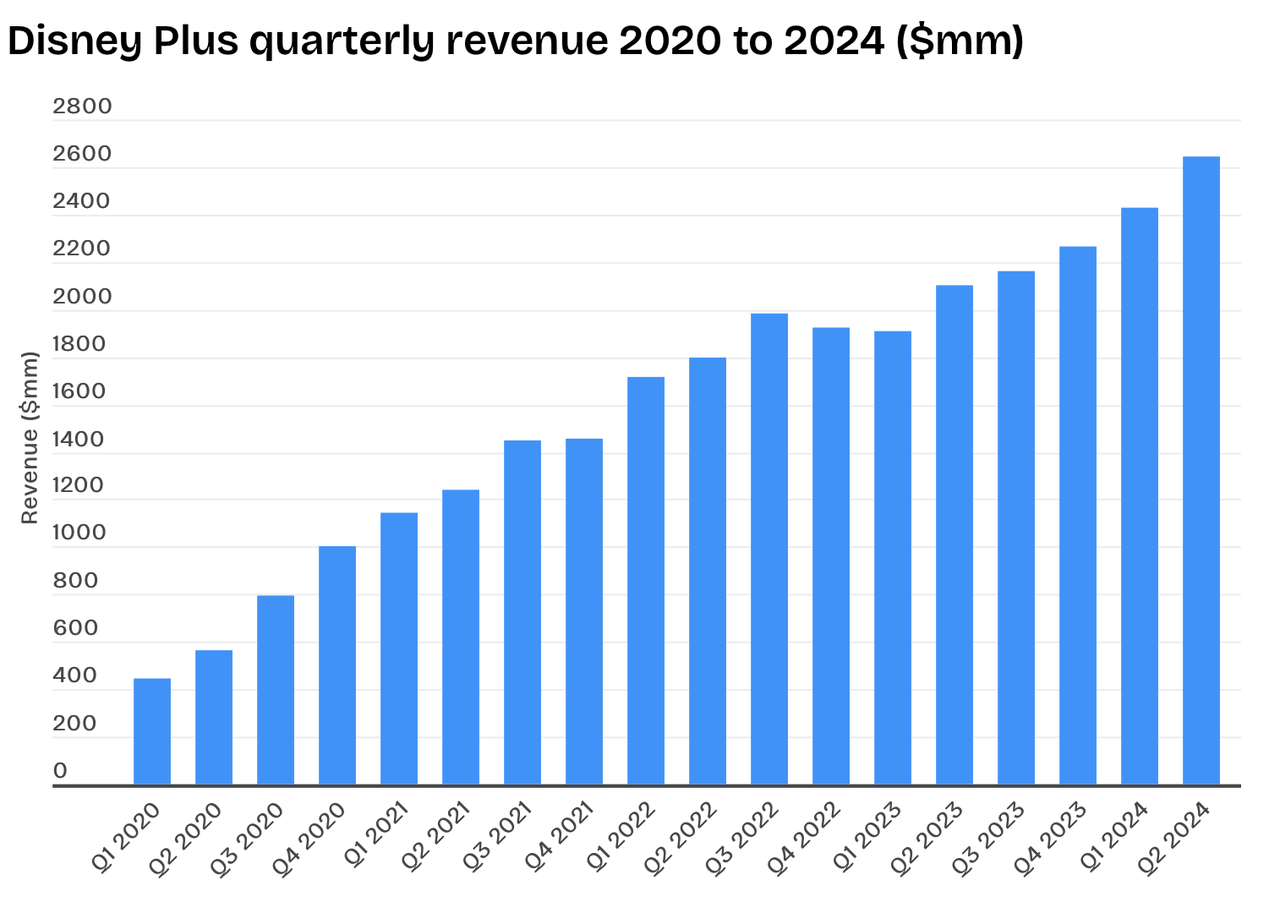

Taking a look at income, under is a chart of Disney+’s income.

Disney+ Income (Enterprise of Apps)

