[ad_1]

Richard Drury

By Seema Shah, Chief World Strategist

The European Central Financial institution’s 25 foundation level price minimize, forward of the Federal Reserve, underscores the differing post-COVID financial recoveries between the Euro space and the U.S.

With Euro space progress lagging and inflation down from its peak, the ECB’s proactive stance is warranted. Nevertheless, this divergence might stress the euro and reignite inflationary concern – anticipate future ECB cuts to seemingly align with the Fed’s timeline.

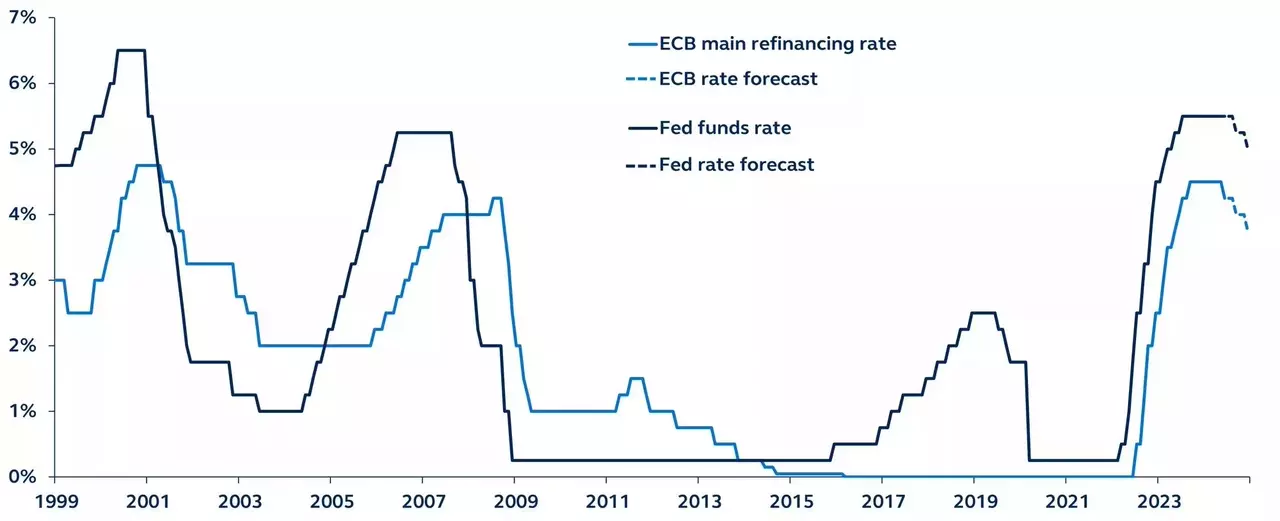

ECB vs. Fed coverage price path

1991–current

Supply: Bloomberg, Principal Asset Administration. Forecasts are Principal Asset Administration forecasts. Knowledge as of June 7, 2024.

On Thursday, the European Central Financial institution (ECB) delivered a 25 foundation level coverage price minimize. Against this, the Federal Reserve (Fed) is ready to maintain charges on maintain at its assembly this month.

Sometimes, central banks await the Fed to scale back charges earlier than they transfer. In truth, till yesterday, the ECB had by no means minimize charges forward of the Fed. However with the Euro space experiencing a meaningfully weaker progress final result post-COVID than the U.S., and Euro space headline inflation having plunged from a peak of 10.6% to 2.6%, the ECB had robust purpose to not await the Fed.

Nonetheless, the ECB will probably be cautious of its diverging coverage path. A widening hole between U.S. and Euro space coverage charges dangers placing downward stress on the euro, in flip including to inflationary pressures – a dynamic the ECB should worry.

Though the Euro space’s inflation struggle has been spectacular, current inflation and wage information have shocked to the upside. Additional euro depreciation would add to creeping issues that Euro space disinflation could also be stalling.

Some international coverage coordination is required. The subsequent ECB price reductions are seemingly in September and December – the identical months the Fed is prone to minimize. Nevertheless, if the Fed delays the beginning of its personal easing cycle till early 2025, the ECB’s subsequent transfer could also be equally delayed. Greater for longer within the U.S. implies larger for longer in Europe.

Unique Publish

Editor’s Word: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Source link