[ad_1]

Douglas Rissing/iStock by way of Getty Photographs

The Industrial Choose Sector SPDR Fund ETF (XLI) rose +1.26% for the week ended Aug. 9, whereas, the SPDR S&P 500 Belief ETF (SPY) inched forward +0.02%.

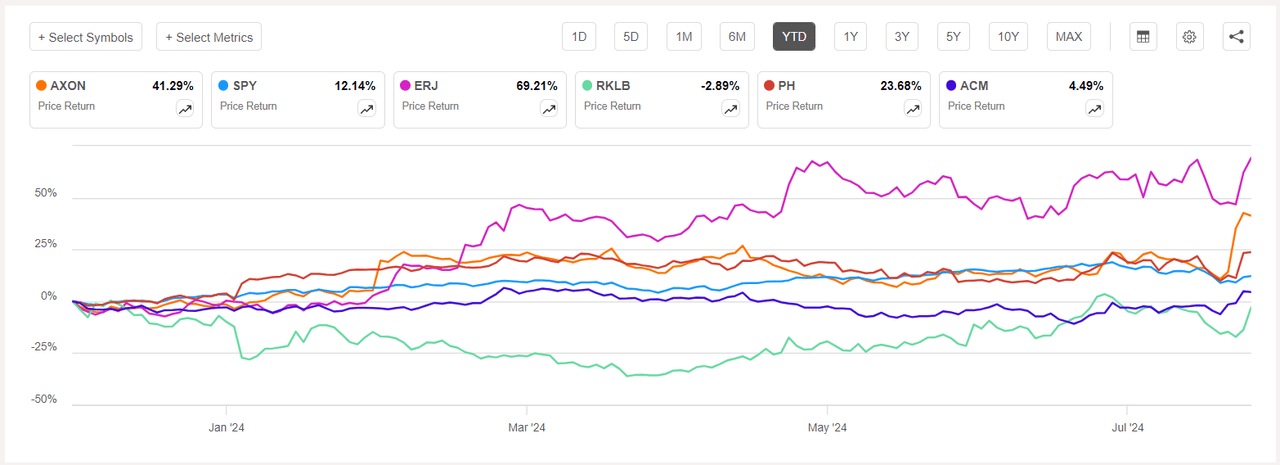

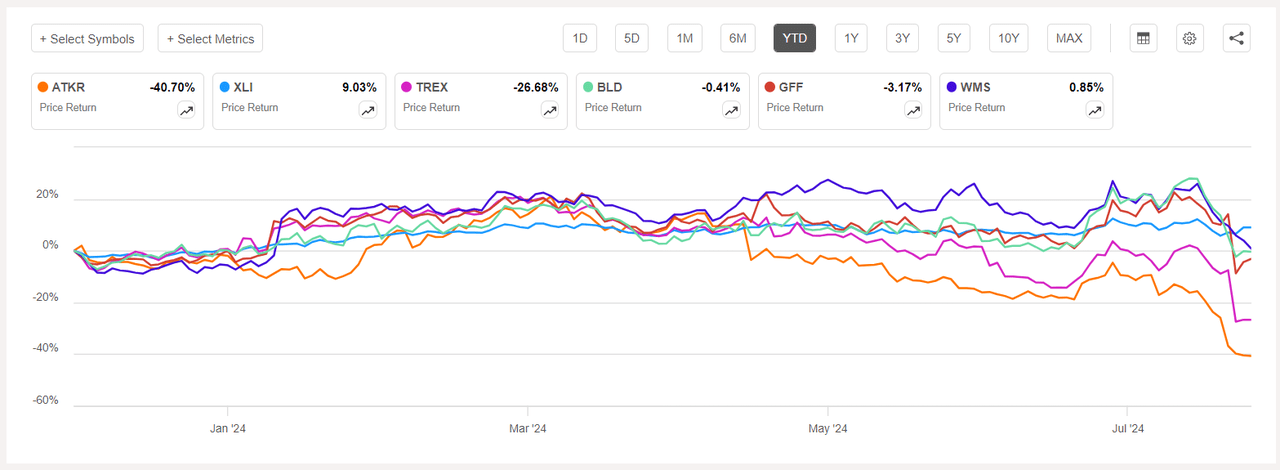

Earnings performed kingmaker once more because it helped Axon to the highest spot amongst industrial gainers (within the below-mentioned phase), whereas Atkore’s shares slumped and noticed the primary decliner tag. 12 months-to-date, or YTD, XLI has climbed +9.03%, whereas SPY has risen +12.14%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +9% every this week. YTD, 4 out of those 5 shares are within the inexperienced.