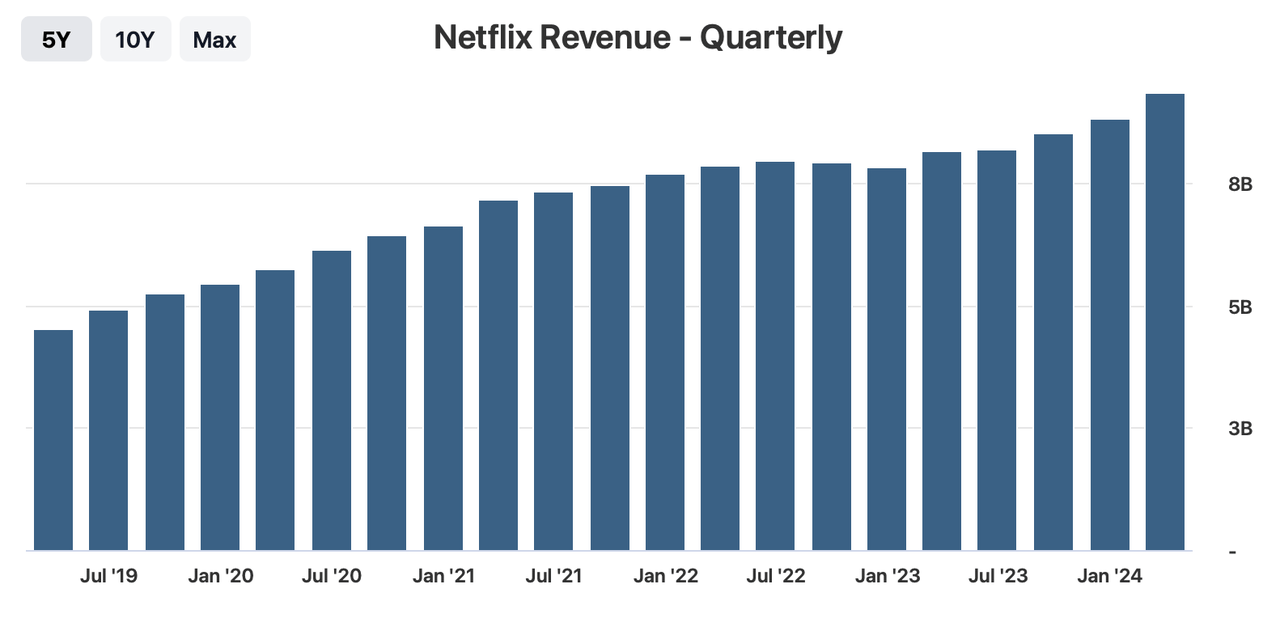

Whereas their income has been largely growing (considerably pushed attributable to value hikes), their latest quarterly income was about $2.643 billion. Nevertheless taking a look at Netflix, it’s clear Disney is lagging behind.

Netflix Income (Inventory Evaluation)

Though he later went on to say that numbers will seemingly flip round within the fourth quarter, this nonetheless leaves me weary relating to their future. Johnston additionally talked about throughout the name name that:

the third quarter’s outcomes shall be impacted by three further components, larger wage bills, pre-opening bills associated to the Disney treasure and journey cruise ships, in addition to Disney Cruise Line’s New Island, Lookout Cay, and a few normalization of post-COVID demand – Q2 2024 earnings name.

He additional increase on this “normalization” stating:

[we’re] seeing some proof of a worldwide moderation from peak post-COVID journey – Q2 2024 earnings name.

The quotes above primarily focus on Q3’s anticipated efficiency, however Johnston additionally went on to state that:

pressures from wages, reopening prices and demand impacts are anticipated to persist in This fall – Q2 2024 earnings name.

Though he believes working revenue development will rebound in the identical quarter, I’m nonetheless involved over their future efficiency.

With rising inflation and financial uncertainty, many households are slicing again on discretionary spending, making it more durable for Disney to draw guests to their parks and cruises. The corporate acknowledged a number of the struggles confronted by their parks, as CFO, Hugh Johnston, acknowledged of their Q2 name:

At Disneyland, regardless of rising attendance and per-capita spend, outcomes declined year-over-year attributable to price inflation, together with from larger labor bills – Q2 2024 earnings name.

With this, as I discussed above, Disney’s theme parks division may be very delicate to financial circumstances. For instance, an financial evaluation accomplished by Harold L Vogel, a CFA, revealed {that a} 1% rise in unemployment price correlates to a 3% drop in U.S Disney park attendance.

Total, I consider Disney’s efficiency may be very delicate to any financial downturn. Till Disney can exhibit important enchancment throughout their enterprise segments, and make them extra sturdy to shopper spending, the corporate’s efficiency will seemingly proceed to lag behind their opponents. I believe the corporate’s P/E a number of doesn’t but replicate this.

Valuation

Disney’s present valuation seems more and more unsustainable given the corporate’s anemic income development and elevated price-to-earnings (P/E) ratio. The corporate has skilled a notable slowdown in income, with projections indicating 2.84% year-over-year development for fiscal yr 2024. I consider this modest development price is inadequate to justify Disney’s excessive P/E ratio, which stays elevated in comparison with the trade common. Disney’s ahead Non- GAAP P/E ratio is 20.60, which is 62.97% larger than the sector median of 12.64. Such a discrepancy means that the market could also be overly optimistic about Disney’s future earnings potential.

Including to the considerations, Disney has confronted quite a few downward revisions of their income estimates. Over the previous three months, there have been 19 downward revisions, and solely 4 upward revisions. This ratio of downward to upward revisions highlights the growing skepticism amongst analysts in regards to the firm’s potential to satisfy their monetary targets.

In an try to keep up efficiency, Disney has resorted to important cost-cutting measures, saying their plan to chop $7.5 billion. Whereas these cuts are essential to handle short-term monetary pressures, they arrive at a crucial time when the corporate wants to take a position closely as a way to compete with their opponents, who as I discussed above, are already out performing them tremendously. These price cuts are solely a one off measure too, which means that this can be a momentary bump in EPS development, however the firm must be extra inventive in the long term to get their EPS to compound.

Given these components, I consider Disney’s valuation needs to be adjusted downward to replicate the sector median. Primarily based on the corporate’s P/E ratio, if it was adjusted to the sector median, this might symbolize 38.6% draw back.

