[ad_1]

Once you backtest an skilled advisor in technique testing, the dealer calls the information from its servers. This half is just a little bit tough. What most individuals usually are not conscious of is that brokers retailer type of ‘shaved information’. That’s, brokers don’t retailer 100% of stay tick information move of their servers. As each dealer has a point of shaving this stay information move, you can be uncovered to totally different information flows in technique testers.

Once you check an skilled advisor within the technique tester, you backtest the skilled with this smoothed information. The skilled can generate glorious outcomes with this shaved information however when the identical skilled is uncovered to a stay information stream, it might behave unexpectedly from the backtest outcomes. Which in flip can create a strain in your account.

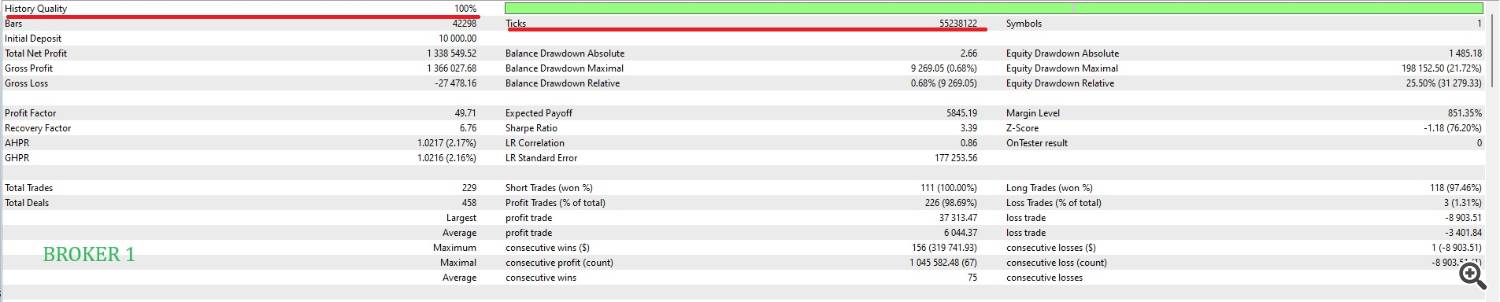

Lets materialize this example with a preferred buying and selling instrument: EURUSD. For instance, after we evaluate the backtest outcomes of those two brokers, we see that the primary dealer has 100% historical past high quality and with about 55 million ticks:

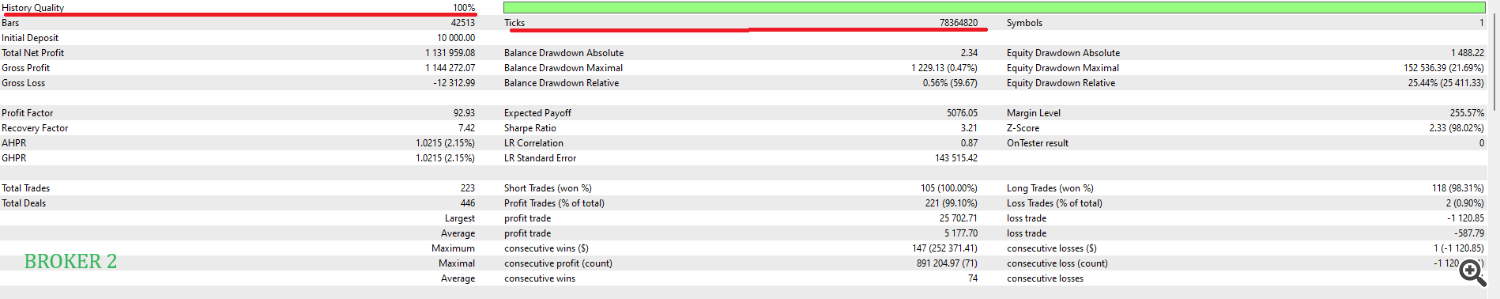

For the second dealer, we have now once more 100% historical past high quality and tick quantity is 78 million!

Each brokers present 100% information high quality, however the second dealer gives virtually 50% extra tick information! On this state of affairs, the tick information of the second dealer higher represents the truth.

Contemplating the instrument is identical, the analyzed interval is identical, the worth motion in that instrument can also be distinctive, each brokers ought to present kind of related tick information numbers. However that’s not the state of affairs.

Once you check your skilled advisor within the first dealer your check outcomes is not going to be as dependable. Once you check your skilled advisor within the second dealer, you’ll check it with extra tick information and due to this fact the check outcomes are extra dependable.

Observe Outcomes

Trying on the outcomes, notably the danger parameters vastly range between two brokers. As I acknowledged at first, this example is anticipated as a result of the supplied information just isn’t distinctive throughout brokers.

When you’ve got much less tick, the farther you might be getting away from the actual information move.

The skilled carried out higher with extra tick information when it comes to threat nevertheless it scarified some beneficial properties in return. On this instance, it’s best to give extra consideration to the backtests from the second dealer.

On this case, in case you are threat delicate and after you testing the skilled within the first dealer and alter your thoughts on shopping for it it could not proper determination.

In case you are revenue oriented and purchase this skilled as a result of it gives good revenue, once more you’d make flawed determination as with extra tick information you’ve got much less revenue.

What can we do to beat this example?

There’s a easy rule of thumb you possibly can apply. It isn’t 100% answer, however it’s going to provide help to to guage an skilled advisor extra transparently.

If you end up enthusiastic about an skilled advisor, you firstly want to check it with your personal dealer. If the outcomes are profitable there, you should check in a minimum of another and ideally 2 extra brokers.

Ideally if an skilled advisor is powerful to information anomalies, it shouldn’t present a giant distinction in outcomes throughout totally different brokers. Often a distinction as much as 10% will be accepted.

Nonetheless, If the skilled advisor fails in one among 3 brokers or outcomes are considerably range, then you shouldn’t think about using it.

Thanks for studying and please take a look my different articles.

Evren Çağlar

[ad_2]

Source link