Axon Enterprise (NASDAQ:AXON) +24.85%. The Taser system maker’s inventory surged +18.39% on Wednesday after second quarter outcomes (put up market Tuesday) beat expectations and full yr income was seen above estimates. YTD, +41.29%.

AXON has a SA Quant Ranking — which takes into consideration components similar to Momentum, Profitability, and Valuation amongst others — of Maintain. The inventory has an element grade of B+ for Profitability and A for Progress. The typical Wall Avenue Analysts’ Ranking differs and has a Purchase ranking, whereby 8 out of 15 analysts tag the inventory as Sturdy Purchase.

Embraer (ERJ) +13.20%. The Brazilian plane maker’s shares soared +10.49% on Thursday following second quarter outcomes. YTD, +69.21%.

The SA Quant Ranking on ERJ is Sturdy Purchase with a rating of C+ for Valuation and A+ for Momentum. The typical Wall Avenue Analysts’ Ranking can be optimistic, with a Purchase ranking, whereby 6 out of 15 analysts see the inventory as Sturdy Purchase.

The chart under reveals YTD price-return efficiency of the highest 5 gainers and SPY:

Rocket Lab USA (RKLB) +11.64%. The shares jumped +12.58% on Friday after the house firm reported file quarterly revenues, led by sturdy demand for its launch companies and house methods merchandise. YTD, -2.89%. The SA Quant Ranking on RKLB is Maintain, which is in distinction to the common Wall Avenue Analysts’ Ranking of Purchase.

Parker-Hannifin (PH) +9.89%. The Cleveland-based firm, which makes movement and management applied sciences and methods, noticed its inventory leap +10.84% on Thursday after outcomes of the fiscal fourth quarter ended June 30 beat estimates. YTD, +23.68%. The SA Quant Ranking on PH is Purchase, and the common Wall Avenue Analysts’ Ranking concurs with a Purchase ranking of its personal.

AECOM (ACM) +9.50%. The infrastructure consulting companies supplier’s shares rose +5.06% on Tuesday following quarterly outcomes (put up market Monday), whereby non-GAAP EPS and income surpassed estimates. The inventory additionally jumped +5.83% on Thursday. YTD, +4.49%. The SA Quant Ranking on ACM is Maintain, which is in distinction to the common Wall Avenue Analysts’ Ranking of Sturdy Purchase.

This week’s high 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -12% every. YTD, 4 out of those 5 shares are within the pink.

Atkore (NYSE:ATKR) -22.34%. Shares of the Harvey, Ailing.-based firm — which makes electrical, mechanical, security, and infrastructure merchandise — fell -14.70% on Tuesday after outcomes for the fiscal third quarter ended June 28, missed estimates. YTD, -40.70%.

The SA Quant Ranking on ATKR is Promote, with an element grade of D- for each Progress and Momentum. The typical Wall Avenue Analysts’ Ranking disagrees and has a Purchase ranking, whereby 3 out of 6 analysts view the inventory as Sturdy Purchase.

Trex (TREX) -21.43%. The shares declined -21.54% on Wednesday after the corporate reported combined second quarter outcomes (put up market Tuesday) and lowered its full yr 2024 income steerage. YTD, -26.68%. The SA Quant Ranking on TREX is Maintain, with a rating of A- for Profitability and C- for Valuation. The typical Wall Avenue Analysts’ Ranking differs and has a Purchase ranking, whereby 7 out of 19 analysts tag the inventory as Sturdy Purchase.

The chart under reveals YTD price-return efficiency of the worst 5 decliners of the week and XLI:

TopBuild (BLD) -14.47%. The inventory fell -7.12% on Tuesday after second quarter outcomes missed expectations. The shares additionally took successful on Wednesday, declining -7.47%. YTD, -0.41%. The SA Quant Ranking on BLD is Purchase, and so is the common Wall Avenue Analysts’ Ranking, Purchase.

Griffon (GFF) The patron and residential, and constructing merchandise maker’s inventory declined -7.47% on Wednesday after quarterly outcomes missed estimates. YTD, -3.17%. The SA Quant Ranking on GFF is Maintain, which is in distinction to the common Wall Avenue Analysts’ Ranking of Sturdy Purchase.

Superior Drainage Techniques (WMS) -12.20%. The corporate’s inventory fell all through the week, which additionally the water administration merchandise maker’s quarterly outcomes miss estimates. YTD, +0.85%. The SA Quant Ranking on WMS is Maintain, whereas the common Wall Avenue Analysts’ Ranking is Sturdy Purchase.

[ad_2]

Source link