Bull Thesis

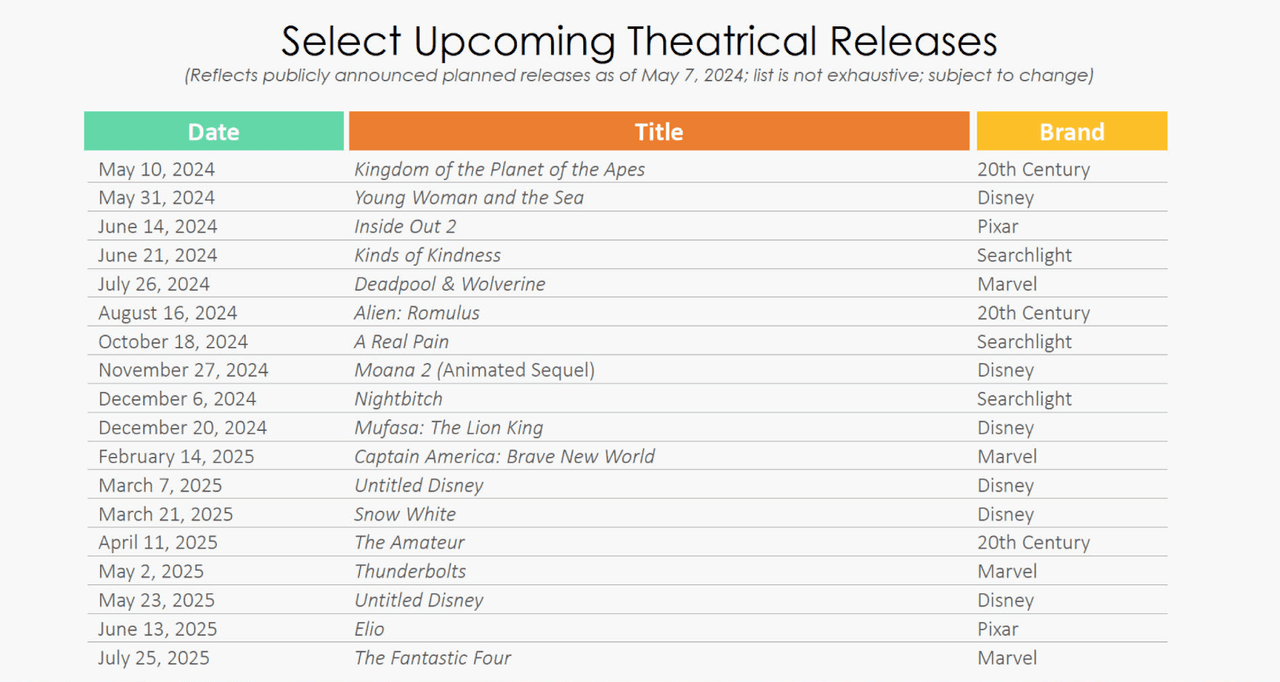

Regardless of the quite a few challenges and the latest underperformance, I believe there might nonetheless be some causes to be optimistic about Disney’s future. The corporate has a formidable content material slate lined up, which might probably flip the tide. For instance, Disney is at present engaged on new content material resembling Deadpool & Wolverine, Mufasa: The Lion King, and Moana 2. One among their most up-to-date releases, Inside Out 2, has already confirmed to be an enormous success. This film, solely being in theaters for a couple of weeks, has handed $1 billion on the world field workplace.

This content material slate doesn’t simply cease right here. Under is a picture from the corporate’s earnings deck.

Disney Content material Slate (Disney Investor Relations)

This picture presents the huge quantity of content material Disney shall be releasing within the subsequent yr. If these motion pictures are as profitable as “Inside Out 2”, the corporate’s income might be promising.

Nevertheless, whereas this new content material could appear promising for Disney, competitors is stronger than earlier than. Along with this, this new film slate could battle to dwell as much as the older slates such because the Marvel Sequence.

The corporate additionally continues to construct on their present line of leisure experiences. As proven throughout the earnings name presentation, Disney plans to open a number of new leisure experiences. For instance, Fantasy Springs, Lookout Cay, Tiana’s Bayou Journey ((which all opened in June)), and the Disney Treasure cruise. Nevertheless, as I beforehand talked about, these income routes are extremely delicate to any downturn in financial circumstances. If shoppers should not have the cash, these enterprise sectors is not going to achieve success for Disney even when they’re new and novel.

Takeaway

Sadly, regardless of Disney’s iconic model and wealthy historical past, I now assume they’re a robust promote. The corporate’s shift in direction of a direct-to-consumer mannequin throughout a possible impending financial downturn, mixed with their overvalued share value and plateauing enterprise development, tremendously considerations me. I believe, as I discussed above, Disney’s makes an attempt to chop prices could present a short-term increase however might result in long-term penalties. In the event that they scale back funding in enhancing buyer expertise, it’s seemingly they may fall even additional behind opponents resembling Netflix. The home of mouse seems overvalued at this level.

[ad_2]

Source link